South Plains Financial, Inc. (NASDAQ:SPFI) (“South Plains” or the

“Company”), today announced that the board of directors of the

Company (the “Board”) approved a stock repurchase program for up to

$15.0 million of the outstanding shares of the Company’s common

stock (the “Stock Repurchase Program”). The Stock Repurchase

Program will conclude on May 5, 2024, subject to the earlier

termination or extension of the Stock Repurchase Program by the

Board or the $15.0 million designated for the Stock Repurchase

Program are depleted.

Curtis Griffith, South Plains’ Chairman and

Chief Executive Officer, commented, “While the banking sector is

experiencing some turmoil and uncertainty, South Plains remains in

an advantageous position given our strong liquidity and capital,

our community-based deposit franchise where 83% of our deposits are

insured, and a high-quality loan portfolio that we believe is well

positioned for an uncertain economy. That said, our shares do not

currently reflect the Company's positive fundamentals as we believe

they continue to trade meaningfully below intrinsic value. As a

result, our Board has authorized a $15 million share repurchase

program where we will commit a portion of the proceeds from the

sale of Windmark to buy back our own stock, which is the most

compelling acquisition that we can make in today’s market.”

Under the Stock Repurchase Program, the Company

may repurchase shares of common stock from time to time in open

market purchases or privately negotiated transactions. Any open

market repurchases will be conducted in accordance with the

limitations set forth in Rule 10b-18 promulgated under the

Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and other applicable legal requirements. Repurchases under the

Stock Repurchase Program may also be made pursuant to a trading

plan under Rule 10b5-1 under the Exchange Act, which would permit

shares to be repurchased by the Company when the Company might

otherwise be precluded from doing so because of self-imposed

trading blackout periods or other regulatory restrictions. The

extent to which the Company repurchases its shares, and the timing

of such repurchases, will depend upon a variety of factors,

including the performance of the Company’s stock price, general

market and economic conditions, regulatory requirements,

availability of funds, and other relevant considerations, as

determined by the Company. The Company may, in its discretion,

begin or terminate repurchases at any time prior to the Stock

Repurchase Program’s expiration, without any prior notice. The

Stock Repurchase Program does not obligate the Company to

repurchase any particular number or amount of shares of common

stock.

About South Plains Financial,

Inc.

South Plains is the bank holding company for

City Bank, a Texas state-chartered bank headquartered in Lubbock,

Texas. City Bank is one of the largest independent banks in West

Texas and has additional banking operations in the Dallas, El Paso,

Greater Houston, the Permian Basin, and College Station, Texas

markets, and the Ruidoso, New Mexico market. South Plains provides

a wide range of commercial and consumer financial services to small

and medium-sized businesses and individuals in its market areas.

Its principal business activities include commercial and retail

banking, along with investment, trust and mortgage services. Please

visit https://www.spfi.bank for more information.

Available Information

The Company routinely posts important

information for investors on its web site (under www.spfi.bank and,

more specifically, under the News & Events tab at

www.spfi.bank/news-events/press-releases). The Company intends to

use its web site as a means of disclosing material non-public

information and for complying with its disclosure obligations under

Regulation FD (Fair Disclosure) promulgated by the U.S. Securities

and Exchange Commission (the “SEC”). Accordingly, investors should

monitor the Company’s web site, in addition to following the

Company’s press releases, SEC filings, public conference calls,

presentations and webcasts.

The information contained on, or that may be

accessed through, the Company’s web site is not incorporated by

reference into, and is not a part of, this document.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements reflect South

Plains’ current views with respect to future events. Any statements

about South Plains’ expectations, beliefs, plans, predictions,

forecasts, objectives, assumptions or future events or performance

are not historical facts and may be forward-looking. These

statements are often, but not always, made through the use of words

or phrases such as “anticipate,” “believes,” “can,” “could,” “may,”

“predicts,” “potential,” “should,” “will,” “estimate,” “plans,”

“projects,” “continuing,” “ongoing,” “expects,” “intends” and

similar words or phrases. South Plains cautions that the

forward-looking statements in this press release are based largely

on South Plains’ expectations and are subject to a number of known

and unknown risks and uncertainties that are subject to change

based on factors which are, in many instances, beyond South Plains’

control. Factors that could cause such changes include, but are not

limited to, general economic conditions, potential recession in the

United States and our market areas, the impacts related to or

resulting from recent bank failures and any continuation of the

recent uncertainty in the banking industry, including the

associated impact to the Company and other financial institutions

of any regulatory changes or other mitigation efforts taken by

government agencies in response thereto, increased competition for

deposits and related changes in deposit customer behavior, changes

in market interest rates, the persistence of the current

inflationary environment in the United States and our market areas,

the uncertain impacts of quantitative tightening and current and

future monetary policies of the Board of Governors of the Federal

Reserve System, regulatory considerations, the extent of the impact

of the COVID-19 pandemic (and any current or future variants

thereof), competition and market expansion opportunities, changes

in non-interest expenditures or in the anticipated benefits of such

expenditures, and changes in applicable laws and regulations.

Additional information regarding these risks and uncertainties to

which South Plains’ business and future financial performance are

subject is contained in South Plains’ most recent Annual Report on

Form 10-K and Quarterly Reports on Form 10-Q on file with the SEC,

and other documents South Plains files with the SEC from time to

time. South Plains urges readers of this press release to review

the “Risk Factors” section of our most recent Annual Report on Form

10-K, as well as the “Risk Factors” section of other documents

South Plains files or furnishes with the SEC from time to time,

which are available on the SEC’s website, www.sec.gov. Actual

results, performance or achievements could differ materially from

those contemplated, expressed, or implied by the forward-looking

statements due to additional risks and uncertainties of which South

Plains is not currently aware or which it does not currently view

as, but in the future may become, material to its business or

operating results. Due to these and other possible uncertainties

and risks, the Company can give no assurance that the results

contemplated in the forward-looking statements will be realized and

readers are cautioned not to place undue reliance on the

forward-looking statements contained in this press release. Any

forward-looking statements presented herein are made only as of the

date of this press release, and South Plains does not undertake any

obligation to update or revise any forward-looking statements to

reflect changes in assumptions, new information, the occurrence of

unanticipated events, or otherwise, except as required by law. All

forward-looking statements, express or implied, included in the

press release are qualified in their entirety by this cautionary

statement.

|

|

|

|

Contact: |

Mikella Newsom, Chief Risk Officer and Secretary |

|

|

investors@city.bank |

|

|

(866) 771-3347 |

|

|

|

Source: South Plains Financial, Inc.

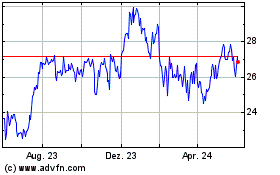

South Plains Financial (NASDAQ:SPFI)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

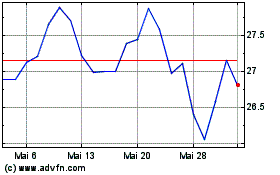

South Plains Financial (NASDAQ:SPFI)

Historical Stock Chart

Von Apr 2024 bis Apr 2025