false

0001173313

0001173313

2024-05-15

2024-05-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 15, 2024

ABVC BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40700 |

|

26-0014658 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

44370 Old Warm Springs Blvd.

Fremont, CA |

|

94538 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number including area

code: (510) 668-0881

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

ABVC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into Material Definitive Agreements

On May 14, 2024, the Company

entered into a definitive agreement with OncoX BioPharma, Inc., a private company registered in the British Virgin Islands (“Oncox”),

pursuant to which the Company will grant Oncox an exclusive right to develop and commercialize ABVC’s BLEX 404 single-herb botanical

drug extract from the dry fruit body of Maitake Mushroom (Grifola Frondosa) for treatment of Tripple Negative Breast Cancer (the “Licensed

Products”), within a certain territory, specified as 50% of the Worldwide Markets for 20 years (the “Oncox Agreement”).

In consideration thereof, Oncox shall pay ABVC a total of $6,250,000 (or 1,250,000 Oncox shares valued at $5 per share1) 30

days after entering into the Oncox Agreement, with an additional milestone payment of $625,000 in cash after OncoX’s next round

of fundraising, of which there can be no guarantee. Oncox may remit cash payments of at least $100,000 towards the licensing fees and

deductible from the second milestone payment; ABVC is also entitled to royalties of 5% of Net Sales, as defined in the Oncox Agreement,

from the first commercial sale of the Licensed Product in the noted territory, which remains uncertain. The Company will permit Oncox

to pay the license fee in installments or in a lump sum and will allow Oncox to use its revenue to fund such payments. Oncox entered into

the same agreement with ABVC’s affiliate, Biolite, Inc.

The

foregoing description of the agreements is not complete and is qualified in its entirety by reference to the full text of the agreements,

copies of which are attached as Exhibit 10.1 and Exhibit 10.2 to this Current Report on Form 8-K and incorporated herein by reference.

Neither this Current Report

on Form 8-K, nor any exhibit attached hereto, is an offer to sell or the solicitation of an offer to buy the Securities described herein.

Such disclosure does not constitute an offer to sell, or the solicitation of an offer to buy nor shall there be any sales of the Company’s

securities in any state in which such an offer, solicitation or sale would be unlawful. The securities mentioned herein have not been

registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements under the Securities Act and applicable state securities laws.

Item 9.01 Financial Statement and Exhibits

(d) Exhibits

| 1 | Price

was determined through private negotiations between the parties; no third party valuation was completed. |

SIGNATURE

Pursuant to the requirements

of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ABVC BioPharma, Inc. |

| |

|

|

| May 15, 2024 |

By: |

/s/ Uttam Patil |

| |

|

Uttam Patil |

| |

|

Chief Executive Officer |

2

Exhibit 10.1

Definitive Licensing Agreement

This Definitive Licensing Agreement (“Agreement”) is entered

into this May 14, 2024 (the “Effective Date”) by and between:

(1) ABVC BioPharma, Inc.,

a company registered in Nevada. (“ABVC”); and

(2) OncoX

BioPharma, Inc. (“ONCOX”), a company registered in the British Virgin Islands.; and ABVC and ONCOX shall be referred to

individually as a “Party” and collectively as the “Parties”.

WHEREAS, the parties have agreed to the Key Terms (see Exhibit A) as

outlined in the Term Sheet, and now formalize their understanding in this Definitive Agreement.

NOW, THEREFORE, in consideration of the mutual covenants contained

herein, the parties agree as follows:

1. Upon signing

this Definitive Agreement, ONCOX shall have the exclusive right, until

the expiration of this agreement, to negotiate and execute a definitive licensing agreement for the licensed products with ABVC.

2. ONCOX

has the right to team with partner(s) or transfer the right to a third party

to negotiate and execute a definitive licensing agreement for the licensed products with ABVC.

3. ONCOX

has satisfactorily completed a due diligence investigation of the Licensed Product.

4. ABVC and

its Representatives shall deal exclusively with ONCOX with respect to

any licensing in the same scope or similar arrangement surrounding the Licensed Product.

IN WITNESS WHEREOF, the parties hereto have executed this Definitive

Agreement as of the Effective Date.

[Signature Page]

| ABVC BioPharma, Inc. |

|

OncoX BioPharma, Inc. |

| |

|

|

|

|

| Authorized Signature/Seal |

|

Authorized Signature/Seal |

| |

|

|

|

|

| |

|

|

| Name: |

Uttam Yashwant Patil |

|

Name: |

Yen Wen Pin |

| Title: |

CEO |

|

Title: |

CEO |

Exhibit A

| LICENSEE |

OncoX BioPharma, Inc. (“ONCOX”) |

| LICENSOR |

ABVC BioPharma, Inc. (“ABVC”) and its affiliates |

| THIRD PARTY |

“Third Party” means a person or entity other than ONCOX or ABVC or their respective affiliates. |

| EFFECTIVE DATE |

The effective dates of Definitive Agreement related to the Licensed Product that would be the result of Parties’ discussions |

|

LICENSED PRODUCT

|

ABVC’s BLEX 404, single-herb botanical drug extract from the dry fruit body of Maitake Mushroom (Grifola Frondosa) for treatment of Tripple Negative Breast Cancer |

| TERRITORY |

50% of the Worldwide Markets |

| GOVERNING LAW |

Laws of the United States |

| FIELD OF USE |

Tripple Negative Breast Cancer |

|

RIGHTS GRANTED

|

ABVC shall grant to ONCOX an exclusive right within the Territory license to develop and commercialize the Licensed Product in the Territory within the Field of Use. |

|

RESPONSIBILITIES & OBLIGATIONS

|

ABVC

will be responsible for conducting the clinical development of the Licensed Product outside Territory and communicating the results as

part of the Product Transfer (PT), which includes delivering the Licensed Product sufficient to support the clinical studies in Territory,

delivering associated documents, manufacturing protocols, QC protocols, to enable ONCOX to

develop and commercialize the Licensed Product in Territory.

ABVC

will be responsible to secure the supply of the Licensed Product to ONCOX in

the Territory with an agreed price and quantity while A will secure the purchase of the Licensed Products from ABVC in the Territory with

committed volume.

ONCOX shall

be responsible for completing regulatory filing of IND in the Territory.

ABVC

will be responsible for providing the Licensed Product to ONCOX at cost,

to support clinical development in the Field of Use in the Territory.

ONCOX will

be responsible for further development and commercialization of the Licensed Product in the Field of Use in the Territory, including any

clinical development, regulatory affairs (including regulatory filings and approvals), and commercialization of the Licensed Product.

As

part of this license, ONCOX will grant ABVC a perpetual, royalty-free

right to use and reference any development, regulatory, and market data associated with the Licensed Product in ONCOX’s

control. |

|

EXCLUSIVITY/

NON-COMPETE |

During the collaboration, neither Parties nor its affiliates will work on the development of or commercialize in the Territory any products containing Maitake Mushroom as the sole active ingredient or in combination with one or more other active ingredients other than with respect to any other product or usage for which the same parties have previously agreed or will agree to work on together or without a specific mutually agreed to written plan for depression indication. |

| TECHNOLOGY SHARING |

After the Effective Date, and at a time to be agreed upon by ONCOX and ABVC in the Definitive Agreement, ABVC would transfer to ONCOX in English that data related to any Licensed Products in ABVC’s possession and control that is required by regulatory authorities for opening an IND, NDA. |

|

INTELLECTUAL PROPERTY RIGHTS

|

Intellectual

Property means any patent, copyright, trade secret, trademark or other proprietary right; including

all their applications , registrations, renewals and extensions.

Each Party or its Affiliates owns all rights, title and interest of

the Intellectual Property developed or controlled by itself and will be responsible for filing and maintaining the Intellectual Property

in the Territory at its own cost.

Each Party warrants it does not and will not infringe, violate or misappropriate

any trademark, patent, copyright, industrial design, trade secret or any other intellectual property or proprietary right of any Third

Party.

No right, title or interest is granted to the other Party in the Definitive

Agreement, whether expressly or by implication, to any technology or Intellectual Property rights owned by a Party other than pursuant

to the terms of the Definitive Agreement.

Each Party will retain an unconditional and

unlimited right of access, inclusion, citation, electronic or photo copy, and regulatory cross reference, without limitation, to any

and all regulatory, technical, and scientific documentations, and any and all communications with any and all regulatory authorities

in the other Party’s Territory for all matters related to each Licensed Product during the License Term. |

| MILESTONE & ROYALTY PAYMENTS |

See Exhibit B. |

|

TAX

|

Payments to Licensor as detailed in Exhibit B are likely considered Licensor’s income generated in Territory. Licensor is responsible for income tax, value-added tax, and other related fees levied by Territory government authorities on these payments. If and to the extent that provision is made in law or regulation of Territory for withholding of taxes with respect to any such payment, Licensee shall pay such taxes on behalf of Licensor and provide Licensor with original receipt of such tax payments or withholding. |

| NET SALES |

“Net Sales” means the total amount of

invoices issued by the Licensee for selling the Product of each pack size in the Territory to the Third Parties responsible for distribution

/ logistics, minus the amount of allowable deduction items related to the Product actually provided to non-affiliates as follows:

a) sales

value added tax

b) allowance,

discount or rebate for rejection, defect, recall, return, retroactive price reduction

Net Sales shall be accounted in accordance with

arm-length principles, industry standards and practices of the Territory, covering all sales of the Product to the Field of Use in the

Territory. Any allowance, discount or rebate for any Third Party sales and marketing activities shall not be deducted from the Net Sales

calculation.

Licensee shall allow Licensor to appoint

a Third Party independent auditor to audit the financial accounts of Licensee or its affiliates to confirm the reasonableness and accuracy

of the Net Sales calculation of the Product each year during the License Term. |

| LICENSE TERMS |

The term of licensing for the Licensed Product in the Territory is 20 years. |

|

MANUFACTURING

|

Both Parties desire Licensee is responsible for

the Licensed Product API manufacturing under CMO model as global primary supplier. Both Parties agree further study and analysis are to

be performed for the feasibility from technical and financial perspective before the execution of related manufacturing agreement.

Manufacturing of Licensed Product finished product

is subject to negotiation by both Parties. |

Exhibit B

All payments below are pre-tax total payments in

USD.

| Milestones |

Timeline |

Payment to ABVC |

| Upfront |

Due 30 days after the signature of the Investment Agreement |

$6,250,000

(or 1,250,000 shares of ONCOX at $5/share) |

| A cash payment of $100,000 and above at any time will then be deducted from the second milestone payment. |

|

Completion

Of

Fundraising |

Due 30 days upon completion of next round fundraising |

US $625,000 |

| Total Licensing Fee |

$6,875,000 |

| Royalties |

5% of annual Net Sales, accumulated

to a total of US$6,250,000 |

Royalties shall be payable quarterly on annual

Net Sales of the Licensed Product from the first commercial sale of a Licensed Product in the Territory to the end of License Terms.

6

Exhibit 10.2

Definitive Licensing Agreement

This Definitive Licensing Agreement (“Agreement”) is entered

into this May 14, 2024 (the “Effective Date”) by and between:

(1) BIOLITE, INC., a company

registered in Taiwan. (“BIOLITE”); and

(2) OncoX

BioPharma, Inc. (“ONCOX”), a company registered in the British Virgin Islands.; and BIOLITE and ONCOX shall be referred to

individually as a “Party” and collectively as the “Parties”.

WHEREAS, the parties have agreed to the Key Terms (see Exhibit A) as

outlined in the Term Sheet, and now formalize their understanding in this Definitive Agreement.

NOW, THEREFORE, in consideration of the mutual covenants contained

herein, the parties agree as follows:

1. Upon signing

this Definitive Agreement, ONCOX shall have the exclusive right, until

the expiration of this agreement, to negotiate and execute a definitive licensing agreement for the licensed products with BIOLITE.

2. ONCOX

has the right to team with partner(s) or transfer the right to a third party

to negotiate and execute a definitive licensing agreement for the licensed products with BIOLITE.

3. ONCOX

has satisfactorily completed a due diligence investigation of the Licensed Product.

4. BIOLITE

and its Representatives shall deal exclusively with ONCOX with respect

to any licensing in the same scope or similar arrangement surrounding the Licensed Product.

IN WITNESS WHEREOF, the parties hereto have executed this Definitive

Agreement as of the Effective Date.

[Signature Page]

| BIOLITE, INC. |

|

OncoX BioPharma, Inc. |

| |

|

|

|

|

| Authorized Signature/Seal |

|

Authorized Signature/Seal |

| |

|

|

|

|

| |

|

|

| Name: |

Tsung Shann Jiang |

|

Name: |

Yen Wen Pin |

| Title: |

Chairman |

|

Title: |

CEO |

Exhibit A

| LICENSEE |

OncoX BioPharma, Inc. (“ONCOX”) |

| LICENSOR |

BIOLITE, INC. (“BIOLITE”) and its affiliates |

| THIRD PARTY |

“Third Party” means a person or entity other than ONCOX or BIOLITE or their respective affiliates. |

| EFFECTIVE DATE |

The effective dates of Definitive Agreement related to the Licensed Product that would be the result of Parties’ discussions |

|

LICENSED PRODUCT

|

BIOLITE’s BLEX 404, single-herb botanical drug extract from the dry fruit body of Maitake Mushroom (Grifola Frondosa) for treatment of Tripple Negative Breast Cancer |

| TERRITORY |

50% of the Worldwide Markets |

| GOVERNING LAW |

Laws of the United States |

| FIELD OF USE |

Tripple Negative Breast Cancer |

|

RIGHTS GRANTED

|

BIOLITE shall grant to ONCOX an exclusive right within the Territory license to develop and commercialize the Licensed Product in the Territory within the Field of Use. |

|

RESPONSIBILITIES & OBLIGATIONS |

BIOLITE

will be responsible for conducting the clinical development of the Licensed Product outside Territory and communicating the results as

part of the Product Transfer (PT), which includes delivering the Licensed Product sufficient to support the clinical studies in Territory,

delivering associated documents, manufacturing protocols, QC protocols, to enable ONCOX to

develop and commercialize the Licensed Product in Territory.

BIOLITE

will be responsible to secure the supply of the Licensed Product to ONCOX in

the Territory with an agreed price and quantity while A will secure the purchase of the Licensed Products from BIOLITE in the Territory

with committed volume.

ONCOX shall

be responsible for completing regulatory filing of IND in the Territory.

BIOLITE

will be responsible for providing the Licensed Product to ONCOX at cost,

to support clinical development in the Field of Use in the Territory.

ONCOX will

be responsible for further development and commercialization of the Licensed Product in the Field of Use in the Territory, including any

clinical development, regulatory affairs (including regulatory filings and approvals), and commercialization of the Licensed Product.

As

part of this license, ONCOX will grant BIOLITE a perpetual, royalty-free

right to use and reference any development, regulatory, and market data associated with the Licensed Product in ONCOX’s

control. |

|

EXCLUSIVITY/

NON-COMPETE |

During the collaboration, neither Parties nor its affiliates will work on the development of or commercialize in the Territory any products containing Maitake Mushroom as the sole active ingredient or in combination with one or more other active ingredients other than with respect to any other product or usage for which the same parties have previously agreed or will agree to work on together or without a specific mutually agreed to written plan for depression indication. |

| TECHNOLOGY SHARING |

After the Effective Date, and at a time to be agreed upon by ONCOX and BIOLITE in the Definitive Agreement, BIOLITE would transfer to ONCOX in English that data related to any Licensed Products in BIOLITE’s possession and control that is required by regulatory authorities for opening an IND, NDA. |

|

INTELLECTUAL PROPERTY RIGHTS

|

Intellectual

Property means any patent, copyright, trade secret, trademark or other proprietary right;including

all their applications , registrations, renewals and extensions.

Each Party or its Affiliates owns all rights, title and interest of

the Intellectual Property developed or controlled by itself and will be responsible for filing and maintaining the Intellectual Property

in the Territory at its own cost.

Each Party warrants it does not and will not infringe, violate or misappropriate

any trademark, patent, copyright, industrial design, trade secret or any other intellectual property or proprietary right of any Third

Party.

No right, title or interest is granted to the other Party in the Definitive

Agreement, whether expressly or by implication, to any technology or Intellectual Property rights owned by a Party other than pursuant

to the terms of the Definitive Agreement.

Each Party will retain an unconditional and unlimited right of access,

inclusion, citation, electronic or photo copy, and regulatory cross reference, without limitation, to any and all regulatory, technical,

and scientific documentations, and any and all communications with any and all regulatory authorities in the other Party’s Territory

for all matters related to each Licensed Product during the License Term.

|

| MILESTONE & ROYALTY PAYMENTS |

See Exhibit B. |

|

TAX

|

Payments to Licensor as detailed in Exhibit B are likely considered Licensor’s income generated in Territory. Licensor is responsible for income tax, value-added tax, and other related fees levied by Territory government authorities on these payments. If and to the extent that provision is made in law or regulation of Territory for withholding of taxes with respect to any such payment, Licensee shall pay such taxes on behalf of Licensor and provide Licensor with original receipt of such tax payments or withholding. |

| NET SALES |

“Net Sales” means the total amount of

invoices issued by the Licensee for selling the Product of each pack size in the Territory to the Third Parties responsible for distribution

/ logistics, minus the amount of allowable deduction items related to the Product actually provided to non-affiliates as follows:

a) sales

value added tax

b) allowance,

discount or rebate for rejection, defect, recall, return, retroactive price reduction

Net Sales shall be accounted in accordance with

arm-length principles, industry standards and practices of the Territory, covering all sales of the Product to the Field of Use in the

Territory. Any allowance, discount or rebate for any Third Party sales and marketing activities shall not be deducted from the Net Sales

calculation.

Licensee shall allow Licensor to appoint a Third

Party independent auditor to audit the financial accounts of Licensee or its affiliates to confirm the reasonableness and accuracy of

the Net Sales calculation of the Product each year during the License Term.

|

| LICENSE TERMS |

The term of licensing for the Licensed Product in the Territory is 20 years. |

|

MANUFACTURING

|

Both Parties desire Licensee is responsible for

the Licensed Product API manufacturing under CMO model as global primary supplier. Both Parties agree further study and analysis are to

be performed for the feasibility from technical and financial perspective before the execution of related manufacturing agreement.

Manufacturing of Licensed Product finished product

is subject to negotiation by both Parties. |

Exhibit B

All payments below are pre-tax total payments in

USD.

| Milestones |

Timeline |

Payment to BIOLITE |

| Upfront |

Due 30 days after the signature of the Investment Agreement |

$6,250,000

(or 1,250,000 shares of ONCOX at $5/share) |

| A cash payment of $100,000 and above at any time will then be deducted from the second milestone payment. |

|

Completion

Of

Fundraising |

Due 30 days upon completion of next round fundraising |

US $625,000 |

| Total Licensing Fee |

$6,875,000 |

| Royalties |

5% of annual Net Sales, accumulated to a total of US$6,250,000 |

Royalties shall be payable quarterly on annual

Net Sales of the Licensed Product from the first commercial sale of a Licensed Product in the Territory to the end of License Terms.

6

Exhibit 99.1

Promising Combination Therapy

for Tripple Negative Breast Cancer Treatment: A Milestone Collaboration Between ABVC and OncoX, Potential Income of $13.75M and Royalties

of up to $12.50M

Fremont, CA (May 16, 2024) – ABVC

BioPharma, Inc. (NASDAQ: ABVC) (“Company”), a clinical-stage biopharmaceutical company developing therapeutic solutions

in ophthalmology, CNS (central nervous systems), and Oncology/Hematology, announced today that in its fight against breast cancer, the

Company, together with its subsidiary BioLite, Inc. entered into a definitive agreement with OncoX BioPharma, Inc., a private company

registered in the British Virgin Islands, to collaborate on combination therapy it believes will help treat Triple Negative Breast Cancer

and improve patient outcomes. The agreement establishes an aggregate license fee of $12,500,000 in the form of cash or shares of OncoX

securities within 30 days of executing the agreement, with an additional milestone payment of $1,250,000 in cash after OncoX’s

next round of fundraising, of which there can be no guarantee. OncoX may remit partial cash payments of at least $ 100,000 to the licensing

fees, which would be deductible from the second milestone payment, and royalties of 5% of net sales, up to $12,500,000, after the launch

of the licensed product, which remains uncertain. There is no guarantee that ABVC or its subsidiary will receive any of the fees listed.

The United States Food & Drug Administration

(US FDA) has approved four INDs: ABV-1501 (IND 129575) for Triple Negative Breast Cancer (TNBC), ABV-1519 (IND 161602) for Non-Small Cell

Lung Cancer (NSCLC), ABV-1702 (IND 131300) for Myelodysplastic Syndrome (MDS), and ABV-1703 (IND 136309) for Pancreatic Cancer Therapy.

The Investigational New Drug (IND) application for ABV-1703 proposed the clinical investigation of BLEX 404 as a Combination Therapy Drug

with Chemotherapy. The active ingredient of BLEX 404 is the β-glucan extracted from Grifola frondosa (maitake mushrooms),

an edible fungus with high medical and commercial values in Asia; it contains various bioactive constituents such as polysaccharides,

pyrrole alkaloids, ergosterol, etc., and has been widely served as a functional food for a long time in daily life.1

TNBC is a subtype of breast cancer that lacks

estrogen, progesterone, and HER2 receptors. Unmet demands in TNBC typically refer to areas where current treatments or approaches fall

short in addressing the needs of patients.2 While some TNBC patients benefit from immunotherapy, many do not; it’s important

to understand better which patients are most likely to respond to immunotherapy and develop strategies to enhance its efficacy.3

Maitake mushrooms are rich in bioactive polysaccharides, especially D-fraction, which is the key ingredient of BLEX 404, the combination

drug proposed in the contract. These protein polysaccharides have well-documented immune-protecting and antitumor properties.4

| 1 | https://www.sciencedirect.com/science/article/abs/pii/S0960852407001083?via%3Dihub |

| 2 | https://pubmed.ncbi.nlm.nih.gov/21161370/ |

| 3 | https://molecular-cancer.biomedcentral.com/articles/10.1186/s12943-023-01850-7#:~:text=Main%20body,and%20formulate%20individualized%20immunotherapy%20schedules. |

“This partnership represents a concerted

effort to address the urgent need for more effective treatments for TNBC, a particularly aggressive form of breast cancer that lacks targeted

treatment options. TNBC accounts for a substantial proportion of breast cancer cases worldwide, posing significant challenges due to its

resistance to conventional hormonal therapies and targeted treatments5,” said Dr. Uttam Patil, ABVC’s Chief Executive

Officer. He added, “In response to this critical unmet medical need, ABVC and OncoX have joined forces to explore a novel therapeutic

approach that holds promise for improving outcomes and quality of life for TNBC patients. The proposed combination therapy draws upon

companies’ complementary expertise and innovative research. By leveraging their drug development and oncology strengths, both companies

aim to create a synergistic treatment regimen targeting multiple pathways involved in TNBC progression.”

“We are excited to embark on this collaborative

journey with ABVC to advance the field of oncology and bring hope to patients battling TNBC,” said Wen-Pin Yen, CEO of OncoX. “This

partnership underscores our shared commitment to harnessing the power of combination therapies to address the complexities of TNBC and

improve patient outcomes. The agreement encompasses a comprehensive research and development program, including preclinical studies, clinical

trials, and regulatory initiatives. Both companies will contribute their resources, expertise, and intellectual property to accelerate

the development timeline and maximize the therapeutic potential of the combined approach.”

Under the terms of the agreement, ABVC grants

OncoX exclusive rights to develop, manufacture, and commercialize BLEX 404, a promising therapeutic agent for treating Tripple Negative

Breast Cancer within a specified territory.

Management

believes the Company’s product pipeline has excellent market potential. The global cancer therapeutics market is expected to be worth

around US$393.61 billion by 2032, up from US$164 billion in 2022, growing at a CAGR of 9.20% from 2023 to 2032.6

The global TNBC market’s expected CAGR is around 5.50% in the mentioned forecast period and it was valued at USD 953.8 million in 2022

and would grow to USD 1,463.82 million by 2030.7

For more information about ABVC and its subsidiaries,

stay updated on the latest updates or visit https://abvcpharma.com. ABVC urges its shareholders to sign up on the Company’s website

for the latest news alerts; visit https://abvcpharma.com/?page_id=17707

About ABVC BioPharma & Its Industry

ABVC BioPharma is a clinical-stage biopharmaceutical

company with an active pipeline of six drugs and one medical device (ABV-1701/Vitargus®) under development. For its drug

products, the Company utilizes in-licensed technology from its network of world-renowned research institutions to conduct proof-of-concept

trials through Phase II of clinical development. The Company’s network of research institutions includes Stanford University, the University

of California at San Francisco, and Cedars-Sinai Medical Center. For Vitargus®, the Company intends to conduct global clinical

trials through Phase III.

| 4 | https://www.webmd.com/diet/maitake-mushroom-health-benefits |

| 5 | https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5352107/ |

| 6 | https://www.precedenceresearch.com/cancer-therapeutics-market |

| 7 | https://www.databridgemarketresearch.com/reports/global-triple-negative-breast-cancer-market |

Forward-Looking Statements

This press release contains “forward-looking

statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,”

“expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,”

“hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based

on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control,

and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such

forward-looking statements. None of the outcomes expressed herein are guaranteed. Such risks and uncertainties include, without limitation,

risks and uncertainties associated with (i) our inability to manufacture our product candidates on a commercial scale on our own, or in

collaboration with third parties; (ii) difficulties in obtaining financing on commercially reasonable terms; (iii) changes in the size

and nature of our competition; (iv) loss of one or more key executives or scientists; and (v) difficulties in securing regulatory approval

to proceed to the next level of the clinical trials or to market our product candidates. More detailed information about the Company and

the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the Securities

and Exchange Commission (SEC), including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors are

urged to read these documents free of charge on the SEC’s website at http://www.sec.gov. The Company assumes no obligation to publicly

update or revise its forward-looking statements as a result of new information, future events or otherwise.

This press release does not constitute an offer

to sell, or the solicitation of an offer to buy any of the Company’s securities, nor shall such securities be offered or sold in the United

States absent registration or an applicable exemption from registration, nor shall there be any offer, solicitation or sale of any of

the Company’s securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such state or jurisdiction.

Contact:

Leeds Chow

Email: leedschow@ambrivis.com

3

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

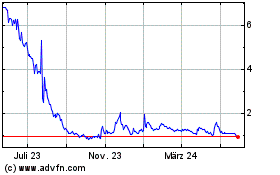

ABVC BioPharma (NASDAQ:ABVC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

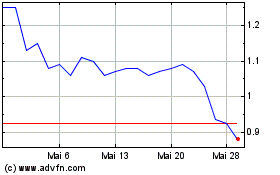

ABVC BioPharma (NASDAQ:ABVC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024