SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the

Securities Exchange Act of 1934

(Amendment No.

)*

American Capital Agency Corp.

Common Stock, par value $0.01 per share

|

|

|

(Title of Class of Securities)

|

02503X 10 5

Samuel A. Flax

Executive Vice President, General Counsel,

Chief Compliance Officer and Secretary

American Capital Strategies, Ltd.

2 Bethesda Metro Center, 14

th

Floor

Bethesda, Maryland 20814

(301) 951-6122

|

|

|

(Name, address and telephone number of person authorized to receive notices and communications)

|

May 20, 2008

|

|

|

(Date of event which requires filing of this statement)

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the

subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-(g), check the following box.

¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for

other parties to whom copies are to be sent.

|

*

|

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information required on the

remainder of this cover page shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be

subject to all other provisions of the Act. (However, see the Notes.)

(CONTINUED ON FOLLOWING PAGES)

|

|

|

|

|

CUSIP No. 02503X 10 5

|

|

(PAGE 2 OF 7)

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

American Capital Strategies,

Ltd.

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP:

(a)

¨

(b)

¨

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

4

|

|

SOURCE OF FUNDS:

BK and WC

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e):

|

|

¨

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION:

Delaware

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

|

7 SOLE VOTING POWER:

5,000,100

|

|

|

8 SHARED VOTING POWER:

0

|

|

|

9 SOLE DISPOSITIVE POWER:

5,000,100

|

|

|

10 SHARED DISPOSITIVE POWER:

0

|

|

|

|

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON:

5,000,100

|

|

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS):

|

|

¨

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

33.3%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON:

CO

|

|

|

|

|

|

|

|

CUSIP No. 02503X 10 5

|

|

(PAGE 3 OF 7)

|

|

ITEM 1.

|

Security and Issuer

|

This statement on Schedule 13D

relates to the common stock, par value $0.01 per share (the “Common Stock”), of American Capital Agency Corp., a Delaware corporation (the “Issuer”). The principal executive offices of the Issuer are located at 2 Bethesda Metro

Center, 14th Floor, Bethesda, Maryland 20814.

|

ITEM 2.

|

Identity and Background

|

American Capital Strategies, Ltd.

(a)-(e) American Capital Strategies, Ltd., a Delaware corporation (“ACAS”), is a publicly-traded private equity fund and

alternative asset manager. ACAS’s principal executive offices are located at 2 Bethesda Metro Center, 14th Floor, Bethesda, Maryland 20814. During the last five years, ACAS (i) has not been convicted in any criminal proceeding and

(ii) has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding is or was subject to a judgment, decree or final order enjoining future violations of, or

prohibiting or mandating activities subject to, federal or state securities laws or finding any violations with respect to such laws.

Directors and

Executive Officers of American Capital Strategies, Ltd.

(a) The name of each director and executive officer of ACAS is listed on

Schedule A

to this Schedule 13D and is incorporated by reference herein.

(b) The business address of each director and executive

officer of ACAS is c/o American Capital Strategies, Ltd., 2 Bethesda Metro Center, 14th Floor, Bethesda, Maryland 20814.

(c) The present

principal occupation or employment of each director and executive officer of ACAS is listed on

Schedule A

to this Schedule 13D and is incorporated by reference herein.

(d)-(e) To the best knowledge of ACAS, during the last five years, none of the directors or executive officers of ACAS (a) has been convicted

in any criminal proceeding or (b) has been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding is or was subject to a judgment, decree or final order enjoining future

violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violations with respect to such laws.

(f) Each director and executive officer of ACAS is a citizen of the United States.

|

|

|

|

|

CUSIP No. 02503X 10 5

|

|

(PAGE 4 OF 7)

|

|

ITEM 3.

|

Source and Amount of Funds or Other Consideration

|

In order to purchase 5,000,000 shares of Common Stock for an aggregate purchase price of $100,000,000 on May 20, 2008, ACAS borrowed $90,000,000 under a $1.6 billion unsecured revolving line of credit administered by Wachovia Bank,

National Association and used $10,000,0000 of its working capital. ACAS used $1,000 of its working capital to purchase 100 shares of Common Stock in January 2008.

To the best knowledge of ACAS, this Item 3 is not applicable to any of the directors or executive officers of ACAS because none of them has purchased, or currently intends to purchase, any shares of Common Stock.

|

ITEM 4.

|

Purpose of Transaction

|

Pursuant to the terms a

Stock Purchase Agreement, dated as of May 14, 2008 (the “Stock Purchase Agreement”), between the Issuer and ACAS, ACAS agreed to purchase 5,000,000 shares of Common Stock at $20.00 per share, subject to and concurrently with the

completion of the Issuer’s initial public offering of the Common Stock (the “IPO”). On May 20, 2008, the Issuer sold (i) 10,000,000 shares of Common Stock at $20.00 per share in the IPO, and (ii) 5,000,000 shares of

Common Stock at $20.00 per share to ACAS. ACAS acquired these 5,000,000 shares of Common Stock with an investment intent and not with a view to distribute these shares.

On May 20, 2008, the Issuer and ACAS also entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with respect to the shares of Common Stock owned by ACAS upon completion of

the IPO. Pursuant to the Registration Rights Agreement, the Issuer granted ACAS (i) unlimited demand registration rights to have these shares registered for resale and (ii) the right to “piggy-back” these shares in registration

statements that the Issuer might file in connection with any future public offering so long as the Issuer retains American Capital Agency Management, LLC as its manager pursuant to the Management Agreement (as described below). With respect to

2,500,000 of the 5,000,000 shares of Common Stock purchased by ACAS on May 20, 2008, the foregoing registration rights only apply beginning on May 20, 2011.

|

|

|

|

|

CUSIP No. 02503X 10 5

|

|

(PAGE 5 OF 7)

|

The Issuer and American Capital Agency Management, LLC, a wholly-owned subsidiary of a

wholly-owned portfolio company of ACAS (the “Manager”) entered into the Management Agreement on May 20, 2008 (the “Management Agreement”), pursuant to which the Manager manages the business and operations of the Issuer in

exchange for a monthly base management fee and the reimbursement of certain expenses. The Management Agreement has an initial term expiring on May 20, 2011. The Management Agreement is automatically renewable for one-year terms after its

initial term unless terminated by either the Issuer or the Manager. Because neither the Issuer nor the Manager have any employees or separate facilities, on May 20, 2008, the Manager and ACAS entered into an Administrative Services Agreement

(the “Administrative Services Agreement”) pursuant to which (i) ACAS provides the Manager with the personnel, services and resources necessary for the Manager to perform its obligations and responsibilities under the Management

Agreement, (ii) certain members of ACAS’s senior management and its Residential Mortgage-Backed Securities Investment Team serve as officers of the Manager and the Issuer, and (iii) ACAS is required to provide the Manager with the

services of ACAS employees such that the Manager may provide the Issuer with a chief executive officer, chief financial officer and chief investment officer pursuant to the terms of the Management Agreement. Reference is made to

Schedule A

to

this Schedule 13D for the name of each executive officer of ACAS who serves as an executive officer of the Issuer. If either the Issuer or the Manager elects to terminate the Management Agreement pursuant to its terms, the Administrative Services

Agreement would likewise be terminated. Neither the Issuer nor the Manager may terminate the Administrative Services Agreement unless the Management Agreement has been terminated pursuant to its terms. Pursuant to the Administrative Services

Agreement, ACAS may assign its rights and obligations thereunder to any of its affiliates, including American Capital, LLC, the parent company of the Manager.

Other than as described above, ACAS does not have any plans or proposals which relate to or would result in: (i) the acquisition by any person of additional securities of the Issuer, or the disposition of

securities of the Issuer; (ii) an extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries; (iii) a sale or transfer of a material amount of assets of the Issuer

or any of its subsidiaries; (iv) any change in the present board of directors or management of the Issuer, including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the board; (v) any

material change in the present capitalization or dividend policy of the Issuer; (vi) any other material change in the Issuer’s business or corporate structure; (vii) changes in the Issuer’s charter, by-laws or other instruments

corresponding thereto or other actions which may impede the acquisition of control of the Issuer by any person; (viii) causing a class of securities of the Issuer to be delisted from a national securities exchange or to cease to be authorized

to be quoted in an inter-dealer quotation system of a registered national securities association; (ix) a class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Act; or

(x) any action similar to any of those enumerated above.

|

|

|

|

|

CUSIP No. 02503X 10 5

|

|

(PAGE 6 OF 7)

|

|

ITEM 5.

|

Interest in Securities of the Issuer

|

(a)-(b) As of May 20, 2008 and the date hereof, ACAS held 5,000,100 shares of Common Stock, which represents 33.3% of the number of outstanding shares of Common Stock outstanding on May 20, 2008 and the date hereof. ACAS has

the sole power to vote, and to dispose of, all such shares of Common Stock.

(c) During the sixty (60) days preceding May 20,

2008 and the date hereof, ACAS did not purchase or otherwise acquire any shares of Common Stock other than the 5,000,000 shares of Common Stock it acquired pursuant to the Stock Purchase Agreement.

(d) No person other than ACAS is known to have the right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of,

such shares of the Common Stock.

(e) Not applicable.

To the best knowledge of ACAS, this Item 5 is not applicable to any of the directors or executive officers of ACAS.

|

ITEM 6.

|

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer

|

There are no contracts, arrangements, understandings or relationships among ACAS and any of the directors or executive officers of ACAS, or between any of

such persons and any other person, with respect to any securities of the Issuer other than the Stock Purchase Agreement and the Registration Rights Agreement, each of which is described in Item 4 of this Schedule 13D.

|

ITEM 7.

|

Material to Be Filed as Exhibits

|

|

99.1

|

Stock Purchase Agreement, dated as of May 14, 2008, between the Issuer and ACAS

|

|

99.2

|

Registration Rights Agreement, dated as of May 20, 2008, between the Issuer and ACAS

|

|

99.3

|

Management Agreement, dated as of May 20, 2008, between the Issuer and the Manager

|

|

|

|

|

|

CUSIP No. 02503X 10 5

|

|

(PAGE 7 OF 7)

|

SIGNATURES

After reasonable inquiry and to the best of the undersigned’s knowledge and belief, the undersigned certifies that the information set forth in this Statement is true, complete and correct.

Dated: May 29, 2008

|

|

|

|

|

AMERICAN CAPITAL STRATEGIES, LTD.

|

|

|

|

|

By:

|

|

/s/ Samuel A. Flax

|

|

Name:

|

|

Samuel A. Flax

|

|

Title:

|

|

Executive Vice President, General Counsel,

Chief

Compliance Officer and Secretary

|

Schedule A

Directors and Executive Officers of ACAS

|

|

|

|

|

ACAS Directors

|

|

Principal Occupation

|

|

|

|

|

Malon Wilkus

|

|

President, Chief Executive Officer and Chairman of the Board of Directors American Capital Strategies, Ltd.* **

|

|

|

|

|

Mary C. Baskin

|

|

Managing Director Ansley Consulting Group

|

|

|

|

|

Neil M. Hahl

|

|

General Business Consultant

|

|

|

|

|

Philip R. Harper

|

|

Chairman US Investigations Services, Inc.

|

|

|

|

|

John A. Koskinen

|

|

President United States Soccer Foundation

|

|

|

|

|

Stan Lundine

|

|

Of Counsel, Sotir and Goldman and Executive Director, Chautauqua County Health Network

|

|

|

|

|

Kenneth D. Peterson, Jr.

|

|

Chief Executive Officer Columbia Ventures Corporation

|

|

|

|

|

Alvin N. Puryear

|

|

Management Consultant*

|

|

|

|

|

Executive Officers

|

|

Principal Occupation

|

|

|

|

|

Malon Wilkus

|

|

President, Chief Executive Officer and Chairman of the Board of Directors American Capital Strategies, Ltd.* **

|

|

|

|

|

John R. Erickson

|

|

Executive Vice President and Chief Financial Officer American Capital Strategies, Ltd.**

|

|

|

|

|

Ira J. Wagner

|

|

Executive Vice President and Chief Operating Officer American Capital Strategies, Ltd.**

|

|

|

|

|

Samuel A. Flax

|

|

Executive Vice President, General Counsel, Chief Compliance Officer and Secretary American Capital Strategies, Ltd.**

|

|

|

|

|

Roland H. Cline

|

|

Senior Vice President and Managing Director

American

Capital Strategies, Ltd.

|

|

|

|

|

Brian S. Graff

|

|

Senior Vice President and Regional Managing Director

American Capital Strategies, Ltd.

|

|

|

|

|

Gordon J. O’Brien

|

|

Senior Vice President and Managing Director

American

Capital Strategies, Ltd.

|

|

|

|

|

Darin R. Winn

|

|

Senior Vice President and Regional Managing Director American Capital Strategies, Ltd.

|

|

*

|

Also serves as a director of the Issuer.

|

|

**

|

Also serves as an executive officer of the Issuer.

|

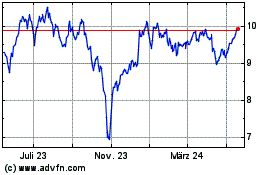

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024