UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

Bellerophon

Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

c/o Verdolino & Lowey, P.C.

124 Washington Street, Suite 101

Foxborough, Massachusetts 02035

November , 2023

To Our Stockholders:

You are cordially invited to attend a Special

Meeting of Stockholders (the “Special Meeting”) of Bellerophon Therapeutics, Inc. (the “Company”) to be held at a.m.,

Eastern time, on , 2023 at the offices of Mintz, Levin, Cohn, Ferris,

Glovsky and Popeo, P.C., 919 Third Avenue, New York, NY 10022.

The purpose of the Special Meeting is to approve

the liquidation and dissolution of the Company (the “Dissolution”) and the Plan of Liquidation and Dissolution (the “Plan

of Dissolution”), which if approved, will authorize the Company’s Board of Directors (the “Board”) to liquidate

and dissolve the Company in accordance with the Plan of Dissolution. The Notice of Meeting and Proxy Statement on the following pages

describe the matters to be presented at the meeting.

The Board carefully reviewed and considered the

Plan of Dissolution in light of the financial position of the Company, including its available cash, resources and operations following

and in light of the Company’s previously announced review and pursuit of strategic alternatives. The Board determined that the Dissolution

was advisable and in the best interests of the Company and our stockholders, approved the Dissolution and the Plan of Dissolution and

directed that the Plan of Dissolution and the Dissolution be submitted to the Company’s stockholders for approval. The Board

unanimously recommends that you vote “FOR” the Dissolution Proposal and “FOR” each of other proposals described

in the accompanying proxy statement.

More information about the Dissolution, the

Plan of Dissolution and the Special Meeting is contained in the accompanying proxy statement. In particular, you should carefully

read the section entitled “Risk Factors” beginning on page 7 of the proxy statement for a discussion of risks you should

consider in evaluating the Dissolution.

It is important that your shares be represented

at this meeting to assure the presence of a quorum. Whether or not you plan to attend the meeting, we hope that you will have your stock

represented by submitting a proxy to vote your shares over the Internet or by telephone as provided in the instructions set forth on the

enclosed proxy card, or by completing, signing, dating and returning your proxy in the enclosed envelope, as soon as possible.

Your stock will be voted in accordance with the instructions you have given in your proxy.

Thank you for your continued support.

Sincerely,

Peter Fernandes

Chief Executive Officer

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held on

, 2023

To Our Stockholders:

NOTICE IS HEREBY GIVEN that a Special Meeting

of Stockholders (the “Special Meeting”) of Bellerophon Therapeutics, Inc. (the “Company”) will be held at a.m.,

Eastern time, on , 2023 at the offices of Mintz, Levin, Cohn, Ferris,

Glovsky and Popeo, P.C., 919 Third Avenue, New York, NY 10022.

At the Special Meeting, stockholders will consider

and vote on the following matters:

1. the

approval of the liquidation and dissolution of the Company (the “Dissolution”) and the Plan of Liquidation and Dissolution

(the “Plan of Dissolution”), which, if approved, will authorize the Board to liquidate and dissolve the Company in accordance

with the Plan of Dissolution (the “Dissolution Proposal”); and

2. the

approval of an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the

time of the Special Meeting to approve the Dissolution Proposal (the “Adjournment Proposal”).

Stockholders of record at the close of business

on , 2023 (the “Record Date”), are entitled to notice

of, and to vote at, the Special Meeting or any postponement, continuation or adjournment thereof. Your vote is important regardless of

the number of shares you own.

We urge you to submit a proxy to vote your shares

over the Internet or by telephone as provided in the instructions set forth on the enclosed proxy card, or complete, date, sign and promptly

return the enclosed proxy card whether or not you expect to attend the Special Meeting. A postage-prepaid envelope, addressed to Broadridge

Financial Solutions, which is serving as proxy tabulator, has been enclosed for your convenience. If you attend the Special Meeting in

person you may vote your shares in person even if you have previously submitted a proxy.

By Order of the Board of Directors,

Naseem Amin

Chairman of the Board of Directors

November , 2023

Table of Contents

Page

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD

, 2023

This proxy statement and the enclosed proxy card

are being furnished in connection with the solicitation of proxies by the Board of Bellerophon Therapeutics, Inc., also referred to in

this proxy statement as the “Company,” “Bellerophon,” “we” or “us,” for use at the Special

Meeting of Stockholders to be held at a.m., Eastern time, on

, 2023 at the offices of Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., 919 Third Avenue, New York, NY 10022, and

at any postponement, continuation or adjournment thereof.

This proxy statement and accompanying proxy materials

are being mailed to stockholders on or about , 2023.

Important Notice Regarding the Availability

of Proxy Materials for

the Special Meeting of Stockholders to be Held

on , 2023:

This proxy statement is available for viewing,

printing and downloading by following the instructions at

www.edocumentview.com/BLPH.

GENERAL INFORMATION

Who is soliciting my vote?

Our board of directors (the “Board”)

is soliciting your vote for the Special Meeting.

When is the record date for the Special Meeting?

The Record Date for determination of stockholders

entitled to vote at the Special Meeting or any postponement, continuation or adjournment thereof is the close of business on

, 2023.

How many votes can be cast by all stockholders?

There were

shares of our common stock, par value $0.01 per share, outstanding on the Record Date, all of which are entitled to vote

with respect to all matters to be acted upon at the Special Meeting. Each stockholder of record is entitled to one vote for each share

of our common stock held by such stockholder. Our common stock is our only class of voting stock.

How is a quorum reached?

Our Amended and Restated Bylaws provide that a

majority of the outstanding shares entitled to vote, present in person or represented by proxy, will constitute a quorum for the transaction

of business at the Special Meeting. Under the General Corporation Law of the State of Delaware (the “DGCL”), shares that are

voted “abstain” and broker “non-votes” (shares held by a broker or nominee that are represented at the meeting,

but with respect to which the broker or nominee is not instructed by the beneficial owner of such shares to vote on the particular proposal)

are counted as present for purposes of determining whether a quorum is present at the Special Meeting. If a quorum is not present, the

meeting may be adjourned until a quorum is obtained.

How do I vote?

If you are the record holder of your shares, you

may vote in one of four ways. You may submit a proxy to vote over the Internet, by telephone, or by mail or you may vote in person at

the Special Meeting.

You may submit a proxy to vote over the Internet

or by telephone: Follow the instructions included in the Notice or, if you received printed materials, in the proxy card to vote by

Internet or telephone.

You may submit a proxy to vote by mail: If

you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the

card.

You may vote in person: If you attend the

Special Meeting, you may vote by delivering your completed proxy card in person or you may vote by completing a ballot. Ballots will be

available at the meeting.

Telephone and Internet voting for stockholders

of record will be available until 11:59 p.m. Eastern Time on ,

2023 and mailed proxy cards must be received by , 2023 in order

to be counted at the Special Meeting. If the Special Meeting is adjourned or postponed, these deadlines may be extended.

The shares represented by all valid proxies will

be voted as specified in those proxies. If the shares you own are held in your name and you return a duly executed proxy without specifying

how your shares are to be voted, they will be voted as follows in accordance with the recommendations of our Board:

| · | FOR the Dissolution Proposal, which includes the approval of the liquidation and dissolution of the Company (the “Dissolution”)

and the Plan of Liquidation and Dissolution (the “Plan of Dissolution”), which, if approved, will authorize the Board to liquidate

and dissolve the Company in accordance with the Plan of Dissolution; and |

| · | FOR the Adjournment Proposal, which includes the approval of an adjournment of the Special Meeting, if necessary, to solicit additional

proxies if there are not sufficient votes at the time of the Special Meeting to approve the Dissolution Proposal. |

If you are a beneficial owner of shares held

in “street name” by your broker, bank or other nominee: If you are a beneficial owner of shares held in “street

name” by your broker, bank or other nominee, you should have received a voting instruction form with these proxy materials from

your broker, bank or other nominee rather than from us. The voting deadlines and availability to submit a proxy by telephone or the Internet

for beneficial owners of shares will depend on the voting processes of the broker, bank or other nominee that holds your shares. Therefore,

we urge you to carefully review and follow the voting instruction form and any other materials that you receive from that organization.

If you hold your shares in multiple accounts, you should submit a proxy to vote your shares as described in each set of proxy materials

you receive.

If the shares you own are held in street name,

the bank or brokerage firm, as the record holder of your shares, is required to vote your shares in accordance with your instructions.

You should direct your broker how to vote the shares held in your account. Under the rules that govern brokers who are voting with respect

to shares held by them as nominee, brokers have the discretion to vote such shares only on routine matters. The approval of the Dissolution

pursuant to the Plan of Dissolution is considered a non-routine matter. A broker “non-vote” occurs when a broker submits a

proxy form but declines to vote on a particular matter because the broker has not received voting instructions from the beneficial owner.

For non-routine matters, broker non-votes will have the effect of voting against that proposal. If you want to approve the Dissolution,

you must vote FOR the Dissolution Proposal. If you do not instruct your broker on how to vote your shares with respect to the Dissolution

Proposal, your broker will not be able to vote your shares with respect to the Dissolution Proposal, and it will have the effect of a

vote against that proposal.

The Adjournment Proposal is considered a routine

matter. If you do not instruct your broker on how to vote your shares, your broker will have the discretion to vote your shares with respect

to the Adjournment Proposal.

How do I revoke my proxy or change my vote?

If you are a stockholder of record on the Record

Date for the Special Meeting, you have the power to revoke your proxy at any time before your proxy is voted at the Special Meeting. You

can revoke your proxy in one of four ways:

| · | providing to our Secretary a signed notice of revocation; |

| · | granting a new, valid proxy bearing a later date; |

| · | submit a new proxy to vote by telephone or the Internet at a later time; or |

| · | attend the Special Meeting and vote in person. However, your attendance at the Special Meeting will not automatically revoke your

proxy unless you vote again at the Special Meeting. |

Any written notice of revocation or subsequent

proxy card must be received by our Corporate Secretary prior to the taking of the vote at the Special Meeting. Such written notice of

revocation or subsequent proxy card should be delivered to Craig Jalbert at Verdolino & Lowey, P.C. (“V&L”), who will

be acting as our Corporate Secretary, or sent to V&L at 124 Washington St., Suite 101, Foxborough, Massachusetts 02035, Attention:

Bellerophon Therapeutics.

Your most current vote, whether by telephone,

Internet or proxy card is the one that will be counted. If a broker, bank or other nominee holds your shares, you must contact such broker,

bank or nominee in order to find out how to change your vote.

What vote is required to adopt each proposal?

The Dissolution Proposal requires the affirmative

vote of the holders of a majority of the outstanding shares of common stock of the Company entitled to vote at the Special Meeting. With

respect to the Dissolution Proposal, abstentions and failures to vote will have the same effect as votes against the proposal.

The Adjournment Proposal requires the approval

of a majority in voting power of the votes cast affirmatively or negatively by the holders entitled to vote on the proposal. With respect

to the Adjournment Proposal, abstentions will not affect the voting results.

The votes will be counted, tabulated and certified

by Computershare Trust Company, N.A. (“Computershare”), who shall serve as the inspector of elections for the Special Meeting.

Why is the Board recommending approval of the Plan of Dissolution?

The Board carefully reviewed and considered the

Plan of Dissolution in light of the financial position of the Company, including our available cash, resources and operations following

and in light of our previously announced review and pursuit of strategic alternatives. After due consideration of the options available

to the Company, our Board has determined that the Dissolution is advisable and in the best interests of the Company and our stockholders.

See “Proposal 1: Approval of the Dissolution Pursuant to the Plan of Dissolution — Reasons for the Proposed

Dissolution.”

What does the Plan of Dissolution entail?

The Plan of Dissolution provides an outline of

the steps for the Dissolution of the Company under Delaware law. The Plan of Dissolution provides that we will file the Certificate of

Dissolution following the required stockholder approval; however, the decision of whether or not to proceed with the Dissolution and when

to file the Certificate of Dissolution will be made by the Board in its sole discretion.

What will happen if the Dissolution is approved?

If the Dissolution is approved by our stockholders,

our Board will have sole discretion to determine if and when (at such time as they deem appropriate following stockholder approval of

the Dissolution) to proceed with the Dissolution. If the Board decides to proceed with the Dissolution, we will liquidate any remaining

assets, satisfy or make reasonable provisions for our remaining obligations, and make distributions to the stockholders of available proceeds,

if any. The Board intends to seek to distribute funds to our stockholders as quickly as possible, as permitted by the DGCL and the Plan

of Dissolution, and intends to take all reasonable actions to optimize the distributable value to our stockholders.

If our Board determines that the Dissolution is

not in our best interests or not in the best interests of our stockholders, our Board may direct that the Dissolution be abandoned, or

may amend or modify the Plan of Dissolution to the extent permitted by Delaware law without the necessity of further stockholder approval.

After the Certificate of Dissolution has been filed, revocation of the Dissolution would require stockholder approval under Delaware law.

Can the Company estimate the distributions that the stockholders

would receive in the Dissolution?

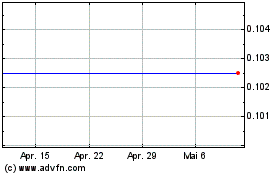

We cannot predict with certainty the amount of

distributions, if any, to our stockholders. However, based on the information currently available to us and if our stockholders approve

the Dissolution, we estimate that the aggregate amount of cash that will be available for distribution to our stockholders in the Dissolution

will be in the range between approximately $400,000 and $900,000 and the total amount distributed to stockholders will be in the range

between approximately $0.03 and $0.07 per share of common stock. These amounts may be paid in one or more distributions. You may receive

substantially less than the amount that we currently estimate that you may receive, or you may receive no distribution at all. Such distributions,

if any, will not occur until after the Certificate of Dissolution is filed, and we cannot predict the timing or amount of any such distributions,

as uncertainties as to the ultimate amount of our liabilities, the operating costs and amounts to be reserved for claims, obligations

and provisions during the liquidation and winding-up process, and the related timing to complete such transactions make it impossible

to predict with certainty the actual net cash amount, if any, that will ultimately be available for distribution to stockholders or the

timing of any such distributions. Accordingly, you will not know the exact amount of any distribution you may receive as a result of the

Plan of Dissolution when you vote on the proposal to approve the Plan of Dissolution.

Although we cannot predict the timing or amount

of any such distributions, to the extent funds are available for distribution to stockholders, the Board intends to seek to distribute

such funds to our stockholders as quickly as possible, as permitted by the DGCL and the Plan of Dissolution, and will take all reasonable

actions to optimize the distributable value to our stockholders. See the section entitled “Proposal 1 — Approval

of the Dissolution Pursuant to the Plan of Dissolution — Estimated Distributions to Stockholders” beginning

on page 10 of this proxy statement for a description of the assumptions underlying and sensitivities of our estimate of the total cash

distributions to our stockholders in the Dissolution.

What is the reporting and listing status of the Company?

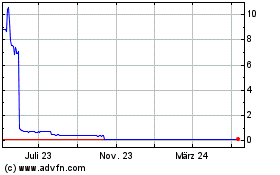

On July 19, 2023, the Company was notified by

the Listing Qualifications Department (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”) that, in light of

the Company’s previously disclosed workforce reduction plan and focus on exploring strategic alternatives, based upon the Staff’s

belief that the Company is a “public shell” as that term is defined in Nasdaq Listing Rule 5101 and the Company’s non-compliance

with the $1.00 bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2), the Company would be delisted from The Nasdaq Capital

Market at the opening of business on July 28, 2023 unless the Company timely requests a hearing before a Nasdaq Hearings Panel (the “Panel”)

to address the deficiencies and present a plan to regain compliance. On July 26, 2023, the Company requested a hearing before the Panel,

which was held on September 21, 2023. On October 2, 2023, the Panel provided an extension for continued listing on the Nasdaq Capital

Market subject to certain conditions. On October 12, 2023, the Company notified the Panel that it will not be able to meet the conditions

of the Panel’s decision. Accordingly, on October 12, 2023, the Staff notified the Company that it determined to delist the Company’s

shares of common stock from the Nasdaq Capital Market and that trading in the Company’s shares will be suspended at the open of

trading on Monday October 16, 2023. Thereafter, Nasdaq will file a Form 25 with the SEC to formally delist the Company’s common

stock. Nasdaq has not specified the exact date on which the Form 25 will be filed. Following such delisting, our common stock may only

trade in the U.S. on the over-the-counter market, which is a less liquid market, if at all.

If the Dissolution is approved by our stockholders

and if the Board determines to proceed with the Dissolution, we will close our transfer books at the effective time of the Certificate

of Dissolution (the “Effective Time”). After such time, we will not record any further transfers of our common stock, except

pursuant to the provisions of a deceased stockholder’s will, intestate succession, or operation of law and we will not issue any

new stock certificates, other than replacement certificates. In addition, after the Effective Time, we will not issue any shares of our

common stock upon exercise of outstanding options, warrants, or restricted stock units. As a result of the closing of our transfer books,

it is anticipated that distributions, if any, made in connection with the Dissolution will likely be made pro rata to the same stockholders

of record as the stockholders of record as of the Effective Time, and it is anticipated that no further transfers of record ownership

of our common stock will occur after the Effective Time.

Additionally, whether or not the Dissolution is

approved, we will have an obligation to continue to comply with the applicable reporting requirements of the Securities Exchange Act of

1934, as amended (the “Exchange Act”) until we have exited such reporting requirements. The Company plans to initiate steps

to exit from certain reporting requirements under the Exchange Act.

However, such process may be protracted and we

may be required to continue to file Current Reports on Form 8-K to disclose material events, including those related to the Dissolution.

Accordingly, we will continue to incur expenses that will reduce the amount available for distribution, including expenses of complying

with public company reporting requirements and paying its service providers, among others.

Do I have appraisal rights in connection with the Dissolution?

None of Delaware law, our Restated Certificate

of Incorporation, as amended, or our Amended and Restated Bylaws provides for appraisal or other similar rights for dissenting stockholders

in connection with the Dissolution, and we do not intend to independently provide stockholders with any such right.

Are there any risks related to the Dissolution?

Yes. You should carefully review the section entitled

“Risk Factors” beginning on page 7 of this proxy statement for a description of risks related to the Dissolution.

Will I owe any U.S. federal income taxes as a result of the Dissolution?

If the Dissolution is approved and

implemented, a stockholder that is a U.S. person generally will recognize gain or loss on a share-by-share basis equal to the

difference between (1) the sum of the amount of cash and the fair market value of property, if any, distributed to the stockholder

with respect to each share, less any known liabilities assumed by the stockholder or to which the distributed property (if any) is

subject, and (2) the stockholder’s adjusted tax basis in each share of our common stock. You are urged to read the section

entitled “Proposal 1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Certain

Material U.S. Federal Income Tax Consequences of the Proposed Dissolution” beginning on page 19 of this proxy statement for a

summary of certain material U.S. federal income tax consequences of the Dissolution, including the ownership of an interest in a

liquidating trust, if any.

What will happen to our common stock if the Certificate of Dissolution

is filed with the Secretary of State of Delaware?

If the Certificate of Dissolution is filed with

the Secretary of State, our common stock (if not previously delisted and deregistered) will be delisted from the Nasdaq and deregistered

under the Exchange Act. From and after the Effective Time, and subject to applicable law, each holder of shares of our common stock shall

cease to have any rights in respect of that stock, except the right to receive distributions, if any, pursuant to and in accordance with

the Plan of Dissolution and the DGCL. After the Effective Time, our stock transfer records shall be closed, and we will not record or

recognize any transfer of our common stock occurring after the Effective Time, except, in our sole discretion, such transfers occurring

by will, intestate succession or operation of law as to which we have received adequate written notice. Under the DGCL, no stockholder

shall have any appraisal rights in connection with the Dissolution.

We expect to file the Certificate of Dissolution

and for the Dissolution to become effective as soon as reasonably practicable after the Dissolution is approved by our stockholders; however,

the decision of whether or not to proceed with the Dissolution will be made by the Board in its sole discretion. We intend to provide

advance notice to our stockholders prior to the closing of our stock transfer records.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information in this proxy statement includes

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend that such forward-looking

statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the Exchange Act. These statements include statements regarding the intent, belief or current expectations of members

of our management team, as well as the assumptions on which such statements are based, and are generally identified by the use of words

such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,”

“expects,” “plans,” “predicts,” “intends,” “should,” “could,”

“continues,” or the negative version of these words or other comparable words. Forward-looking statements in this proxy statement

include, but are not limited to:

| · | plans and expectations for the Dissolution; |

| · | beliefs about the Company’s available options and financial condition; |

| · | all statements regarding the tax and accounting consequences of the transactions contemplated by the Dissolution; and |

| · | all statements regarding the amount and timing of distributions made to stockholders, if any, in connection with the Dissolution. |

You are cautioned not to place undue

reliance on these forward-looking statements, which speak only as of the date they are made. Such statements are subject to known

and unknown risks and uncertainties and other unpredictable factors, many of which are beyond our control. We make no representation

or warranty (express or implied) about the accuracy of any of the forward-looking statements. These statements are based on a number

of assumptions involving the judgment of management. Many relevant risks are described under the caption “Risk Factors”

on page 7 of this proxy statement, as well as throughout this proxy statement and the incorporated documents, and you should

consider these important cautionary factors as you read this document.

The forward-looking statements in this proxy statement

involve certain uncertainties and risks, including but not limited to:

| · | our ability to complete the Dissolution in a timely manner, or at all; |

| · | the timing and amount of cash and other assets available for distribution to our stockholders upon Dissolution; |

| · | the impact of business uncertainties in connection with the Dissolution; |

| · | the occurrence of any event, change or circumstance that could give rise to the termination of the Plan of Dissolution; |

| · | the risk that we may have liabilities or obligations about which we are not currently aware; |

| · | the risk that the cost of settling our liabilities and contingent obligations could be higher than anticipated; and |

| · | other risks and uncertainties described in Part I, Item 1A. “Risk Factors” in our Annual Report on Form 10-K for the year

ended December 31, 2022 filed with the SEC on March 31, 2023 and those risks and uncertainties described in our other reports filed with

the SEC, including our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. |

Any forward-looking statements are made as of

the date of this proxy statement only. In each case, actual results may differ materially from such forward-looking information. We can

give no assurance that such expectations or forward-looking statements will prove to be correct. An occurrence of or any material adverse

change in one or more of the risk factors or risks and uncertainties referred to in this proxy statement or included in the documents

incorporated by reference herein or other periodic reports or other documents or filings filed with or furnished to the SEC from time

to time could materially and adversely affect our business, prospects, financial condition and results of operations. Except as required

by law, we do not undertake or plan to update or revise any such forward-looking statements to reflect actual results, changes in plans,

assumptions, estimates or projections or other circumstances affecting such forward-looking statements occurring after the date of this

proxy statement.

RISK FACTORS

The following risk factors, together with the

other information in this proxy statement and in the “Risk Factors” sections included in the documents incorporated by reference

into this proxy statement (see the section entitled “Where You Can Find More Information; Incorporation by Reference” beginning

on page 26 of this proxy statement), should be carefully considered before deciding whether to vote to approve the Dissolution Proposal

as described in this proxy statement. In addition, stockholders should keep in mind that the risks described below are not the only risks

that are relevant to your voting decision. The risks described below are the risks that we currently believe are the material risks of

which our stockholders should be aware. Nonetheless, additional risks that are not presently known to us, or that we currently believe

are not material, may also prove to be important. Notably, the Company cautions that trading in the Company’s securities is highly

speculative and poses substantial risks.

Trading prices for the Company’s securities

may bear little or no relationship to the actual value realized, if any, by holders of the Company’s securities. Accordingly, the

Company urges extreme caution with respect to existing and future investments in its securities.

RISKS RELATED TO THE DISSOLUTION

We cannot predict the timing of the distributions to stockholders.

Our current intention is that, if approved by

our stockholders, the Certificate of Dissolution would be filed promptly after such approval; however, the decision of whether or not

to proceed with the Dissolution will be made by the Board in its sole discretion. No further stockholder approval would be required to

effect the Dissolution. However, if the Board determines that the Dissolution is not in our best interest or the best interest of our

stockholders, the Board may, in its sole discretion, abandon the Dissolution or may amend or modify the Plan of Dissolution to the extent

permitted by Delaware law without the necessity of further stockholder approval. After the Certificate of Dissolution has been filed,

revocation of the Dissolution would require stockholder approval under Delaware law.

Under Delaware law, before a dissolved corporation

may make any distribution to its stockholders, it must pay or make reasonable provision to pay all of its claims and obligations, including

all contingent, conditional or unmatured contractual claims known to the corporation. Furthermore, we may be subject to potential liabilities

relating to indemnification obligations, if any, to third parties or to our current and former officers and directors. It might take significant

time to resolve these matters, and as a result we are unable to predict the timing of distributions, if any are made, to our stockholders.

We cannot assure you as to the amount of distributions, if any,

to be made to our stockholders.

We cannot predict with certainty the amount of

distributions, if any, to our stockholders. However, based on the information currently available to us and if our stockholders approve

the Dissolution, we estimate that the aggregate amount of cash that will be available for distribution to our stockholders in the Dissolution

will be in the range between approximately $400,000 and $900,000 and the total amount distributed to stockholders will be in the range

between approximately $0.03 and $0.07 per share of common stock. These estimates do not include cash that may be available for distribution

from the proceeds from any sales or our remaining assets, including our intellectual property. Any such amounts may be paid in one or

more distributions. Such distributions will not occur until after the Certificate of Dissolution is filed, and we cannot predict the timing

or amount of any such distributions, as uncertainties as to the ultimate amount of our liabilities, the operating costs and amounts to

be set aside for claims, obligations and provisions during the liquidation and winding-up process, and the related timing to complete

such transactions make it impossible to predict with certainty the actual net cash amount that will ultimately be available for distribution

to stockholders or the timing of any such distributions. Examples of uncertainties that could reduce the value of distributions to our

stockholders include: unanticipated costs relating to the defense, satisfaction or settlement of lawsuits or other claims threatened against

us or our directors or officers; amounts necessary to resolve claims of any creditors or other third parties; and delays in the liquidation

and dissolution or other winding up process.

In addition, as we wind down, we will

continue to incur expenses from operations, including directors’ and officers’ insurance; payments to service providers

and any continuing employees or consultants; taxes; legal, accounting and consulting fees and expenses related to our filing

obligations with the SEC or in connection with our listing (including our scheduled hearing) on Nasdaq, which will reduce any

amounts available for distribution to our stockholders. As a result, we cannot assure you as to any amounts to be distributed to our

stockholders if the Board proceeds with the Dissolution. If our stockholders do not approve the Dissolution Proposal, we will not be

able to proceed with the Dissolution and no liquidating distributions will be made in connection therewith. See the section entitled

“Proposal 1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Estimated Distributions to

Stockholders” beginning on page 10 of this proxy statement for a description of the assumptions underlying and sensitivities

of our estimate of the total cash distributions to our stockholders in the Dissolution.

It is the current intent of the Board, assuming

approval of the Dissolution, that any cash will first be used to pay our outstanding current liabilities and then will be retained to

pay ongoing corporate and administrative costs and expenses associated with winding down the company, liabilities and potential liabilities

relating to or arising out of any litigation matters and potential liabilities relating to our indemnification obligations, if any, to

our service providers, or to our current and former officers and directors.

The Board will determine, in its sole discretion,

the timing of the distribution of the remaining amounts, if any, to our stockholders in the Dissolution. We can provide no assurance as

to if or when any such distribution will be made, and we cannot provide any assurance as to the amount to be paid to stockholders in any

such distribution, if one is made. Stockholders may receive substantially less than the amount that we currently estimate that they may

receive, or they may receive no distribution at all. To the extent funds are available for distribution to stockholders, the Board intends

to seek to distribute such funds to our stockholders as quickly as possible, as permitted by the DGCL, and intends to take all reasonable

actions to optimize the distributable value to our stockholders.

If our stockholders do not approve the Dissolution Proposal,

we would not be able to continue our business operations.

On June 5, 2023, we issued a press release announcing

top-line results from our pivotal Phase 3 REBUILD clinical trial evaluating the safety and efficacy of INOpulse® for the treatment

of fILD. The trial did not meet its primary endpoint and the secondary endpoints demonstrated minimal difference between the two groups

with none approaching statistical significance. Based on these findings, we decided to terminate the REBUILD Phase 3 clinical study and

withdraw patients from all of our ongoing INOpulse development programs and disclosed our intention to explore a range of strategic alternatives

to maximize stockholder value, including, but not limited to, a merger, a business combination, a sale of assets or other transaction

or a liquidation and dissolution, which we disclosed in a Form 8-K filed on June 29, 2023. In connection with our plan to explore strategic

alternatives, we also announced a reduction in force. After an extensive review of strategic alternatives, we have been unable to identify

and enter into a viable transaction with a merger partner or purchaser of our company or our assets. If our stockholders do not approve

the Dissolution Proposal, the Board will continue to explore what, if any, alternatives are available for the future of the Company in

light of its discontinued business activities; however, those alternatives are likely limited to seeking voluntary dissolution at a later

time with potentially diminished assets or seeking bankruptcy protection (should our net assets decline to levels that would require such

action). It is unlikely that these alternatives would result in greater stockholder value than the proposed Plan of Dissolution and the

Dissolution.

The Board may determine not to proceed with the Dissolution.

Even if the Dissolution Proposal is approved by

our stockholders, the Board may determine in its sole discretion not to proceed with the Dissolution. If our Board elects to pursue any

alternative to the Plan of Dissolution, our stockholders may not receive any of the funds that might otherwise be available for distribution

to our stockholders. After the Certificate of Dissolution has been filed, revocation of the Dissolution would require stockholder approval

under Delaware law.

Our stockholders may be liable to third parties for part or all

of the amount received from us in our liquidating distributions if reserves are inadequate.

If the Dissolution becomes effective, we may

establish a contingency reserve designed to satisfy any additional claims and obligations that may arise. Any contingency reserve

may not be adequate to cover all of our claims and obligations. Under the DGCL, if we fail to create an adequate contingency reserve

for payment of our expenses, claims and obligations, each stockholder could be held liable for payment to our creditors for claims

brought prior to or after the expiration of the Survival Period (as defined below) after we file the Certificate of Dissolution with

the Secretary of State (or, if we choose the Safe Harbor Procedures (as defined under the section entitled “Proposal

1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Delaware Law

Applicable to Our Dissolution — Payments and Distributions to Claimants and

Stockholders — Safe Harbor Procedures under DGCL Sections 280 and 281(a)” beginning on page 13 of

this proxy statement), for claims brought prior to the expiration of the Survival Period), up to the lesser of (i) such

stockholder’s pro rata share of amounts owed to creditors in excess of the contingency reserve and (ii) the amounts previously

received by such stockholder in Dissolution from us and from any liquidating trust or trusts. Accordingly, in such event, a

stockholder could be required to return part or all of the distributions previously made to such stockholder, and a stockholder

could receive nothing from us under the Plan of Dissolution. Moreover, if a stockholder has paid taxes on amounts previously

received, a repayment of all or a portion of such amount could result in a situation in which a stockholder may incur a net tax cost

if the repayment of the amount previously distributed does not cause a commensurate reduction in taxes payable in an amount equal to

the amount of the taxes paid on amounts previously distributed.

Our stockholders of record will not be able to buy or sell shares

of our common stock after we close our stock transfer books on the Effective Time.

If the Board determines to proceed with the Dissolution,

we intend to close our stock transfer books and discontinue recording transfers of our common stock at the Effective Time. After we close

our stock transfer books, we will not record any further transfers of our common stock on our books except by will, intestate succession

or operation of law. Therefore, shares of our common stock will not be freely transferable after the Effective Time. As a result of the

closing of the stock transfer books, all liquidating distributions in the Dissolution will likely be made pro rata to the same stockholders

of record as the stockholders of record as of the Final Record Date.

We plan to initiate steps to exit from certain reporting requirements

under the Exchange Act, which may substantially reduce publicly available information about us. If the exit process is protracted, we

will continue to bear the expense of being a public reporting company despite having no source of revenue.

Our common stock is currently registered under

the Exchange Act, which requires that we, and our officers and directors with respect to Section 16 of the Exchange Act, comply with certain

public reporting and proxy statement requirements thereunder. Compliance with these requirements is costly and time-consuming. We plan

to initiate steps to exit from such reporting requirements in order to curtail expenses; however, such process may be protracted and we

may be required to continue to file Current Reports on Form 8-K or other reports to disclose material events, including those related

to the Dissolution. Accordingly, we will continue to incur expenses that will reduce the amount available for distribution, including

expenses of complying with public company reporting requirements and paying its service providers, among others. If our reporting obligations

cease, publicly available information about us will be substantially reduced.

Stockholders may not be able to recognize a loss for U.S. federal

income tax purposes until they receive a final distribution from us.

As a result of the Dissolution, for U.S.

federal income tax purposes, a stockholder that is a U.S. person generally will recognize gain or loss on a share-by- share basis

equal to the difference between (1) the sum of the amount of cash and the fair market value of property, if any, distributed to the

stockholder with respect to each share, less any known liabilities assumed by the stockholder or to which the distributed property

(if any) is subject, and (2) the stockholder’s adjusted tax basis in each share of our common stock. A liquidating

distribution pursuant to the Plan of Dissolution may occur at various times and in more than one tax year. Any loss generally will

be recognized by a stockholder only in the tax year in which the stockholder receives our final liquidating distribution, and then

only if the aggregate value of all liquidating distributions with respect to a share of our common stock is less than the

stockholder’s tax basis for that share. Stockholders are urged to consult with their own tax advisors as to the specific tax

consequences to them of the Dissolution pursuant to the Plan of Dissolution. See the section entitled “Proposal

1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Certain Material U.S.

Federal Income Tax Consequences of the Proposed Dissolution” beginning on page 19 of this proxy statement.

The tax treatment of any liquidating distribution may vary from

stockholder to stockholder, and the discussions in this proxy statement regarding tax consequences are general in nature.

We have not requested a ruling from the IRS with

respect to the anticipated tax consequences of the Dissolution, and we will not seek an opinion of counsel with respect to the anticipated

tax consequences of any liquidating distributions. If any of the anticipated tax consequences described in this proxy statement prove

to be incorrect, the result could be increased taxation at the corporate or stockholder level, thus reducing the benefit to our stockholders

and us from the Dissolution. Tax considerations applicable to particular stockholders may vary with and be contingent on the stockholder’s

individual circumstances. You should consult your own tax advisor for tax advice instead of relying on the discussions of tax consequences

in this proxy statement.

PROPOSAL 1 — APPROVAL

OF THE DISSOLUTION PURSUANT TO THE PLAN OF DISSOLUTION

We are asking you to authorize and approve

the Dissolution. Our Board has determined that the Dissolution is advisable and in the best interests of the Company and our

stockholders, has approved the Dissolution and has adopted the Plan of Dissolution. The reasons for the Dissolution are described

under “Proposal 1 — Approval of the Dissolution Pursuant to the Plan of

Dissolution — Background of the Proposed Dissolution” beginning on page 11 of this proxy statement. The

Dissolution requires approval by the holders of a majority of our outstanding common stock entitled to vote at the Special Meeting

that is the subject of this proxy statement. Our Board unanimously recommends that our stockholders authorize the Dissolution.

In general terms, when we dissolve, we will cease

conducting our business, wind up our affairs, dispose of our non-cash assets, pay or otherwise provide for our obligations, and distribute

our remaining assets, if any, during a post-dissolution period of at least three years, as required by the DGCL. With respect to the Dissolution,

we will follow the dissolution and winding-up procedures prescribed by the DGCL, as described in further detail under “Proposal

1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Delaware Law Applicable

to Our Dissolution” beginning on page 12 of this proxy statement. Our liquidation, winding up and distribution procedures will be

further guided by our Plan of Dissolution, as described in further detail under “Proposal 1 — Approval of the

Dissolution Pursuant to the Plan of Dissolution — Our Plan of Dissolution” beginning on page 15 of this proxy

statement. You should carefully consider the risk factors relating to our complete liquidation and dissolution and described under “Risk

Factors — Risks Related to The Dissolution” beginning on page 7 of this proxy statement.

Subject to the requirements of the DGCL and our

Plan of Dissolution, as further described below, we will use our existing cash to pay for our winding up procedures, including:

| · | the costs associated with our Dissolution and winding up over the Survival Period; these costs may include, among others, expenses

necessary to the implementation and administration of our Plan of Dissolution and fees and other amounts payable to professional advisors

(including legal counsel, financial advisors and others) and to consultants and others assisting us with our Dissolution; |

| · | any claims by others against us that we do not reject as part of the dissolution process; |

| · | any amounts owed by us under contracts with third parties; |

| · | the funding of any reserves or other security we are required to establish, or deem appropriate to establish, to pay for asserted

claims (including lawsuits) and possible future claims, as further described below; and |

| · | solely to the extent remaining after provision for the above-described payments, liquidating distributions to be made to our stockholders,

which distributions may be made from time to time as available and in accordance with the DGCL procedures described below. |

ESTIMATED DISTRIBUTIONS TO STOCKHOLDERS

Based on currently available information, we estimate

that we will have in the range between approximately $400,000 and $900,000 of cash that we will be able to distribute to stockholders

in connection with the Dissolution, which implies a per share distribution range of $0.03 to $0.07 per share of common stock. Calculating

such an estimate is inherently uncertain and requires that we make a number of assumptions regarding future events, many of which are

unlikely to ultimately be true. We used the following assumptions when calculating the estimated distributable cash value: (i) approximately

$700,000 payable for insurance, (ii) approximately $400,000 payable for wind-down administration services and retainage, (iii) approximately

$200,000 payable for legal fees, (iv) approximately $300,000 payable for severance, (v) approximately $400,000 payable for wages, board

fees and consultants, (vi) approximately $100,000 payable for accounting fees, (vii) approximately $100,000 payable for disposal of inventory,

property and equipment and (viii) approximately $200,000 payable for other general and administrative costs.

Distributions, if any, to our stockholders may

be paid in one or more distributions. Such distributions will not occur until after the Certificate of Dissolution is filed, and we cannot

predict the timing or amount of any such distributions, as uncertainties as to the ultimate amount of our liabilities, the operating costs

and amounts to be set aside for claims, obligations and provisions during the liquidation and winding-up process, and the related timing

to complete such transactions make it impossible to predict with certainty the actual net cash amount that will ultimately be available

for distribution to stockholders or the timing of any such distributions. Examples of uncertainties that could reduce the value of distributions

to our stockholders include: unanticipated costs relating to the defense, satisfaction or settlement of existing or future lawsuits or

other claims threatened against us or our officers or directors; amounts necessary to resolve claims of our creditors; and delays in the

liquidation and dissolution or other winding up of our subsidiaries due to our inability to settle claims or otherwise.

Our estimate of the anticipated initial distribution

amounts is preliminary and many of the factors that are necessary to determine how much, if any, we will be able to distribute to our

stockholders in liquidation are subject to change and outside of our control. While we intend to pursue matters related to our liquidation

and winding up as quickly as possible if we obtain approval from our stockholders, the timing of many elements of this process after our

Dissolution will not be entirely within our control and, therefore, we are unable to estimate when we would be able to begin making any

post-Dissolution liquidating distributions to our stockholders. See the section entitled “Risk Factors — Risks

Related to The Dissolution” beginning on page 7 of this proxy statement.

The description of the Dissolution contained in

this introductory section is general in nature and is subject to various other factors and requirements, as described in greater detail

below.

BACKGROUND OF THE PROPOSED DISSOLUTION

In the ordinary course from time to time, our

Board and management team have evaluated and considered a variety of financial and strategic opportunities for the Company as part of

our long-term strategy to enhance value for our stockholders, including potential acquisitions, divestitures, business combinations and

other transactions.

Historically, we were a clinical-stage therapeutics

company focused on developing innovative products to address significant unmet medical needs in the treatment of cardiopulmonary diseases.

Our focus had primarily been the development of our nitric oxide therapy for patients with or at risk of pulmonary hypertension, or PH,

using our proprietary pulsatile nitric oxide delivery platform, INOpulse.

On June 5, 2023, we issued a press release announcing

top-line results from our pivotal Phase 3 REBUILD clinical trial evaluating the safety and efficacy of INOpulse. The trial did not meet

its primary endpoint and the secondary endpoints demonstrated minimal difference between the two groups with none approaching statistical

significance. Based on these findings, we decided to terminate the REBUILD Phase 3 clinical study and withdraw patients from all of our

ongoing INOpulse development programs and disclosed our intention to explore a range of strategic alternatives to maximize stockholder

value, including, but not limited to, a merger, a business combination, a sale of assets or other transaction or a liquidation and dissolution.

We also began implementation of a Board-approved plan to preserve capital, reduce operating costs, and maximize the value of our assets.

Consistent with our capital preservation efforts, we reduced our workforce except for certain executive officers and finance personnel

required to lead the strategic review process and manage remaining operations.

Our Board and management consulted with advisors

relating to the pursuit of a sale or merger of the Company, including a reverse merger. Despite broad canvassing and discussions with

multiple potential strategic parties, we were unsuccessful in identifying and entering into agreements for any viable transactions.

In light of the strategic alternatives review,

our Board determined that approving the Plan of Dissolution gives our Board the most flexibility in optimizing value for our stockholders

and as a result, on October 12, 2023, our Board adopted resolutions approving the Plan of Dissolution and the Dissolution and recommending

that our stockholders approve the Plan of Dissolution and the Dissolution.

REASONS FOR THE PROPOSED DISSOLUTION

The Board believes that the Dissolution is in

the Company’s best interests and the best interests of our stockholders. The Board considered and pursued at length potential strategic

alternatives available to the Company such as a merger, strategic partnership or other business combination transaction, and, following

the results of such review, now believe that pursuing a wind-up of the Company in accordance with the Plan of Dissolution gives our Board

the most flexibility in optimizing value for our stockholders.

In making its determination to approve the Dissolution,

the Board considered, in addition to other pertinent factors, the fact that the Company currently has no significant remaining business

operations or business prospects; the fact that the Company will continue to incur substantial accounting, legal and other expenses associated

with being a public company despite having no source of revenue or financing alternatives; and the fact that the Company has conducted

an evaluation to identify remaining strategic alternatives involving the Company, such as a merger, strategic partnership or other business

combination transaction, that would have a reasonable likelihood of providing value to our stockholders in excess of the amount the stockholders

would receive in a liquidation. As a result of its evaluation, the Board concluded that the Dissolution is the preferred strategy among

the alternatives now available to the Company and is in the best interests of the Company and its stockholders. Accordingly, the Board

approved the Dissolution of the Company pursuant to the Plan of Dissolution and recommends that our stockholders approve the Dissolution

Proposal.

DELAWARE LAW APPLICABLE TO OUR DISSOLUTION

We are a corporation organized under the laws

of the State of Delaware and the Dissolution will be governed by the DGCL. The following is a brief summary of some of the DGCL provisions

applicable to the Dissolution. The following summary is qualified in its entirely by Sections 275 through 283 of the DGCL, which are attached

to this proxy statement as Annex B.

Delaware Law Generally

Authorization of Board and Stockholders.

If a corporation’s board of directors deems it advisable that the corporation should dissolve, it may adopt a resolution to that

effect by a majority vote of the whole board and notify the corporation’s stockholders entitled to vote on the dissolution of the

adoption of the resolution and the calling of a meeting of stockholders to act on the resolution. Our Board has unanimously adopted a

resolution approving the Dissolution and the Plan of Dissolution and declaring them advisable and recommending them to our stockholders.

The Dissolution must be authorized and approved by the holders of a majority of our outstanding common stock on the Record Date entitled

to vote on the Dissolution Proposal.

Certificate of Dissolution. If a

corporation’s stockholders authorize its dissolution, to consummate the dissolution the corporation must file a certificate of dissolution

with the Secretary of State. If our stockholders authorize the Dissolution at the Special Meeting, we intend to file the Certificate of

Dissolution with the Secretary of State as soon as practicable after the receipt of such approval. However, the timing of such filing

is subject to the discretion of the Board.

Possible Permitted Abandonment of Dissolution.

The resolution authorizing a dissolution adopted by a corporation’s board of directors may provide that, notwithstanding authorization

of the dissolution by the corporation’s stockholders, the board of directors may abandon the dissolution without further action

by the stockholders. While we do not currently foresee any reason that our Board would abandon our proposed Dissolution once it is authorized

by our stockholders, to provide our Board with the maximum flexibility to act in the best interests of our stockholders, the resolutions

adopted by our Board included language providing the board with the flexibility to abandon the Dissolution without further action of our

stockholders at any time prior to the filing of the Certificate of Dissolution.

Time of Dissolution. When a corporation’s

certificate of dissolution is filed with the Secretary of State and has become effective, along with the corporation’s tender of

all taxes (including Delaware franchise taxes) and fees authorized to be collected by the Secretary of State, the corporation will be

dissolved. We refer to the effective time of the Certificate of Dissolution herein as the “Effective Time.”

Continuation of Corporation After Dissolution

A dissolved corporation continues its existence

for three years after dissolution, or such longer period as the Delaware Court of Chancery may direct, for the purpose of prosecuting

and defending suits and enabling the corporation to settle and close its business, to dispose of and convey its property, to discharge

its liabilities and to distribute to its stockholders any remaining assets. A dissolved corporation may not, however, continue the business

for which it was organized. Any action, suit or proceeding begun by or against the corporation before or during this survival period does

not abate by reason of the dissolution, and for the purpose of any such action, suit or proceeding, the corporation will continue beyond

the Survival Period until any related judgments, orders or decrees are fully executed, without the necessity for any special direction

by the Delaware Court of Chancery. Our Plan of Dissolution will govern our winding up process after Dissolution. See the section entitled

“Proposal 1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Our Plan

of Dissolution” beginning on page 15 of this proxy statement.

Payment and Distribution to Claimants and Stockholders

A dissolved corporation must make provision for

the payment (or reservation of funds as security for payment) of claims against the corporation in accordance with the applicable provisions

of the DGCL and the distribution of remaining assets to the corporation’s stockholders. The dissolved corporation may do this by

following one of two procedures, as described below.

Safe Harbor Procedures under DGCL Sections 280 and 281(a) (the

“Safe Harbor Procedures”)

A dissolved corporation may elect to give notice

of its dissolution to persons having a claim against the corporation (other than claims against the corporation in any pending actions,

suits or proceedings to which the corporation is a party) (“Current Claimants”) and to persons with contractual claims contingent

on the occurrence or nonoccurrence of future events or otherwise conditional or unmatured (“Contingent Contractual Claimants”),

and after giving these notices, following the procedures set forth in the DGCL, as described below.

The Plan of Dissolution provides the Board with

the discretion to elect to follow the Safe Harbor Procedures rather than the Alternative Procedures.

Current Claimants

Notices and Publication. The notice

to Current Claimants must state (1) that all such claims must be presented to the corporation in writing and must contain sufficient information

reasonably to inform the corporation of the identity of the claimant and the substance of the claim; (2) the mailing address to which

the claim must be sent; (3) the date (the “Claim Date”) by which the claim must be received by the corporation, which must

be no earlier than 60 days from the date of the corporation’s notice; (4) that the claim will be barred if not received by the Claim

Date; (5) that the corporation may make distributions to other claimants and the corporation’s stockholders without further notice

to the Current Claimant; and (6) the aggregate annual amount of all distributions made by the corporation to its stockholders for each

of the three years before the date of dissolution. The notice must be published at least once a week for two consecutive weeks in a newspaper

of general circulation in the county in which the corporation’s registered agent in Delaware is located and in the corporation’s

principal place of business and, in the case of a corporation having $10.0 million or more in total assets at the time of dissolution,

at least once in all editions of a daily newspaper with a national circulation. On or before the date of the first publication of the

notice, the corporation must also mail a copy of the notice by certified or registered mail, return receipt requested, to each known claimant

of the corporation, including persons with claims asserted against the corporation in a pending action, suit or proceeding to which the

corporation is a party.

Effect of Non-Responses to Notices.

If the dissolved corporation does not receive a response to the corporation’s notice by the Claim Date from a Current Claimant who

was given actual notice according to the foregoing paragraph, then the claimant’s claim will be barred.

Treatment of Responses to Notices.

If the dissolved corporation receives a response to the corporation’s notice by the Claim Date, the dissolved corporation may accept

or reject, in whole or in part, the claim. If the dissolved corporation rejects a claim, it must mail a notice of the rejection to the

Current Claimant by certified or registered mail, return receipt requested, within 90 days after receipt of the claim (or, if earlier,

at least 150 days before the expiration of the Survival Period). The notice must state that any claim so rejected will be barred if the

Current Claimant does not commence an action, suit or proceeding with respect to the claim within 120 days of the date of the rejection.

Effect of Non-Responses to Rejections of

Claims. If the dissolved corporation rejects a claim and the Current Claimant does not commence an action suit or proceeding with

respect to the claim within the 120-day post- rejection period, then the Current Claimant’s claim will be barred.

Contingent Contractual Claims

Notices. The notice to Contingent

Contractual Claimants (persons with contractual claims contingent on the occurrence or nonoccurrence of future events or otherwise conditional

or unmatured) must be in substantially the same form and sent and published in the same manner, as notices to Current Claimants and shall

request that Contingent Contractual Claimants present their claims in accordance with the terms of such notice.

Responses to Contractual Claimants.

If the dissolved corporation receives a response by the date specified in the notice by which the claims from Contingent Contractual Claimants

must be received by the corporation, which must be no earlier than 60 days from the date of the corporation’s notice to Contingent

Contractual Claimants, the dissolved corporation must offer to the Contingent Contractual Claimant such security as the dissolved corporation

determines is sufficient to provide compensation to the claimant if the claim matures. This offer must be mailed to the Contingent Contractual

Claimant by certified or registered mail, return receipt requested, within 90 days of the dissolved corporation’s receipt of the

claim (or, if earlier, at least 150 days before the expiration of the post- dissolution survival period). If the Contingent Contractual

Claimant does not deliver to the dissolved corporation a written notice rejecting the offer within 120 days after receipt of the offer

for security, the claimant is deemed to have accepted the security as the sole source from which to satisfy the claim against the dissolved

corporation.

Determinations by Delaware Court of Chancery

A dissolved corporation that has complied with

the Safe Harbor Procedures must petition the Delaware Court of Chancery to determine the amount and form of security that will be (1)

reasonably likely to be sufficient to provide compensation for any claim against the dissolved corporation that is the subject of a pending

action, suit or proceeding to which the dissolved corporation is a party, other than a claim barred pursuant to the Safe Harbor Procedures,

(2) sufficient to provide compensation to any Contingent Contractual Claimant who has rejected the dissolved corporation’s offer

for security for such person’s claims made pursuant to the Safe Harbor Procedures, and (3) reasonably likely to be sufficient to

provide compensation for claims that have not been made known to the dissolved corporation or that have not arisen but that, based on

facts known to the dissolved corporation, are likely to arise or to become known to the dissolved corporation within five years after

the date of dissolution or such longer period of time as the Delaware Court of Chancery may determine, not to exceed ten years after the

date of dissolution.

Payments and Distributions

If a dissolved corporation has followed the Safe

Harbor Procedures, then it will (1) pay the current claims made but not rejected, (2) post the security offered and not rejected for contractual

claims that are contingent, conditional or unmatured, (3) post any security ordered by the Delaware Court of Chancery in response to the

dissolved corporation’s petition to the court described above, and (4) pay or make provision for all other claims that are mature,

known and uncontested or that have been finally determined to be owing by the dissolved corporation. If there are insufficient assets

to make these payments and provisions, then they will be satisfied ratably in accordance with legal priorities, to the extent that assets

are available.

All remaining assets will be distributed to the

dissolved corporation’s stockholders, but not earlier than 150 days after the date of the last notice of rejection given by the

dissolved corporation to a Current Claimant pursuant to the Safe Harbor Procedures.

Alternative Procedures under DGCL Section 281(b) (the “Alternative

Procedures”)

If a dissolved corporation does not elect to follow

the Safe Harbor Procedures, it must adopt a plan of distribution pursuant to which it will (1) pay or make reasonable provision to pay

all claims and obligations, including all contingent, conditional or unmatured contractual claims known to the corporation, (2) make such

provision as will be reasonably likely to be sufficient to provide compensation for any claim against the dissolved corporation that is

the subject of a pending action, suit or proceeding to which the dissolved corporation is a party and (3) make such provision as will

be reasonably likely to be sufficient to provide compensation for claims that have not been made known to the dissolved corporation or

that have not arisen but that, based on facts known to the dissolved corporation, are likely to arise or to become known to the dissolved

corporation within ten years after the date of dissolution. If there are insufficient assets to make these payments and provisions, then

they will be satisfied ratably in accordance with legal priorities, to the extent assets are available. All remaining assets will be distributed

to the dissolved corporation’s stockholders.

The Plan of Dissolution adopted by the Board and

proposed to the stockholders for approval constitutes the plan of distribution for purposes of the Alternative Procedures.

Liabilities of Stockholders and Directors

If a dissolved corporation follows either the

Safe Harbor Procedures or the Alternative Procedures, then (1) a stockholder of the dissolved corporation’s will not be liable for

any claim against the dissolved corporation in an amount in excess of the lesser of (a) the stockholder’s pro rata share of the

claim and (b) the amount distributed to the stockholder. If a dissolved corporation follows the Safe Harbor Procedures, then a stockholder

of the dissolved corporation will not be liable for any claim against the dissolved corporation on which an action, suit or proceeding

is not begun before the expiration of the Survival Period. In no event will the aggregate liability of a stockholder of a dissolved corporation

for claims against the dissolved corporation exceed the amount distributed to the stockholder in dissolution. If a dissolved corporation

fully complies with either the Safe Harbor Procedures or the Alternative Procedures, then the dissolved corporation’s directors

will not be personally liable to the dissolved corporation’s claimants.

Application of These Procedures to Us

We currently plan to elect to follow the

Alternative Procedures. However, our Plan of Dissolution specifically permits our Board the discretion to decide to abandon any

plans to follow the Alternative Procedures and to follow the Safe Harbor Procedures permitted by Delaware law. If we follow the Safe

Harbor Procedures, then the required published notices would be published in a newspaper of general circulation in New Castle

County, Delaware (the location of our registered agent), and Foxborough, Massachusetts (the location of our principal place of

business). For more information about our liquidation, winding up and distribution procedures, see the section entitled

“Proposal 1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Our

Plan of Dissolution” beginning on page 15 of this proxy statement.

OUR PLAN OF DISSOLUTION

The Dissolution will be conducted in accordance

with the Plan of Dissolution, which is attached to this proxy statement as Annex A and incorporated by reference into this proxy statement.

The following is a summary of our Plan of Dissolution and does not purport to be complete or contain all of the information that is important

to you. To understand our Plan of Dissolution more fully, you are urged to read this proxy statement as well as the Plan of Dissolution.

Our Plan of Dissolution may be modified, clarified or amended by action by our Board at any time and from time to time, as further described

below.

Authorization and Effectiveness

Our Plan of Dissolution will be deemed approved

if the holders of a majority of the outstanding stock entitled to vote on the Dissolution Proposal have authorized the Plan of Dissolution

and the Dissolution and will constitute our authorized plan and will evidence our authority to take all actions described in the Plan

of Dissolution. Following the authorization of the Dissolution by our stockholders, at such time as our Board determines to be appropriate,

we will file the Certificate of Dissolution with the Secretary of State and ensure that all relevant taxes (including Delaware franchise

taxes) and fees are paid. The Effective Time of our Dissolution will be when the Certificate of Dissolution is filed with the office of

the Secretary of State or such later date and time that is stated in the Certificate of Dissolution.

Survival Period

For three years after the Effective Time (or such

longer period as the Delaware Court of Chancery may direct) (the “Survival Period”), we will continue as a body corporate

for the purpose of prosecuting and defending lawsuits (civil, criminal or administrative) by or against us; settling and closing our business;

disposing of and conveying our property; discharging our liabilities in accordance with the DGCL; and distributing our remaining assets

to our stockholders. We will no longer engage in the development of treatments for cardiopulmonary diseases. We anticipate that distributions,

if any, to our stockholders will be made in cash, and may be made at any time, from time to time, in accordance with the DGCL.

General Liquidation, Winding Up and Distribution Process

We intend to elect to follow the Alternative

Procedures described under the section entitled “Proposal 1 — Approval of the Dissolution Pursuant to the

Plan of Dissolution — Delaware Law Applicable to Our Dissolution — Alternative Procedures

under DGCL Section 281(b)” beginning on page 14 of this proxy statement but our Board retains the discretion to opt to

dissolve the Company in accordance with the Safe Harbor Procedures.

The Board intends to seek to distribute funds,

if any, to our stockholders as quickly as possible, as permitted by the DGCL and the Plan of Dissolution, and intends to take all reasonable

actions to optimize the distributable value to our stockholders.

Continuing Employees and Consultants

During the Survival Period, we may retain, hire,