0001600132

false

0001600132

2023-10-12

2023-10-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

October 12, 2023

Bellerophon Therapeutics, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-36845 |

|

47-3116175 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

20 Independence Boulevard, Suite 402

Warren, New Jersey |

|

07059 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (908) 574-4770

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, $0.01 par value per share |

|

BLPH |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging

growth company

| ¨ | If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard; Transfer of Listing.

As previously disclosed, on July 19, 2023, the Nasdaq Listing Qualifications

staff (“Staff”) notified Bellerophon Therapeutics, Inc. (the “Company”) that, pursuant to Listing Rule 5101, it

had determined to delist the Company’s shares of common stock as the Staff believed that the Company was a "public shell,"

and that the continued listing of its securities was no longer warranted. Additionally, the Staff informed the Company that it no longer

complied with the minimum bid price requirement under Listing Rule 5550(a)(2), which served as an additional and separate basis for delisting.

On July 26, 2023, the Company requested a hearing before the Panel, which was held on September 21, 2023. On October 2, 2023, the Panel

provided an extension for continued listing on the Nasdaq Capital Market subject to certain conditions. On October 12, 2023, the Company

notified the Panel that it will not be able to meet the conditions of the Panel’s decision. Accordingly, on October 12, 2023, the

Staff notified the Company that it determined to delist the Company’s shares of common stock from the Nasdaq Capital Market and

that trading in the Company’s shares will be suspended at the open of trading on Monday October 16, 2023.

Item 8.01 Other Events.

On October 12, 2023, after completing a review of the strategic options

available to the Company, the Company’s board of directors approved the plan of liquidation and dissolution of the Company (the

“Plan of Dissolution”), subject to the approval of the Company’s stockholders. The Company intends to call a special

meeting of stockholders (the “Special Meeting”) to seek approval of the Plan of Dissolution and will file proxy materials

relating to the Special Meeting with the Securities and Exchange Commission as soon as practicable.

A copy of the Plan of Dissolution is filed as Exhibit 2.1 to this Current

Report on Form 8-K and is incorporated herein by reference.

Cautionary Information Regarding Trading in the Company’s

Securities

The Company cautions that trading in the Company’s securities

is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship

to the actual value realized, if any, by holders of the Company’s securities. Accordingly, the Company urges extreme caution with

respect to existing and future investments in its securities.

Additional Information and Where to Find It

Bellerophon will file with the Securities

and Exchange Commission (“SEC”) a proxy statement in connection with the planned dissolution. The definitive proxy statement

will be sent to the Company's stockholders and will contain important information about the planned dissolution. INVESTORS AND STOCKHOLDERS

ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME

AVAILABLE. Investors and stockholders may obtain a free copy of the proxy statement (when it is available) and other documents filed with

the SEC at the SEC's website at www.sec.gov.

Certain Information Concerning Participants

Bellerophon and its directors and executive

officers may be deemed to be participants in the solicitation of proxies from stockholders of the Company in connection with the planned

dissolution. Information about the persons who may be considered to be participants in the solicitation of the Company's stockholders

in connection with its planned dissolution, and any interest they have in the planned dissolution, will be set forth in the definitive

proxy statement when it is filed with the SEC. Further information about Bellerophon' directors and executive officers is set forth in

its proxy statement for its 2023 Annual Meeting of Stockholders and its most recent annual report on Form 10-K, respectively filed with

the SEC on April 28, 2023 and March 31, 2023. These documents may be obtained for free at the SEC's website at www.sec.gov.

Forward Looking Statements

Certain statements in this report constitute

“forward-looking statements” of the Company within the meaning of applicable laws and regulations and constitute “forward-looking

information” within the meaning of applicable securities laws. Any statements contained herein which do not describe historical

facts, including statements regarding the Company’s Plan of Liquidation and the related Special Meeting are forward-looking statements

which involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-looking

statements. Such risks and uncertainties include, among others, the possibility that the Company’s stockholders will not realize

any value in the Company’s shares or that the Plan of Liquidation will not be able to be completed in a timely manner, or at all,

as well as those risks identified in the Company’s filings with the Commission, including under the heading “Risk Factors”

in the Company’s Annual Report on Form 10-K for the year-ended December 31, 2023, and subsequent filings, with the Commission, including

the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, available on the Commission’s website at

www.sec.gov. Any such risks and uncertainties could materially and adversely affect the Company’s results of operations and cash

flows and the amount of time the Company can meet its operational and capital needs. The Company cautions investors not to place undue

reliance on any forward-looking statements, which speak only as of the date they are made. Except as required by law, the Company undertakes

no obligation to update or revise the information contained in this press release, whether as a result of new information, future events

or circumstances or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BELLEROPHON THERAPEUTICS, INC. |

| |

|

|

| Date: October 13, 2023 |

By: |

/s/ Peter Fernandes |

| |

|

Name: Peter Fernandes |

| |

|

Title: Chief Executive Officer |

Exhibit 2.1

PLAN

OF LIQUIDATION AND DISSOLUTION

OF

BELLEROPHON THERAPEUTICS, INC.

This Plan of Liquidation and

Dissolution (the “Plan”) is intended to accomplish the complete liquidation and dissolution of BELLEROPHON THERAPEUTICS, INC.,

a Delaware corporation (such corporation or a successor entity, the “Company”), in accordance with Section 281(b) of

the General Corporation Law of the State of Delaware (the “DGCL”).

1. Approval

of Plan. The Board of Directors of the Company (the “Board”) has adopted this Plan and presented the Plan to the Company’s

stockholders to take action on the Plan. If the Plan is adopted by the requisite vote of the Company’s stockholders, the Plan shall

constitute the adopted Plan of the Company.

2. Certificate

of Dissolution. Subject to Section 14 hereof, after the stockholders of the Company approve the dissolution of the Company,

the Company shall file with the Secretary of State of the State of Delaware a certificate of dissolution (the “Certificate of Dissolution”)

in accordance with the DGCL at such time as determined by the Board in its sole discretion (the time of such filing, or such later time

as stated therein, the “Effective Time”).

3. Cessation

of Business Activities. After the Effective Time, the Company shall not engage in any business activities except to the extent necessary

to preserve the value of its assets, wind up its business affairs and distribute its assets in accordance with this Plan.

4. Continuing

Employees and Consultants. For the purpose of effecting the dissolution of the Company, the Company may hire or retain such employees,

consultants and advisors as the Company deems necessary or desirable to supervise or facilitate the dissolution and winding up of the

Company.

5. Dissolution

Process.

From and after the Effective

Time, the Company (or any successor entity of the Company) shall complete the following corporate actions:

(i) The

Company (a) shall pay or make reasonable provision to pay all claims and obligations, including all contingent, conditional or unmatured

contractual claims known to the Company, (b) shall make such provision as will be reasonably likely to be sufficient to provide

compensation for any claim against the Company which is the subject of a pending action, suit or proceeding to which the Company is a

party, and (c) shall make such provision as will be reasonably likely to be sufficient to provide compensation for claims that have

not been made known to the Company or that have not arisen but that, based on facts known to the Company, are likely to arise or to become

known to the Company within 10 years after the date of dissolution. All such claims shall be paid in full and any such provision for payment

made shall be made in full if there are sufficient assets. If there are insufficient assets, such claims and obligations shall be paid

or provided for according to their priority and, among claims of equal priority, ratably to the extent of assets legally available therefor.

(ii) After

the payments are made pursuant to clause (i) above, if there are any assets remaining, the Company shall distribute to its stockholders,

in accordance with the Company’s certificate of incorporation, as amended and/or restated through the Effective Time, all remaining

assets, including all available cash, including the cash proceeds of any sale, exchange or disposition, except such cash, property or

assets as are required for paying or making reasonable provision for the claims and obligations of the Company. Such distribution may

occur all at once or in a series of distributions and shall be in cash or assets, in such amounts, and at such time or times, as the Board

in its absolute discretion, may determine. If and to the extent deemed necessary, appropriate or desirable by the Board, in its absolute

discretion, the Company may establish and set aside a reasonable amount of cash and/or property to satisfy claims against the Company,

including, without limitation, tax obligations, all expenses related to the sale of the Company’s property and assets, all expenses

related to the collection and defense of the Company’s property and assets, and the liquidation and dissolution provided for in

this Plan.

Notwithstanding anything contained

herein to the contrary, the Company, at the discretion of the Board, may opt to dissolve and wind-up the Company in accordance with the

procedures set forth in Sections 280 and 281(a) of the DGCL.

6. Cancellation

of Stock. The distributions to the Company’s stockholders pursuant to Section 5 hereof shall be deemed to be in complete

cancellation of all of the outstanding shares of capital stock of the Company as of the date that the continuation of the Company’s

legal existence terminates in accordance with Section 278 of the DGCL. From and after the Effective Time, and subject to applicable

law, the holder of all outstanding shares of capital stock of the Company shall cease to have any rights in respect thereof, except the

right to receive distributions, if any, pursuant to and in accordance with Section 5 hereof. As a condition to receipt of any distribution

to the Company’s stockholders, the Company may require the Company’s stockholders to (i) surrender their certificates

evidencing its shares of capital stock to the Company, or (ii) furnish the Company with evidence satisfactory to the Company of

the loss, theft or destruction of such certificates, together with such surety bond or other security or indemnity as may be required

by and satisfactory to the Company. The Company will close its stock transfer books and discontinue recording transfers of shares of capital

stock of the Company at the Effective Time, and thereafter any certificate representing shares of capital stock of the Company will not

be assignable or transferable on the books of the Company except by will, intestate succession, operation of law or upon the dissolution

of the stockholders or their successors.

7. Conduct

of the Company Following Approval of the Plan. Under Delaware law, dissolution is effective upon the filing of a certificate of dissolution

with the Secretary of State of the State of Delaware or upon such future effective date as may be set forth in the certificate of dissolution.

Section 278 of the DGCL provides that a dissolved corporation shall be continued for the term of 3 years from such dissolution or

for such longer period as the Court of Chancery shall in its discretion direct, bodies corporate for the purpose of prosecuting and defending

suits, whether civil, criminal or administrative, by or against it, and of enabling it gradually to settle and close its business, to

dispose of and convey its property, to discharge its liabilities and to distribute to its stockholders any remaining assets, but not for

the purpose of continuing the business for which the corporation was organized. With respect to any action, suit or proceeding begun by

or against the corporation either prior to or within 3 years after the date of its dissolution, the action shall not abate by reason of

the dissolution of the corporation; the corporation shall, solely for the purpose of such action, suit or proceeding, be continued as

a body corporate beyond the 3-year period and until any judgments, orders or decrees therein shall be fully executed, without the necessity

for any special direction to that effect by the Court of Chancery. The powers of the officers and directors of the corporation shall continue

during this time period in order to allow them to take the necessary steps to wind up the affairs of the corporation.

8. Absence

of Appraisal Rights. Under Delaware law, the Company’s stockholders are not entitled to appraisal rights for shares of capital

stock of the Company in connection with the transactions contemplated by the Plan.

9. Abandoned

Property. If any distribution to the stockholders of the Company cannot be made, whether because such stockholder cannot be located,

has not surrendered its certificate evidencing the capital stock as required hereunder or for any other reason, the distribution to which

such stockholder is entitled shall be transferred, at such time as the final liquidating distribution is made by the Company, to the official

of such state or other jurisdiction authorized by applicable law to receive the proceeds of such distribution. The proceeds of such distribution

shall thereafter be held solely for the benefit of and for ultimate distribution to such stockholders as the sole equitable owner thereof

and shall be treated as abandoned property and escheat to the applicable state or other jurisdiction in accordance with applicable law.

In no event shall the proceeds of any such distribution revert to or become the property of the Company.

10. Stockholder

Consent to Sale of Assets. Adoption of this Plan by the stockholders of the Company shall constitute the approval of such stockholders

of the sale, exchange or other disposition in liquidation of all of the property and assets of the Company, whether such sale, exchange

or other disposition occurs in one transaction or a series of transactions, and shall constitute ratification of all contracts for sale,

exchange or other disposition that are conditioned on adoption of this Plan.

11. Expenses

of Dissolution. In connection with and for the purposes of implementing and assuring completion of this Plan, the Company may pay

any brokerage, agency, professional and other fees and expenses of persons rendering services to the Company in connection with the collection,

sale, exchange or other disposition of the Company’s property and assets and the implementation of this Plan.

12. Compensation.

In connection with and for the purpose of implementing and assuring the completion of this Plan, the Company may pay the Company’s

officers, directors, employees, agents and representatives, or any of them, compensation or additional compensation above their regular

compensation, including pursuant to severance and retention agreements, in money or other property, in recognition of the extraordinary

efforts they, or any of them, will be required to undertake, or actually undertake, in connection with the implementation of this Plan.

Adoption of this Plan by the requisite vote of the outstanding capital stock of the Company shall constitute the approval of the Company’s

stockholders of the payment of any such compensation.

13. Indemnification.

The Company shall continue to indemnify its officers, directors, employees, agents and trustee in accordance with its Certificate of Incorporation,

Bylaws, and contractual arrangements as therein or elsewhere provided, the Company’s existing directors’ and officers’

liability insurance policy and applicable law, and such indemnification shall apply to acts or omissions of such persons in connection

with the implementation of this Plan and the winding up of the affairs of the Company. The Company is authorized to obtain and maintain

insurance as may be necessary to cover the Company’s indemnification obligations.

14. Modification

or Abandonment of the Plan. Notwithstanding adoption of this Plan by the stockholders of the Company, the Board may modify, amend

or abandon this Plan and the transactions contemplated hereby without further action by such stockholders to the extent permitted by the

DGCL.

15. Authorization.

The Board is hereby authorized, without further action by the stockholders of the Company, to do and perform or cause the officers of

the Company to do and perform, any and all acts, and to make, execute, deliver or adopt any and all agreements, resolutions, conveyances,

certificates and other documents of every kind that are deemed necessary, appropriate or desirable, to implement this Plan and the transactions

contemplated hereby, including, without limiting the foregoing, all filings or acts required by any state or federal law or regulation

to wind up the affairs of the Company.

v3.23.3

Cover

|

Oct. 12, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 12, 2023

|

| Entity File Number |

001-36845

|

| Entity Registrant Name |

Bellerophon Therapeutics, Inc.

|

| Entity Central Index Key |

0001600132

|

| Entity Tax Identification Number |

47-3116175

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

20 Independence Boulevard

|

| Entity Address, Address Line Two |

Suite 402

|

| Entity Address, City or Town |

Warren

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07059

|

| City Area Code |

908

|

| Local Phone Number |

574-4770

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

BLPH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

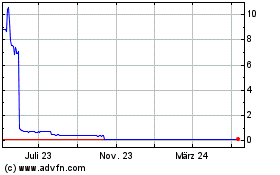

Bellerophon Therapeutics (NASDAQ:BLPH)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Bellerophon Therapeutics (NASDAQ:BLPH)

Historical Stock Chart

Von Apr 2023 bis Apr 2024