Company Meets Q3 Revenues,

Gross Margin and EPS Guidance

- Sales increased 17.5% year-over-year to $190.4

million, the highest quarterly revenues since

Q409

- Small and medium-sized panel driver sales increased

9.5% year over year to $87.3 million, achieving record-high

quarterly revenues

- Non-driver sales increased 30.2%

year-over-year to $26.6 million

- Gross margin increased 480

basis points to 23.3%

from 18.5% in Q311

and increased 20 basis points from 23.1% in

Q212.

- Non-GAAP net income increased

244.1% to $16.5

million from $4.8 million

in Q311.

Non-GAAP diluted earnings per ADS

increased 259.3%

to$9.7 cents from

$2.7 cents in

Q311

- GAAP net income increased

1521.7% to $10.4

million from $0.6 million

in

Q311.

GAAP diluted earnings per ADS

increased

1425% to $6.1

cents from $0.4 cents

in Q311

Himax

Technologies, Inc.

(Nasdaq:HIMX) ("Himax" or

"Company"), a leading supplier and fabless manufacturer of

display drivers and other semiconductor products, today announced

financial results for the third quarter ended September 30,

2012.

SUMMARY FINANCIALS

| Third quarter

2012 Results Compared to Third quarter 2011 Results (USD in

millions) (unaudited) |

| |

| |

Q3

2012 |

Q3

2011 |

CHANGE |

| Net Revenues |

$ 190.4 |

$ 162.1 |

+17.5% |

| Gross Profit |

$ 44.3 |

$ 30.0 |

+47.7% |

| Gross Margin |

23.3% |

18.5% |

+4.8% |

| GAAP Net Income Attributable to

Shareholders |

$ 10.4 |

$ 0.6 |

+1521.7% |

| Non-GAAP Net Income Attributable to

Shareholders |

$16.5 (1) |

$4.8 (2) |

+244.1% |

| GAAP EPS (Per Diluted ADS, USD) |

$ 0.061 |

$ 0.004 |

+1425% |

| Non-GAAP EPS (Per Diluted ADS, USD) |

$0.097(1) |

$0.027(2) |

+259.3% |

| |

| (1) Non-GAAP Net income

attributable to common shareholders and EPS excludes $5.6 million

of share-based compensation expenses, net of tax and $0.5 million

non-cash acquisition related charges, net of tax. |

| (2) Non-GAAP Net income

attributable to common shareholders and EPS excludes $3.8 million

of share-based compensation expenses, net of tax and $0.4 million

non-cash acquisition related charge, net of tax. |

| |

| Third quarter 2012

Results Compared to Second quarter 2012 Results (USD in millions)

(unaudited) |

| |

| |

Q3 2012 |

Q2 2012 |

CHANGE |

| Net Revenues |

$190.4 |

$189.5 |

+0.5% |

| Gross Profit |

$44.3 |

$43.7 |

+1.3% |

| Gross Margin |

23.3% |

23.1% |

+0.2% |

| GAAP Net Income Attributable to

Shareholders |

$10.4 |

$15.1 |

-31.1% |

| Non-GAAP Net Income Attributable to

Shareholders |

$16.5 (1) |

$15.9 (2) |

+3.5% |

| GAAP EPS (Per Diluted ADS, USD) |

$0.061 |

$0.089 |

-31.5% |

| Non-GAAP EPS (Per Diluted ADS, USD) |

$0.097(1) |

$0.093(2) |

+4.3% |

| |

|

| (1) Non-GAAP Net income

attributable to common shareholders and EPS excludes $5.6 million

of share-based compensation expenses, net of tax and $0.5 million

non-cash acquisition related charges, net of tax. |

| (2) Non-GAAP Net income

attributable to common shareholders and EPS excludes $0.4 million

of share-based compensation expenses, net of tax and $0.4 million

non-cash acquisition related charges, net of tax. |

"We are pleased with the top and bottom line financial

improvements during the third quarter of 2012. We will continue to

execute our strategy and are excited about further growth

opportunities going forward," explained Mr. Jordan Wu, President

and Chief Executive Officer of Himax.

Third quarter 2012 Financial Results

| Breakdown by

Product Line (USD in millions)

(unaudited) |

| |

Q3

2012 |

% |

Q3

2011 |

% |

%

Change |

| Display drivers for large-size panels |

$76.5 |

40.2% |

$62.0 |

38.3% |

+23.4% |

| Display drivers for small/medium sized

panels |

$87.3 |

45.8% |

$79.7 |

49.2% |

+9.5% |

| Non-driver products |

$26.6 |

14.0% |

$20.4 |

12.5% |

+30.2% |

| |

|

|

|

|

|

| |

Q3

2012 |

% |

Q2

2012 |

% |

%

Change |

| Display drivers for large-size panels |

$76.5 |

40.2% |

$79.7 |

42.1% |

-4.0% |

| Display drivers for small/medium sized

panels |

$87.3 |

45.8% |

$83.8 |

44.2% |

+4.1% |

| Non-driver products |

$26.6 |

14.0% |

$26.0 |

13.7% |

+2.3% |

Total revenues for the third quarter of 2012 increased 17.5% to

$190.4 million year-over-year and increased 0.5% sequentially.

Strong sales in Himax's large-size panel drivers and non-driver ICs

were the primary contributors to the Company's year over year

revenue growth.

Revenues from large panel display drivers were $76.5 million, up

23.4% from a year ago and down 4.0% from the second quarter of 2012

and accounted for 40.2% of total revenues. The sequential decrease

came in after three consecutive quarters of growth and was

attributed to slower demand from the TV models which Himax's

customers launched earlier this year. The sales increase over the

previous year was mainly due to the growing sales to the panel

customers in China. The Company will continue to strive toward

winning more market share in this segment.

Sales of small and medium-sized drivers reached another record

high in the third quarter. They came in at $87.3 million, up 9.5%

in the third quarter from the same period 2011 and up 4.1% from the

previous quarter and accounted for 45.8% of total revenues with

tablet and automotive display being the fastest growing

applications. These products will continue to contribute noteworthy

growth in 2013. As the Company expected, sales for smartphone

driver ICs were flat from the second quarter of 2012 as a select

group of Himax customers in China, many of them leaders in higher

end market, were experiencing competitive pressure from lower-end

peers penetrating the marketplace aggressively. Notwithstanding the

short-term momentum, smartphone remains Himax's strongest-growing

product segment overall driven by strong demand from both Chinese

and international brands. The Company has won further design-wins

from leading global brands which it will start shipment from the

fourth quarter. Additionally, the Company has also experienced

positive results from its efforts in working with the fast growing

tier-2 smartphone customers in China during the third quarter. The

Company will continue to make progress and gain market share in

that area. The Company remains bullish on the growth prospect

of the smartphone segment for the remainder of 2012 and beyond.

Revenues from Himax's non-driver businesses, which include CMOS

image sensors, LCOS microdisplays, touch panel controllers, power

management ICs, LED diver ICs, wafer level optics, timing

controllers, ASIC services and IP licensing, were $26.6 million, an

increase of 30.2% from the same period last year and 2.3% higher

than the second quarter of 2012 and accounted for 14.0% of total

revenues. Touch panel controller, power management ICs, WLED

drivers, wafer level optics, and operational amplifiers experienced

double digit growth in the third quarter 2012. The Company remains

confident that its non-driver business will continue to account for

an increasing percentage of its sales over time and it provides the

most exciting long-term prospects for growth.

Gross margins were 23.3% for the three months ended September

30, 2012, up 480 basis points from 18.5% in the third quarter of

2011 and up 20 basis points from 23.1% in the second quarter of

2012. This is the fourth consecutive quarter of gross margin

improvement for the Company. The increase in gross margin is a

direct result of a richer mix of Himax's higher-margin products

like those in its fast-growing non-driver category. The Company

will also focus on more value-added high-end driver IC products

which have higher entry barrier. Gross margin improvement will

continue to be one of the Company's business goals going

forward.

Third quarter 2012 GAAP operating expenses were $31.1 million,

up 2.1% from $30.5 million a year ago and up 32.4% from $23.5

million in the previous quarter. The sequential increase was

primarily due to the expenses from the 2012 RSU vest of $6.3

million and higher salary expenses as the Company made its annual

salary adjustment in the third quarter. GAAP operating income was

$13.2 million, or 6.9% of sales, in the third quarter of 2012. It

went down $7.0 million sequentially and up $13.7 million year over

year. The sequential decline in operating income is also attributed

to the RSU vest expenses and salary expense increases identified

above, which accounted for 4.0% of sales.

Reported GAAP net income was $10.4 million, or 6.1 cents per

ADS, for the third quarter of 2012 compared to $0.6 million, or 0.4

cents per ADS, in the corresponding quarter a year ago, and $15.1

million, or 8.9 cents per ADS, in the previous quarter. GAAP net

income improved 1521.7% compared to third quarter 2011 but

decreased 31.1% quarter over quarter mainly due to the $6.3 million

2012 RSU charge in the third quarter.

Non-GAAP net income in the third quarter was $16.5 million, or

9.7 cents per diluted ADS, up from $4.8 million, or 2.7 cents per

ADS, for the same period last year, and up from $15.9 million, or

9.3 cents per ADS, in the previous quarter. Non-GAAP net income for

the third quarter 2012 grew 244.1% over the same period last year

and 3.5% over second quarter of 2012.

| |

| Year to Date 2012 Results

(USD in millions) (unaudited) |

| |

| |

YTD 2012 |

YTD 2011 |

CHANGE |

| Net Revenues |

$546.7 |

$463.8 |

+17.9% |

| Gross Profit |

$126.1 |

$88.2 |

+43.0% |

| Gross Margin |

23.1% |

19.0% |

+4.1% |

| GAAP Net Income Attributable to

Shareholders |

$36.8 |

$7.0 |

+427.0% |

| Non-GAAP Net Income Attributable to

Shareholders |

$44.6 (1) |

$14.0 (2) |

+219.5% |

| GAAP EPS (Per Diluted ADS, USD) |

$0.216 |

$0.039 |

+453.8% |

| Non-GAAP EPS (Per Diluted ADS, USD) |

$0.261(1) |

$0.079(2) |

+230.4% |

| |

|

| (1) Non-GAAP Net income

attributable to common shareholders and EPS excludes $6.5 million

of share-based compensation expenses, net of tax and $1.3 million

non-cash acquisition related charges, net of tax. |

| (2) Non-GAAP Net income

attributable to common shareholders and EPS excludes $5.7 million

of share-based compensation expenses, net of tax and $1.3 million

non-cash acquisition related charges, net of tax. |

Revenues were $546.7 million and gross profits were $126.1

million, representing growth of 17.9% and 43.0% over the first nine

months of 2011 respectively. Gross margin increased to 23.1% in the

first nine months of 2012, up from 19.0% in the same period last

year, a 410 basis point improvement.

GAAP operating expenses were $78.3 million for the first nine

months of 2012, down $4.5 million, or 5.4% from the same period

2011. The significant reduction was due to a better overall cost

control and the reduction in the ramp-up costs for production of

WLO, WLM and LCOS products at Himax's in-house factories for these

product lines, offset by increased share-based expenses of $0.9

million.

Operating income was $47.8 million, or 8.8% of sales, as

compared to $5.4 million, or 1.2% of sales, for the first nine

months of 2011, representing $42.4 million or 780.9% increase year

over year. The improvement in operating income was a reflection of

its overall top and bottom line financial improvement from last

year.

GAAP net income for the first nine months 2012 was $36.8

million, or 21.6 cents per diluted ADS, up from $7.0 million, or

3.9 cents per ADS, for the same period last year. GAAP net income

for the first nine months of 2012 grew 427.0% and GAAP EPS per

diluted share grew 453.8% year over year.

Non-GAAP net income for the first nine months of 2012 was $44.6

million, or 26.1 cents per diluted ADS, up from $14.0 million, or

7.9 cents per ADS, for the same period last year. Non-GAAP net

income for the first nine months of 2012 grew 219.5% and Non-GAAP

EPS per diluted ADS grew 230.4% over the same period last year.

Balance Sheet and Cash Flow

The Company had $89.0 million in cash, cash equivalents and

marketable securities available for sale on September 30, 2012,

compared to $103.2 million on June 30, 2012 and $90.8 million for

the same time last year. The Company made a cash payment for RSU of

$6.3 million and a cash dividend of $10.7 million during the

quarter. Inventories at the end of September were $128.3 million,

up from $104.7 million a year ago and down from $139.2 million a

quarter ago.

Accounts receivable were $218.3 million on September 30, 2012 as

compared to $212.9 million on June 30, 2012 and $174.7 million a

year ago. Day Sales Outstanding ("DSO") was 109 days at end of

third quarter 2012 versus 109 days in the second quarter of 2012

and 103 days last year.

Net cash outflow from operating activities for the third quarter

was $7.1 million. This is mainly because the Company had a

relatively high inventory level at the end of the second quarter as

delivery for much goods prepared for shipping before quarter-end

was postponed into the third quarter out of short notice by the

customers. As a result, while the Company had to pay for those

goods in the third quarter, the Company will not get paid until the

fourth quarter. Himax expects to generate a substantial net cash

inflow from operations during the fourth quarter.

Share Buyback Update

With regards to the Company's $25 million dollars share buyback

program, Himax has purchased a total of $12.7 million, or

approximately 9.1 million ADS through September 30, 2012. Himax

purchased approximately $0.4 million or 0.3 million ADS in the

three months ended September 30, 2012. Himax management has stated

they will continue to execute the remaining share repurchase

program in accordance with Rule 10b-18.

December 2012 Non-Deal Road Show

Ms. Jackie Chang, CFO, Ms. Penny Lin, IR Manager, and John

Mattio, US-Based IR from the MZ Group, will host a number of

investor meetings in the New York Metro and Boston area from

December 3rd to 7th, 2012. If you are interested in meeting with

the Company in a 1-1 session or group session, please contact

Himax's US or Taiwan based investor relations contact at the

numbers below.

Conference Call

Himax Technologies, Inc. will hold a conference call with

investors and analysts tomorrow, November 8, 2012 at 8:00 a.m. US

Eastern Standard Time to discuss the Company's third quarter and

year-to-date 2012 financial results. Details of the call follow

below.

| DATE: |

Thursday, November 8,

2012 |

|

| |

|

|

|

| TIME: |

U.S. 8:00 a.m. EST |

|

|

| |

TAIWAN

9:00 p.m. |

|

|

| |

|

|

|

| DIAL

IN: |

U.S. 1-877-407-4018 |

|

|

| |

INTERNATIONAL

1-201-689-8471 |

|

| |

|

|

|

| CONFERENCE

ID: |

402099 |

|

|

| |

|

|

WEBCAST: |

http://public.viavid.com/index.php?id=102174 |

A replay of the call will be available beginning two hours after

the call through midnight November 15, 2012 (12 p.m. November 16,

Taiwan time) on www.himax.com.tw and by telephone at

+1-877-870-5176 (US Domestic) or +1-858-384-5517 (International).

The conference ID number is 402099. This call is being webcast by

ViaVid Broadcasting and can be accessed by clicking on this

http://public.viavid.com/index.php?id=102174 or at ViaVid's

website at http://www.viavid.net, where the webcast can be accessed

through November 7, 2013.

About Himax Technologies, Inc.

Himax Technologies, Inc. (HIMX) is a fabless semiconductor

solution provider dedicated to display imaging processing

technologies. Himax is a worldwide market leader in display driver

ICs and timing controllers used in TVs, laptops, monitors, mobile

phones, tablets, digital cameras, car navigation, and many other

consumer electronics devices. Additionally, Himax designs and

provides controllers for touch sensor displays, LCOS micro-displays

used in palm-size projectors and head-mounted displays, LED driver

ICs, power management ICs, scaler products for monitors and

projectors, tailor-made video processing IC solutions and silicon

IPs. The company also offers digital camera solutions, including

CMOS image sensors and wafer level optics, which are used in a wide

variety of applications such as mobile phone, tablet, laptop, TV,

PC camera, automobile, security and medical devices. Founded in

2001 and headquartered in Tainan, Taiwan, Himax currently employs

1,400 people from three Taiwan-based offices in Tainan, Hsinchu and

Taipei and country offices in China, Korea, Japan and the US. Himax

has 1,657 patents granted and 1,504 patents pending approval

worldwide as of September 30, 2012. Himax has retained its position

as the leading display imaging processing semiconductor solution

provider to consumer electronics brands worldwide.

http://www.himax.com.tw

About Non-GAAP Financial Measures

To supplement the unaudited consolidated statement of income and

comprehensive income presented in accordance with GAAP, the Company

is also providing non-GAAP measures of income before income tax

expenses, net income, net income attributable to us and basic and

diluted earnings per share for the three and nine months ended

September 30, 2012 and 2011, which are adjusted from results based

on GAAP to exclude the non-cash transactions. The non-GAAP

financial measures are provided to enhance the Investors' overall

understanding of our current performance in on-going core

operations as well as the prospects for the future. These measures

should be considered in addition to results prepared and presented

in accordance with GAAP, but should not be considered a substitute

for or superior to GAAP results. The Company uses both GAAP and

non-GAAP information in evaluating our operating business results

internally and therefore deems it important to provide all of this

information to investors. The non-GAAP adjustments include share

based compensations and acquisition related charges.

Forward-Looking Statements

Factors that could cause actual events or results to differ

materially include, but not limited to, general business and

economic conditions and the state of the semiconductor industry;

market acceptance and competitiveness of the driver and non-driver

products developed by the Company; demand for end-use applications

products; reliance on a small group of principal customers; the

uncertainty of continued success in technological innovations; our

ability to develop and protect our intellectual property; pricing

pressures including declines in average selling prices; changes in

customer order patterns; changes in estimated full-year effective

tax rate; shortages in supply of key components; changes in

environmental laws and regulations; exchange rate fluctuations;

regulatory approvals for further investments in our subsidiaries;

our ability to collect accounts receivable and manage inventory;

the uncertainty of success in our Taiwan listing plan which is

still under review by Taiwan regulatory authorities and subject to

change due to, among other things, changes in either Taiwan or U.S.

authorities' policies and Taiwan regulatory authorities' acceptance

of the Company's Taiwan listing application and other risks

described from time to time in the Company's SEC filings, including

those risks identified in the section entitled "Risk Factors" in

its Form 20-F for the year ended December 31, 2011 filed with the

SEC, as may be amended.

-- FINANCIAL TABLES –

| |

| Himax Technologies,

Inc. |

| Unaudited Condensed

Consolidated Statements of Income |

| (These interim

financials do not fully comply with US GAAP because they omit all

interim disclosure required by US GAAP) |

| (Amounts in Thousands

of U.S. Dollars, Except Per Share Data) |

| |

|

|

|

| |

Three

Months |

Three Months |

| |

Ended September

30, |

Ended June 30, |

| |

2012 |

2011 |

2012 |

| Revenues |

|

|

|

| Revenues from

third parties, net |

$125,671 |

$98,404 |

$126,164 |

| Revenues from

related parties, net |

64,742 |

63,717 |

63,346 |

| |

190,413 |

162,121 |

189,510 |

| |

|

|

|

| Costs and expenses: |

|

|

|

| Cost of revenues |

146,113 |

132,134 |

145,794 |

| Research and development |

21,494 |

21,292 |

15,717 |

| General and

administrative |

5,056 |

5,146 |

4,066 |

| Sales and marketing |

4,588 |

4,072 |

3,728 |

| Total costs and

expenses |

177,251 |

162,644 |

169,305 |

| |

|

|

|

| Operating income (loss) |

13,162 |

(523) |

20,205 |

| |

|

|

|

| Non operating income

(loss): |

|

|

|

| Interest income |

58 |

126 |

100 |

| Equity in losses of equity method

investees |

(30) |

(82) |

(12) |

| Foreign exchange gains (losses), net |

(63) |

759 |

185 |

| Interest expense |

(77) |

(131) |

(97) |

| Other income (loss), net |

502 |

(271) |

(17) |

| |

390 |

401 |

159 |

| Earnings (loss) before income

taxes |

13,552 |

(122) |

20,364 |

| Income tax expense (benefit) |

3,388 |

(31) |

5,447 |

| Net income (loss) |

10,164 |

(91) |

14,917 |

| Net loss attributable to

noncontrolling interests |

247 |

733 |

188 |

| Net income attributable to Himax

stockholders |

$10,411 |

$642 |

$15,105 |

| |

|

|

|

| Basic earnings per ordinary share

attributable to Himax stockholders |

$0.031 |

$0.002 |

$0.044 |

| Diluted earnings per ordinary share

attributable to Himax stockholders |

$0.031 |

$0.002 |

$0.044 |

| Basic earnings per ADS attributable

to Himax stockholders |

$0.061 |

$0.004 |

$0.089 |

| Diluted earnings per ADS attributable

to Himax stockholders |

$0.061 |

$0.004 |

$0.089 |

| |

|

|

|

| Basic Weighted Average

Outstanding ADS |

169,782 |

176,698 |

170,283 |

| Diluted Weighted Average

Outstanding ADS |

169,929 |

176,876 |

170,586 |

| |

| Himax Technologies,

Inc. |

| Unaudited Condensed

Consolidated Statements of Income |

| (Amounts in Thousands

of U.S. Dollars, Except Per Share Data) |

| |

|

|

| |

|

|

| |

Nine

Months |

| |

Ended September

30, |

| |

2012 |

2011 |

| Revenues |

|

|

| Revenues from

third parties, net |

$355,308 |

$264,947 |

| Revenues from

related parties, net |

191,308 |

198,846 |

| |

546,616 |

463,793 |

| |

|

|

| Costs and expenses: |

|

|

| Cost of revenues |

420,484 |

375,599 |

| Research and development |

53,910 |

60,376 |

| General and

administrative |

12,811 |

13,172 |

| Sales and marketing |

11,580 |

9,216 |

| Total costs and

expenses |

498,785 |

458,363 |

| |

|

|

| Operating income |

47,831 |

5,430 |

| |

|

|

| Non operating income

(loss): |

|

|

| Interest income |

243 |

396 |

| Equity in losses of equity method

investees |

(114) |

(275) |

| Foreign exchange gains (losses), net |

(219) |

776 |

| Interest expense |

(273) |

(330) |

| Other income (loss), net |

694 |

(27) |

| |

331 |

540 |

| Earnings before income

taxes |

48,162 |

5,970 |

| Income tax expense |

12,040 |

1,492 |

| Net income |

36,122 |

4,478 |

| Net loss attributable to

noncontrolling interests |

707 |

2,511 |

| Net income attributable to Himax

stockholders |

$36,829 |

$6,989 |

| |

|

|

| Basic earnings per ordinary share

attributable to Himax stockholders |

$0.108 |

$0.020 |

| Diluted earnings per ordinary share

attributable to Himax stockholders |

$0.108 |

$0.020 |

| Basic earnings per ADS attributable

to Himax stockholders |

$0.216 |

$0.039 |

| Diluted earnings per ADS attributable

to Himax stockholders |

$0.216 |

$0.039 |

| |

|

|

| Basic Weighted Average

Outstanding ADS |

170,691 |

177,107 |

| Diluted Weighted Average

Outstanding ADS |

170,702 |

177,197 |

| |

| Himax Technologies,

Inc. |

| Unaudited Supplemental

Financial Information |

| (Amounts in Thousands

of U.S. Dollars) |

| |

|

|

|

| |

|

|

| |

|

|

| The amount of share-based

compensation included in applicable statements of income categories

is summarized as follows: |

Three

Months |

Three Months

Ended |

| |

Ended September

30, |

June 30, |

| |

2012 |

2011 |

2012 |

| Share-based compensation |

|

|

|

| Cost of revenues |

$150 |

$96 |

$6 |

| Research and development |

4,570 |

3,139 |

366 |

| General and

administrative |

1,009 |

554 |

62 |

| Sales and marketing |

1,004 |

684 |

76 |

| Income tax benefit |

(1,118) |

(744) |

(87) |

| Total |

$5,615 |

$3,729 |

$423 |

| |

|

|

|

| The amount of

acquisition-related charges included in applicable statements of

income categories is summarized as follows: |

| |

|

|

|

| Acquisition-related charges |

|

|

|

| Research and development |

$305 |

$259 |

$240 |

| Sales and marketing |

289 |

289 |

290 |

| Income tax benefit |

(125) |

(125) |

(125) |

| Total |

$469 |

$423 |

$405 |

| |

| Himax Technologies,

Inc. |

| Unaudited Supplemental

Financial Information |

| (Amounts in Thousands

of U.S. Dollars) |

| |

|

|

| The amount of share-based

compensation included in applicable statements of income categories

is summarized as follows: |

Nine

Months |

| |

Ended September

30, |

| |

2012 |

2011 |

| Share-based compensation |

|

|

| Cost of revenues |

$161 |

$118 |

| Research and development |

5,309 |

4,874 |

| General and administrative |

1,133 |

839 |

| Sales and marketing |

1,157 |

963 |

| Income tax benefit |

(1,291) |

(1,099) |

| Total |

$6,469 |

$5,695 |

| |

|

|

| The amount of

acquisition-related charges included in applicable statements of

income categories is summarized as follows: |

| |

|

|

| Acquisition-related charges |

|

|

| Research and

development |

$786 |

$775 |

| Sales and

marketing |

868 |

868 |

| Income tax

benefit |

(375) |

(375) |

| Total |

$1,279 |

$1,268 |

| |

| Himax Technologies,

Inc. |

| GAAP Unaudited

Condensed Consolidated Balance Sheets |

| (Amounts in Thousands

of U.S. Dollars, Except Per Share Data) |

| |

September 30, |

June 30, |

December 31, |

| |

2012 |

2012 |

2011 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$88,822 |

$102,992 |

$106,164 |

| Restricted cash and cash equivalents |

73,000 |

63,000 |

84,200 |

| Investments in marketable securities

available-for-sale |

171 |

167 |

165 |

| Accounts receivable, less allowance for

doubtful accounts, sales returns and discounts |

136,284 |

129,045 |

101,280 |

| Accounts receivable from related parties,

less allowance for sales returns and discounts |

82,019 |

83,832 |

79,833 |

| Inventories |

128,339 |

139,158 |

112,985 |

| Deferred income taxes |

16,760 |

16,432 |

16,217 |

| Prepaid expenses and other current

assets |

15,012 |

15,108 |

14,865 |

| Total current

assets |

$540,407 |

$549,734 |

$515,709 |

| |

|

|

|

| Investment securities, including

securities measured at fair value |

$12,926 |

$24,619 |

$24,506 |

| Equity method

investments |

295 |

322 |

439 |

| Property, plant and equipment,

net |

53,119 |

54,173 |

57,150 |

| Deferred income

taxes |

5,785 |

13,830 |

13,649 |

| Goodwill |

30,923 |

26,846 |

26,846 |

| Intangible assets, net |

6,557 |

3,431 |

4,494 |

| Other assets |

2,427 |

2,434 |

2,185 |

| |

112,032 |

125,655 |

129,269 |

| Total assets |

$652,439 |

$675,389 |

$644,978 |

| |

|

|

|

| Liabilities and Equity |

|

|

|

| Current liabilities: |

|

|

|

| Short-term debt |

$73,000 |

$63,000 |

$84,200 |

| Accounts payable |

129,959 |

159,407 |

134,353 |

| Income taxes payable |

8,687 |

12,753 |

3,644 |

| Other accrued expenses and other current

liabilities |

22,688 |

31,082 |

23,163 |

| Total current

liabilities |

$234,334 |

$266,242 |

$245,360 |

| Other liabilities |

3,860 |

5,018 |

4,560 |

| Total liabilities |

$238,194 |

$271,260 |

$249,920 |

| |

|

|

|

| Equity |

|

|

|

| Himax stockholders'

equity: |

|

|

|

| Ordinary shares, US$0.3 par value,

1,000,000,000 shares authorized; 356,699,482 shares issued and

339,834,778, 339,047,694 and 349,279,556 outstanding at September

30, 2012, June 30, 2012, and December 31, 2011, respectively |

$107,010 |

$107,010 |

$107,010 |

| Additional paid-in capital |

104,700 |

104,580 |

103,051 |

| Treasury shares, at cost (16,864,704

ordinary shares, 17,651,788 ordinary shares and 7,419,926 ordinary

shares at September 30, 2012, June 30, 2012, and December 31, 2011,

respectively) |

(11,805) |

(12,213) |

(4,502) |

| Accumulated other comprehensive

income |

(488) |

137 |

166 |

| Unappropriated retained earnings |

213,861 |

203,450 |

187,712 |

| Himax stockholders'

equity |

$413,278 |

$402,964 |

$393,437 |

| Noncontrolling

interests |

967 |

1,165 |

1,621 |

| Total

equity |

$414,245 |

$404,129 |

$395,058 |

| Total liabilities

and equity |

$652,439 |

$675,389 |

$644,978 |

| |

| Himax Technologies,

Inc. |

| Unaudited Condensed

Consolidated Statements of Cash Flows |

| (Amounts in Thousands

of U.S. Dollars) |

| |

Three

Months |

Three Months |

| |

Ended September

30, |

Ended June 30, |

| |

2012 |

2011 |

2012 |

| |

|

|

|

| Cash flows from operating

activities: |

|

|

|

| Net income (loss) |

$10,164 |

$ (91) |

$14,917 |

| Adjustments to reconcile net

income (loss) to net cash provided by (used in) operating

activities: |

|

| Depreciation and amortization |

3,152 |

3,162 |

3,165 |

| Share-based compensation expenses |

451 |

1,600 |

510 |

| Loss on disposal of property, plant and

equipment |

30 |

114 |

-- |

| Loss (gain) on disposal of marketable

securities, net |

(635) |

36 |

11 |

| Unrealized loss on conversion option |

62 |

298 |

62 |

| Interest income from amortization of

discount on investment in corporate bonds |

(18) |

(41) |

(41) |

| Equity in losses of equity method

investees |

30 |

82 |

12 |

| Deferred income tax expense |

7,587 |

2,020 |

257 |

| Inventories write downs |

3,241 |

1,813 |

4,115 |

| Changes in operating assets and

liabilities: |

|

|

|

| Accounts receivable |

(7,239) |

(1,921) |

(25,956) |

| Accounts receivable from related

parties |

1,811 |

6,542 |

2,077 |

| Inventories |

7,579 |

17,873 |

(24,758) |

| Prepaid expenses and other current

assets |

(320) |

1,890 |

424 |

| Accounts payable |

(29,448) |

(12,224) |

24,476 |

| Income taxes payable |

(4,067) |

(2,431) |

4,967 |

| Other accrued expenses and other current

liabilities |

1,568 |

(316) |

(1,066) |

| Other liabilities |

(1,039) |

(980) |

36 |

| Net cash provided by (used in)

operating activities |

(7,091) |

17,426 |

3,208 |

| |

|

|

|

| Cash flows from investing

activities: |

|

|

|

| Purchase of property and equipment |

(1,746) |

(7,128) |

(1,009) |

| Proceeds from disposal of property and

equipment |

-- |

7 |

-- |

| Purchase of available-for-sale marketable

securities |

(3,351) |

(5,193) |

(5,526) |

| Disposal of available-for-sale marketable

securities |

7,984 |

5,158 |

5,515 |

| Proceeds from disposal of equity method

investment |

-- |

371 |

-- |

| Cash acquired in acquisition |

546 |

-- |

-- |

| Release (pledge)of restricted cash

equivalents and marketable securities |

(3) |

9 |

2 |

| Decrease (increase) in other assets |

585 |

65 |

(132) |

| Net cash provided by (used in)

investing activities |

4,015 |

(6,711) |

(1,150) |

| |

| |

| Himax Technologies,

Inc. |

| Unaudited Condensed

Consolidated Statements of Cash Flows |

| (Amounts in Thousands

of U.S. Dollars) |

| |

|

|

| |

|

|

| |

Three

Months |

Three Months |

| |

Ended September

30, |

Ended June 30, |

| |

2012 |

2011 |

2012 |

| Cash flows from financing

activities: |

|

|

|

| Distribution of cash dividends |

$ (10,680) |

$ (21,224) |

$ -- |

| Proceeds from issuance of new shares by

subsidiaries |

33 |

10 |

86 |

| Payments to repurchase ordinary

shares |

(511) |

(2,062) |

(1,147) |

| Proceeds from disposal of subsidiary

shares to noncontrolling interests by Himax Technologies

Limited |

-- |

-- |

97 |

| Proceeds from disposal of subsidiary

shares to noncontrolling interests by Himax Imaging, Inc. |

78 |

720 |

1 |

| Purchase of subsidiary shares from

noncontrolling interests |

(9) |

(1,383) |

(3) |

| Release (pledge) of restricted cash

equivalents and marketable securities (for borrowing of short-term

debt) |

(10,000) |

(27,200) |

21,200 |

| Proceeds from borrowing of short-term

debt |

73,000 |

27,200 |

146,800 |

| Repayment of short-term debt |

(63,000) |

-- |

(168,000) |

| Net cash used in financing

activities |

(11,089) |

(23,939) |

(966) |

| Effect of foreign currency exchange

rate changes on cash and cash equivalents |

(5) |

(9) |

(12) |

| Net increase (decrease) in cash and

cash equivalents |

(14,170) |

(13,233) |

1,080 |

| Cash and cash equivalents at

beginning of period |

102,992 |

103,887 |

101,912 |

| Cash and cash equivalents at end of

period |

$88,822 |

$90,654 |

$102,992 |

| |

|

|

|

| Supplemental disclosures of cash flow

information: |

|

|

|

| Cash paid during the period

for: |

|

|

|

| Interest expense |

$77 |

$188 |

$97 |

| Income taxes |

$174 |

$95 |

$123 |

| Supplemental disclosures of non-cash

investing and financing activities: |

|

|

|

| Dividend Payable |

$ -- |

$ -- |

$10,680 |

| Fair value of ordinary shares issued by

Himax Display, Inc. in the acquisition of

Spatial Photonics, Inc. |

$541 |

$ -- |

$ -- |

| |

| Himax Technologies,

Inc. |

| Unaudited Condensed

Consolidated Statements of Cash Flows |

| (Amounts in Thousands

of U.S. Dollars) |

| |

Nine

Months |

| |

Ended September

30, |

| |

2012 |

2011 |

| |

|

|

| Cash flows from operating

activities: |

|

|

| Net income |

$36,122 |

$4,478 |

| Adjustments to reconcile net

income to net cash provided by (used in) operating activities: |

| Depreciation and amortization |

9,630 |

9,613 |

| Share-based compensation expenses |

1,478 |

3,921 |

| Loss on disposal of property, plant and

equipment |

30 |

114 |

| Gain on disposal of equity method

investment |

-- |

(313) |

| Gain on disposal of marketable

securities, net |

(631) |

(351) |

| Unrealized loss (gain) on conversion

option |

(28) |

902 |

| Interest income from amortization of

discount on investment in corporate bonds |

(101) |

(130) |

| Equity in losses of equity method

investees |

114 |

275 |

| Deferred income tax expense |

6,938 |

1,279 |

| Inventories write downs |

9,973 |

6,381 |

| Changes in operating assets and

liabilities: |

|

|

| Accounts receivable |

(35,004) |

(14,071) |

| Accounts receivable from related

parties |

(2,191) |

15,587 |

| Inventories |

(25,326) |

6,943 |

| Prepaid expenses and other current

assets |

(566) |

1,465 |

| Accounts payable |

(4,394) |

(2,376) |

| Income taxes payable |

5,042 |

(6,291) |

| Other accrued expenses and other current

liabilities |

(1,029) |

625 |

| Other liabilities |

(334) |

(1,897) |

| Net cash provided by (used in)

operating activities |

(277) |

26,154 |

| |

|

|

| Cash flows from investing

activities: |

|

|

| Purchase of property and equipment |

(4,361) |

(17,653) |

| Proceeds from disposal of property and

equipment |

-- |

7 |

| Purchase of available-for-sale marketable

securities |

(15,124) |

(14,047) |

| Disposal of available-for-sale marketable

securities |

19,753 |

22,392 |

| Proceeds from disposal of equity method

investment |

-- |

371 |

| Purchase of investment securities |

(3) |

-- |

| Cash acquired in acquisition |

546 |

-- |

| Release (pledge) of restricted cash

equivalents and marketable securities |

(5) |

1,007 |

| Decrease in other assets |

429 |

34 |

| Net cash provided by (used in)

investing activities |

1,235 |

(7,889) |

| |

| Himax Technologies,

Inc. |

| Unaudited Condensed

Consolidated Statements of Cash Flows |

| (Amounts in Thousands

of U.S. Dollars) |

| |

Nine

Months |

| |

Ended September

30, |

| |

2012 |

2011 |

| Cash flows from financing

activities: |

|

|

| Distribution of cash dividends |

$ (10,680) |

$ (21,224) |

| Proceeds from issuance of new shares by

subsidiaries |

116 |

41 |

| Payments to repurchase ordinary

shares |

(8,222) |

(2,129) |

| Proceeds from disposal of subsidiary

shares to noncontrolling interests by Himax Technologies

Limited |

97 |

-- |

| Proceeds from disposal of subsidiary

shares to noncontrolling interests by Himax Imaging, Inc. |

411 |

720 |

| Purchase of subsidiary shares from

noncontrolling interests |

(13) |

(1,911) |

| Release (pledge) of restricted cash

equivalents and marketable securities (for borrowing of short-term

debt) |

11,200 |

(27,200) |

| Proceeds from borrowing of short-term

debt |

304,000 |

27,200 |

| Repayment of short-term debt |

(315,200) |

-- |

| Net cash used in financing

activities |

(18,291) |

(24,503) |

| Effect of foreign currency exchange

rate changes on cash and cash equivalents |

(9) |

50 |

| Net decrease in cash and cash

equivalents |

(17,342) |

(6,188) |

| Cash and cash equivalents at

beginning of period |

106,164 |

96,842 |

| Cash and cash equivalents at end of

period |

$88,822 |

$90,654 |

| |

|

|

| Supplemental disclosures of cash flow

information: |

|

|

| Cash paid during the period

for: |

|

|

| Interest expense |

$273 |

$364 |

| Income taxes |

$360 |

$6,280 |

| Supplemental disclosures of non-cash

investing activities: |

|

|

| Fair value of ordinary shares issued by

Himax Display, Inc. in the acquisition of Spatial Photonics,

Inc. |

$541 |

$ -- |

| |

| Himax Technologies,

Inc. |

| Non-GAAP Unaudited

Supplemental Data – Reconciliation Schedule |

| (Amounts in Thousands

of U.S. Dollars) |

| |

|

|

|

| Gross Margin, Operating

Margin and Net Margin Excluding Share-based Compensation and

Acquisition-Related Charges: |

| |

|

|

| |

|

|

| |

Three

Months |

Three Months |

| |

Ended September

30, |

Ended June 30, |

| |

2012 |

2011 |

2012 |

| Revenues |

$190,413 |

$162,121 |

$189,510 |

| |

|

|

|

| Gross profit |

44,300 |

29,987 |

43,716 |

| Add: Share-based compensation – Cost of

revenues |

150 |

96 |

6 |

| Gross profit excluding share-based

compensation |

44,450 |

30,083 |

43,722 |

| Gross margin excluding share-based

compensation |

23.3% |

18.6% |

23.1% |

| |

|

|

|

| Operating income (loss) |

13,162 |

(523) |

20,205 |

| Add: Share-based compensation |

6,733 |

4,473 |

510 |

| Operating income excluding share-based

compensation |

19,895 |

3,950 |

20,715 |

| Add: Acquisition-related charges –Intangible

assets amortization |

594 |

548 |

530 |

| Operating income excluding share-based

compensation and acquisition-related charges |

20,489 |

4,498 |

21,245 |

| Operating margin excluding share-based

compensation and acquisition-related charges |

10.8% |

2.8% |

11.2% |

| Net income attributable to Himax

stockholders |

10,411 |

642 |

15,105 |

| Add: Share-based compensation, net of

tax |

5,615 |

3,729 |

423 |

| Add: Acquisition-related charges, net of

tax |

469 |

423 |

405 |

| Net income attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

16,495 |

4,794 |

15,933 |

| Net margin attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

8.7% |

3.0% |

8.4% |

| |

|

|

|

| *Gross margin excluding

share-based compensation equals gross profit excluding share-based

compensation divided by revenues |

| *Operating margin excluding

share-based compensation and acquisition-related charges equals

operating income excluding share-based compensation and

acquisition-related charges divided by revenues |

| *Net margin attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges equals net income attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges divided by revenues |

| |

| Himax Technologies,

Inc. |

| Non-GAAP Unaudited

Supplemental Data – Reconciliation Schedule |

| (Amounts in Thousands

of U.S. Dollars) |

| |

|

|

| Gross Margin, Operating

Margin and Net Margin Excluding Share-based Compensation and

Acquisition-Related Charges: |

| |

Nine

Months |

| |

Ended September

30, |

| |

2012 |

2011 |

| Revenues |

$546,616 |

$463,793 |

| |

|

|

| Gross profit |

126,132 |

88,194 |

| Add: Share-based compensation – Cost of

revenues |

161 |

118 |

| Gross profit excluding share-based

compensation |

126,293 |

88,312 |

| Gross margin excluding share-based

compensation |

23.1% |

19.0% |

| Operating income |

47,831 |

5,430 |

| Add: Share-based compensation |

7,760 |

6,794 |

| Operating income excluding share-based

compensation |

55,591 |

12,224 |

| Add: Acquisition-related charges –Intangible

assets amortization |

1,654 |

1,643 |

| Operating income excluding share-based

compensation and acquisition-related charges |

57,245 |

13,867 |

| Operating margin excluding share-based

compensation and acquisition-related charges |

10.5% |

3.0% |

| Net income attributable to Himax

stockholders |

36,829 |

6,989 |

| Add: Share-based compensation, net of

tax |

6,469 |

5,695 |

| Add: Acquisition-related charges, net of

tax |

1,279 |

1,268 |

| Net income attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

44,577 |

13,952 |

| Net margin attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

8.2% |

3.0% |

| |

|

|

| *Gross margin excluding

share-based compensation equals gross profit excluding share-based

compensation divided by revenues |

| *Operating margin excluding

share-based compensation and acquisition-related charges equals

operating income excluding share-based compensation and

acquisition-related charges divided by revenues |

| *Net margin attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges equals net income attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges divided by revenues |

| |

| Diluted Earnings Per ADS

Attributable to Himax stockholders Excluding Share-based

Compensation and Acquisition-Related Charges: |

| |

|

|

| |

Three Months |

Nine Months |

| |

Ended September 30, |

Ended September 30, |

| |

2012 |

2012 |

| Diluted GAAP earning per ADS attributable to

Himax stockholders |

$0.061 |

$0.216 |

| Add: Share-based compensation per ADS |

$0.033 |

$0.038 |

| Add: Acquisition-related charges per ADS |

$0.003 |

$0.007 |

| |

|

|

| Diluted non-GAAP earning per ADS attributable

to Himax stockholders excluding share-based compensation and

acquisition-related charges |

$0.097 |

$0.261 |

| |

|

|

| Numbers do not add up due to rounding |

|

|

| |

|

|

CONTACT: For the Company

Jackie Chang, CFO

Himax Technologies, Inc.

Tel: 886-2-2370-3999 Ext.22300

Fax: 886-2-2314-0877

Email: jackie_chang@himax.com.tw

www.himax.com.tw

Penny Lin, Investor Relations

Himax Technologies, Inc.

Tel: 886-2-2370-3999 Ext.22320

Fax: 886-2-2314-0877

Email: penny_lin@himax.com.tw

www.himax.com.tw

Investor Relations - US Representative

MZ North America

John Mattio, SVP

Tel: +1-212-301-7130

Email: john.mattio@mzgroup.us

www.mz-ir.com

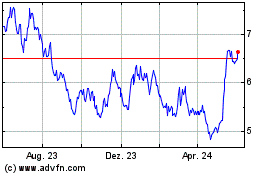

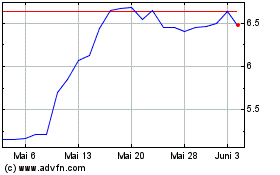

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

Von Jul 2023 bis Jul 2024