Akoya Biosciences Reports Second Quarter 2024 Financial Results

05 August 2024 - 10:00PM

Akoya Biosciences, Inc. (Nasdaq: AKYA) (“Akoya”), The Spatial

Biology Company®, today announced its financial results for the

second quarter ending June 30, 2024.

“Our second-quarter revenue showed a strong rebound with 26%

sequential top-line growth and a stable year-over-year

performance,” said Brian McKelligon, CEO of Akoya Biosciences. “We

believe that Akoya’s platforms are poised to lead the spatial

biology market from discovery to diagnostics, while we also

position the company to achieve near-term operating cash flow

breakeven as we align our cost structure with our strategic

objectives.”

Second Quarter 2024 Financial and Business

Results

- For the second quarter of 2024,

revenue was $23.2 million, a 26.2% quarter-over-quarter increase

from $18.4 million in the first quarter and 1.5% year-over-year

decrease from $23.5 million in the second quarter of 2023.

- Instruments, consumables and

services all contributed to sequential growth. Instrument revenue

was $8.3 million, a 70.4% quarter-over-quarter increase. Reagent

revenue was $7.4 million, a 5.6% quarter-over-quarter increase.

Service and other revenue was $7.2 million, a 16.6%

quarter-over-quarter increase.

- For the second quarter of 2024,

gross margin was 57.8%, compared to gross margin of 45.7% in the

first quarter of 2024 and 51.5% in the second quarter of 2023.

- For the second quarter of 2024,

operating expenses were $24.5 million, compared to operating

expenses of $30.0 million in the first quarter of 2024, a 18.3%

quarter-over-quarter decrease, and $31.4 million in the second

quarter of 2023, a 22.0% year-over-year decrease.

- For the second quarter of 2024,

loss from operations was $11.1 million, compared to loss from

operations of $21.6 million in the first quarter of 2024, a 48.6%

quarter-over-quarter decrease, and $19.2 million in the second

quarter of 2023, a 42.4% year-over-year decrease.

- Ended the second quarter of 2024

with an instrument installed base of 1,264 (374 PhenoCyclers, 890

PhenoImagers), a year-over-year increase of 18.8%, compared to an

installed base of 1,064 in the prior year period (300 PhenoCyclers,

764 PhenoImagers).

- As of June 30, 2024, there were

1,450 total publications citing Akoya’s technology, compared to 988

total publications in the prior year period, a 46.8% increase.

- $48.7 million of cash, cash equivalents and marketable

securities as of June 30, 2024.

YTD 2024 Financial Results

- YTD 2024 revenue was $41.5 million, compared to $44.9 million

in the prior year period: a 7.6% decrease.

- YTD 2024 reported gross margin was 52.4% while non-GAAP

adjusted gross margin was 57.4% when excluding the write-off from

discontinued legacy products in the first quarter of 2024. Both

GAAP and non-GAAP gross margin were 54.3% in the prior year period

of 2023.

- YTD 2024 operating expenses were $54.4 million while non-GAAP

operating expenses were $50.1 million when excluding the impairment

charge for facility consolidation and restructuring associated with

a reduction in force in the first quarter of 2024. Both GAAP and

non-GAAP operating expenses were $61.1 million in the prior year

period of 2023.

- YTD 2024 loss from operations was

$32.7 million while non-GAAP loss from operations was $26.3 million

excluding the items noted above. Both GAAP and non-GAAP loss from

operations were $36.7 million in the prior year period of

2023.

2024 Financial Outlook

Akoya is updating its revenue outlook for the full year 2024

while maintaining its commitment to achieving operating cash flow

breakeven by year end. The Company now expects the full year 2024

revenue to be in the range of $96-104 million.

Webcast and Conference Call Details

Akoya will host a conference call today, August 5, 2024, at 5:00

p.m. Eastern Time to discuss its second quarter 2024 financial

results. Investors interested in listening to the conference call

are required to register online. A live webcast of the conference

call will be available on the “Investors” section of the Company's

website at https://investors.akoyabio.com/. The webcast will be

archived on the website following the completion of the call for

three months.

Non-GAAP Financial Measures

In addition to reporting financial measures in accordance with

generally accepted accounting principles (“GAAP”), Akoya is

including in this press release “non-GAAP adjusted gross profit,”

“non-GAAP adjusted gross margin,” “non-GAAP operating expense,” and

“non-GAAP loss from operations,” all of which are non-GAAP

financial measures. Akoya defines non-GAAP adjusted gross profit as

gross profit margin adjusted for certain excess and obsolete

inventory charges. Non-GAAP adjusted gross margin is defined as

non-GAAP adjusted gross profit divided by total revenue. Akoya

defines non-GAAP operating expense as operating expense adjusted

for impairment and restructuring charges. Akoya defines non-GAAP

loss from operations as loss from operations adjusted for certain

excess and obsolete inventory charges, impairment, and

restructuring charges.

Akoya includes these non-GAAP financial measures because it

believes they allow investors to understand and evaluate the

Company’s core operating performance and trends. In particular, the

exclusion of certain items in calculating non-GAAP adjusted gross

profit, non-GAAP adjusted gross margin, non-GAAP operating expense,

and non-GAAP loss from operations can provide useful measures for

period-to-period comparisons of the Company’s core business. These

non-GAAP financial measures have limitations as analytical tools,

including the fact that such non-GAAP financial measures may not be

comparable to similarly titled measures presented by other

companies because other companies may calculate non-GAAP adjusted

gross profit, non-GAAP adjusted gross margin, non-GAAP operating

expense, and non-GAAP loss from operations differently than Akoya

does. For more information regarding these non-GAAP financial

measures, see the tables included at the end of this press

release.

Forward-Looking Statements

This press release contains forward-looking statements that are

based on management’s beliefs and assumptions and on information

currently available to management. All statements contained in this

release other than statements of historical fact are

forward-looking statements, including statements regarding our

expectations for full year 2024 revenue, our growth prospects, our

ability to lead the spatial biology market from discovery to

diagnostics, our ability to achieve operating cash flow breakeven

by year end or at all, and other statements regarding our business

strategies, use of capital, results of operations, financial

performance and plans and objectives for future operations.

In some cases, you can identify forward-looking statements by

the words “may,” “will,” “could,” “would,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“project,” “potential,” “continue,” “ongoing” or the negative of

these terms or other comparable terminology, although not all

forward-looking statements contain these words. These statements

involve risks, uncertainties and other factors that may cause

actual results, levels of activity, performance, or achievements to

be materially different from the information expressed or implied

by these forward-looking statements. These risks, uncertainties and

other factors are described under "Risk Factors," "Management's

Discussion and Analysis of Financial Condition and Results of

Operations" and elsewhere in the documents we file with the

Securities and Exchange Commission from time to time. We caution

you that forward-looking statements are based on a combination of

facts and factors currently known by us and our projections of the

future, about which we cannot be certain. As a result, the

forward-looking statements may not prove to be accurate. The

forward-looking statements in this press release represent our

views as of the date hereof. We undertake no obligation to update

any forward-looking statements for any reason, except as required

by law.

About Akoya Biosciences

As The Spatial Biology Company®, Akoya Biosciences’ mission is

to bring context to the world of biology and human health through

the power of spatial phenotyping. The Company offers comprehensive

single-cell imaging solutions that allow researchers to phenotype

cells with spatial context and visualize how they organize and

interact to influence disease progression and response to therapy.

Akoya offers a full continuum of spatial phenotyping solutions to

serve the diverse needs of researchers across discovery,

translational and clinical research: PhenoCode™ Panels and

PhenoCycler®, PhenoImager® Fusion and PhenoImager HT Instruments.

To learn more about Akoya, visit www.akoyabio.com.

Investor Contact:

Priyam Shahinvestors@akoyabio.com

Media Contact:

Christine Quernmedia@akoyabio.com

| |

|

AKOYA BIOSCIENCES, INC. AND

SUBSIDIARYCondensed Consolidated Balance

Sheets (unaudited)(in

thousands) |

|

|

|

|

|

|

|

|

|

|

| |

|

June 30, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

8,923 |

|

|

$ |

83,125 |

|

|

Marketable securities |

|

|

36,301 |

|

|

|

— |

|

|

Accounts receivable, net |

|

|

16,554 |

|

|

|

16,994 |

|

|

Inventories, net |

|

|

24,796 |

|

|

|

17,877 |

|

|

Prepaid expenses and other current assets |

|

|

2,938 |

|

|

|

3,794 |

|

| Total current assets |

|

|

89,512 |

|

|

|

121,790 |

|

| Property and equipment,

net |

|

|

8,164 |

|

|

|

10,729 |

|

| Marketable securities, net of

current portion |

|

|

3,496 |

|

|

|

— |

|

| Demo inventory, net |

|

|

666 |

|

|

|

893 |

|

| Intangible assets, net |

|

|

15,986 |

|

|

|

17,412 |

|

| Goodwill |

|

|

18,262 |

|

|

|

18,262 |

|

| Operating lease right of use

assets, net |

|

|

5,154 |

|

|

|

8,365 |

|

| Financing lease right of use

assets, net |

|

|

1,154 |

|

|

|

1,562 |

|

| Other non-current assets |

|

|

1,351 |

|

|

|

1,356 |

|

| Total assets |

|

$ |

143,745 |

|

|

$ |

180,369 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable, accrued expenses and other current

liabilities |

|

$ |

22,955 |

|

|

$ |

25,209 |

|

|

Current portion of operating lease liabilities |

|

|

2,680 |

|

|

|

2,681 |

|

|

Current portion of financing lease liabilities |

|

|

642 |

|

|

|

767 |

|

| Deferred revenue |

|

|

6,461 |

|

|

|

6,688 |

|

| Total current liabilities |

|

|

32,738 |

|

|

|

35,345 |

|

| Deferred revenue, net of

current portion |

|

|

3,170 |

|

|

|

3,193 |

|

| Long-term debt, net |

|

|

75,684 |

|

|

|

75,254 |

|

| Contingent consideration

liability, net of current portion |

|

|

4,097 |

|

|

|

5,765 |

|

| Operating lease liabilities,

net of current portion |

|

|

5,155 |

|

|

|

6,238 |

|

| Financing lease liabilities,

net of current portion |

|

|

537 |

|

|

|

766 |

|

| Other long-term

liabilities |

|

|

115 |

|

|

|

38 |

|

| Total liabilities |

|

|

121,496 |

|

|

|

126,599 |

|

| Total stockholders'

equity |

|

|

22,249 |

|

|

|

53,770 |

|

| Total liabilities and

stockholders' equity |

|

$ |

143,745 |

|

|

$ |

180,369 |

|

| |

|

|

|

|

|

|

|

|

| |

|

AKOYA BIOSCIENCES, INC. AND

SUBSIDIARYConsolidated Statements of

Operations (unaudited)(in

thousands, except share and per share amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Six months ended |

| |

|

June 30, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue |

|

$ |

15,926 |

|

|

$ |

17,147 |

|

|

$ |

28,066 |

|

|

$ |

32,671 |

|

|

Service and other revenue |

|

|

7,238 |

|

|

|

6,374 |

|

|

|

13,448 |

|

|

|

12,260 |

|

| Total revenue |

|

|

23,164 |

|

|

|

23,521 |

|

|

|

41,514 |

|

|

|

44,931 |

|

| Cost of goods sold: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product revenue |

|

|

6,467 |

|

|

|

7,788 |

|

|

|

13,190 |

|

|

|

13,539 |

|

|

Cost of service and other revenue |

|

|

3,311 |

|

|

|

3,617 |

|

|

|

6,559 |

|

|

|

6,983 |

|

| Total cost of goods sold |

|

|

9,778 |

|

|

|

11,405 |

|

|

|

19,749 |

|

|

|

20,522 |

|

| Gross profit |

|

|

13,386 |

|

|

|

12,116 |

|

|

|

21,765 |

|

|

|

24,409 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

19,094 |

|

|

|

23,905 |

|

|

|

38,957 |

|

|

|

47,030 |

|

|

Research and development |

|

|

5,288 |

|

|

|

6,923 |

|

|

|

10,842 |

|

|

|

13,300 |

|

|

Change in fair value of contingent consideration |

|

|

88 |

|

|

|

530 |

|

|

|

267 |

|

|

|

757 |

|

|

Impairment |

|

|

— |

|

|

|

— |

|

|

|

2,971 |

|

|

|

— |

|

|

Restructuring |

|

|

— |

|

|

|

— |

|

|

|

1,397 |

|

|

|

— |

|

|

Total operating expenses |

|

|

24,470 |

|

|

|

31,358 |

|

|

|

54,434 |

|

|

|

61,087 |

|

| Loss from operations |

|

|

(11,084 |

) |

|

|

(19,242 |

) |

|

|

(32,669 |

) |

|

|

(36,678 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(2,606 |

) |

|

|

(2,175 |

) |

|

|

(5,218 |

) |

|

|

(4,229 |

) |

|

Interest income |

|

|

668 |

|

|

|

737 |

|

|

|

1,605 |

|

|

|

1,502 |

|

|

Other expense, net |

|

|

(80 |

) |

|

|

(105 |

) |

|

|

(241 |

) |

|

|

(153 |

) |

| Loss before provision for

income taxes |

|

|

(13,102 |

) |

|

|

(20,785 |

) |

|

|

(36,523 |

) |

|

|

(39,558 |

) |

| Provision for income

taxes |

|

|

(47 |

) |

|

|

(18 |

) |

|

|

(110 |

) |

|

|

(47 |

) |

| Net loss |

|

$ |

(13,149 |

) |

|

$ |

(20,803 |

) |

|

$ |

(36,633 |

) |

|

$ |

(39,605 |

) |

| Net loss per share

attributable to common stockholders, basic and diluted |

|

$ |

(0.27 |

) |

|

$ |

(0.51 |

) |

|

$ |

(0.74 |

) |

|

$ |

(1.00 |

) |

| Weighted-average shares

outstanding, basic and diluted |

|

|

49,419,982 |

|

|

|

40,639,714 |

|

|

|

49,304,076 |

|

|

|

39,489,261 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

AKOYA BIOSCIENCES, INC. AND

SUBSIDIARYGross Profit to Non-GAAP Adjusted Gross

Profit Reconciliation and Calculation of Gross Margin and Non-GAAP

Adjusted Gross

Margin (unaudited)(in

thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Six months ended |

| |

|

June 30, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Total revenue |

|

$ |

23,164 |

|

|

$ |

23,521 |

|

|

$ |

41,514 |

|

|

$ |

44,931 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

13,386 |

|

|

|

12,116 |

|

|

|

21,765 |

|

|

|

24,409 |

|

| Provision for excess and

obsolete inventories - product discontinuation and lease exit

inventory charges |

|

|

— |

|

|

|

— |

|

|

|

2,045 |

|

|

|

— |

|

| Non-GAAP adjusted gross

profit |

|

$ |

13,386 |

|

|

$ |

12,116 |

|

|

$ |

23,810 |

|

|

$ |

24,409 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

58 |

% |

|

|

52 |

% |

|

|

52 |

% |

|

|

54 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP adjusted gross

margin |

|

|

58 |

% |

|

|

52 |

% |

|

|

57 |

% |

|

|

54 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

AKOYA BIOSCIENCES, INC. AND

SUBSIDIARYOperating Expense to Non-GAAP Operating

Expense

Reconciliation (unaudited)(in

thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Six months ended |

| |

|

June 30, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Operating expenses |

|

$ |

24,470 |

|

|

$ |

31,358 |

|

|

$ |

54,434 |

|

|

$ |

61,087 |

|

| Impairment |

|

|

— |

|

|

|

— |

|

|

|

(2,971 |

) |

|

|

— |

|

| Restructuring |

|

|

— |

|

|

|

— |

|

|

|

(1,397 |

) |

|

|

— |

|

| Non-GAAP operating

expenses |

|

$ |

24,470 |

|

|

$ |

31,358 |

|

|

$ |

50,066 |

|

|

$ |

61,087 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

AKOYA BIOSCIENCES, INC. AND SUBSIDIARYLoss

From Operations to Non-GAAP Loss From Operations

Reconciliation (unaudited)(in

thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Six months ended |

| |

|

June 30, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Loss from operations |

|

$ |

(11,084 |

) |

|

$ |

(19,242 |

) |

|

$ |

(32,669 |

) |

|

$ |

(36,678 |

) |

| Provision for excess and

obsolete inventories - product discontinuation and lease exit

inventory charges |

|

|

— |

|

|

|

— |

|

|

|

2,045 |

|

|

|

— |

|

| Impairment |

|

|

— |

|

|

|

— |

|

|

|

2,971 |

|

|

|

— |

|

| Restructuring |

|

|

— |

|

|

|

— |

|

|

|

1,397 |

|

|

|

— |

|

| Non-GAAP loss from

operations |

|

$ |

(11,084 |

) |

|

$ |

(19,242 |

) |

|

$ |

(26,256 |

) |

|

$ |

(36,678 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

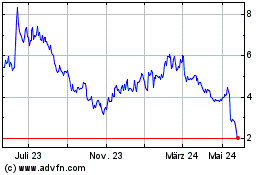

Akoya BioSciences (NASDAQ:AKYA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

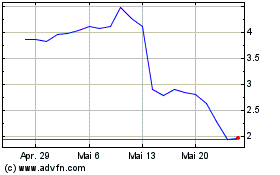

Akoya BioSciences (NASDAQ:AKYA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024