Galileo Launches Instant Account Verification and Machine Learning Risk Score to Secure Financial Transactions Amid Escalating Cyber Threats

10 September 2024 - 2:00PM

Business Wire

New tools deliver real-time fraud detection for

fintechs, banks and businesses and maintain frictionless account

experiences for customers

Galileo Financial Technologies, a leading financial technology

company and a subsidiary of SoFi Technologies, Inc. (NASDAQ: SOFI),

is delivering fintechs, banks and businesses new ways to fight

fraud with the launch of Galileo Instant Verification Engine (GIVE)

and Transaction Risk GScore.

As digital transactions surge and cyber threats evolve, these

tools offer fintechs, financial institutions and businesses

advanced real-time fraud detection and risk management

capabilities, addressing an industry in which 63% of financial

firms reported an increase in fraud, with digital channels

contributing to half of the total fraud losses.

Galileo Instant Verification Engine

Galileo Instant Verification Engine (GIVE) provides real-time

verification of external bank accounts and ownership. Whether used

as a standalone product or integrated with the Galileo Payment Risk

Platform (PRP), GIVE delivers real-time insights that help

businesses prevent fraud by quickly verifying account existence,

status, and ownership before processing transactions.

GIVE is further enhanced by its integration with the Galileo

Payment Risk Platform, which uses a sophisticated Transaction

Decision Rules Engine. This engine applies customizable models,

rules and profiles to each transaction, allowing for real-time,

automated fraud prevention decisions tailored to the specific needs

and risk appetite of each business.

The key benefits of GIVE are:

- Instant Account Verification: GIVE instantly verifies

external bank account information, confirming its existence,

status, and risk signals. This enables Galileo clients to make

informed decisions when linking accounts or processing

transactions, such as determining account status and risk

associated with the account.

- Instant Identity Verification: GIVE ensures that only

authorized individuals can transact by verifying the ownership of

external bank accounts. It matches the account holder’s name and

personal information — such as social security number (SSN), date

of birth, and address — against the provided owner details, which

is particularly useful for preventing identity fraud.

- Account Risk Profiling: By leveraging machine learning,

the Galileo Instant Verification Engine generates risk scores that

assess the probability of ACH returns and non-sufficient funds

(NSF) issues, providing a comprehensive view of account

reliability. This enables businesses to predict funding issues and

take proactive measures to prevent them.

- Seamless User Experience: GIVE supports “me-to-anyone”

and “anyone-to-me” use cases without requiring customers to input

their credentials for external accounts, ensuring a frictionless

and secure transaction process.

The Galileo Instant Verification Engine significantly reduces

the risk of fraud by providing real-time verification of external

bank accounts and ownership, cutting verification times from days

to seconds. This minimizes customer drop-offs — reducing

abandonment rates from nearly 50% based on a traditional method

such as MDA (Micro-deposit Authentication) to as low as 1% — and

delivers a smoother, more reliable customer experience across

multiple channels, including ACH, FedNow, Wires and check

deposits.

Transaction Risk GScore

Transaction Risk GScore is a machine-learning-based risk score

that assesses the risk of card transactions in real time. By

analyzing multiple data points, such as user behavior and

transaction patterns, GScore enables financial institutions,

fintechs and businesses to detect and respond swiftly to potential

fraud, reducing losses and ensuring more efficient operations.

GScore supplements the existing enhanced capabilities in Payment

Risk Platform by adding a layer of fraud signals while allowing the

client to determine the risk appetite based on the multiple model

responses. GIVE and GScore are designed with scalability in mind,

ensuring they can grow alongside your business.

Whether transaction volumes increase or a company’s business

expands into new markets, these tools provide consistent protection

and seamlessly integrate with existing systems, minimizing

disruption while maximizing fraud detection. This feature gives

Galileo clients greater control over transaction validity, enabling

them to fine-tune fraud prevention measures to meet their specific

needs. GScore is available to clients using the Galileo Payment

Risk Platform.

Why GIVE and GScore Matter

The Galileo Instant Verification Engine and GScore empower

financial institutions, fintechs and businesses to navigate the

complexities of an increasingly digital financial landscape,

reducing fraud, improving operational efficiency, and delivering a

seamless customer experience across multiple payment channels.

"These tools represent the future of secure financial

transactions," said David Feuer, Chief Product Officer at Galileo

Financial Technologies. "By harnessing advanced machine learning

and real-time data, we're setting a new standard for how businesses

safeguard their customers and their operations."

For more information on how to integrate these fraud prevention

solutions, please visit

https://docs.galileo-ft.com/pro/docs/about-galileo-instant-verification-engine.

About Galileo Financial Technologies

Galileo Financial Technologies, LLC and certain of its

affiliates collectively comprise a financial technology company

owned and operated independently by SoFi Technologies, Inc.

(NASDAQ: SOFI) that enables fintechs, financial institutions, and

emerging and established brands to build differentiated financial

solutions that deliver exceptional, customer-centric experiences.

Through modern, open APIs, Galileo’s flexible, secure, scalable and

fully integrated platform drives innovation across payments and

financial services. Trusted by digital banking heavyweights,

early-stage innovators and enterprise clients alike, Galileo

supports issuing physical and virtual payment cards, mobile push

provisioning, tailored and differentiated financial products and

more, across industries and geographies.

©2024 Galileo Financial Technologies, LLC. All rights

reserved.

Galileo Financial Technologies, LLC is a technology company, not

a bank. Galileo partners with many issuing banks to provide banking

services in North and Latin America.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240910452642/en/

Katie Boyless The Fletcher Group (404) 791-8245

katie@fletchergroupllc.com

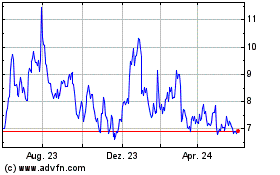

SoFi Technologies (NASDAQ:SOFI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

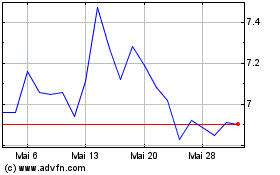

SoFi Technologies (NASDAQ:SOFI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024