TIDMKNB

RNS Number : 5903C

Kanabo Group PLC

13 June 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN OR THE REPUBLIC OF SOUTH AFRICA OR ANY

OTHER JURISDICTION IN WHICH THE RELEASE, PUBLICATION OR

DISTRIBUTION OF THIS ANNOUNCEMENT WOULD CONSTITUTE A VIOLATION OF

THE RELEVANT LAWS OF SUCH JURISDICTION.THIS ANNOUNCEMENT IS FOR

INFORMATION PURPOSES ONLY AND DOES NOT CONSTITUTE OR CONTAIN ANY

INVITATION, SOLICITATION, RECOMMATION, OFFER OR ADVICE TO ANY

PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE OR DISPOSE OF ANY

SECURITIES IN ANY JURISDICTION.

Neither this announcement, nor anything contained herein , shall

form the basis of, or be relied upon in connection with, any offer

or commitment whatsoever in any jurisdiction. Investors should not

subscribe for or purchase any securities referred to in this

announcement except solely on the basis of the information

contained in the prospectus referred to in this announcement

(together with any supplementary prospectus, if relevant, the

"Prospectus"), including the risk factors set out therein,

published by Kanabo Group plc .

13 June 2023

Kanabo Group plc

("Kanabo", the "Company")

Admission of New Ordinary Shares

Publication of Prospectus

Total Voting Rights

Kanabo Group plc (LSE: KNB) , the patient focused healthcare

technology and medicinal cannabis company, is pleased to announce

that it has today received approval from the FCA of its prospectus

(the "Prospectus") and has published its Prospectus in relation to

the proposed issue of 38,461,492 Ordinary Shares ("2020 Deferred

Consideration Shares") in connection with the acquisition of Kanabo

Research Limited at a price of 6.5p and proposed issue of

72,831,186 Ordinary Shares ("Outstanding Consideration Shares") in

connection with the acquisition of The GP Service (UK) Ltd at a

price of 12.65p.

An electronic copy of the Prospectus dated 13 June 2023 will

shortly be available for inspection on the Company's website at

https://www.kanabogroup.com and will be submitted to the National

Storage Mechanism maintained by the FCA and will be available for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

Admission to listing and trading

Application will be made to the FCA and the London Stock

Exchange for the Outstanding Consideration Shares to be admitted to

the Official List of the FCA and to trading on the Main Market for

listed securities of the London Stock Exchange ("Admission").

Admission is expected to take place on or around 28 June 2023. The

Outstanding Consideration Shares will rank pari passu with the

Company's existing Ordinary Shares.

The issue and allotment of the 2020 Deferred Consideration

Shares is subject to and conditional upon the approval by Enlarged

Shareholders at the 2023 AGM. Assuming such approval is received,

admission of the 2020 Deferred Consideration Shares to the Official

List of the FCA and trading on the Main Market for listed

securities of the London Stock Exchange is expected to become

effective and unconditional dealings are expected to commence

within five business days following the 2023 AGM. The 2020 Deferred

Consideration Shares will rank pari passu with the Company's

existing Ordinary Shares.

Lock-in arrangement

In relation to the GP Services Acquisition:

The Maven GP Sellers entered into lock-in agreements with Kanabo

pursuant to which they are prevented from disposing of any of the

Consideration Shares held by them (including any Outstanding

Consideration Shares), subject to certain exceptions, for a period

of 18 months from 21 February 2022. For a further period of 18

months following the expiry of the Lock-In Period (being 20 August

2023), each Maven GP Seller is subject to an orderly market

restriction.

The non-Maven GP Sellers entered into lock-in agreements with

Kanabo pursuant to which they are prevented from disposing of any

of the Consideration Shares held by them (including any Outstanding

Consideration Shares), subject to certain exceptions, for a period

of 36 months from 21 February 2022.

3,712,146 shares out of the 72,831,186 Outstanding Consideration

Shares are not subject to any lock-in restrictions.

Further details of the Lock-In Agreements are set out in the

Prospectus.

Total voting rights

The Company hereby notifies the market, in accordance with the

FCA's Disclosure Guidance and Transparency Rule 5.6.1, that on

Admission, the Company's issued share capital will consist of

573,216,379 Ordinary Shares, each with one vote. The Company does

not hold any Ordinary Shares in Treasury. On Admission, the total

number of voting rights in the Company will be 573,216,379 and this

figure may be used by Shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

Unless otherwise defined, capitalised terms used in this

announcement shall have the same meaning as set out in the

Prospectus.

Expected timetable of principal events:

Admission & commencement of dealings 8.00 a.m. on or around

in the Outstanding Consideration Shares 28 June 2023

on the London Stock Exchange

CREST accounts of GP Sellers holding 8.00 a.m. on or around

in uncertificated form credited with 28 June 2023

Outstanding Consideration Shares

---------------------------

Despatch of share certificates for Outstanding within 7 days of Admission

Consideration Shares to GP Sellers holding

in certificated form

---------------------------

Admission & commencement of dealings within 5 business days

in the 2020 Deferred Consideration Shares following the 2023 AGM*

on the London Stock Exchange*

---------------------------

CREST accounts of Kanabo Research Sellers 8.00 a.m. on admission

holding in uncertificated form credited of the 2020 Deferred

with 2020 Deferred Consideration Shares* Consideration Shares*

---------------------------

Despatch of share certificates for 2020 within 7 days of admission

Deferred Consideration Shares to Kanabo of the 2020 Deferred

Research Sellers holding in certificated Consideration Shares*

form*

---------------------------

* Subject to and conditional upon approval by the Enlarged

Shareholders at the 2023 AGM.

All references to time are to London time unless otherwise

stated.

Directors' participation in the 2020 Deferred Consideration

Shares

Board members Mr David Tsur (Deputy Chair), Mr Avihu Tamir

(Chief Executive Officer) and former None-Executive director Mr Uzi

Danino (together "Directors and Ex-Directors") will all be issued

with shares as part of the 2020 Deferred Consideration Shares.

The number of shares issued under the 2020 Deferred

Consideration Shares for by each of these Directors and

Ex-Directors are set out below:

Director/Ex-Director Number of shares issue under

the 2020 Deferred Consideration

Shares

Mr David

Tsur 1,515,392

--------------------------------

Mr Avihu

Tamir 16,266,552

--------------------------------

Mr Uziel

Danino 616,014

--------------------------------

(*) The issue of the 2020 Deferred Consideration Shares is

subject and conditional upon approval by the Enlarged Shareholders

at the 2023 AGM. The Company will issue further announcements in

this regard.

Enquiries:

Kanabo Group plc via Vigo Consulting

Avihu Tamir, Chief Executive Officer +44 (0)20 7390 0230

Assaf Vardimon, Chief Financial Officer

Ian Mattioli, Non-Executive Chair of the Board

Peterhouse Capital Ltd (Financial Adviser

and Broker)

Eran Zucker / Lucy Williams / Charles Goodfellow +44 (0)20 7469 0930

Vigo Consulting (Financial Public Relations/Investor

Relations)

Jeremy Garcia / Fiona Hetherington / Verity

Snow +44 (0)20 7390

kanabo@vigoconsulting.com 0230

About Kanabo Group Plc

Kanabo Group Plc (LSE:KNB) is a healthtech company committed to

revolutionising patient care through its innovative technology

platform and disruptive product offerings. Since its inception in

2017, Kanabo has been focused on researching, developing, and

commercialising regulated medicinal cannabis-derived formulations

and therapeutic inhalation devices.

Kanabo's NHS-approved online telehealth platform, The GP

Service, provides patients with video consultations, online

prescriptions, and primary care services. The Company is a leader

in its field, focusing on improving patient outcomes and providing

more accessible healthcare experiences.

In March 2023, Kanabo successfully launched its Pain Clinic,

Treat It, under the expert guidance of its technological and

product expertise. Treat It initially focuses on chronic pain

management using plant-based medicine and treatments that are

currently unavailable through traditional channels.

At Kanabo Group Plc, we are dedicated to providing patients with

the highest quality medical treatments and more accessible

healthcare experiences.

Visit www.kanabogroup.com for more information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PDISFMFDDEDSEDM

(END) Dow Jones Newswires

June 13, 2023 09:39 ET (13:39 GMT)

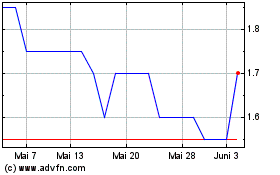

Kanabo (LSE:KNB)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Kanabo (LSE:KNB)

Historical Stock Chart

Von Dez 2023 bis Dez 2024