Form 425 - Prospectuses and communications, business combinations

02 Februar 2024 - 11:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 29, 2024

AKERNA CORP.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39096 |

|

83-2242651 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

| 1550 Larimer Street, #246, Denver, Colorado |

|

80202 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (888) 932-6537

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☒ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to

Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

KERN |

|

NASDAQ Capital Market |

| Warrants to purchase one share of Common Stock |

|

KERNW |

|

NASDAQ Capital Market |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (§230.405 of this chapter) or Rule 12b-2

of the Exchange Act (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

At the Special Meeting (as defined in Item 5.07

below), the stockholders of Akerna Corp. (the “Company,” “Akerna”, “we,” “our,” or “us”)

approved the Company’s 2024 Omnibus Incentive Plan (the “Plan’). A description of the material terms of the Plan was

included in the Company’s prospectus/proxy statement for the Special Meeting dated January 5, 2024 included in the Form S-4 registration

statement (File No. 333-271857), which was declared effective by the Securities and Exchange Commission on January 9, 2024 (the “Proxy

Statement/Prospectus”), which descriptions are incorporated herein by reference. Such descriptions of the Plan are qualified in

their entirety by terms of the Plan a copy of which is attached hereto as Exhibit 4.1 and is incorporated by reference herein.

Item 5.07. Submission of Matters to a Vote of Security Holders.

On January 29, 2024, the Company held a special

meeting of the stockholders of the Company (the “Special Meeting”). Stockholders representing 11,385,929 shares of the Company’s

capital stock entitled to vote at the Special Meeting were present in person or by proxy being 68% of the voting shares (and share equivalents)

issued and outstanding on the record date of December 21, 2023 and constituting a quorum to conduct business at the Special Meeting. The

following sets forth the matters that were voted upon by the Company’s stockholders at the Special Meeting and the voting results

for such matters. These matters are described in more detail in the Proxy Statement/Prospectus.

The results of the stockholder votes for the various

proposals at the Special Meeting are set forth in their entirety below.

| 1. | Proposal

No. 1: The proposal, to approve the issuance of Akerna common stock in the Merger in accordance with the terms of the Agreement and

Plan of Merger, dated as of January 27, 2023, as amended, by and among the Company, Akerna Merger Co., and Gryphon Digital Mining,

Inc. (“Gryphon”), and the change of control of the Company resulting from the Merger (as defined in the Proxy Statement/Prospectus),

was voted on by the stockholders as follows: |

| For | | |

Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 9,837,559 | | |

| 99,742 | | |

| 8,763 | | |

| 1,439,865 | |

| 2. | Proposal

No. 2: The proposal, to approve the sale of the membership interests of MJ Freeway and the capital stock of Ample Organics, Inc.

to MJ Acquisition Corp. (“MJ Acquisition”), pursuant to the terms of the Securities Purchase Agreement dated as of April 28,

2023, as amended, by and among Akerna, Akerna Canada Ample Exchange Inc., a wholly owned subsidiary of Akerna, and MJ Acquisition, and

the transactions contemplated thereby, was voted on by the stockholders as follows: |

| For | | |

Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 9,399,563 | | |

| 87,702 | | |

| 8,799 | | |

| 1,439,865 | |

| 3. | Proposal

No. 3: The proposal, to amend the Company’s Amended and Restated Certificate of Incorporation, as amended, to effect a reverse

stock split of the Company’s issued and outstanding shares of common stock, par value $0.0001, at a ratio of one (1) new share

for every fifteen (15) to one hundred (100) shares of outstanding Akerna common stock, with the exact ratio and effective time

of the reverse stock split of Akerna common stock to be determined by the Akerna board of directors, agreed to by Gryphon and publicly

announced by press release, was voted on by the stockholders as follows: |

| For | | |

Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 11,123,165 | | |

| 260,489 | | |

| 2,275 | | |

| 0 | |

| 4. | Proposal

No. 4: The proposal, to increase the number of authorized shares of Akerna’s common stock, was voted on by the stockholders

as follows: |

| For |

|

|

Against |

|

|

Abstentions |

|

|

Broker Non-Votes |

|

| |

Total Voting: 11,037,010

Common Stock as

Separate Class: 4,180,534 |

|

|

|

Total Voting: 344,071

Common Stock as

Separate Class: 344,071 |

|

|

|

Total Voting: 4,848

Common Stock as

Separate Class: 4,848 |

|

|

|

Total Voting: 0

Common Stock as

Separate Class: 0 |

|

| 5. | Proposal

No. 5: The proposal, to approve an amendment to the amended and restated certificate of incorporation of Akerna to change the corporate

name from Akerna Corp. to “Gryphon Digital Mining, Inc.”, was voted on by the stockholders as follows: |

| For | | |

Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 11,209,771 | | |

| 138,965 | | |

| 24,717 | | |

| 0 | |

| 6. | Proposal

No. 6: The proposal, to approve the Akerna 2024 Omnibus Incentive Plan, in the form attached as Annex F to the Proxy

Statement/Prospectus, was voted on by the stockholders as follows: |

| For | | |

Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 9,643,234 | | |

| 278,050 | | |

| 24,780 | | |

| 1,439,865 | |

| 7. | Proposal

No. 7: The proposal, to approve the issuance of Akerna common stock upon the conversion of $1,650,000 in principal amount of a secured

convertible promissory note held by MJ Acquisition Corp. in accordance with the terms of such secured convertible promissory note a copy

of which was attached as Annex G to the Proxy Statement/Prospectus, was voted on by the stockholders as follows: |

| For | | |

Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 9,795,499 | | |

| 140,552 | | |

| 10,013 | | |

| 1,439,865 | |

| 8. | Proposal

No. 8: The proposal, adjourn the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are

not sufficient votes in favor of Proposal Nos. 1 — 7, was voted on by the stockholders as follows: |

| For | | |

Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 11,173,190 | | |

| 202,622 | | |

| 10,117 | | |

| 0 | |

In accordance, with the above results, Proposal

Nos. 1, 2, 3, 5, 6, 7 and 8 have been approved by the stockholders.

Proposal No. 4, which was the proposal to increase

the number of authorized shares of Akerna’s common stock, while approved by the voting stock, was not approved by the shares of

common stock voting as a separate class as the number of shares voted in favor of Proposal No. 4 was less than a majority of outstanding

shares of common stock on the record date.

Item 9.01 Financial Statements, Pro Forma

Financial Information and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AKERNA CORP. |

| |

|

| |

By: |

/s/ Jessica Billingsley |

| |

|

Jessica Billingsley |

| |

|

Chief Executive Officer |

| |

|

|

| Dated: February 2, 2024 |

|

3

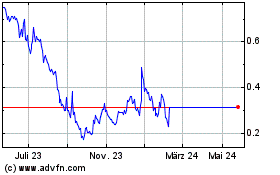

Akerna (NASDAQ:KERN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

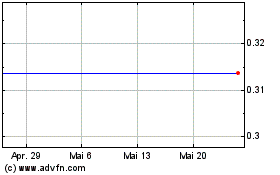

Akerna (NASDAQ:KERN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024