Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Sep. 27, 2024 |

Sep. 29, 2023 |

Sep. 30, 2022 |

Oct. 01, 2021 |

| Pay vs Performance Disclosure |

|

|

|

|

| Pay vs Performance Disclosure, Table |

PAY VERSUS PERFORMANCE

As required by the pay versus performance rules adopted by the Securities and Exchange Commission pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and Rule 402(v) of Regulation S-K, we are providing the following information regarding the relationship between “compensation actually paid” to our named executive officers (“NEOs”) and certain of our financial performance metrics for each of the past four fiscal years. Amounts included as “compensation actually paid” do not represent the value of cash compensation and equity awards actually received by our named executive officers but instead are amounts calculated pursuant to SEC rules and which result in adjustments to the amounts reported above in the summary compensation table. Shareholders should refer to the discussion of our compensation philosophy and programs described above under “Executive Compensation,” including the “Compensation Discussion and Analysis,” for a complete discussion of our compensation programs and their connection to our performance. Our Compensation Committee did not consider the following Pay Versus Performance analysis and disclosures in making compensation decisions with respect to any fiscal year shown below. Pay Versus Performance Table The following table sets forth additional compensation information for our CEO and our other Named Executives (Other NEOs) (averaged) along with total shareholder return, net income, and pre-tax income performance results for fiscal 2024, 2023, 2022 and 2021. | | | | | | | | | | | | | | | | | | | | | | | | | 2024 | | | $2,081,320 | | | $513,854 | | | $1,045,804 | | | $424,806 | | | $45.52 | | | $176.42 | | | ($26.53) | | | ($29.86) | | | 2023 | | | $2,147,751 | | | $1,283,488 | | | $1,226,621 | | | $1,069,711 | | | $66.28 | | | $132.58 | | | $19.53 | | | $25.82 | | | 2022 | | | $2,446,656 | | | ($848,899) | | | $1,121,919 | | | ($263,603) | | | $60.87 | | | $110.44 | | | $44.49 | | | $58.89 | | | 2021 | | | $3,231,701 | | | $6,173,580 | | | $1,393,706 | | | $2,273,959 | | | $128.21 | | | $166.98 | | | $83.38 | | | $112.92 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1)

| For 2024, 2023, 2022 and 2021 the CEO was Helen P. Johnson-Leipold (Current CEO) and the sole Other NEO was David W. Johnson. |

(2)

| Compensation actually paid (“CAP”) was determined by making the following adjustments for equity awards: |

| | | | | | | | | | | | | | | | Summary Compensation Table (“SCT”) Total | | | $2,081,320 | | | $1,045,804 | | | $2,147,751 | | | $1,226,621 | | | $2,446,656 | | | $1,121,919 | | | $3,231,701 | | | $1,393,706 | | | Adjustments:

| | | | | | | | | | | | | | | | | | | | | | | | | | | Amounts Reported as ‘Stock Awards’ in SCT | | | ($1,150,016) | | | ($524,982) | | | ($1,149,478) | | | ($524,984) | | | ($1,150,005) | | | ($512,451) | | | ($999,969) | | | ($499,940) | | | Addition: Fair value at year-end of awards granted during the covered fiscal year that are outstanding and unvested at year-end | | | $170,194 | | | $215,423 | | | $438,305 | | | $353,972 | | | $413,336 | | | $221,066 | | | $1,859,071 | | | $774,544 | | | Addition (Subtraction): Year-over-year change in fair value of awards granted in any prior fiscal year that are outstanding and unvested at year end | | | ($511,233) | | | ($308,737) | | | ($317,729) | | | ($57,208) | | | ($2,337,138) | | | ($1,056,581) | | | $2,055,859 | | | $589,028 | | | Addition (Subtraction): Change as of the vesting date (from the end of the prior fiscal year) in fair value of awards granted in any prior fiscal year for which vesting conditions were satisfied during such year | | | ($76,411) | | | ($21,510) | | | $164,639 | | | $56,303 | | | ($221,748) | | | ($49,684) | | | $26,918 | | | $9,293 | | | Addition: Dividends on vesting of restricted stock grants | | | — | | | $18,808 | | | — | | | $15,007 | | | — | | | $12,128 | | | — | | | $7,328 | | | Compensation Actually Paid | | | $513,854 | | | $424,806 | | | $1,283,488 | | | $1,069,711 | | | ($848,899) | | | ($263,603) | | | $6,173,580 | | | $2,273,959 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Summary Compensation Table amounts reflect the grant date fair values of equity awards. For CAP calculation purposes, adjustments have been made to reflect fair values as of each measurement date. For performance-based restricted stock units, this includes actual and forecasted funding results as of end of each fiscal year as disclosed in the table above. (3)

| Company and peer group total shareholder return (“TSR”) for each year reflects what the cumulative value of $100 would be, including reinvestment of dividends, if such amount were invested on September 30, 2020. For purposes of the table, the Company’s peer group is the S&P 600 Consumer Discretionary Sector, as reflected in our stock performance graph in our Annual Report on Form 10-K, which was filed with the Commission on December 11, 2024. |

(4)

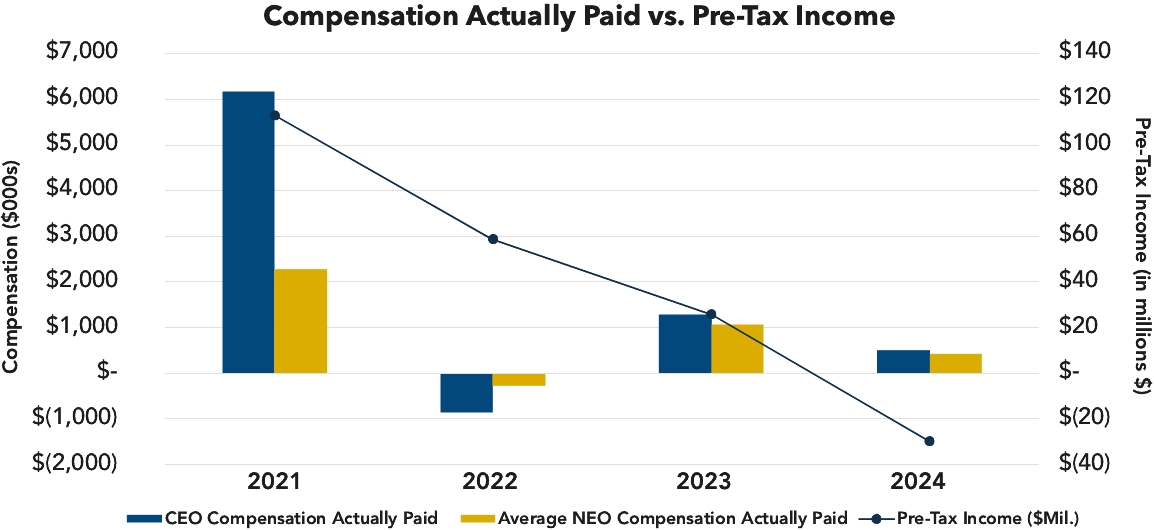

| Our company-selected measure, which is the measure we believe represents the most important financial performance not otherwise presented in the table above that we use to link compensation actually paid to our NEOs for fiscal 2024 to our performance, is pre-tax income, as discussed in our “Compensation Discussion and Analysis – Components of Executive Compensation – Annual Cash Incentives.” |

|

|

|

|

| Company Selected Measure Name |

pre-tax income

|

|

|

|

| Named Executive Officers, Footnote |

(1)

| For 2024, 2023, 2022 and 2021 the CEO was Helen P. Johnson-Leipold (Current CEO) and the sole Other NEO was David W. Johnson. |

|

|

|

|

| Peer Group Issuers, Footnote |

(3)

| Company and peer group total shareholder return (“TSR”) for each year reflects what the cumulative value of $100 would be, including reinvestment of dividends, if such amount were invested on September 30, 2020. For purposes of the table, the Company’s peer group is the S&P 600 Consumer Discretionary Sector, as reflected in our stock performance graph in our Annual Report on Form 10-K, which was filed with the Commission on December 11, 2024. |

|

|

|

|

| PEO Total Compensation Amount |

$ 2,081,320

|

$ 2,147,751

|

$ 2,446,656

|

$ 3,231,701

|

| PEO Actually Paid Compensation Amount |

$ 513,854

|

1,283,488

|

(848,899)

|

6,173,580

|

| Adjustment To PEO Compensation, Footnote |

(2)

| Compensation actually paid (“CAP”) was determined by making the following adjustments for equity awards: |

| | | | | | | | | | | | | | | | Summary Compensation Table (“SCT”) Total | | | $2,081,320 | | | $1,045,804 | | | $2,147,751 | | | $1,226,621 | | | $2,446,656 | | | $1,121,919 | | | $3,231,701 | | | $1,393,706 | | | Adjustments:

| | | | | | | | | | | | | | | | | | | | | | | | | | | Amounts Reported as ‘Stock Awards’ in SCT | | | ($1,150,016) | | | ($524,982) | | | ($1,149,478) | | | ($524,984) | | | ($1,150,005) | | | ($512,451) | | | ($999,969) | | | ($499,940) | | | Addition: Fair value at year-end of awards granted during the covered fiscal year that are outstanding and unvested at year-end | | | $170,194 | | | $215,423 | | | $438,305 | | | $353,972 | | | $413,336 | | | $221,066 | | | $1,859,071 | | | $774,544 | | | Addition (Subtraction): Year-over-year change in fair value of awards granted in any prior fiscal year that are outstanding and unvested at year end | | | ($511,233) | | | ($308,737) | | | ($317,729) | | | ($57,208) | | | ($2,337,138) | | | ($1,056,581) | | | $2,055,859 | | | $589,028 | | | Addition (Subtraction): Change as of the vesting date (from the end of the prior fiscal year) in fair value of awards granted in any prior fiscal year for which vesting conditions were satisfied during such year | | | ($76,411) | | | ($21,510) | | | $164,639 | | | $56,303 | | | ($221,748) | | | ($49,684) | | | $26,918 | | | $9,293 | | | Addition: Dividends on vesting of restricted stock grants | | | — | | | $18,808 | | | — | | | $15,007 | | | — | | | $12,128 | | | — | | | $7,328 | | | Compensation Actually Paid | | | $513,854 | | | $424,806 | | | $1,283,488 | | | $1,069,711 | | | ($848,899) | | | ($263,603) | | | $6,173,580 | | | $2,273,959 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Summary Compensation Table amounts reflect the grant date fair values of equity awards. For CAP calculation purposes, adjustments have been made to reflect fair values as of each measurement date. For performance-based restricted stock units, this includes actual and forecasted funding results as of end of each fiscal year as disclosed in the table above.

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 1,045,804

|

1,226,621

|

1,121,919

|

1,393,706

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 424,806

|

1,069,711

|

(263,603)

|

2,273,959

|

| Adjustment to Non-PEO NEO Compensation Footnote |

(2)

| Compensation actually paid (“CAP”) was determined by making the following adjustments for equity awards: |

| | | | | | | | | | | | | | | | Summary Compensation Table (“SCT”) Total | | | $2,081,320 | | | $1,045,804 | | | $2,147,751 | | | $1,226,621 | | | $2,446,656 | | | $1,121,919 | | | $3,231,701 | | | $1,393,706 | | | Adjustments:

| | | | | | | | | | | | | | | | | | | | | | | | | | | Amounts Reported as ‘Stock Awards’ in SCT | | | ($1,150,016) | | | ($524,982) | | | ($1,149,478) | | | ($524,984) | | | ($1,150,005) | | | ($512,451) | | | ($999,969) | | | ($499,940) | | | Addition: Fair value at year-end of awards granted during the covered fiscal year that are outstanding and unvested at year-end | | | $170,194 | | | $215,423 | | | $438,305 | | | $353,972 | | | $413,336 | | | $221,066 | | | $1,859,071 | | | $774,544 | | | Addition (Subtraction): Year-over-year change in fair value of awards granted in any prior fiscal year that are outstanding and unvested at year end | | | ($511,233) | | | ($308,737) | | | ($317,729) | | | ($57,208) | | | ($2,337,138) | | | ($1,056,581) | | | $2,055,859 | | | $589,028 | | | Addition (Subtraction): Change as of the vesting date (from the end of the prior fiscal year) in fair value of awards granted in any prior fiscal year for which vesting conditions were satisfied during such year | | | ($76,411) | | | ($21,510) | | | $164,639 | | | $56,303 | | | ($221,748) | | | ($49,684) | | | $26,918 | | | $9,293 | | | Addition: Dividends on vesting of restricted stock grants | | | — | | | $18,808 | | | — | | | $15,007 | | | — | | | $12,128 | | | — | | | $7,328 | | | Compensation Actually Paid | | | $513,854 | | | $424,806 | | | $1,283,488 | | | $1,069,711 | | | ($848,899) | | | ($263,603) | | | $6,173,580 | | | $2,273,959 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Summary Compensation Table amounts reflect the grant date fair values of equity awards. For CAP calculation purposes, adjustments have been made to reflect fair values as of each measurement date. For performance-based restricted stock units, this includes actual and forecasted funding results as of end of each fiscal year as disclosed in the table above.

|

|

|

|

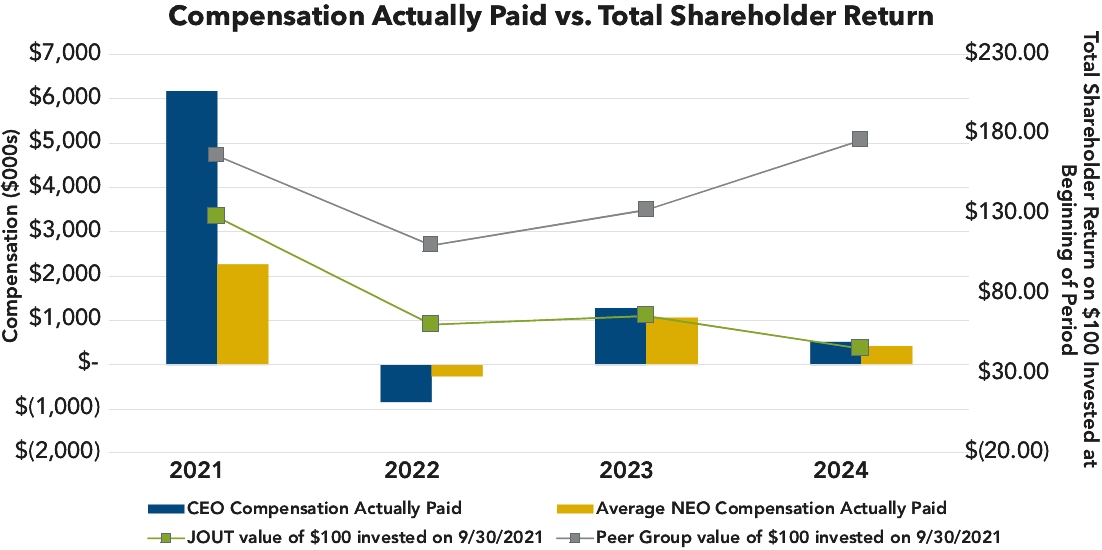

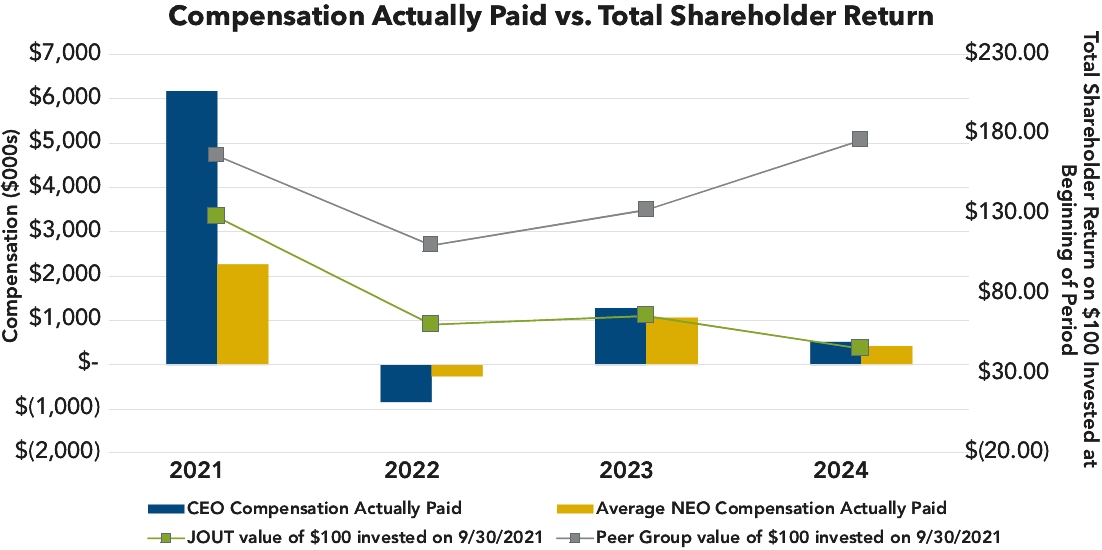

| Compensation Actually Paid vs. Total Shareholder Return |

Total shareholder return in the first chart below, in the case of both the Company and our peer group, reflects the cumulative return of $100 as if invested on September 30, 2020, including reinvestment of dividends.

|

|

|

|

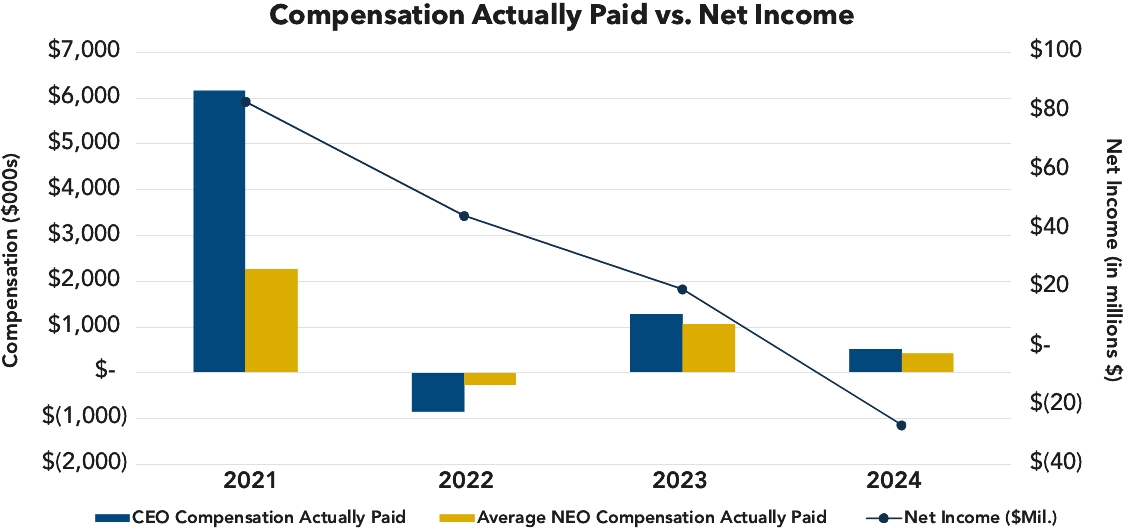

| Compensation Actually Paid vs. Net Income |

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

|

|

|

|

| Total Shareholder Return Vs Peer Group |

Total shareholder return in the first chart below, in the case of both the Company and our peer group, reflects the cumulative return of $100 as if invested on September 30, 2020, including reinvestment of dividends.

|

|

|

|

| Tabular List, Table |

Most Important Performance Measures for 20241 As described in greater detail in this Proxy Statement, the Company’s executive compensation programs reflect a pay-for-performance philosophy. The metrics that the Company uses for both long-term and short-term incentive awards are selected generally based on an objective of incentivizing our NEOs to increase the value of the Company for our shareholders and to align compensation with our strategic goals for the Company. The most important financial performance measures used by the Company to link executive compensation actually paid to the Company’s NEOs, for the most recently completed fiscal year, to the Company’s performance are as follows: | | | | Pre-tax income | | | Net sales | | | Operating profit | | | Return on invested capital | | | | |

1

| See “Compensation Discussion and Analysis—Components of Executive Compensation” for additional discussion. |

|

|

|

|

| Total Shareholder Return Amount |

$ 45.52

|

66.28

|

60.87

|

128.21

|

| Peer Group Total Shareholder Return Amount |

176.42

|

132.58

|

110.44

|

166.98

|

| Net Income (Loss) |

$ (26,530,000)

|

$ 19,530,000

|

$ 44,490,000

|

$ 83,380,000

|

| Company Selected Measure Amount |

(29,860,000)

|

25,820,000

|

58,890,000

|

112,920,000

|

| PEO Name |

Helen P. Johnson-Leipold

|

Helen P. Johnson-Leipold

|

Helen P. Johnson-Leipold

|

Helen P. Johnson-Leipold

|

| Measure:: 1 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Pre-tax income

|

|

|

|

| Measure:: 2 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Net sales

|

|

|

|

| Measure:: 3 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Operating profit

|

|

|

|

| Measure:: 4 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Return on invested capital

|

|

|

|

| PEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

$ (1,150,016)

|

$ (1,149,478)

|

$ (1,150,005)

|

$ (999,969)

|

| PEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

170,194

|

438,305

|

413,336

|

1,859,071

|

| PEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(511,233)

|

(317,729)

|

(2,337,138)

|

2,055,859

|

| PEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(76,411)

|

164,639

|

(221,748)

|

26,918

|

| PEO | Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Total Compensation for Covered Year |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(524,982)

|

(524,984)

|

(512,451)

|

(499,940)

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

215,423

|

353,972

|

221,066

|

774,544

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(308,737)

|

(57,208)

|

(1,056,581)

|

589,028

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(21,510)

|

56,303

|

(49,684)

|

9,293

|

| Non-PEO NEO | Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Total Compensation for Covered Year |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

$ 18,808

|

$ 15,007

|

$ 12,128

|

$ 7,328

|