Johnson Outdoors Announces Cash Dividend

25 Mai 2023 - 12:00PM

Johnson Outdoors Inc. (Nasdaq: JOUT), a leading

global innovator of outdoor recreation equipment and

technology, today announced approval by its Board of Directors of a

quarterly cash dividend of $0.31 per Class A share and $0.2818 per

Class B share.

The quarterly cash dividend is payable on July 27, 2023, to

shareholders of record at the close of business on July 13,

2023.

ABOUT JOHNSON OUTDOORS INC.

JOHNSON

OUTDOORS is a leading global

innovator of outdoor recreation equipment and technologies that

inspire more people to experience the awe of the great outdoors.

The company designs, manufactures and markets a portfolio of

winning, consumer-preferred brands across four categories:

Watercraft Recreation, Fishing, Diving and Camping. Johnson

Outdoors' iconic brands include: Old Town® canoes and kayaks;

Carlisle® paddles; Minn Kota® trolling motors, shallow water

anchors and battery chargers; Cannon® downriggers; Humminbird®

marine electronics and charts; SCUBAPRO® dive equipment; Jetboil®

outdoor cooking systems; and, Eureka!®camping and hiking

equipment.

Visit Johnson Outdoors at

http://www.johnsonoutdoors.com

Safe Harbor Statement

Certain matters discussed in this press release are

“forward-looking statements,” intended to qualify for the safe

harbors from liability established by the Private Securities

Litigation Reform Act of 1995. Statements other than

statements of historical fact are considered forward-looking

statements. These statements may be identified by the use of

forward-looking words or phrases such as "anticipate,'' "believe,''

"confident," "could,'' "expect,'' "intend,'' "may,'' "planned,''

"potential,'' "should,'' "will,'' "would'' or the negative of those

terms or other words of similar meaning. Such forward-looking

statements are subject to certain risks and uncertainties, which

could cause actual results or outcomes to differ materially from

those currently anticipated. Factors that could affect

actual results or outcomes include the matters described under the

caption “Risk Factors” in Item 1A of the Company’s Form 10-K filed

with the Securities and Exchange Commission on December 9, 2022,

and the following: changes in economic conditions, consumer

confidence levels and discretionary spending patterns in key

markets; uncertainties stemming from political instability (and its

impact on the economies in jurisdictions where the Company has

operations), uncertainties stemming from changes in U.S. trade

policies, tariffs, and the reaction of other countries to such

changes; the global outbreaks of disease, such as the COVID-19

pandemic, which has affected, and may continue to affect, market

and economic conditions, and the timing, pricing and continued

availability of raw materials and components from our supply chain,

along with wide-ranging impacts on employees, customers and various

aspects of our operations; the Company’s success in implementing

its strategic plan, including its targeted sales growth platforms,

innovation focus and its increasing digital presence; litigation

costs related to actions of and disputes with third parties,

including competitors; the Company’s continued success in its

working capital management and cost-structure reductions; the

Company’s success in integrating strategic acquisitions; the risk

of future write-downs of goodwill or other long-lived assets; the

ability of the Company’s customers to meet payment obligations; the

impact of actions of the Company’s competitors with respect to

product development or enhancement or the introduction of new

products into the Company’s markets; movements in foreign

currencies, interest rates or commodity costs; fluctuations in the

prices of raw materials or the availability of raw materials or

components used by the Company; any disruptions in the Company’s

supply chain as a result of material fluctuations in the Company’s

order volumes and requirements for raw materials and other

components necessary to manufacture and produce the Company’s

products including related to shortages in procuring necessary raw

materials and components to manufacture and produce such products;

the success of the Company’s suppliers and customers and the impact

of any consolidation in the industries of the Company’s suppliers

and customers; the ability of the Company to deploy its capital

successfully; unanticipated outcomes related to outsourcing certain

manufacturing processes; unanticipated outcomes related to

litigation matters; and adverse weather conditions and other

factors impacting climate change legislation. Shareholders,

potential investors and other readers are urged to consider these

factors in evaluating the forward-looking statements and are

cautioned not to place undue reliance on such forward-looking

statements. The forward-looking statements included

herein are only made as of the date of this filing. The Company

assumes no obligation, and disclaims any obligation, to update such

forward-looking statements to reflect subsequent events or

circumstances.

|

At Johnson Outdoors Inc. |

|

| David Johnson |

Patricia Penman |

| VP & Chief Financial Officer |

VP – Marketing Services & Global Communications |

| 262-631-6600 |

262-631-6600 |

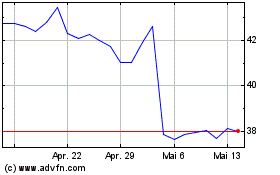

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

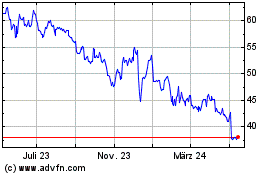

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

Von Nov 2023 bis Nov 2024