0001490281False00014902812023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 12, 2024

Commission File Number: 1-35335 | | | | | | | | | | | | | | |

| Groupon, Inc. |

| (Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | | 27-0903295 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | |

| 600 W Chicago Avenue | | 60654 |

| Suite 400 | | (Zip Code) |

| Chicago | | |

| Illinois | | (312) | 334-1579 |

| (Address of principal executive offices) | | (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | GRPN | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 406 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 12, 2024, Groupon, Inc. (the “Company”) issued a press release providing a business update and announcing selected preliminary unaudited financial information for its fourth quarter ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein. The Company’s management plans to announce and discuss the Company’s complete fourth quarter 2023 and full year financial results in March 2024.

The information in this Current Report on Form 8-K and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | | | | | | |

| (d) | Exhibits: | |

| | Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | GROUPON, INC. |

| Date: January 12, 2024 | |

| | By: /s/ Jiri Ponrt Name: Jiri Ponrt Title: Chief Financial Officer |

Groupon, Inc. Provides Business Update

Expects to report 4Q23 financial results close to, or above, the high-end of guidance

Reaffirms Preliminary 2024 Outlook

Year-end cash & cash equivalents of approximately $141 million

CHICAGO - January 12, 2024 - Groupon, Inc. (NASDAQ: GRPN, the “Company”, “we"), an internet marketplace focused on local services & experiences, today provided a business update.

Updating 4Q23 financial outlook and cash position

Following a strong holiday season in North America Local, we expect:

•Fourth quarter 2023 revenues to be close to, or above, the high-end of our guidance.

•Fourth quarter 2023 Adjusted EBITDA to be close to, or above, the high-end of our guidance.

•Fourth quarter 2023 Free Cash Flow to be positive.

We ended the year with approximately $141 million in cash & cash equivalents and approximately $26 million in restricted cash. During fourth quarter 2023, we paid down $3.9 million of borrowings under our revolving credit agreement and received $18.9 million in proceeds from previously disclosed sales of portions of our investment in SumUp.

Reaffirming Preliminary 2024 Outlook

With respect to 2024, we are reaffirming our previously issued preliminary outlook and continue to expect revenue growth of -5% to 0% compared to 2023, Adjusted EBITDA between $80 million and $100 million and positive Free Cash Flow for the entire year. We continue to expect our Free Cash Flow in the first quarter of 2024 will be negative, given the seasonality timing of our Accrued Merchant Payables as we exit the Q4 holiday season.

Cautionary Disclaimer Statement

The Company intends to provide a detailed operational and financial update during its fourth quarter and full-year 2023 earnings call in March 2024. Closing procedures for the fiscal quarter and year ended December 31, 2023, are not yet complete.

The updated and reaffirmed outlook (the “Outlook”) and preliminary financial information discussed in this press release are based on management’s preliminary, unaudited analysis of financial results for the three months and year ended December 31, 2023. The Outlook is an estimate based on information available to management as of the date of this release and subject to change as a result of the completion of the Company’s standard financial and operating closing procedures and customary audit procedures.

As of the date of this press release, the company has not completed its financial statement closing process for the three months and year ended December 31, 2023, and the company’s independent registered accounting firm has not audited the preliminary financial data discussed in this press release. As we complete our quarter and year end close process and finalize our financial statements for the quarter, it is possible that we may identify items that require adjustments to the Outlook and preliminary financial information set forth above, and those changes could be material. We do not intend to update this Outlook and preliminary financial information prior to the release of final fourth quarter and full year results in March 2024.

As a result, the Outlook and preliminary financial information above constitute forward-looking information and are subject to risks and uncertainties, including possible adjustments, which may cause the Company’s actual results to be different from those set forth above and the differences could be material. Accordingly, you should not place undue reliance on this Outlook and preliminary financial information.

Non-GAAP Financial Measures

This press release references the following non-GAAP financial measures: Adjusted EBITDA and Free Cash Flow. See our 3Q 2023 earnings release press release posted on our Investor Relations website for information regarding non-GAAP financial measures. We do not provide a reconciliation for non-GAAP estimates on a forward-looking basis where we are unable to provide a meaningful calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing or amount of various items that would impact the most directly comparable forward-looking U.S. GAAP financial measure that have not yet occurred, are out of the Company’s control and/or cannot be reasonably predicted. Forward-looking non-GAAP financial measures provided without the most directly comparable U.S. GAAP financial measures may vary materially from the corresponding U.S. GAAP financial measures.

Forward Looking Statements

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the Company's expected results for the fourth quarter of 2023, business strategy and plans and the Company's objectives for future operations and future liquidity. The words "may," "will," "should," "could," "expect," "anticipate," "believe," "estimate," "intend," "continue" and other similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on current expectations and projections about future events and financial trends that we believe may affect the Company's financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements involve risks and uncertainties that could cause the Company's actual results to differ materially from those expressed or implied in the Company's forward-looking statements. Factors that may cause such differences include, but are not limited to, prevailing market conditions, whether holders of record will exercise basic subscription rights to purchase common stock and the amount subscribed in the Company’s ongoing rights offering, whether the Company will be able to successfully complete the rights offering, the Company's ability to execute, and achieve the expected benefits of, the Company's go-forward strategy; execution of the Company's business and marketing strategies; volatility in the Company's operating results; challenges arising from the Company's international operations, including fluctuations in currency exchange rates, legal and regulatory developments in the jurisdictions in which the Company operates and geopolitical instability resulting from the conflicts in Ukraine and the Middle East; global economic uncertainty, including as a result of inflationary pressures, ongoing impacts from the COVID-19 pandemic and labor and supply chain challenges; retaining and adding high quality merchants and third- party business partners; retaining existing customers and adding new customers; competing successfully in the Company's industry; providing a strong mobile experience for the Company's customers; managing refund risks; retaining and attracting members of the Company's executive and management teams and other qualified employees and personnel; customer and merchant fraud; payment-related risks; the Company's reliance on email, internet search engines and mobile application marketplaces to drive traffic to the Company's marketplace; cybersecurity breaches; maintaining and improving the Company's information technology infrastructure; reliance on cloud-based computing platforms; completing and realizing the anticipated benefits from acquisitions, dispositions, joint ventures and strategic investments; lack of control over

minority investments; managing inventory and order fulfillment risks; claims related to product and service offerings; protecting the Company's intellectual property; maintaining a strong brand; the impact of future and pending litigation; compliance with domestic and foreign laws and regulations, including the CARD Act, GDPR, CPRA, other privacy-related laws and regulations of the Internet and e-commerce; classification of the Company's independent contractors, agency workers or employees; the Company's ability to remediate its material weakness over internal control over financial reporting; risks relating to information or content published or made available on the Company's websites or service offerings the Company makes available; exposure to greater than anticipated tax liabilities; adoption of tax laws; the Company's ability to use its tax attributes; impacts if the Company becomes subject to the Bank Secrecy Act or other anti-money laundering or money transmission laws or regulations; the Company's ability to raise capital if necessary; the Company's ability to continue as a going concern; risks related to the Company's access to capital and outstanding indebtedness, including the Company's 1.125% Convertible Senior Notes due 2026 (the "Convertible Notes"); the Company's common stock, including volatility in the Company's stock price; the Company's ability to realize the anticipated benefits from the capped call transactions relating to the Convertible Notes; difficulties, delays or the Company's inability to successfully complete all or part of the announced restructuring actions or to realize the operating efficiencies and other benefits of such restructuring actions; higher than anticipated restructuring charges or changes in the timing of such restructuring charges; and those risks and other factors discussed in Part I, Item 1A. Risk Factors of the Company's Annual Report on Form 10-K for the year ended December 31, 2022 and Part II, Item 1A. Risk Factors of the Company's Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023, and the Company's other filings with the SEC, copies of which may be obtained by visiting the company's Investor Relations web site at investor.groupon.com or the SEC's web site at www.sec.gov. Groupon's actual results could differ materially from those predicted or implied and reported results should not be considered an indication of future performance.

You should not rely upon forward-looking statements as predictions of future events. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither the Company nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. The forward-looking statements reflect the Company's expectations as of January 12, 2024, and are subject to change as a result of the completion of the Company’s standard financial and operating closing procedures and customary audit procedures. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this release to conform these statements to actual results or to changes in the Company's expectations.

About Groupon

Groupon (www.groupon.com) (NASDAQ: GRPN) is a trusted local marketplace where consumers go to buy services and experiences that make life more interesting and deliver boundless value. To find out more about Groupon, please visit press.groupon.com.

Contacts:

Investor Relations

ir@groupon.com

Public Relations

press@groupon.com

v3.23.4

Cover

|

Nov. 07, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 12, 2024

|

| Entity File Number |

1-35335

|

| Entity Registrant Name |

Groupon, Inc.

|

| Entity Tax Identification Number |

27-0903295

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Postal Zip Code |

60654

|

| Entity Address, Address Line One |

600 W Chicago Avenue

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Chicago

|

| City Area Code |

(312)

|

| Entity Address, State or Province |

IL

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

GRPN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001490281

|

| Amendment Flag |

false

|

| Extension |

334-1579

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

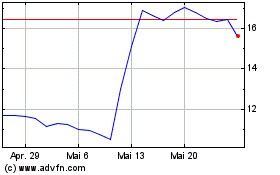

Groupon (NASDAQ:GRPN)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Groupon (NASDAQ:GRPN)

Historical Stock Chart

Von Nov 2023 bis Nov 2024