American Capital Reports Strong - Analyst Blog

27 Oktober 2011 - 5:00PM

Zacks

American Capital Agency

Corp. (AGNC), a real estate investment trust (REIT) that

focuses on investments in mortgage pass-through securities and

collateralized mortgage obligations (CMOs), reported earnings of

$1.39 per share during third quarter 2011, compared to $1.69 in the

year-earlier quarter. Excluding one-time items, recurring net

income for the reported quarter was $1.23 per share.

The company generated total

revenues of $326.8 million during third quarter 2011 compared to

$62.6 million in the year-ago quarter. Net interest income was

$231.7 million for the reported quarter, which was below the Zacks

Consensus Estimate of $259 million.

American Capital Agency recorded an

annualized return on equity of 20% for the quarter. As of September

30, 2011, the company’s investment portfolio comprised $42.0

billion worth of agency securities at fair value, including $38.3

billion of fixed-rate securities, $3.2 billion of adjustable-rate

securities and $0.5 billion of CMOs.

About 52% of the investment

portfolio comprises less than or equal to 15-year fixed-rate

securities, 37% of 30-year fixed-rate securities, 2% of 20-year

fixed-rate securities, 8% adjustable-rate securities, and 1% of

CMOs backed by fixed and adjustable-rate securities.

The investment portfolio of

American Capital Agency was financed with $38.8 billion of

repurchase agreements, $4.9 billion of equity capital and $0.1

billion of variable debt resulting in a leverage ratio of 7.9x.

Adjusting for the net payable for agency securities not yet

settled, the leverage ratio was 7.7x as of September 30, 2011.

American Capital Agency declared a

second quarter dividend of $1.40 per share, which equates to a

total of $936.7 million in dividends or $17.46 per share since its

initial public offering. American Capital Agency is one of only a

few companies to have increased its dividend even during the

recession.

American Capital Agency’s

annualized weighted average yield on average earning assets was

3.14% and its annualized average cost of funds was 1.00%, which

resulted in an annualized net interest rate spread of 2.14% during

the quarter – a 32-bps dip from the second quarter of 2011. As of

September 30, 2011, the company's book value per share was $26.90

compared to $26.76 as of June 30, 2011. At quarter-end, American

Capital Agency had cash and cash equivalents of $984.4 million.

American Capital Agency had earlier

initiated a ‘Controlled Equity Offering Program’ under which it

could offer from time to time up to an aggregate 15 million shares

in privately negotiated and/or at-the-market transactions.

During the reported quarter, the company sold 5.1 million shares at

an average price of $29.08 each for net proceeds of $147 million.

At quarter-end, 1.2 million shares remained available for issuance

under the program.

We maintain our ‘Neutral’

recommendation on American Capital Agency, which currently has a

Zacks #3 Rank translating into a short-term ‘Hold’ rating. However,

we have an ‘Underperform’ recommendation and a Zacks #5 Rank

(short-term ‘Strong Sell’) for Anworth Mortgage Asset

Corporation (ANH), a competitor of American Capital

Agency.

AMER CAP AGENCY (AGNC): Free Stock Analysis Report

ANWORTH MTGE (ANH): Free Stock Analysis Report

Zacks Investment Research

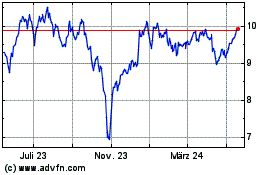

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024