UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

| Filed

by the Registrant |

☒ |

| |

|

| Filed

by a party other than the Registrant |

☐ |

Check

the appropriate box:

| |

☐ |

Preliminary

Proxy Statement |

| |

|

|

| |

☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

|

| |

☒ |

Definitive

Proxy Statement |

| |

|

|

| |

☐ |

Definitive

Additional Materials |

| |

|

|

| |

☐ |

Soliciting

Material under §240.14a-12 |

GAN

Limited

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| |

☐ |

No

fee required |

| |

|

|

| |

☒ |

Fee

paid previously with preliminary materials |

| |

|

|

| |

☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

GAN

Limited

400

Spectrum Center Drive, Suite 1900

Irvine,

CA 92618

January

4, 2024

Dear

GAN Limited Shareholder:

On

behalf of the board of directors and management, we cordially invite you to a special general meeting of the shareholders of GAN Limited,

a Bermuda exempted company limited by shares (“GAN,” “we,” “us,” “our,” or the “Company”),

to be held in a virtual meeting format via the Internet, originating from GAN’s headquarters located at 400 Spectrum Center Drive,

Suite 1900, Irvine, CA 92618, on February 13, 2024, at 10:00 a.m. (Pacific Time), and at any adjournment or postponement

thereof. We refer to such meeting and any adjournment or postponement thereof as the “special general meeting.”

On

November 7, 2023, GAN entered into an Agreement and Plan of Merger with SEGA SAMMY CREATION INC., a Japanese corporation (“SSC”),

and Arc Bermuda Limited, a Bermuda exempted company limited by shares and a wholly-owned subsidiary of SSC (“Merger Sub”).

We refer to the Agreement and Plan of Merger, as it has been and as it may be amended from time to time, as the “merger

agreement”. Pursuant to the merger agreement and the statutory merger agreement attached as an exhibit to the merger agreement

(which we refer to as the “statutory merger agreement”), Merger Sub will be merged with and into GAN (which we refer to as

the “merger”), the separate corporate existence of Merger Sub will cease and GAN will continue as the surviving company in

the merger and a wholly-owned subsidiary of SSC.

Pursuant

to the terms and subject to the conditions set forth in the merger agreement and the statutory merger agreement, at the effective time

of the merger (which we refer to as the “effective time”), each ordinary share of GAN, $0.01 par value per ordinary share

(which we refer to as the “ordinary shares” and, each, as an “ordinary share”), issued immediately prior to such

time (other than any issued ordinary share owned by SSC, Merger Sub, or any direct or indirect wholly-owned subsidiary of SSC, Merger

Sub or GAN, or owned by GAN as a treasury share) will be automatically canceled and converted into the right to receive, with respect

to each such ordinary share, $1.97 in cash, without interest and less any applicable tax withholding (which we refer to as the “merger

consideration”). The ordinary shares are currently listed on The Nasdaq Capital Market under the symbol “GAN”. The

merger consideration represents a premium of over 120% to the closing price of an ordinary share on The Nasdaq Capital Market on November

7, 2023, the last full trading day prior to the public announcement that the parties entered into the merger agreement.

If

the merger is completed, GAN will become a privately-held company wholly owned by SSC. SSC is a subsidiary of SEGA SAMMY HOLDINGS INC.,

which is the holding company of the SEGA SAMMY Group.

At

the special general meeting, holders of ordinary shares will be asked to consider and vote upon proposals to: (1) approve and adopt the

merger agreement, the statutory merger agreement required in accordance with Section 105 of the Bermuda Companies Act 1981, as amended

(which we refer to as the “Bermuda Companies Act”), and the consummation of the transactions contemplated by the merger agreement

and the statutory merger agreement, including the merger (which we refer to as the “merger proposal”); (2) approve, on an

advisory (non-binding) basis, the compensation that may be paid or become payable to GAN’s named executive officers in connection

with the merger, as described in the accompanying proxy statement (which we refer to as the “compensation advisory proposal”);

and (3) approve an adjournment of the special general meeting, if necessary or appropriate, to permit us to solicit additional proxies

in the event that there are insufficient votes to approve the merger proposal at the special general meeting (which we refer to as the

“adjournment proposal”). Holders of ordinary shares will be entitled to vote on all three proposals.

The

GAN board of directors unanimously (a) determined that the merger consideration constitutes fair value for each ordinary share in accordance

with the Bermuda Companies Act, (b) determined that the terms of the merger agreement, the statutory merger agreement, the merger and

the other agreements and transactions contemplated by the merger agreement and the statutory merger agreement are in the best interests

of GAN and its shareholders, (c) approved and declared advisable GAN’s execution, delivery and performance of the merger agreement

and the statutory merger agreement and the transactions contemplated by the merger agreement and the statutory merger agreement,

including the merger, (d) directed that the merger agreement and the statutory merger agreement be submitted to GAN shareholders for

adoption and approval and (e) recommends that GAN shareholders vote in favor of adoption and approval of the merger agreement, the statutory

merger agreement and the transactions contemplated by the merger agreement and the statutory merger agreement, including the merger.

As more fully described in the accompanying proxy statement, the GAN board of directors made these determinations in accordance with

and upon the unanimous recommendation of its committee comprised solely of independent directors and after consultation with GAN’s

management and independent legal and financial advisors and consideration of a number of factors. Accordingly, the GAN board of directors

unanimously recommends that GAN shareholders vote “FOR” the merger proposal, “FOR” the advisory compensation

proposal and “FOR” the adjournment proposal.

In

considering the recommendations of the GAN board of directors, shareholders should be aware that the executive officers and directors

of GAN have certain interests in the merger that may be different from, or in addition to, the interests of GAN shareholders generally.

Those interests are more fully described in the accompanying proxy statement. The GAN board of directors was aware of those interests

and considered them, among other matters, in making its recommendations.

Assuming

a quorum is present at the special general meeting, the approval of each of the three proposals at the special general meeting requires

the affirmative vote of a simple majority of the votes cast by holders of ordinary shares present in person or represented by proxy and

entitled to vote at the special general meeting in accordance with GAN’s bye-laws. Approval of the merger proposal by GAN shareholders

is necessary to complete the merger.

The

accompanying proxy statement describes provisions of the merger agreement and of the statutory merger agreement and the transactions

contemplated by the merger agreement and the statutory merger agreement, including the merger, and provides information about

the special general meeting. A copy of each of the merger agreement and the statutory merger agreement is attached as Annex A (the

merger agreement), Annex A-1 (the statutory merger agreement), and Annex A-2 (amendment to the merger agreement) to the proxy statement. We encourage you to carefully read the entire proxy statement and its annexes, including the merger agreement,

and the documents referred to or incorporated by reference in the proxy statement in their entirety. You may also obtain additional information

about GAN from documents GAN files with the United States Securities and Exchange Commission.

Your

vote is very important. Regardless of the number of ordinary shares you own, and whether or not you plan to attend the special general

meeting, we hope that you will vote as soon as possible. If you are the owner of record of ordinary shares, you will find enclosed

a proxy card or cards and an envelope in which to return the card(s). Whether or not you plan to attend the special general meeting,

please sign, date and return your enclosed proxy card(s), or submit your proxy via the Internet or over the phone, as soon as

possible so that your shares can be voted at the meeting in accordance with your instructions. You can revoke your proxy before the special

general meeting and issue a new proxy as you deem appropriate. If you wish to revoke your proxy, you will find the procedures to follow

in the accompanying proxy statement.

If

you hold your ordinary shares in “street name” through a broker, bank or other nominee, you should follow the directions

provided by your broker, bank or other nominee regarding how to instruct your broker, bank or other nominee to vote your ordinary shares.

If you do not follow those instructions, your ordinary shares will not be voted at the special general meeting.

If

you have any questions or need assistance voting your shares, please contact Morrow Sodali LLC, GAN’s proxy solicitor, in connection

with the special general meeting:

Morrow

Sodali LLC

333

Ludlow Street, 5th Floor, South Tower

Stamford,

CT 06902

Toll-Free:

(800) 662-5200

GAN@info.morrowsodali.com

Thank

you in advance for your cooperation and continued support.

| |

Sincerely, |

| |

|

| |

/s/

Seamus McGill |

| |

Seamus

McGill |

| |

Interim

Chief Executive Officer |

The

accompanying proxy statement is dated January 4, 2024, and is first being mailed to GAN shareholders on or about January 9,

2024.

None

of the United States Securities and Exchange Commission, any state securities regulatory agency, the Bermuda Registrar of Companies or

the Bermuda Monetary Authority has approved or disapproved the merger, passed upon the merits or fairness of the merger or passed upon

the adequacy or accuracy of the disclosure in this document. Any representation to the contrary is a criminal offense.

The

accompanying proxy statement will not be filed with any government or regulatory authority in Bermuda. Neither the Bermuda Monetary Authority

nor the Bermuda Registrar of Companies accepts any responsibility for GAN’s financial soundness or the correctness of any of the

statements made or opinions expressed in the accompanying proxy statement.

GAN

Limited

400

Spectrum Center Drive, Suite 1900

Irvine,

CA 92618

| |

|

|

| |

NOTICE

OF SPECIAL GENERAL MEETING OF SHAREHOLDERS |

|

| |

|

|

| |

To

be Held on February 13, 2024 |

|

January

4, 2024

To

GAN Limited Shareholders:

On

November 7, 2023, GAN Limited, a Bermuda exempted company limited by shares (which we refer to as “GAN,” “we,”

“us,” “our,” or the “Company”), entered into an Agreement and Plan of Merger with SEGA SAMMY CREATION

INC., a Japanese corporation (“SSC”), and Arc Bermuda Limited, a Bermuda exempted company limited by shares and a wholly-owned

subsidiary of SSC (“Merger Sub”). We refer to the Agreement and Plan of Merger, as it has been and as it may be amended

from time to time, as the “merger agreement”. Pursuant to the terms and subject to the conditions set forth in the merger

agreement and the statutory merger agreement attached as an exhibit to the merger agreement (which we refer to as the “statutory

merger agreement”), Merger Sub will be merged with and into GAN (which we refer to as the “merger”), the separate corporate

existence of Merger Sub will cease and GAN will continue as the surviving company in the merger and a wholly-owned subsidiary of SSC.

Notice

is hereby given that a special general meeting of shareholders of GAN (which we refer to, including any adjournment or postponement thereof,

as the “special general meeting”) will be held on February 13, 2024 at 10:00 a.m. (Pacific Time) solely in

a virtual meeting format via the Internet at www.virtualshareholdermeeting.com/GAN2024SM,

originating from GAN’s headquarters located at 400 Spectrum Center Drive, Suite 1900, Irvine, CA 92618 for the following purposes:

| |

● |

Proposal

1: To consider and vote on a proposal to approve and adopt the merger agreement, the statutory merger agreement required pursuant

to Section 105 of the Bermuda Companies Act 1981, as amended (which we refer to as the “Bermuda Companies Act”), and

the consummation of the transactions contemplated by the merger agreement and the statutory merger agreement, including the merger; |

| |

|

|

| |

● |

Proposal

2: To consider and vote on a proposal to approve, on an advisory (non-binding) basis, the compensation that may be paid or become

payable to our named executive officers in connection with the merger, as described in the accompanying proxy statement; and |

| |

|

|

| |

● |

Proposal

3: To consider and vote on a proposal to approve the adjournment of the special general meeting, if necessary or appropriate,

to solicit additional proxies if there are insufficient votes at the time of the special general meeting to approve Proposal 1. |

Consummation

of the merger is conditioned on, among other things, the approval of Proposal 1 (which we refer to as the “merger proposal”),

but is not conditioned on the approval of Proposal 2 (which we refer to as the “compensation advisory proposal”) or Proposal

3 (which we refer to as the “adjournment proposal”).

Only

holders of record of our ordinary shares, par value $0.01 per share (which we refer to as “ordinary shares” and, each, as

an “ordinary share”), at the close of business on January 2, 2024 (which we refer to as the “record date”),

will be entitled to receive notice of and to vote on the proposals described above at the special general meeting.

Your

vote is important, regardless of the number of ordinary shares you own. At the special general meeting, the presence of two or more persons

representing in the aggregate, in person or by proxy, in excess of 50% of the total issued ordinary shares as of the record date throughout

the meeting will form a quorum for the transaction of business. Assuming a quorum is present, the merger proposal cannot be approved

(and the merger cannot be completed) without the affirmative vote (in person or by proxy) of a simple majority of votes cast by holders

of ordinary shares present (in person or by proxy) at the special general meeting. Our ordinary shares are entitled to one vote per share.

Even

if you plan to attend the special general meeting, we request that you sign, date and return your enclosed proxy card(s), or submit your

proxy by using a toll-free telephone number or the Internet, as soon as possible and thus ensure that your shares will be represented

at the meeting and voted in accordance with your instructions if you are unable to attend. We have provided instructions in the accompanying

proxy statement and on the proxy card and voting instruction form for using the toll-free telephone number or the Internet to submit

your proxy. You can revoke your proxy before the special general meeting and issue a new proxy as you deem appropriate. If you wish to

revoke your proxy, you will find the procedures to follow in the accompanying proxy statement.

If

you hold your ordinary shares in “street name” through a broker, bank or other nominee, you

will need to follow the instructions provided by such broker, bank or nominee regarding how to instruct it to vote your ordinary shares

at the special general meeting.

The

GAN board of directors unanimously recommends that you vote “FOR” the merger proposal, “FOR” the compensation

advisory proposal, and “FOR” the adjournment proposal, each of which is described in more detail in the accompanying proxy

statement.

For

purposes of Section 106(2)(b)(i) of the Bermuda Companies Act, the GAN board of directors considers $1.97 in cash, without interest and

less any applicable withholding taxes, to represent the fair value for each issued ordinary share. GAN shareholders of record who do

not vote in favor of the merger proposal and who are not satisfied that they have been offered fair value for their shares have the right

to apply to the Supreme Court of Bermuda pursuant to Section 106(6) of the Bermuda Companies Act to have the fair value of their shares

appraised. GAN shareholders intending to exercise such appraisal rights MUST file their application for the appraisal of the fair value

of their shares with the Supreme Court of Bermuda within ONE MONTH of the giving of the notice convening the special general meeting.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Sylvia Tiscareño |

| January

4, 2024 |

Sylvia

Tiscareño |

| Irvine,

California |

Chief

Legal Officer & Corporate Secretary |

TABLE

OF CONTENTS

SUMMARY

This

summary highlights material information in this proxy statement. To fully understand the proposals to be considered and voted upon at

the special general meeting and for a more complete description of the legal terms of the merger (as defined below), you should carefully

read this entire proxy statement, including the annexes and documents incorporated by reference herein, and the other documents to which

we refer you in their entirety. For information on how to obtain the documents that we file with the United States Securities and Exchange

Commission (which we refer to as the “SEC”), please see the section of this proxy statement titled “Where You Can Find

More Information.”

The

proxy statement is dated January 4, 2024, and is first being mailed to shareholders of GAN Limited on or about January 9, 2024.

Parties

to the Merger (Page 21)

GAN

Limited

400

Spectrum Center Drive, Suite 1900

Irvine,

California 92618

(833)

565-0550

GAN

Limited (which we refer to as “GAN,” “we,” “us,” “our,” or the “Company”

before the merger and as the “surviving company” following the merger) is a Bermuda exempted company limited by shares and,

through its subsidiaries, operates in two lines of business. GAN is a business-to-business (“B2B”) supplier of enterprise

Software-as-a-Service (“SaaS”) solutions for online casino gaming, commonly referred to as iGaming, and online sports betting

applications. Beginning with GAN’s January 2021 acquisition of Vincent Group p.l.c., a Malta public limited company (“Coolbet”),

GAN is also a business-to-consumer (“B2C”) developer and operator of an online sports betting and casino platform, which

offers consumers in select markets in Northern Europe, Latin America and Canada a digital portal for engaging in sports betting, online

casino games and poker.

GAN’s

ordinary shares are listed on The Nasdaq Capital Market under the symbol “GAN”.

For

additional information on GAN and its business, including how to obtain the documents GAN has filed with the SEC, see the section of

this proxy statement titled “Where You Can Find More Information.”

SEGA

SAMMY CREATION INC.

Sumitomo

Fudosan Osaki Garden Tower

1

Chome-1-1 Nishishinagawa

Shinagawa

City, Tokyo 141-0033 Japan

SEGA

SAMMY CREATION INC. (which we refer to as “SSC”), is a Japanese corporation established in June 2013. SSC, together with

its wholly-owned subsidiary SEGA SAMMY CREATION USA Inc., develop, manufacture and distribute land-based and online/social casino gaming

products and software. SSC is a wholly-owned subsidiary of SEGA SAMMY HOLDINGS INC. (which we refer to as “SEGA SAMMY HOLDINGS”).

SEGA SAMMY HOLDINGS, a Japanese corporation, is the holding company of the SEGA SAMMY Group, a group of companies comprising the Entertainment

Contents Business, which offers a diversity of fun through consumer and arcade game content, toys and animation; the Pachislot and Pachinko

Machines Business, which conducts everything from development to sales of Pachinko/Pachislot machines; and the Resort Business, which

develops and operates resort facilities in Japan and overseas. For the six months ended September 30, 2023 and the fiscal year

ended March 31, 2023, SEGA SAMMY HOLDINGS reported Japanese GAAP1 ordinary income of ¥42.0 billion and ¥49.4 billion,

respectively. SEGA SAMMY HOLDINGS reported total net assets of ¥356.6 billion and ¥331.3 billion as of September 30, 2023 and

March 31, 2023, respectively. SEGA SAMMY HOLDINGS’ shares are listed on the Tokyo Stock Exchange under the ticker code 6460. SEGA

SAMMY HOLDINGS’ American Depository Receipts are traded in the over-the-counter (OTC) market under the symbol “SGAMY.”

Arc

Bermuda Limited

c/o

SEGA SAMMY CREATION INC.

Sumitomo

Fudosan Osaki Garden Tower

1

Chome-1-1 Nishishinagawa

Shinagawa

City, Tokyo 141-0033 Japan

1

SEGA SAMMY HOLDINGS’ financial statements are prepared in accordance with the provisions set forth in the Financial Instruments

and Exchange Law of Japan and its related accounting regulations, and in conformity with accounting principles generally accepted in

Japan (“Japanese GAAP”).

Arc

Bermuda Limited (which we refer to as “Merger Sub”), a Bermuda exempted company limited by shares, is a wholly-owned

subsidiary of SSC formed solely for purposes of entering into the merger agreement and the statutory merger agreement (as such terms

are defined below) and, subject to the terms and conditions thereof, completing the transactions contemplated by the merger agreement

and the statutory merger agreement. Upon completion of the merger, Merger Sub will be merged with and into GAN, the separate corporate

existence of Merger Sub will cease and GAN will continue as the surviving company in the merger and a wholly-owned subsidiary of SSC.

The

Merger (Page 22)

On

the terms and subject to the conditions of that certain Agreement and Plan of Merger, entered into on November 7, 2023, by and among

GAN, SSC and Merger Sub, as amended by that certain Amendment to Agreement and Plan of Merger dated December 15, 2023 (we refer to

the agreement and plan of merger, as it has been and as it may be amended from time to time, as the “merger agreement”),

and the statutory merger agreement attached as an exhibit to the merger agreement (which we refer to as the “statutory merger

agreement”) required in accordance with Section 105 of the Bermuda Companies Act 1981, as amended (which we refer to as the

“Bermuda Companies Act”), Merger Sub will merge with and into GAN, with GAN continuing as the surviving company in the merger

(which we refer to as the “merger”). GAN, as the surviving company in the merger, will continue in existence as a Bermuda

exempted company limited by shares and as a wholly owned subsidiary of SSC. As a result of the merger, under Bermuda law, from and after

the effective time of the merger, GAN’s and Merger Sub’s respective undertakings, properties and liabilities will become

vested in GAN as the surviving company in the merger. The closing of the merger (which we refer to as the “closing”) will

occur within five business days following the satisfaction or (to the extent permitted by applicable law) waiver of all the closing conditions

set forth in the merger agreement (other than those conditions that, by their nature, are to be satisfied at the closing, but subject

to the satisfaction or, to the extent permitted by applicable law, waiver of those conditions) or at such other date and time as GAN

and SSC may agree. We refer to the date on which the closing occurs as the “closing date”. The merger will be effective upon

the issuance of a certificate of merger by the Bermuda Registrar of Companies and at the time and date shown on such certificate of merger

(which we refer to as the “effective time”).

Merger

Consideration (Page 22)

At

the effective time, each ordinary share of GAN, $0.01 par value per share (which we refer to as an “ordinary share”), issued

immediately prior to the effective time (other than any issued ordinary share that is owned by SSC, Merger Sub, or any direct or indirect

wholly-owned subsidiary of SSC, Merger Sub or GAN, or owned by GAN as a treasury share) will be automatically canceled and converted

into the right to receive $1.97 in cash, without interest and less any required withholding taxes (which we refer to as the “merger

consideration”). The merger consideration represents a premium of over 120% to the closing price of an ordinary share on The Nasdaq

Capital Market on November 7, 2023, the last full trading day prior to the public announcement that the parties entered into the merger

agreement. All ordinary shares converted into the right to receive the merger consideration will no longer be issued and will be automatically

canceled and will cease to exist as of the effective time, and will thereafter represent only the right to receive the merger consideration.

As

described further in the section of this proxy statement titled “The Merger – Payment of Merger Consideration”

beginning on page 50, prior to the effective time, SSC will appoint a paying agent reasonably acceptable to GAN for the payment and delivery

of the aggregate merger consideration. At or prior to the effective time, SSC will deposit or cause to be deposited with the paying agent

cash in an amount sufficient to pay the aggregate merger consideration. As promptly as reasonably practicable after the effective time,

but in no event later than three business days after the effective time, SSC will cause the paying agent to send a letter of transmittal

to each holder of record of ordinary shares as of immediately prior to the effective time (all of which are in uncertificated book-entry

form) and instructions for effecting the surrender of book-entry shares in exchange for the merger consideration. Upon the completion

of such applicable procedures and without any action by holders of book-entry shares, the paying agent will deliver to the holder the

merger consideration that the holder is entitled to receive and the book-entry shares will be canceled immediately. No interest will

be paid or accrue on the merger consideration.

After

the completion of the merger, under the terms of the merger agreement and the statutory merger agreement, you will have the right to

receive the merger consideration, but you will no longer have any rights as a GAN shareholder (except that GAN shareholders who have

properly demanded appraisal for their shares in accordance with, and have complied in all respects with, the Bermuda Companies Act will

be entitled only to those rights granted under the Bermuda Companies Act as described in the sections of this proxy statement titled

“The Merger — Dissenters’ Rights of Appraisal for GAN Shareholders” beginning on page 50, “The

Merger Agreement — Dissenting Shares” beginning on page 59 and “Appraisal Rights” beginning

on page 74).

The

Statutory Merger Agreement (Page 3)

The

statutory merger agreement, together with the merger agreement, governs the legal effects of the merger under Bermuda law. A copy of

the form of statutory merger agreement is attached as Annex A-1 to this proxy statement.

The

Special General Meeting (Page 76)

Time,

Place and Purpose of the Special General Meeting (Page 76)

A

special general meeting of shareholders of GAN (which we refer to, including any adjournment or postponement thereof, as the “special

general meeting”) will be held on February 13, 2024 starting at 10:00 a.m. (Pacific Time) solely in a virtual meeting

format via the Internet at www.virtualshareholdermeeting.com/GAN2024SM. The special

general meeting will originate from GAN’s headquarters located at 400 Spectrum Center Drive, Suite 1900, Irvine, CA 92618 and will

begin promptly at the designated start time. Participants will be able to log in 15 minutes prior to the designated start time and are

encouraged to do so in case of any technical difficulties.

At

the special general meeting, GAN shareholders will be asked to consider and vote on each of the following proposals:

| |

● |

Proposal

1 (the “merger proposal”): to approve and adopt the merger agreement, the statutory merger agreement and the consummation

of the transactions contemplated by the merger agreement and the statutory merger agreement, including the merger; |

| |

|

|

| |

● |

Proposal

2 (the “compensation advisory proposal”): to approve, on an advisory (non-binding) basis, the compensation that may

be paid or become payable to GAN’s named executive officers in connection with the merger, as described in this proxy statement;

and |

| |

|

|

| |

● |

Proposal

3 (the “adjournment proposal”): to approve an adjournment of the special general meeting, if necessary or appropriate,

to solicit additional proxies, if there are insufficient votes at the time of the special general meeting to approve the merger proposal. |

Holders

of ordinary shares issued as of the record date (as defined below) will be entitled to vote on each of the above proposals.

Consummation

of the merger is conditioned on, among other things, the approval of the merger proposal, but is not conditioned on the approval of either

the compensation advisory proposal or the adjournment proposal.

Record

Date (Page 76)

Only

shareholders of record at the close of business on January 2, 2024, the record date for the special general meeting (which we

refer to as the “record date”), will be entitled to notice of, and to vote at, the special general meeting. As of January

2, 2024, the record date for the special general meeting, there were 45,071,920 ordinary shares issued.

Quorum

(Page 76)

At

the special general meeting, the presence of two or more persons representing in the aggregate, in person or by proxy, in excess of 50%

of the total issued ordinary shares as of the record date throughout the meeting will form a quorum for the transaction of business.

As a result, two or more persons representing (in person or by proxy) at least 22,535,961 of the issued ordinary shares as of

the record date must be present throughout the meeting for a quorum to exist. If a quorum is not present, the special general meeting

shall stand adjourned to the same day one week later, at the same time and place or to such other day, time or place as the Corporate

Secretary of GAN may determine. If the special general meeting is adjourned, notice of the resumption of the meeting will be given to

each GAN shareholder entitled to notice of, and to vote, at such meeting, unless the meeting is adjourned to a specific date, time and

place announced at the meeting being adjourned.

Required

Vote (Page 77)

Assuming

a quorum is present at the special general meeting, the approval of each of the three proposals at the special general meeting requires

the affirmative vote of a simple majority of the votes cast by holders of ordinary shares present in person or represented by proxy and

entitled to vote at the special general meeting in accordance with GAN’s bye-laws.

Share

Ownership of Our Directors and Executive Officers (Page 77)

As

of the record date, our directors and executive officers beneficially owned and were entitled to vote an aggregate of 341,384

ordinary shares (excluding any ordinary shares that would be issuable upon the vesting, exercise or settlement, as applicable, of options

to acquire ordinary shares, restricted share units or restricted share awards), representing less than 1% of the issued ordinary

shares.

Our

directors and executive officers have informed us that they currently intend to vote all of their ordinary shares: (i) “FOR”

the merger proposal; (ii) “FOR” the compensation advisory proposal; and (iii) “FOR” the adjournment proposal.

Voting

(Page 77)

Holders

of ordinary shares have one vote for each ordinary share held by them as of the record date and are entitled to vote all ordinary shares

held by them as of the record date on all the proposals voted on at the special general meeting. If your ordinary shares are held in

your name, then you will be able to vote under GAN’s voting system in accordance with the description under “Voting Procedures”

below.

If

your ordinary shares are held in “street name” through a bank, broker or other nominee, you should receive this proxy statement

along with instructions for voting your shares from such broker, bank, or other nominee. You may submit your voting instructions by completing,

signing and dating the voting instruction form enclosed with this proxy statement and returning it in the accompanying postage-paid envelope.

Your broker, bank, or other nominee may also allow you to deliver your voting instructions over the Internet and may also permit you

to vote by telephone. If you are a beneficial owner of shares held in street name and wish to vote in person at the special general meeting,

you must obtain a legal proxy from the bank, broker or other nominee that holds those shares. A legal proxy is a written document that

authorizes you to vote your shares held in street name. Please contact the organization that holds your shares for instructions regarding

obtaining a legal proxy.

With

respect to each of the proposals to be voted upon at the special general meeting, shareholders may vote “FOR” the proposal,

“AGAINST” the proposal, or abstain from voting. An abstention is not considered a vote cast.

If

you fail to submit a proxy or to vote in person at the special general meeting and you are a record holder, your shares will not be counted

for purposes of quorum or as votes cast at the special general meeting. If your ordinary shares are held in “street name”

and you do not provide your bank, broker or other nominee with any voting instructions, your shares will be treated as “broker

non-votes” and will not be counted for purposes of quorum or voted at the special general meeting.

Voting

Procedures (Page 77)

There

are four ways to vote:

| |

● |

Online.

You may vote by proxy by visiting www.proxyvote.com and entering the control number located on the proxy card or voting

instruction form enclosed with this proxy statement. If your ordinary shares are held in “street name” by your broker,

bank, or other nominee, the availability of online voting will depend on the voting procedures of the organization that holds your

shares. |

| |

|

|

| |

● |

Phone.

You may vote by proxy by calling the toll-free number found on the proxy card or voting instruction form enclosed with this

proxy statement. If your ordinary shares are held in “street name” by your broker, bank, or other nominee, the availability

of voting by phone will depend on the voting procedures of the organization that holds your shares. |

| |

● |

Mail.

You may vote by proxy by completing, signing and dating the proxy card or voting instruction form enclosed with this proxy

statement and returning it in the postage-paid envelope provided with this proxy statement. |

| |

|

|

| |

● |

At

the Special General Meeting. If you are a shareholder of record, you may vote during the special general meeting. You will

need the control number located on your proxy card to do so. Instructions on how to attend and participate, including how to demonstrate

proof of share ownership, are available at www.virtualshareholdermeeting.com/GAN2024SM.

If you are a beneficial owner of shares held in street name and wish to vote in person at the special general meeting, you must

obtain a legal proxy from the bank, broker or other nominee that holds those shares. Please contact the organization that holds your

shares for instructions regarding obtaining a legal proxy. |

Shareholders

who submit a proxy online or by telephone need not return a proxy card or voting instruction form.

All

shares represented by valid proxies received prior to the taking of the vote at the special general meeting will be voted at the special

general meeting. Where a shareholder provides voting instructions with respect to any matter to be acted upon, the shares will

be voted in accordance with the shareholder’s instructions.

If

you are a record holder and submit a valid proxy or voting instruction form but do not indicate your voting instructions on

one or more of the proposals to be voted on at the special general meeting, your shares will be voted as recommended by the GAN board

of directors on those proposals and as the designated proxyholders may determine in their discretion with respect to any other matters

properly presented for a vote at the special general meeting.

The

GAN board of directors unanimously recommends that you vote “FOR” the merger proposal, “FOR” the advisory compensation

proposal and “FOR” the adjournment proposal.

Abstentions

and “Broker Non-Votes” (Page 78)

Abstentions

will be counted toward the presence of a quorum at the special general meeting.

If

your ordinary shares are held in “street name” through a bank, broker or other nominee, and you do not provide voting

instructions to such bank, broker or other nominee, such bank, broker or other nominee can vote the ordinary shares with respect to

“discretionary” proposals, but cannot vote such shares with respect to “non-discretionary” proposals. It is

expected that all proposals to be voted on at the special general meeting will be considered “non-discretionary”

proposals. Accordingly, if you do not provide voting instructions to the bank, broker or other nominee holding your shares, it is

expected that such bank, broker or other nominee will not be able to vote such shares on your behalf, resulting in a “broker

non-vote.” “Broker non-votes” will

not be counted toward the presence of a quorum at the special general meeting (unless instructions have been provided by the

applicable beneficial owner to the bank, broker or other nominee, as applicable, with respect to at least one proposal to be voted

upon at the special general meeting).

Abstentions

and “broker non-votes” will not be considered votes cast on any proposal brought before the special general meeting. Because

approval of the proposals to be voted on at the special general meeting requires the affirmative vote of a simple majority of votes cast

by holders of ordinary shares present in person or represented by proxy and entitled to vote at the special general meeting in accordance

with GAN’s bye-laws, assuming a quorum is present, an abstention or a “broker non-vote” with respect to any proposal

to be voted on at the special general meeting will not have the effect of a vote for or against such proposal, but will reduce the number

of votes cast and therefore increase the relative influence of those shareholders who casted votes on such proposal.

Revocation

of Proxies (Page 78)

You

may revoke a submitted proxy prior to its exercise at the special general meeting in any of the following ways: (1) submitting a later-dated

proxy by telephone or through the Internet prior to the telephone or Internet voting deadline indicated on your proxy card; (2) submitting

a later-dated and signed proxy card to GAN’s Corporate Secretary; (3) attending the special general meeting and voting in person

(attending the meeting will not, in and of itself, revoke your proxy); or (4) submitting a written revocation of your proxy to GAN’s

Corporate Secretary. Any later-dated and signed proxy card or written notice of revocation must be delivered prior to the special

general meeting to GAN’s Corporate Secretary at 400 Spectrum Center Drive, Suite 1900, Irvine, CA 92618.

If

your ordinary shares are held in “street name” by your bank, broker or other nominee, please follow the instructions provided

by your bank, broker or other nominee as to how to revoke or change your previously provided voting instructions.

Expenses

of Proxy Solicitation (Page 79)

The

GAN board of directors is soliciting your proxy, and GAN will bear the cost of such proxy solicitation. GAN engaged Morrow Sodali

LLC (which we refer to as “Morrow Sodali”) to solicit proxies for the special general meeting. Morrow Sodali will also provide

consulting and proxy solicitation services in connection with the special general meeting. GAN will pay Morrow Sodali a fee of approximately

$17,500, plus reasonable out-of-pocket disbursements for its services, and GAN will indemnify Morrow Sodali for certain losses

arising out of its proxy solicitation services. In addition to the solicitation of proxies by mail, proxies may be solicited by GAN directors,

officers and employees, or representatives of Morrow Sodali, in person or by telephone, email, or other means of communication, and GAN

may pay persons holding ordinary shares on behalf of others their expenses for sending proxy materials to their principals. No additional

compensation will be paid to GAN directors, officers or employees for their services in connection with any such solicitation

of proxies.

Certain

Effects of the Merger on GAN (Page 22)

Upon

the terms and subject to the conditions of the merger agreement and the statutory merger agreement, at the effective time, Merger

Sub will be merged with and into GAN, the separate corporate existence of Merger Sub will cease and GAN will continue as the surviving

company in the merger and a wholly-owned subsidiary of SSC. As a result of the merger, GAN will cease to be a publicly traded company

and the ordinary shares will be delisted from The Nasdaq Capital Market and deregistered under the Securities Exchange Act of 1934, as

amended (which we refer to as the “Exchange Act”). If the merger is completed, you will not own any ordinary shares of the

surviving company and instead will only be entitled to receive the merger consideration described in the section of this proxy statement

titled “The Merger – Merger Consideration” beginning on page 22 (unless you have properly demanded appraisal

for your shares in accordance with, and have complied in all respects with, the Bermuda Companies Act, in which case you will be entitled

only to those rights granted under the Bermuda Companies Act as described in the sections of this proxy statement titled “The

Merger — Dissenters’ Rights of Appraisal for GAN Shareholders” beginning on page 50, “The Merger Agreement

— Dissenting Shares” beginning on page 59 and “Appraisal Rights” beginning on page 74).

Effect

on GAN if the Merger is Not Completed (Page 22)

If

the merger proposal is not approved by GAN shareholders or if the merger is not completed for any other reason, you will not receive

the merger consideration, GAN will remain a public company, the ordinary shares will continue to be listed and traded on The Nasdaq Capital

Market and registered under the Exchange Act, and GAN will continue to be obligated to file periodic reports with the SEC. Upon termination

of the merger agreement, GAN may be required, under certain circumstances, to pay a termination fee of $6.0 million to SSC, as described

in the section of this proxy statement titled “The Merger Agreement — Expenses and Termination Fee” beginning

on page 64.

Background

of the Merger (Page 23)

A

description of the actions that led to the execution of the merger agreement is included under the section of this proxy statement titled

“The Merger — Background of the Merger.”

Recommendation

of the GAN Board of Directors (Page 28)

The

GAN board of directors, based on the unanimous recommendation of its special committee comprised solely of independent directors (which

we refer to as the “special committee”), unanimously recommends that GAN shareholders vote “FOR” the merger

proposal, “FOR” the compensation advisory proposal and “FOR” the adjournment proposal. See the

section of this proxy statement titled “The Merger — GAN’s Reasons for the Merger and Recommendation of the GAN

Board of Directors” beginning on page 28 for the factors considered by the GAN board of directors in reaching its determination

that the merger, on the terms and subject to the conditions set forth in the merger agreement, is fair to, and in the best interests

of, GAN and its shareholders.

Opinion

of GAN’s Financial Advisor (Page 33)

The

GAN board of directors retained B. Riley Securities, Inc. (which we refer to as “B. Riley”) to provide it or, if requested

by the GAN board of directors, the special committee, with financial advisory services in connection with the merger. The GAN

board of directors selected B. Riley to act as its financial advisor based on B. Riley’s qualifications, expertise and reputation,

and its knowledge of GAN’s business and affairs. On November 7, 2023, B. Riley rendered its oral opinion, which was subsequently

confirmed in writing, to the special committee to the effect that, as of the date of such opinion and based upon and subject to the qualifications,

limitations and assumptions considered in connection with the preparation of its opinion, including those stated in B. Riley’s

written opinion letter, the per share cash merger consideration of $1.97 to be received by the holders of ordinary shares pursuant to

the merger agreement and the statutory merger agreement was fair, from a financial point of view, to such shareholders.

B.

Riley’s opinion was directed to the special committee (in its capacity as such) and only addressed the fairness, from a financial

point of view, to the holders of ordinary shares of the per share consideration to be received by such holders in the merger pursuant

to the merger agreement and the statutory merger agreement and did not address any other aspect or implication of the merger, the merger

agreement, the statutory merger agreement or any other agreement or understanding entered into in connection with the merger or otherwise.

The summary of B. Riley’s opinion in this proxy statement is qualified in its entirety by reference to the full text of B. Riley’s

written opinion, which is included as Annex B to this proxy statement and sets forth the procedures followed, assumptions made, qualifications

and limitations on the review undertaken and other matters considered by B. Riley in preparing its opinion. However, neither B. Riley’s

written opinion nor the summary of its opinion and the related analyses set forth in this proxy statement is intended to be, and they

do not constitute, a recommendation to the special committee, the GAN board of directors, GAN, any security holder of GAN or any other

person as to how to act or vote on any matter relating to the merger or otherwise.

No

Financing Condition (Page 41)

Completion

of the merger is not subject to any financing condition. The total amount of funds required to complete the merger and related transactions

and pay related fees and expenses is estimated to be approximately $107.6 million. SSC expects that it will be able to fund all

payments required of it to complete the merger and related transactions entirely from its cash on hand.

Interests

of Certain Persons in the Merger (Page 42)

In

considering the recommendations of the GAN board of directors, you should be aware that certain of GAN’s directors and executive

officers may have interests in the merger that may be different from or in addition to those of GAN shareholders generally. The GAN board

of directors and the special committee were aware of and considered these interests, among other matters, in evaluating the merger agreement,

in approving the merger agreement and the statutory merger agreement and the transactions contemplated by the merger agreement and the

statutory merger agreement, including the merger, and in recommending that GAN shareholders approve the merger proposal. As described

in more detail in the section of this proxy statement titled “The Merger — Interests of GAN’s Directors and Executive

Officers in the Merger,” these interests potentially include:

| |

● |

the

accelerated vesting (upon the effective time of the merger and assuming for this purpose that the effective time of the merger was

on December 31, 2023) of (i) stock option awards covering 331,494 ordinary shares with an aggregate estimated value

equal to $649,728, and (ii) restricted share unit awards covering 906,943 ordinary shares with an aggregate estimated

value equal to $1,786,678, in each case, based on the per share merger consideration of $1.97 per ordinary share and, with

respect to stock option awards, including only those stock option awards with a per share exercise price of less than $1.97; |

| |

|

|

| |

● |

the

payment of certain severance payments and benefits that the executive officers of GAN may become entitled to receive under their

respective employment agreements if they experience a qualifying termination of employment following the effective time of the merger

(assuming for this purpose that the merger was completed on December 31, 2023), with an aggregate estimated value of

$8,192,538; |

| |

|

|

| |

● |

the payment of transaction bonuses that the executive officers of GAN will become entitled to receive under their

respective employment agreements upon a change in control of GAN, which the merger will represent, with an aggregate estimated value of

$1,685,972; |

| |

|

|

| |

● |

that GAN’s executive officers may enter into arrangements with SSC prior to or following the closing; |

| |

|

|

| |

● |

that GAN’s executive officers may receive restricted

stock awards in 2024 that would entitle them to receive the merger consideration of $1.97 per ordinary share subject to such restricted

stock awards; |

| |

|

|

| |

● |

that GAN’s executive officers as of the effective time of the merger are expected to become the initial executive

officers of the surviving company in the merger; and |

| |

|

|

| |

● |

certain

indemnification arrangements for GAN’s officers and directors and the continuation of certain insurance arrangements for such

persons for six years after the completion of the merger. |

The

Merger Agreement (Page 51)

Treatment

of Ordinary Shares (Page 28)

At

the effective time, as a result of the merger (and without any action on the part of SSC, Merger Sub, GAN or any holder of ordinary shares)

each ordinary share issued immediately prior to the effective time (other than any issued ordinary share that is owned by SSC, Merger

Sub, or any direct or indirect wholly-owned subsidiary of SSC, Merger Sub or GAN, or owned by GAN as a treasury share) will no longer

be issued and will automatically be canceled and converted into the right to receive the merger consideration of $1.97 per ordinary share

in cash, without interest and subject to any applicable tax withholding.

Treatment

of GAN Equity Awards (Page 59)

At

the effective time, as a result of the merger (and without any action on the part of SSC, Merger Sub, GAN or any holder of any outstanding

option, restricted share unit, or restricted share award, as applicable):

| |

● |

each

then outstanding option to acquire ordinary shares (whether vested or unvested) will become fully vested and will be automatically

canceled in exchange for the right of the holder thereof to receive a single lump sum cash payment, without interest, equal to (a)

the product of (i) the excess, if any, of $1.97 over the per share exercise price of the option and (ii) the number of ordinary shares

issuable upon the exercise in full of such option, less (b) any applicable tax withholding; any such option with an exercise price

per share equal to or greater than $1.97 will be canceled and terminated for no consideration as of immediately prior to the effective

time; |

| |

|

|

| |

● |

each

then outstanding restricted share unit (whether vested or unvested) will become fully vested and will be automatically canceled in

exchange for the right of the holder thereof to receive a single lump sum cash payment, without interest, equal to (a) the product

of (i) $1.97 and (ii) the number of ordinary shares subject to such restricted share unit, less (b) any applicable tax withholding;

and |

| |

|

|

| |

● |

each

then outstanding restricted share award (whether vested or unvested) will become fully vested and non-forfeitable and will be converted

into the right of the holder thereof to receive a single lump sum cash payment, without interest,

equal to $1.97 per share subject to such restricted share award. |

No

Solicitation of Takeover Proposals; Adverse Recommendation Change; Alternative Acquisition Agreements (Page 55)

In

the merger agreement, GAN agreed to cease any solicitation, encouragement, discussions or negotiations with any persons (other than SSC

and Merger Sub and their respective representatives) that may be ongoing with respect to a “takeover proposal” (as described

and summarized on page 55 of this proxy statement) and to cease providing any further information with respect to GAN and its subsidiaries

or in connection with any takeover proposal to any third party.

In

the merger agreement, GAN also agreed not to: (a) solicit, initiate, encourage, facilitate or assist any inquiries, discussions

or requests regarding, or the making, submission or announcement of, any proposal or offer that constitutes, or could reasonably be expected

to lead to, a takeover proposal; (b) engage in, maintain or otherwise participate in any solicitations, discussions or negotiations regarding,

or furnish to any third party or its representatives any information in connection with or with the intent to induce or for the purpose

of soliciting, initiating, encouraging or facilitating, a takeover proposal (excluding a response to an unsolicited inquiry that refers

the inquiring person to the terms of GAN’s covenants in the merger agreement with respect to the non-solicitation of takeover proposals,

or upon receipt of a bona fide, unsolicited written takeover proposal that did not result from a breach of GAN’s covenants in the

merger agreement with respect to the non-solicitation of takeover proposals, solely to the extent necessary to ascertain facts or clarify

terms with respect to the takeover proposal in accordance with the merger agreement); or (c) approve, adopt, publicly recommend or enter

into any letter of intent or similar agreement or commitment related to a takeover proposal (whether written or oral), or publicly propose

to do the same.

If,

at any time after November 7, 2023 and before shareholder approval of the merger proposal is obtained, GAN receives a bona fide, unsolicited

written takeover proposal from a third party that did not result from a breach of GAN’s covenants in the merger agreement with

respect to the non-solicitation of takeover proposals, and if the GAN board of directors and/or the special committee determines,

in good faith, after consultation with its outside financial advisor and outside legal counsel, that such takeover proposal constitutes

or could reasonably be expected to result in a “superior proposal” (as described and summarized on page 55 of this proxy

statement), then GAN may, subject to certain conditions, furnish information to the third party who made such takeover proposal and participate

in discussions with such third party regarding such takeover proposal.

The

GAN board of directors is required to recommend that GAN shareholders approve the merger proposal at the special general meeting and

may not change such recommendation, except in certain circumstances described below.

Before

the time that shareholder approval of the merger proposal is obtained, the GAN board of directors may make an “adverse recommendation

change” (as described and summarized on page 55 of this proxy statement) in response to either an “intervening event”

(as described and summarized on page 57 of this proxy statement) or a bona fide, unsolicited takeover proposal that did not result

from a breach of GAN’s covenants in the merger agreement with respect to the non-solicitation of takeover proposals, but only,

in each case, in compliance with the procedures of the merger agreement, including that the GAN board of directors and/or the special

committee determines, in good faith, after consultation with its outside financial advisor and outside legal counsel, that the failure

to make such adverse recommendation change would be inconsistent with the fiduciary duties of the GAN board of directors under applicable

law. In such case, and if the merger agreement is terminated, GAN would be required to pay a $6.0 million termination fee to SSC.

Before

the time that shareholder approval of the merger proposal is obtained, GAN may waive any standstill provisions to the extent necessary

to permit a third party to make, on a confidential basis to the GAN board of directors and/or the special committee, a takeover proposal,

so long as (a) such third party agrees to the disclosure of such takeover proposal to SSC and (b) the GAN board of directors and/or the

special committee determines in good faith that the failure to take such action would reasonably be expected to result in a breach by

the GAN board of directors of its fiduciary duties under applicable law.

See

the section of this proxy statement titled “The Merger Agreement — No Solicitation of Takeover Proposals; Adverse Recommendation

Change; Alternative Acquisition Agreement” beginning on page 55.

Conditions

to the Merger (Page 52)

The

obligations of SSC, Merger Sub and GAN to consummate the merger are subject to the satisfaction or, to the extent permitted by applicable

law, waiver at or prior to the closing of each of the following conditions:

| |

● |

the

merger proposal having been approved by GAN shareholders; |

| |

|

|

| |

● |

the

absence of any law, order, judgment, injunction, or ruling that makes the merger illegal or that prohibits the consummation of the

merger; |

| |

|

|

| |

● |

with

respect to the obligations of SSC and Merger Sub to consummate the merger, on the one hand, and the obligation of GAN to consummate

the merger, on the other hand, the other party having performed in all material respects all of its obligations required to be performed

under the merger agreement at or prior to the closing, the other party’s representations and warranties in the merger agreement,

subject to applicable materiality qualifiers, being true and correct when made and at and as of the closing, and the party having

received an officer certificate on behalf of the other party certifying as to the satisfaction of specified conditions to closing; |

| |

|

|

| |

● |

with

respect to the obligations of SSC and Merger Sub to consummate the merger, the absence of a material adverse effect on GAN; and |

| |

|

|

| |

● |

with

respect to the obligations of SSC and Merger Sub to consummate the merger, not more than nine percent of the ordinary shares constituting

dissenting shares, any waiting period (and any extension thereof) applicable to the merger under antitrust laws having been terminated

or expired, the consents or approvals of governmental authorities and of gaming authorities having been obtained, and the National

Congress of Chile not having enacted any applicable law or issued any order that makes GAN’s operation of online gaming illegal

in Chile. |

See

the section of this proxy statement titled “The Merger Agreement — Conditions to Completion of the Merger”

beginning on page 52 for more information on the conditions to the parties’ respective obligations to consummate the

merger.

Termination

of the Merger Agreement (Page 62)

The

merger agreement may be terminated at any time before the effective time by mutual written consent of GAN and SSC and, subject to certain

limitations described in the merger agreement, by either GAN or SSC if any of the following occurs:

| |

● |

if

GAN shareholders vote on the merger proposal at the special general meeting and do not approve the merger proposal; |

| |

|

|

| |

● |

if

(i) any governmental authority issues an order or takes any other action prohibiting the merger and such order or other action becomes

final and non-appealable or (ii) any law prohibits the merger; or |

| |

|

|

| |

● |

if

the effective time does not occur on or before (i) November 7, 2024 or (ii) February 7, 2025 (which date the parties may agree to

extend), if, on November 7, 2024, one or more of the regulatory approvals required under the merger agreement has not been obtained

but all of the other conditions to closing have been satisfied or are capable of being satisfied (we refer to November 7, 2024 and

February 7, 2025 (or such later date on which the parties agree), as the case may be, as the “end date”). |

SSC

may terminate the merger agreement:

| |

● |

if

any of the required regulatory approvals (other than delivering the statutory merger agreement and the filing of the merger application

pursuant to the Bermuda Companies Act) (i) imposes any burdensome condition, (ii) are not in full force and effect or (iii) cannot

be obtained, as ultimately determined by a final, non-appealable order or other determination of a governmental authority; |

| |

|

|

| |

● |

if

(i) the GAN board of directors effects an adverse recommendation change, (ii) GAN enters into any agreement related to a takeover

proposal or (iii) GAN materially breaches its covenants with respect to the non-solicitation of takeover proposals; or |

| |

|

|

| |

● |

at

any time prior to the effective time (whether before or after GAN shareholders approve the merger proposal), if there has been a

breach or failure to perform by GAN of its representations, warranties, covenants or other agreements in the merger agreement, or

if any representation or warranty of GAN becomes untrue, in each case, such that certain conditions to closing are not reasonably

capable of being satisfied, and either such breach or failure to perform is not capable of cure on or before the end date or 30 days

have elapsed since the date of delivery of a written notice from SSC to GAN and such breach or failure to perform is not cured in

all material respects. |

GAN

may terminate the merger agreement:

| |

● |

at

any time prior to the effective time (whether before or after GAN shareholders approve the merger proposal), if (i) there has been

a breach by SSC or Merger Sub of their representations, warranties, covenants or other agreements contained in the merger agreement

or (ii) if any representation or warranty of SSC and Merger Sub becomes untrue, in each case, such that certain conditions to closing

are not reasonably capable of being satisfied, and either such breach or failure to perform is not capable of cure on or before the

end date or 30 days have elapsed since the date of delivery of a written notice from GAN to SSC and such breach or failure to perform

is not cured in all material respects; or |

| |

|

|

| |

● |

before

GAN shareholders approve the merger proposal in order to substantially concurrently with such termination enter into an agreement

related to a takeover proposal (whether written or oral) or other definitive agreement relating to a superior proposal in accordance

with the terms of the merger agreement. |

Subject

to the procedures set forth in the merger agreement, if GAN receives a superior proposal and GAN shareholders have not yet approved the

merger proposal, GAN may terminate the merger agreement to enter into an agreement in respect of such superior proposal if the GAN board

of directors determines in good faith, after consultation with its financial advisors and outside legal counsel, that failure to take

such action would be inconsistent with its fiduciary duties under applicable law.

See

the section of this proxy statement titled “The

Merger Agreement — Termination of the Merger Agreement” for more information on the respective

termination rights of the parties under the merger agreement.

Expenses

and Termination Fee (Page 64)

Generally,

all fees and expenses incurred in connection with the merger agreement, the statutory merger agreement and the transactions contemplated

by the merger agreement and the statutory merger agreement will be paid by the party incurring or required to incur such fees and expenses,

whether or not the merger is consummated.

Upon

termination of the merger agreement, GAN may be required, under certain circumstances, to pay a termination fee of $6.0 million to SSC,

and vice versa. See the section of this proxy statement titled “The Merger Agreement — Expenses and Termination Fees”

for more information on the expenses and termination fee under the merger agreement.

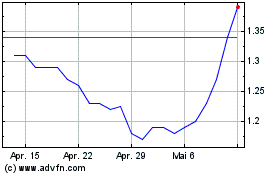

Market

Price of GAN Ordinary Shares (Page 11)

The

closing price of the ordinary shares on The Nasdaq Capital Market on November 7, 2023, the last full trading day prior to the announcement

of the merger agreement, was $0.89 per ordinary share. On January 3, 2024, the most recent practicable date before this proxy

statement was first mailed to GAN shareholders, the closing price of the ordinary shares on The Nasdaq Capital Market was $1.57

per ordinary share. You are encouraged to obtain current market quotations for the ordinary shares prior to voting your ordinary shares.

Dissenting

Shares (Page 59)

Under

Bermuda law, GAN shareholders of record who do not vote in favor of the merger proposal and who are not satisfied that they have been

offered fair value for their shares have the right to apply to the Supreme Court of Bermuda pursuant to Section 106(6) of the Bermuda

Companies Act to have the fair value of their shares appraised. GAN shareholders intending to exercise such appraisal rights must file

their application for appraisal of the fair value of their shares with the Supreme Court of Bermuda within one month of the giving of

the notice convening the special general meeting. For the avoidance of doubt, this proxy statement constitutes such notice.

A

failure of a dissenting shareholder to affirmatively vote against the merger proposal will not constitute a waiver of its rights to have

the fair value of its ordinary shares appraised, provided that such shareholder did not vote in favor of the merger proposal.

See

the sections of this proxy statement titled “The Merger — Dissenters’ Rights of Appraisal for GAN Shareholders”

beginning on page 50, “The Merger Agreement — Dissenting Shares” beginning on page 59 and “Appraisal

Rights” beginning on page 74 for a more detailed description of the appraisal rights available to GAN shareholders.

Delisting

and Deregistration of GAN Shares (Page 50)

If

the merger is completed, the ordinary shares will be delisted from The Nasdaq Capital Market and deregistered under the Exchange Act,

and GAN will no longer be required to file periodic reports with the SEC on account of the ordinary shares.

Material

U.S. Federal Income Tax Consequences (Page 83)

The

exchange of ordinary shares for the merger consideration pursuant to the merger agreement generally will be a taxable transaction to

U.S. holders of ordinary shares for U.S. federal income tax purposes. On an exchange of ordinary shares for the merger consideration

in the merger, U.S. holders will generally recognize gain or loss for U.S. federal income tax purposes in an amount equal to the difference,

if any, between the amount of cash received by them in the merger and their adjusted tax basis in their ordinary shares.

TAX

MATTERS ARE COMPLICATED AND THE TAX CONSEQUENCES OF THE MERGER TO HOLDERS OF ORDINARY SHARES WILL DEPEND UPON THE FACTS OF THEIR RESPECTIVE

SITUATIONS. BECAUSE INDIVIDUAL CIRCUMSTANCES MAY DIFFER, WE STRONGLY URGE GAN SHAREHOLDERS TO CONSULT WITH THEIR TAX ADVISORS AS TO THE

SPECIFIC TAX CONSEQUENCES OF THE MERGER TO THEM, INCLUDING THE APPLICABILITY OF U.S. FEDERAL, STATE, LOCAL, NON-U.S. AND OTHER TAX LAWS.

QUESTIONS

AND ANSWERS ABOUT THE MERGER AND THE SPECIAL GENERAL MEETING

The

following questions and answers are intended to briefly address some commonly asked questions regarding the merger, the merger agreement,

the statutory merger agreement and the special general meeting. These questions and answers may not address all questions that may be

important to you. For more information, please see the section of this proxy statement titled “Summary” and the more

detailed information contained elsewhere in this proxy statement, the annexes to this proxy statement and the documents incorporated

by reference into this proxy statement.

| Q: |

Why

am I receiving this proxy statement? |

| |

|

| A: |

GAN,

SSC and Merger Sub, a wholly-owned subsidiary of SSC, entered into the merger agreement, pursuant to which Merger Sub will be merged

with and into GAN, the separate corporate existence of Merger Sub will cease and GAN will continue as the surviving company in the

merger and a wholly-owned subsidiary of SSC. |

| |

|

| |

To

consummate the merger, GAN shareholders must approve the merger proposal. The special general meeting is being held to seek such

approval and to consider certain other related matters which are not prerequisites to the consummation of the merger. This proxy

statement contains important information about the merger and related transactions and other matters being considered at the special

general meeting. |

| |

|

| Q: |

When

and where is the special general meeting? |

| |

|

| A: |

The

special general meeting will take place at 10:00 a.m. (Pacific Time), on February 13, 2024 in a virtual meeting format

via the Internet at www.virtualshareholdermeeting.com/GAN2024SM originating from

GAN’s headquarters located at 400 Spectrum Center Drive, Suite 1900, Irvine, CA 92618. |

| |

|

| Q: |

What

proposals will be presented at the special general meeting? |

| |

|

| A: |

At

the special general meeting, GAN shareholders will be asked to consider and vote on each of the following proposals: |

| |

● |

Proposal

1 (the merger proposal): to approve and adopt the merger agreement, the statutory merger agreement and the consummation of the

transactions contemplated by the merger agreement and the statutory merger agreement, including the merger; |

| |

|

|

| |

● |

Proposal

2 (the compensation advisory proposal): to approve, on an advisory (non-binding) basis, the compensation that may be paid or

become payable to GAN’s named executive officers in connection with the merger, as described in this proxy statement; and |

| |

|

|

| |

● |

Proposal

3 (the adjournment proposal): to approve the adjournment of the special general meeting, if necessary or appropriate, to solicit

additional proxies if there are insufficient votes at the special general meeting to approve the merger proposal. |

Holders

of ordinary shares issued as of the record date will be entitled to vote on each of the above proposals.

| Q: |

Does

the GAN board of directors recommend approval of the proposals? |

| |

|

| A: |

The

GAN board of directors, based on the unanimous recommendation of the special committee, unanimously (a) determined that the merger

consideration constitutes fair value for each ordinary share in accordance with the Bermuda Companies Act, (b) determined that the

terms of the merger agreement, the statutory merger agreement, the merger and the other agreements and transactions contemplated

by the merger agreement and the statutory merger agreement are in the best interests of GAN and its shareholders, (c) approved and

declared advisable GAN’s execution, delivery and performance of the merger agreement and the statutory merger agreement and

the transactions contemplated by the merger agreement and the statutory merger agreement, including the merger, (d) directed

that the merger agreement and the statutory merger agreement be submitted to GAN shareholders for adoption and approval and (e) recommends

that GAN shareholders vote in favor of adoption and approval of the merger agreement, the statutory merger agreement and the transactions

contemplated by the merger agreement and the statutory merger agreement, including the merger. |

The

GAN board of directors unanimously recommends that GAN shareholders vote “FOR” the merger proposal, “FOR” the

compensation advisory proposal, and “FOR” the adjournment proposal.

See

the section of this proxy statement titled “The Merger — GAN’s Reasons for the Merger and Recommendation of the

GAN Board of Directors” beginning on page 28 for a more complete description of the recommendations of the GAN board of directors.

In considering the recommendations of the GAN board of directors, you should be aware that certain of GAN’s executive officers

and directors may have interests in the merger that are different from, or in addition to, those of GAN shareholders generally. See the

section of this proxy statement titled “The Merger — Interests of GAN’s Directors and Executive Officers in the

Merger” beginning on page 42.

| Q: |

What

will happen in the merger? |

| |

|

| A: |

If

the merger proposal is approved and all other conditions to the merger have been satisfied or (to the extent permitted by applicable

law) waived, Merger Sub will be merged with and into GAN, the separate corporate existence of Merger Sub will cease and GAN will