Trending: AstraZeneca Hikes Forecasts and Makes a $2 Billion Licensing Deal

09 November 2023 - 1:03PM

Dow Jones News

1133 GMT - AstraZeneca is among the most mentioned companies

across news items over the past four hours, according to Factiva

data. The Anglo-Swedish drugmaker hiked its forecasts for core

earnings per share and total revenue for the year as soaring cancer

medicine sales offset plummeting coronavirus vaccine sales.

AstraZeneca's third-quarter revenue largely met market

expectations, rising 5% to $11.49 billion, compared to a $11.56

billion forecast by 12 analysts taken from FactSet. The higher

sales in the oncology division--which accounts for 40% of company

revenue--offset a 65% drop to $312 million in sales from the

vaccine and immune therapies division, due to sharp declines in

demand for coronavirus vaccines. The company also separately said

it has entered a $2 billion exclusive agreement with Eccogene,

licensing its ECC5004 product for treating conditions such as

type-2 diabetes and obesity. "[AstraZeneca's] latest update will

build confidence the company can sustain its recent momentum and

reclaim its position as the largest company on the FTSE 100 from

energy giant Shell," AJ Bell investment director Russ Mould says in

a market comment. Shares at 1125 GMT were up 282.0 pence, or 2.8%

at 10,452.0 pence. Dow Jones & Co. owns Factiva.

(joseph.hoppe@wsj.com)

(END) Dow Jones Newswires

November 09, 2023 06:48 ET (11:48 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

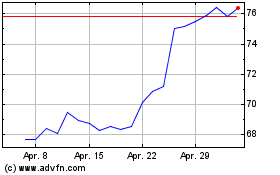

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

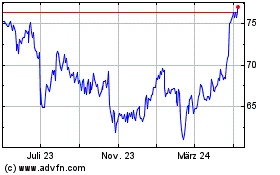

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024