false

0001093691

0001093691

2023-11-09

2023-11-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 9, 2023

Plug Power Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-34392 |

|

22-3672377 |

| (State or other jurisdiction |

|

(Commission File |

|

(IRS Employer |

| of incorporation) |

|

Number) |

|

Identification No.) |

| |

|

|

|

|

968 Albany Shaker Road,

Latham, New York |

|

12110 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (518) 782-7700

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.01 per share |

|

PLUG |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On November 9, 2023, Plug Power Inc., a Delaware

corporation (the “Company”), issued a press release regarding its financial results for the third quarter ended September 30,

2023. A copy of the press release is furnished herewith as Exhibit 99.1.

The information in this Item 2.02 of this Current

Report on Form 8-K, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”),

or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

The information contained in Item 2.02 of this

Current Report on Form 8-K is incorporated herein by reference.

The information included in this Item 7.01 and

Exhibit 99.1 of this Current Report on Form 8-K are not deemed to be “filed” for purposes of Section 18 of

the Exchange Act, or otherwise subject to the liabilities of that section, nor shall this item or Exhibit 99.1 be incorporated by

reference into the Company’s filings under the Securities Act or the Exchange Act, except as expressly set forth by specific reference

in such future filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

Plug Power Inc. |

| |

|

| Date: November 9, 2023 |

By: |

/s/ Paul Middleton |

| |

|

Name: Paul Middleton |

| |

|

Title: Chief Financial Officer |

Exhibit 99.1

Plug

Reports Third Quarter 2023 Results with Revenue of $199M

2023

overall financial performance has been negatively impacted

by unprecedented supply challenges in the hydrogen network

in North America.

We

believe this hydrogen supply challenge is a transitory issue, especially as we expect our Georgia and Tennessee facilities to produce

at full capacity by year-end.

Lessons

from ramping up our Georgia green hydrogen facility coupled with our manufacturing ramp, diversity of products, and major new customer

wins reinforce Plug’s leadership position in the global green hydrogen economy.

| ● | The

liquid hydrogen market in North America has been severely constrained by multiple frequent

force majeure events, leading to volume constraints which has delayed Plug’s deployments

and service margin improvements: Plug continues to manage through a historically difficult

hydrogen supply environment by leveraging our logistics assets and team members to transport

hydrogen across the US to support customer operations as well as implementing contingency

plans in various regions of the country. Despite this challenging industry environment, we

have achieved 21% sequential gross margin improvement in 3Q 2023 compared to 2Q 2023 in our

fuel business. |

| ● | Despite

hydrogen supply challenges impacting overall company gross margin, we have seen margin expansion

in certain new products: Reported GAAP gross loss of (69%), was impacted negatively by

equipment sales mix, service contract loss accruals, and continued negative fuel margins.

Despite these factors, the Company saw margin expansion across certain new product platforms. |

| ● | Georgia

green hydrogen plant nearing major milestone: We are completing the final step of the

commissioning process for the liquefiers/cold box. Liquid production is anticipated between

November 15th and year-end. Also, developments at Louisiana, Texas and New York are expected

to provide an additional step change in our fuel margin expansion. Our gas plant in Georgia

has now been operating for almost a year supporting high pressure tube trailer filling for

Plug as well as other customers. Unprecedented hydrogen supply challenges in the US only

further reinforces our vertically integrated strategy and need for a resilient generation

network to support multiple applications. |

| ● | Electrolyzer

sales grew greater than three times quarter over quarter. Multiple large-scale

orders validate Plug’s position as a go-to electrolyzer supplier for industrial scale

projects: Since our second quarter 2023 call, Plug has line of sight to an additional

1 GW of electrolyzer orders to our backlog, including 550 MW for Fortescue in Australia and

280 MW for Arcadia e-Fuels in Denmark. |

| ● | Liquefier

and cryogenics business continues rapid growth - sales pipeline now exceeding $1.1B: Plug’s

cryogenics and liquefier business revenue increased approximately three times year over year

(YoY), while margins have expanded by an even greater improvement in the same period. |

| ● | Average

sales cycle continues to accelerate in our material handling business given the value

proposition of our product and increased market awareness of our solutions. Recently, Plug

has added multiple global customers including Tyson, Ryder, STEF and others. |

| ● | Large-scale

stationary manufacturing is ramping up, with first units operating at customer sites: Stationary

power manufacturing lines are commissioned, with customer orders increasing across EV charging,

data centers, and microgrid opportunities. Plug is on track to deliver multiple units in

the fourth quarter of 2023, with expected substantial growth in 2024 and beyond. |

| ● | Service

accrual charge reflects higher near-term cost projections, which have been impacted by delay

in roll out of certain reliability investments: In the third quarter of 2023, the Company

has incurred a non-cash charge of $41.6 million. This charge reflects the projection for

future costs to service our existing fleet through the remainder of their service contract.

The severe hydrogen shortages have negatively affected direct cost of service as well as

the timing for implementation of fleet upgrades into customer operated equipment. These factors

have been compounded by certain cost increases from inflation impacts on labor, materials

and overhead. The Company is continuing to monitor the current cost trends and hydrogen market

dynamics. If these trends continue, the Company may have to record additional service loss

provisions in future periods. |

| ● | Plug's Gigafactory and Vista facilities represent

global manufacturing excellence that we believe will create a sustainable competitive advantage and industry cost leadership: Plug

has increased our manufacturing footprint from 50 thousand sq. ft. to nearly 1 million sq. ft. With minimal additional capital

investment, Plug believes it can significantly expand our manufacturing capacity to meet anticipated demand while delivering

continued manufacturing cost reduction. |

As Plug manages through short-term hydrogen

supply disruption, we are focused on operational scale, in-house hydrogen generation and policy tailwinds to further the Company's position

as a global leader in the green hydrogen industry.

We believe four

key business accelerators position the Company to dramatically change our operations and financials in coming quarters, following what

have been unprecedented challenges that have arisen from hydrogen supply disruptions in 2023.

| ● | Diverse

New Product Platforms: Electrolyzers, liquefiers, cryogenics, and new fuel cell applications

are beginning to become an increasing share of our revenue while we continue to add multiple

large customers in our material handling business. Business opportunities remain robust,

and expansion of these platforms will be instrumental in achieving our top line growth, but

more importantly establishes a clear path to margin expansion and profitability. |

| ● | Large

Scale Electrolyzer Customers: Over 1 GW of new electrolyzer opportunities, including Fortescue

and Arcadia, illustrate how Plug’s scale and technology are equating to industrial-scale

electrolyzer orders. |

| ● | Partnerships

Reaching Scale Globally: Plug and SK’s current activities include the use of products

across our entire platform. AccionaPlug is progressing the 15TPD plant in Spain. Hyvia joint venture (JV)

is well positioned to deliver robust growth in 2024 and beyond, with multiple test pilots

ongoing and fuel cell vans available for commercial use today. |

| 2. | Margin

Enhancement Roadmaps: |

| ● | Hydrogen

Generation: Fuel margin rate improved by 21% sequentially from Q2 2023. Margin improvement

was achieved despite numerous force majeure events within the hydrogen network that impacted

as much as one-third of the US liquid hydrogen supply. Plug's logistics capabilities and

contingency plans have allowed us to manage this difficult environment. We expect this is

transitory as we expect Georgia and Tennessee facilities to come on-line by year-end. We

believe we have effectively managed this situation considering hydrogen pricing has reached

over $30/kg on the West Coast. |

| ● | Manufacturing

Scale: Plug has already established a world-class manufacturing presence with the ability

to meaningfully expand manufacturing capacity with minimal or no additional capital expenditure.

This sets the stage for continued cost reduction. |

| ● | Simplifying

Designs and Improving Performance: Service cost improvements remain a key focus area

for the Company in order to drive overall margin within the material handling business.

As part of this effort, Plug has deployed several fleet wide initiatives in 2023 implementing

upgrades for in service equipment that will improve power density, reliability and life of

the fuel cell components in material handling applications. Equipment upgrades include a

combination of software operability improvements as well as new hardware. Plug continues

to target 30% per unit service cost decrease over the medium-term, as we see the results

of these enhancements, continued increase of the fleet mix to latest technology, release

of new product stack platforms with higher power density, and the rollout of power upgrades

planned for 2024. |

| 3. | Future

Funding Roadmaps: Given our forecasted capital expenditure and operating requirements under the current business plan, and the Company’s

existing cash and liquidity position, the Company will need to access additional capital in the market to fund its activities. The Company

is pursuing a number of debt capital and project financing solutions. |

| ● | Corporate

Debt Solutions: We are evaluating varied debt financing solutions to support our growth. |

| ● | US

Department of Energy (DOE) Loan Program: Currently, Plug is working towards a conditional

commitment from the DOE Loan Program Office to finance plants in our green hydrogen network. |

| ● | Project

Finance and Plant Equity Partners: Our MOU with Fortescue contemplates Fortescue having

a 40% equity stake in Plug’s Texas hydrogen plant and for Plug to take up to a 25%

equity stake in Fortescue’s Phoenix hydrogen plant. We will continue to evaluate partners

to lower our capital expenditure needs. |

| 4. | Policy

and Regulations: |

| ● |

Guidance for the Inflation Reduction Act (IRA) Production Tax Credit (PTC) is expected before year-end: We believe that the guidance

will be beneficial to the development of Plug’s green hydrogen platform, serve as a

catalyst for final investment decisions (FIDs) on multiple hydrogen projects, and support

future deployments of our fuel cell units and systems. |

| ● | Hydrogen

Hubs: The DOE announced $7 Billion for Regional Hydrogen Hubs. Plug is engaged in all

seven hubs and a corporate sponsor in five of the announced hubs. This involvement, along

with Plug’s expansive product portfolio, sets up the Company to play a substantial

role in these programs. |

| ● | EU

Renewable Energy Directive (RED): RED mandates renewable hydrogen use in transport, industry,

buildings, and district heating and cooling, with targets of 42% green hydrogen by 2030 and

60% by 2035 in the European Union (EU). The adoption of this policy, along with the Net Zero Industry Act and Hydrogen

Bank pilot auctions, represents meaningful government incentives to accelerate hydrogen adoption

across the region. |

Green Hydrogen

Generation Network and Plant Updates

Our Georgia plant

represents a first-of-a-kind facility, which has come with invaluable learnings, Some of the key lessons learned are already benefiting

Plug as we are building additional plants in various locations.

| ● | Improved

contracting strategy: We have been able to secure a lump sum contract for engineering, procurement and construction (EPC) work at

our Texas plant. This will meaningfully reduce construction capital expenditures versus the

“time & materials” contract employed in Georgia. |

| ● | EPC

scope of work: Turnkey contracts include the entire scope of the plant, ensuring continuity

and timeliness of plant construction. |

| ● | Procedure

development: The project execution team has been able to optimize construction and commissioning

procedures based on experience with each plant component in Georgia |

| ● | Construction

team members and facility oversight: The team has identified multiple key positions to

lead construction and commissioning activities across our network to ensure efficient installation

of key components. This includes lead mechanical supervisors and additional electrical and

instrumentation engineers. |

| ● | Timeline

management for first-of-kind projects: Timelines at Georgia, and key changes listed above,

allow our project execution timelines to have lower risk and greater oversight, ensuring

completion of future plants on targeted timelines. |

In light of these

learnings, we are also updating schedules for current plants under construction.

US Green Hydrogen Network:

Georgia:

We are completing the final step of the commissioning process for the liquefiers/cold box. Liquid production is anticipated between

November 15th and year-end.

Olin

JV - Louisiana: Construction continues with site grading, with the turnkey provider mobilizing for installation of the liquefaction

package in November. The commissioning plan has been developed to ensure a smooth process from construction through commissioning and

start-up.

Texas:

Construction began at the site with our hydrogen facility EPC contractor, Kiewit. Work is ongoing for on-site grading, access roads,

the power transmission line, and on-site substation.

Alabama,

New York: We continue to work in collaboration with New York Power Authority and National Grid to complete and energize the substation, which remains

the gating item to achieve the full 74 TPD capacity in the first half of 2025.

Other

Projects: Plug is actively evaluating several sites for potential new or expanded production capabilities, with a focus on achieving

up to 45 TPD of liquid hydrogen output.

European

Green Hydrogen Network:

Port

of Antwerp: We expect all permits to be obtained in 2024, which would allow it to move to the construction phase in the course of

the following year. Meanwhile, conversations with off-takers are progressing, with the plant’s targeted production already oversubscribed

by over tenfold.

Acciona

JV: The JV is actively advancing the development of our first three projects, which target curtailed renewable energy sources. This

will be the first 15 MW green hydrogen plant in Spain, which we expect to be on track for commissioning in the latter half of 2024.

Finland:

Feasibility studies are being finalized, with the aim to start the next engineering phase in the first quarter of 2024. The plants

aim for a total capacity of 850 TPD, with FID expected by 2026.

Other

Projects: Plug is developing small-scale sites throughout Europe, driven by Plug customers' demand for hydrogen, notably in the

United Kingdom and Germany.

Plug continues to capture large-scale

projects globally, with IRA guidance as a potential catalyst for project FIDs in the US

We continue to

track new orders in our previously disclosed 7.5 GW pipeline of near-term projects approaching FID.

| ● | Arcadia

eFuels has selected Plug to provide a 280 MW electrolyzer system to Arcadia’s Vordingborg

plant for the production of sustainable aviation fuel. |

| ● |

Plug is the preferred supplier of 550

MW electrolyzers for Fortescue’s proposed Gibson Island Project. The plant is expected to produce approximately 385,000 metric

tons of green ammonia a year.

|

The near-term focus of customers remains on industrial applications.

Low-carbon mandates in the EU, hydrogen PTC in the US, and other low carbon fuel standards globally are driving investment. Plug’s

experience across our plant network and with customers has allowed continuous optimization of our offering for industrial scale plant

customers.

Cryogenics and

Liquefier Business Delivers Strong Revenue Growth and Further Product Diversification

Cryogenics solutions

and liquefier sales contributed $35.4 million to Q3 revenue. The sales pipeline includes up to $1.1B of opportunities, including multiple

programs that may be able to begin revenue recognition in the fourth quarter of 2023, depending on contract timing. We anticipate bookings

and revenue will continue to be lumpy in the near-term while we pursue these opportunities and seek to build our liquefier backlog.

Customer Demand in High-Power Stationary

Application Creates Significant Hydrogen Offtake Opportunities

Plug commissioned

our first high-power stationary units in the field in the third quarter of 2023 and expects the business to continue growing in 2024

and beyond. A variety of end users for this product are creating a large sales pipeline for both the stationary products and hydrogen

offtake.

EV

Charging: 1 – 5 MW of additional power for a site is needed for EV fleets, creating challenges with grid availability, upgrade

costs, and electricity pricing swings. Our application solves time to power, cost of power, and reliability issues, while demanding up

to 1TPD+ of hydrogen for a 1MW unit.

Micro-grids

and Peaker Plants: Hydrogen for large-scale (1 MW - 1 GW+) backup power and peak power is gaining traction as grid intermittency

and physical limits of battery backup make alternatives difficult. Hydrogen can address both scalability and duration for sites with

backup power needs beyond 6-8 hours.

Data

Center Prime and Peak Power: Growing demand for cloud and AI processing is stressing grid capacity globally. Plug's value proposition

for data centers includes time to power, limited impact to current data center architecture, true zero-emissions, and 100% renewable

matching.

Material Handling Customer Diversity

is Driving Broad-Based Growth

Our pedestal customers

are continuing to grow their business in the US and Europe, with 11 total pedestal customers in the US and Europe. Plug’s remains

focused on improving service and power purchase agreement margins for material handling and is executing internal initiatives to drive costs down as we scale

our business.

Plug’s newest

pedestal customer Tyson showed overwhelmingly positive results when analyzing their business case for integrating Plug’s fuel cells.

This included a 13-15% productivity gain, 17M pounds of estimated carbon footprint reduction annually, and 50,000 annual labor hours

saved across eight sites.

A driving factor

in our global material handling growth is the reduction in product lead times from our new manufacturing sites, coupled with the maturity

of our solution following years of successful implementation. The sales cycle has decreased meaningfully given the value proposition

of our product and we have added multiple customers including Tyson, Ryder and STEF.

World-Class Global Manufacturing

Facilities Drive Operating Leverage

The Innovation

Center and Gigafactory in Rochester, NY reached its initial nameplate capacity of 100 MW of electrolyzer stacks per month in May 2023.

The factory design allows for continued expansion and automation, which will enable Plug to drive down costs and increase throughput

over time with additional equipment. The Company plans to organically expand its proton exchange membrane (PEM) stack manufacturing capacity in Rochester well beyond

2.5 GW per year. We believe this could result in greater than 4GW of electrolyzer capacity, and over 200,000 fuel cell stacks produced

per year by 2030.

Additionally, we

are nearing completion on the balance of the manufacturing lines at our Vista Fuel Cell Manufacturing facility in Slingerlands, NY. The

Vista facility spans 407,000 square feet, with the ability to expand to 800,000 square feet to meet the growing demand for our fuel cell

products. This massive expansion in Plug’s fuel cell manufacturing for material handling represents a four-fold increase YoY. The

site targets capacity by 2030 to produce 80,000 GenDrive units, 500MW of 1-3 MW stationary power units, and 20,000 ProGen engines.

Summary of Third

Quarter Financials

Revenue was $199M

in the quarter, compared to $189M for the third quarter of 2022, up 5% YoY. Overall, company gross margin was negative 69%, compared

to negative 24% for the third quarter of 2022. The equipment line item now consists of a blended margin from established fuel

cell applications in the material handling sector and our rapidly expanding new product lines such as electrolyzers, on-road mobility

solutions, stationary power units, cryogenic equipment, and liquefiers.

The unprecedented

number of hydrogen facilities in the market running below nameplate capacity has caused significant hydrogen shortages impacting deployment

schedules, fuel prices, system efficiencies, service on hydrogen infrastructures, and timing of varied reliability program rollouts.

The network has seen improvement recently, and we expect liquid hydrogen production from both the Georgia and Tennessee facilities will

have substantial impacts on network disruptions.

Service costs have

been affected as hydrogen disruptions have delayed the roll out of upgrades at both new and existing customer sites. These factors have

been compounded by certain cost increases from inflation impacts on labor, materials and overhead. Upgrades in the field also take a

period of time to create meaningful cost improvements, as aging units in the field continue to require additional service. In the interim,

given the impact on service and near-term cost projections, we have recorded additional service loss accrual for open contracts. Improvements

to our service margin profile are planned to be addressed through the roll out of a new GenDrive platform in 2024, continued upgrades

at existing facilities, and operational continuity from lower hydrogen supply disruptions.

Delivering on Roadmap and Margin

Expansion Remains Key Corporate Focus

Plug remains focused

on building a global green hydrogen ecosystem and delivering on its growth objectives, margin expansion and path to profitability. We

look forward to updating you all on our next call.

A

conference call will be held on Thursday, November 9, 2023.

Join the call:

| ● | Toll-free:

877-407-9221 or +1 201-689-8597 |

| ● | Direct

webcast: https://event.webcasts.com/starthere.jsp?ei=1637631&tp_key=7e3a258c08 |

The webcast can

also be accessed directly from the Plug homepage (www.plugpower.com). A playback of the call will be available online for a period of

time following the call.

About Plug

Plug is

building the hydrogen economy as the leading provider of comprehensive hydrogen fuel cell (HFC) turnkey solutions. The

Company’s innovative technology powers electric motors with hydrogen fuel cells amid an ongoing paradigm shift in the power,

energy, and transportation industries to address climate change and energy security, while providing efficiency gains and meeting

sustainability goals. Plug Power created the first commercially viable market for hydrogen fuel cell (HFC) technology. As a result,

the Company has deployed over 60,000 fuel cell systems for e-mobility, more than anyone else in the world, and has become the

largest buyer of liquid hydrogen, having built and operated a hydrogen highway across North America. Plug Power delivers a

significant value proposition to end-customers, including meaningful environmental benefits, efficiency gains, fast fueling, and

lower operational costs. Plug Power’s vertically integrated GenKey solution ties together all critical elements to power,

fuel, and provide service to customers such as Amazon, BMW, The Southern Company, Carrefour, and Walmart. The Company is now

leveraging its know-how, modular product architecture and foundational customers to rapidly expand into other key markets including

zero-emission on-road vehicles, robotics, and data centers.

Cautionary Note

on Forward-Looking Statements

This communication

contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve

significant risks and uncertainties about Plug Power Inc. (“Plug”), including but not limited to statements about Plug’s

ability to deliver on its business and strategic objectives and achieve substantial growth; Plug’s projections regarding its future

financial and market outlook, including its ability to achieve margin expansion and profitability; Plug’s plans to improve its

service margins; Plug’s near-term cost projections and recording of service loss provisions; Plug’s expectation that business

accelerators will further position it to be a global leader in the green hydrogen industry; the expectation that Plug will be able to

significantly expand manufacturing capacity to meet anticipated demand while delivering continued manufacturing cost reduction; the expected

production tax credits and other benefits Plug may receive under the Inflation Reduction Act and other policy and regulations; the timing

and achievement of expected outputs at Plug’s Georgia and Tennessee facilities; the expectation that Plug’s construction

of hydrogen plants at Louisiana, Texas and New York will provide additional step change in its fuel margin expansion; Plug’s beliefs

with respect to its sales opportunities and the timing of FID; Plug’s expectation regarding the number of material handling sites

and new customers; Plug’s ability to organically expand Plug’s PEM stack manufacturing capacity at its Innovation Center

and Gigafactory in Rochester, NY, drive down costs and increase throughput, and achieve expected capacity by the target dates; the expected

production at Plug’s Vista facility; the belief that Plug’s Gigafactory and Vista facility will create a sustainable competitive

advantage and industry cost leadership; Plug’s ability to complete additional green hydrogen plants in North America, Europe and

globally by the target dates and achievement of target production capacities by those dates; the anticipated progress and expected growth

of Plug’s ability to execute its strategic growth plan through joint ventures; Plug’s ability to apply learnings from its

Georgia plant to additional plants and the belief that such learnings may improve contracting strategy, reduce construction capital expenditures

and ensure completion on targeted timelines; the expected timing for deployment of Plug’s stationary power solutions; Plug’s

plans to roll out power upgrades; Plug’s ability to continue to expand manufacturing capabilities and manage supply chain issues,

including Plug’s belief that current hydrogen supply challenges is a transitory issue; the expected sales pipelines, timing of

revenue recognition and bookings, including the expectation that a backlog of new product orders will result in increased sales; and

Plug’s ability to obtain financing on acceptable terms to fund its forecasted capital expenditure and operating requirements under

the current business plan.

You are cautioned

that such statements should not be read as a guarantee of future performance or results as such statements are subject to risks and uncertainties.

Actual performance or results may differ materially from those expressed in these statements as a result of various factors, including,

but not limited to, that we continue to incur losses and might never achieve or maintain profitability; our ability to continue as a

going concern; that we will need to raise additional capital to fund our operations and such capital may not be available to us; global

economic uncertainty, including supply chain disruptions, credit tightening, inflationary pressures, and high interest rates; that we

may not be able to obtain from our hydrogen suppliers a sufficient supply of hydrogen at competitive prices or the risk that we may not

be able to produce hydrogen internally at competitive prices; that we may not be able to expand our business or manage our future growth

effectively; that delays in or not completing our product development and hydrogen plant construction goals may adversely affect our

revenue and profitability; that we may not be able to convert all of our backlog into revenue and cash flows; the benefit that we will

receive under the Inflation Reduction Act; that we may not be able to successfully execute on our joint ventures; and our ability to

manufacture and market products on a profitable and large-scale commercial basis. For a further description of the risks and uncertainties

that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the

business of Plug in general, see Plug’s public filings with the Securities and Exchange Commission, including the “Risk Factors”

section of Plug’s Annual Report on Form 10-K for the year ended December 31, 2022, Plug’s Quarterly Reports on Form 10-Q

for the quarters ended March 31, 2023 and June 30, 2023 as well as any subsequent filings. Readers are cautioned not to place undue reliance

on these forward-looking statements. The forward-looking statements are made as of the date hereof and are based on current expectations,

estimates, forecasts and projections as well as the beliefs and assumptions of management. We disclaim any obligation to update forward-looking

statements except as may be required by law.

Plug Investor Contact

Roberto Friedlander

investors@plugpower.com

Plug Media Contact

Kristin Monroe

Allison+Partners

PlugPR@allisonpr.com+

| Plug Power Inc. and Subsidiaries |

| |

| Condensed Consolidated Balance Sheets |

| |

| (In thousands, except share and per share amounts) |

| |

| (Unaudited) |

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 110,809 | | |

$ | 690,630 | |

| Restricted cash | |

| 225,818 | | |

| 158,958 | |

| Available-for-sale securities, at fair

value (amortized cost of $388,768 and allowance for credit losses of $0 at September 30, 2023 and amortized cost of $1,355,614 and

allowance for credit losses of $0 at December 31, 2022) | |

| 388,768 | | |

| 1,332,943 | |

| Equity securities | |

| 67,823 | | |

| 134,836 | |

| Accounts receivable, net of allowance of $1,339 at September 30, 2023 and $391 at December 31, 2022 | |

| 163,187 | | |

| 129,450 | |

| Inventory, net | |

| 1,024,209 | | |

| 645,636 | |

| Contract assets | |

| 112,385 | | |

| 62,456 | |

| Prepaid expenses and other current assets | |

| 146,905 | | |

| 150,389 | |

| Total current assets | |

| 2,239,904 | | |

| 3,305,298 | |

| | |

| | | |

| | |

| Restricted cash | |

| 825,863 | | |

| 699,756 | |

| Property, plant, and equipment, net | |

| 1,252,483 | | |

| 719,793 | |

| Right of use assets related to finance leases, net | |

| 54,819 | | |

| 53,742 | |

| Right of use assets related to operating leases, net | |

| 404,595 | | |

| 360,287 | |

| Equipment related to power purchase agreements and fuel delivered to customers, net | |

| 108,717 | | |

| 89,293 | |

| Contract assets | |

| 29,068 | | |

| 41,831 | |

| Goodwill | |

| 248,023 | | |

| 248,607 | |

| Intangible assets, net | |

| 193,177 | | |

| 207,725 | |

| Investments in non-consolidated entities and non-marketable equity securities | |

| 78,871 | | |

| 31,250 | |

| Other assets | |

| 16,601 | | |

| 6,694 | |

| Total assets | |

$ | 5,452,121 | | |

$ | 5,764,276 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 292,925 | | |

$ | 191,895 | |

| Accrued expenses | |

| 153,635 | | |

| 156,430 | |

| Deferred revenue and other contract liabilities | |

| 176,614 | | |

| 131,813 | |

| Operating lease liabilities | |

| 62,110 | | |

| 48,861 | |

| Finance lease liabilities | |

| 9,094 | | |

| 8,149 | |

| Finance obligations | |

| 85,372 | | |

| 58,925 | |

| Current portion of long-term debt | |

| 2,648 | | |

| 5,142 | |

| Contingent consideration, loss accrual for service contracts, and other current liabilities | |

| 148,187 | | |

| 34,060 | |

| Total current liabilities | |

| 930,585 | | |

| 635,275 | |

| | |

| | | |

| | |

| Deferred revenue and other contract liabilities | |

| 76,983 | | |

| 98,085 | |

| Operating lease liabilities | |

| 295,232 | | |

| 271,504 | |

| Finance lease liabilities | |

| 35,120 | | |

| 37,988 | |

| Finance obligations | |

| 287,039 | | |

| 270,315 | |

| Convertible senior notes, net | |

| 194,922 | | |

| 193,919 | |

| Long-term debt | |

| 1,405 | | |

| 3,925 | |

| Contingent consideration, loss accrual for service contracts, and other liabilities | |

| 121,549 | | |

| 193,051 | |

| Total liabilities | |

| 1,942,835 | | |

| 1,704,062 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock, $0.01 par value per share; 1,500,000,000

shares authorized; Issued (including shares in treasury): 624,267,053 at September 30, 2023 and 608,421,785 at December 31,

2022 | |

| 6,243 | | |

| 6,084 | |

| Additional paid-in capital | |

| 7,456,196 | | |

| 7,297,306 | |

| Accumulated other comprehensive loss | |

| (1,621 | ) | |

| (26,004 | ) |

| Accumulated deficit | |

| (3,847,349 | ) | |

| (3,120,911 | ) |

| Less common stock in treasury: 18,879,367 at September 30, 2023 and 18,076,127 at December 31, 2022 | |

| (104,183 | ) | |

| (96,261 | ) |

| Total stockholders’ equity | |

| 3,509,286 | | |

| 4,060,214 | |

| Total liabilities and stockholders’ equity | |

$ | 5,452,121 | | |

$ | 5,764,276 | |

Plug Power Inc. and Subsidiaries

Condensed Consolidated

Statements of Operations

(In thousands, except

share and per share amounts)

(Unaudited)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net revenue: | |

| | | |

| | | |

| | | |

| | |

| Sales of equipment, related infrastructure and other | |

$ | 145,130 | | |

$ | 157,985 | | |

$ | 543,510 | | |

$ | 383,065 | |

| Services performed on fuel cell systems and related infrastructure | |

| 9,290 | | |

| 8,406 | | |

| 27,088 | | |

| 25,468 | |

| Power purchase agreements | |

| 20,068 | | |

| 9,524 | | |

| 44,135 | | |

| 30,730 | |

| Fuel delivered to customers and related equipment | |

| 19,371 | | |

| 12,389 | | |

| 47,391 | | |

| 40,289 | |

| Other | |

| 4,852 | | |

| 324 | | |

| 7,055 | | |

| 1,146 | |

| Net revenue | |

| 198,711 | | |

| 188,628 | | |

| 669,179 | | |

| 480,698 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue: | |

| | | |

| | | |

| | | |

| | |

| Sales of equipment, related infrastructure and other | |

| 158,989 | | |

| 127,381 | | |

| 504,717 | | |

| 310,362 | |

| Services performed on fuel cell systems and related infrastructure | |

| 17,916 | | |

| 12,619 | | |

| 53,586 | | |

| 38,106 | |

| Provision for loss contracts related to service | |

| 41,581 | | |

| 5,727 | | |

| 55,801 | | |

| 8,843 | |

| Power purchase agreements | |

| 56,981 | | |

| 35,549 | | |

| 157,773 | | |

| 102,194 | |

| Fuel delivered to customers and related equipment | |

| 59,012 | | |

| 53,129 | | |

| 177,963 | | |

| 134,008 | |

| Other | |

| 2,197 | | |

| 286 | | |

| 4,843 | | |

| 1,063 | |

| Total cost of revenue | |

| 336,676 | | |

| 234,691 | | |

| 954,683 | | |

| 594,576 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross loss | |

| (137,965 | ) | |

| (46,063 | ) | |

| (285,504 | ) | |

| (113,878 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 27,651 | | |

| 28,105 | | |

| 83,437 | | |

| 72,123 | |

| Selling, general and administrative | |

| 105,451 | | |

| 85,578 | | |

| 310,621 | | |

| 262,420 | |

| Impairment | |

| 665 | | |

| — | | |

| 11,734 | | |

| — | |

| Change in fair value of contingent consideration | |

| 2,239 | | |

| — | | |

| 26,316 | | |

| (2,605 | ) |

| Total operating expenses | |

| 136,006 | | |

| 113,683 | | |

| 432,108 | | |

| 331,938 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (273,971 | ) | |

| (159,746 | ) | |

| (717,612 | ) | |

| (445,816 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 10,369 | | |

| 13,429 | | |

| 44,392 | | |

| 19,321 | |

| Interest expense | |

| (11,802 | ) | |

| (9,020 | ) | |

| (33,717 | ) | |

| (28,871 | ) |

| Other income/(expense), net | |

| 4,987 | | |

| (5,399 | ) | |

| (4,866 | ) | |

| (9,164 | ) |

| Realized gain/(loss) on investments, net | |

| — | | |

| — | | |

| 263 | | |

| (1,315 | ) |

| Other-than-temporary impairment of available-for-sale securities | |

| (10,831 | ) | |

| — | | |

| (10,831 | ) | |

| — | |

| Change in fair value of equity securities | |

| 70 | | |

| (4,221 | ) | |

| 8,987 | | |

| (22,864 | ) |

| Loss on equity method investments | |

| (7,030 | ) | |

| (4,280 | ) | |

| (19,970 | ) | |

| (10,304 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income taxes | |

$ | (288,208 | ) | |

$ | (169,237 | ) | |

$ | (733,354 | ) | |

$ | (499,013 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax (benefit)/expense | |

| (4,729 | ) | |

| 1,521 | | |

| (6,916 | ) | |

| 1,530 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (283,479 | ) | |

$ | (170,758 | ) | |

$ | (726,438 | ) | |

$ | (500,543 | ) |

| Net loss per share: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | (0.47 | ) | |

$ | (0.30 | ) | |

$ | (1.22 | ) | |

$ | (0.87 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common stock outstanding | |

| 599,465,146 | | |

| 578,043,278 | | |

| 593,417,595 | | |

| 578,217,636 | |

| Plug

Power Inc. and Subsidiaries |

| |

| Condensed

Consolidated Statements of Cash Flows |

| |

| (In

thousands) |

| |

| (Unaudited) |

| | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | |

| Operating activities | |

| | | |

| | |

| Net loss | |

$ | (726,438 | ) | |

$ | (500,543 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation of long-lived assets | |

| 37,810 | | |

| 20,201 | |

| Amortization of intangible assets | |

| 14,158 | | |

| 15,238 | |

| Lower of cost or net realizable value inventory adjustment and provision for excess and obsolete inventory | |

| 33,889 | | |

| | |

| Payments of contingent consideration | |

| (2,895 | ) | |

| | |

| Stock-based compensation | |

| 129,074 | | |

| 134,984 | |

| Provision for losses on accounts receivable | |

| 948 | | |

| | |

| Amortization of debt issuance costs and discount on convertible senior notes | |

| 1,699 | | |

| 1,969 | |

| Provision for common stock warrants | |

| 12,737 | | |

| 12,513 | |

| Deferred income tax (benefit)/expense | |

| (621 | ) | |

| 699 | |

| Impairment | |

| 11,734 | | |

| 763 | |

| Loss/(benefit) on service contracts | |

| 35,893 | | |

| (21,984 | ) |

| Fair value adjustment to contingent consideration | |

| 26,316 | | |

| (2,605 | ) |

| Net realized (gain)/loss on investments | |

| (263 | ) | |

| 1,315 | |

| Other-than-temporary impairment of available-for-sale securities | |

| 10,831 | | |

| | |

| (Accretion)/amortization of premium on available-for-sale securities | |

| (5,144 | ) | |

| 6,383 | |

| Lease origination costs | |

| (7,665 | ) | |

| (5,991 | ) |

| Loss on disposal of assets | |

| - | | |

| 268 | |

| Change in fair value for equity securities | |

| (8,987 | ) | |

| 22,864 | |

| Loss on equity method investments | |

| 19,970 | | |

| 10,304 | |

| Changes in operating assets and liabilities that provide/(use) cash: | |

| | | |

| | |

| Accounts receivable | |

| (34,685 | ) | |

| (1,980 | ) |

| Inventory | |

| (411,737 | ) | |

| (245,770 | ) |

| Contract assets | |

| (39,040 | ) | |

| (7,027 | ) |

| Prepaid expenses and other assets | |

| (6,423 | ) | |

| (82,657 | ) |

| Accounts payable, accrued expenses, and other liabilities | |

| 21,221 | | |

| 112,952 | |

| Deferred revenue and other contract liabilities | |

| 23,699 | | |

| 6,055 | |

| Net cash used in operating activities | |

| (863,919 | ) | |

| (522,049 | ) |

| | |

| | | |

| | |

| Investing activities | |

| | | |

| | |

| Purchases of property, plant and equipment | |

| (484,030 | ) | |

| (317,553 | ) |

| Purchases of equipment related to power purchase agreements and equipment related to fuel delivered to customers | |

| (26,094 | ) | |

| (22,785 | ) |

| Purchase of available-for-sale securities | |

| - | | |

| (295,329 | ) |

| Proceeds from sales of available-for-sale securities | |

| - | | |

| 475,676 | |

| Proceeds from maturities of available-for-sale securities | |

| 961,160 | | |

| 209,379 | |

| Purchase of equity securities | |

| - | | |

| (4,990 | ) |

| Proceeds from sales of equity securities | |

| 76,263 | | |

| | |

| Net cash paid for acquisitions | |

| - | | |

| (26,473 | ) |

| Cash paid for non-consolidated entities and non-marketable equity securities | |

| (66,811 | ) | |

| (38,574 | ) |

| Net cash provided by/(used in) investing activities | |

| 460,488 | | |

| (20,649 | ) |

| | |

| | | |

| | |

| Financing activities | |

| | | |

| | |

| Payments of contingent consideration | |

| (10,105 | ) | |

| (2,667 | ) |

| Payments of tax withholding on behalf of employees for net stock settlement of stock-based compensation | |

| (7,922 | ) | |

| (22,811 | ) |

| Proceeds from exercise of stock options | |

| 1,313 | | |

| 2,135 | |

| Principal payments on long-term debt | |

| (5,710 | ) | |

| (62,794 | ) |

| Proceeds from finance obligations | |

| 90,265 | | |

| 83,980 | |

| Principal repayments of finance obligations and finance leases | |

| (53,394 | ) | |

| (39,156 | ) |

| Net cash provided by/(used in) financing activities | |

| 14,447 | | |

| (41,313 | ) |

| Effect of exchange rate changes on cash | |

| 2,130 | | |

| 6,907 | |

| Decrease in cash and cash equivalents | |

| (579,821 | ) | |

| (733,516 | ) |

| Increase in restricted cash | |

| 192,967 | | |

| 156,412 | |

| Cash, cash equivalents, and restricted cash beginning of period | |

| 1,549,344 | | |

| 3,132,194 | |

| | |

| | | |

| | |

| Cash, cash equivalents, and restricted cash end of period | |

$ | 1,162,490 | | |

$ | 2,555,090 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information | |

| | | |

| | |

| Cash paid for interest, net of

capitalized interest of $6.0 million at September 30, 2023 and $9.8 million at September 30, 2022 | |

$ | 29,207 | | |

$ | 24,392 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

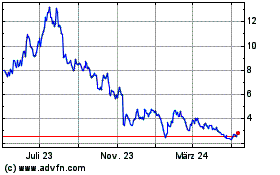

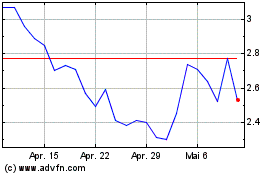

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024