0001564708false00015647082024-09-302024-09-300001564708us-gaap:CommonClassAMember2024-09-302024-09-300001564708us-gaap:CommonClassBMember2024-09-302024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 30, 2024

NEWS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-35769 | | 46-2950970 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

1211 Avenue of the Americas, New York, New York 10036

(Address of principal executive offices, including zip code)

(212) 416-3400

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.01 per share | | NWSA | | The Nasdaq Global Select Market |

| Class B Common Stock, par value $0.01 per share | | NWS | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On September 30, 2024, News Corporation's (the “Company”) subsidiary, REA Group Ltd, issued an announcement withdrawing its possible offer for Rightmove plc. A copy of the announcement is attached as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

The information in this report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | | |

| | NEWS CORPORATION

(REGISTRANT) |

| | | |

| | | |

| | By: | | /s/ Michael L. Bunder |

| | | | Michael L. Bunder |

| | | | Senior Vice President, Deputy General Counsel and Corporate Secretary |

Dated: September 30, 2024

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION

THIS IS AN ANNOUNCEMENT FALLING UNDER RULE 2.8 OF THE CITY CODE ON TAKEOVERS AND MERGERS (THE "CODE")

FOR IMMEDIATE RELEASE

30 September 2024

REA Group Ltd ("REA")

Statement regarding Rightmove plc:

REA withdraws possible offer for Rightmove

REA continues to exercise the financial discipline that has underpinned long-term value creation

Further to Rightmove’s announcement on 30 September 2024 that it had rejected REA’s fourth non-binding indicative proposal (the “Fourth Proposal”), made on 27 September 2024, regarding a possible cash and share offer for the entire issued and to be issued share capital of Rightmove plc (“Rightmove”), REA confirms that it does not intend to make an offer for Rightmove. This is a statement to which Rule 2.8 of the Code applies.

REA’s approach to Rightmove’s Board was driven by a clear strategic rationale and the opportunity to create a global and diversified digital property company, with strong margins and significant cash generation, underpinned by number one positions in Australia and the UK.

REA believes the proposed combination would have provided Rightmove shareholders the opportunity to meaningfully participate in a fast growing, diversified, global leader whilst receiving value certainty in an operating environment challenged by increased market competition.

Rightmove’s share price has lacked any sustained upward momentum for two years despite being supported by its ongoing share buyback programme and revised strategy announced at last year’s Capital Markets Day. The Fourth Proposal, at an implied offer price of 775 pence per share based on REA closing price on 27 September 2024, being the date the Fourth Proposal was made, plus a special dividend of 6 pence per share, together represented a 45% premium to Rightmove’s 12-month and 24- month volume weighted average share prices.

REA is committed to its capital allocation framework and maintains a disciplined approach to mergers and acquisitions. The potential acquisition of Rightmove was dependent on coming to an agreement at a fair price, which would have required meaningful engagement and a constructive dialogue.

The first substantive engagement provided by Rightmove was an introductory high-level Chairman-to- Chairman meeting which took place on 28 September 2024. At the REA Chairman’s request, this was followed by an additional meeting on 29 September 2024 where no presentation or any other information was given by Rightmove to REA. The lack of meaningful engagement and the consistent lack of information provided by Rightmove impeded the ability to progress discussions and work together towards a recommended transaction, within the timetable permitted. All other contact has been cursory and procedural.

REA had firmly believed that it would have been in the interests of Rightmove shareholders for the Board of Directors of Rightmove to engage with REA and to extend the 30 September 2024 deadline to determine whether a mutually acceptable proposal could have been reached. REA reiterates its disappointment that the Board of Directors of Rightmove were unwilling to do so, but REA is excited to pursue its many other avenues for growth.

REA has a longstanding track-record of creating value for shareholders and remains confident in the growth potential across its core business, adjacent opportunities, and India. REA’s full year financial results, released on 9 August 2024, disclosed a 23% increase in revenues and a 27% increase in EBITDA (excluding associates), reflecting the strength of this growth potential. With a robust balance sheet and strong underlying cash flow, REA remains well-positioned to fund growth across its portfolio.

Commenting on Rightmove’s rejection of REA’s Fourth Proposal, Owen Wilson, CEO of REA, said:

“Against a backdrop of intensifying global competition, we approached Rightmove’s Board because we strongly believed in the opportunity to create a globally diversified leader in the digital property sector that would benefit both REA and Rightmove shareholders. We were disappointed with the limited engagement from Rightmove that impeded our ability to make a firm offer within the timetable available. They had nothing to lose by engaging with us.

“We are always financially disciplined when we look at M&A and reinvestment in our business and will continue to focus on the many other opportunities ahead of us. Our recent investment in Athena Home Loans is a great example of this. We have a clear strategy to expand in our core business and adjacent markets, and India represents an exceptional opportunity for growth. We look forward to pursuing these opportunities and generating further value for REA shareholders.”

Under Note 2 of Rule 2.8 of the Code, REA, and any person(s) acting in concert with it, reserves the right to set the restrictions in Rule 2.8 of the Code aside in the following circumstances:

(a) with the agreement of the board of directors of Rightmove;

(b) following the announcement of a firm intention to make an offer for Rightmove by or on behalf of a third party;

(c) following the announcement by Rightmove of a Rule 9 waiver proposal (as described in Note 1 of the Notes on Dispensations from Rule 9 of the Code) or a reverse takeover (as defined in the Code); or

(d) where the Takeover Panel has determined that there has been a material change of circumstances.

The release of this announcement was authorised by the Disclosure Committee and was made outside of hours of operation of the ASX markets announcements platform.

Enquiries:

| | | | | |

| REA Group Ltd Investors: | REA Group Ltd Media: |

| Alice Bennett | Angus Urquhart |

| Executive Manager Investor Relations | General Manager Corporate Affairs |

| P: +61 409 037 726 | P: + 61 437 518 713 |

| E: ir@rea-group.com | E: angus.urquhart@rea-group.com |

| | | | | |

| Deutsche Bank (Financial adviser to REA) | |

| |

| Gavin Deane | +44 (0) 207 545 8000 |

| Oliver Ives | |

| Jennifer Conway | |

| Emma-Jane Newton | |

| |

Brunswick Group (Media enquiries) | |

| |

Simon Sporborg | +44 (0) 207 404 5959 |

Nina Coad | reagroup@brunswickgroup.com |

Paul Durman | |

Jack Walker | |

Sources of information and bases of calculation

i.Any references to the issued and to be issued share capital of Rightmove are based on:

▪788,750,604 basic ordinary shares as at 2 September 2024, based on Rightmove’s Rule 2.9 disclosure;

▪plus 4,130,729 shares reflecting the dilutive impact of Rightmove share options and awards outlined in Rightmove‘s FY23 Annual Report based on the treasury stock method.

ii.The implied total offer value of the Fourth Proposal, which was subject to the reservations set out in REA’s announcement dated 27 September 2024, of 781 pence per Rightmove share has been calculated by reference to a A$/£ exchange rate of 1.946 on 27 September 2024 and a closing price of A$200.00 per REA share (being the last closing price on 27 September 2024, the date of the Fourth Proposal) plus a 6 pence special dividend to be paid in lieu of any final dividend for the year ending 31 December 2024.

iii.VWAPs are calculated with reference to the period ending 30 August 2024, being the last business day prior to the possible offer announcement on 2 September 2024.

iv.Certain figures included in this announcement have been subject to rounding adjustments.

Disclaimer

Deutsche Bank AG is a stock corporation (Aktiengesellschaft) incorporated under the laws of the Federal Republic of Germany with its principal office in Frankfurt am Main. It is registered with the local district court (Amtsgericht) in Frankfurt am Main under No HRB 30000 and licensed to carry on banking business and to provide financial services. The London branch of Deutsche Bank AG is registered as a branch office in the register of companies for England and Wales at Companies House (branch registration number BR000005) with its registered branch office address and principal place of business at 21 Moorfields, London EC2Y 9DB. Deutsche Bank AG is subject to supervision by the European Central Bank (ECB), Sonnemannstrasse 22, 60314 Frankfurt am Main, Germany, and the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht or BaFin), Graurheindorfer Strasse 108, 53117 Bonn and Marie-Curie-Strasse 24-28, 60439 Frankfurt am Main, Germany. With respect to activities undertaken in the United Kingdom, Deutsche Bank AG is authorised by the Prudential Regulation Authority. It is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of Deutsche Bank AG's authorisation and regulation by the Prudential Regulation Authority are available from Deutsche Bank AG on request.

Deutsche Bank AG, acting through its London branch ("Deutsche Bank") is acting as financial adviser to REA and no-one else in connection with the matters described in this announcement and will not be responsible to anyone other than REA for providing the protections afforded to clients of Deutsche Bank, nor for providing advice in connection with the subject matter of this announcement or any other matter referred to in this announcement.

About REA Group Ltd (www.rea-group.com)

REA Group Ltd ACN 068 349 066 (ASX:REA) (“REA Group”) is a multinational digital advertising business specialising in property. REA Group operates Australia’s leading residential and commercial property websites – realestate.com.au and realcommercial.com.au – as well as the leading website dedicated to share property, Flatmates.com.au and property research website, property.com.au. REA Group owns Mortgage Choice Pty Ltd, an Australian mortgage broking franchise group, PropTrack Pty Ltd, a leading provider of property data services, Campaign Agent Pty Ltd, Australia’s leading provider in vendor paid advertising and home preparation finance solutions for the Australian real estate market and Realtair Pty Ltd, a digital platform providing end-to-end technology solutions for the real estate transaction process. In Australia, REA Group holds strategic investments in Simpology Pty Ltd, a leading provider of mortgage application and e-lodgement solutions for the broking and lending industries and Arealytics, a provider of commercial real estate information and technology in Australia. Internationally, REA Group holds a controlling interest in REA India Pte. Ltd. operator of established

brands Housing.com and PropTiger.com. REA Group also holds a significant minority shareholding in Move, Inc., operator of realtor.com in the US, the PropertyGuru Group, operator of leading property sites in Malaysia, Singapore, Thailand and Vietnam and Easiloan, a technology platform for end-to-end digital processing of home loans in India.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassBMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

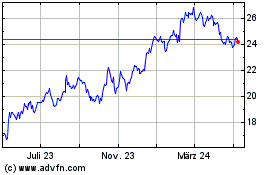

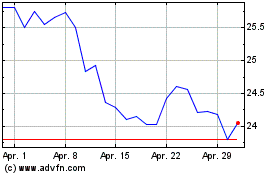

News (NASDAQ:NWSA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

News (NASDAQ:NWSA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024