RNS Number:0286Z

Intercede Group PLC

25 May 2004

INTERCEDE GROUP plc

("Intercede", "the Company" or "the Group")

Preliminary Results for the Year Ended 31 March 2004

Intercede, a leading developer of electronic identity management software, today

announces its preliminary results for the year ended 31 March 2004.

SUMMARY

* Pre-tax losses reduced from #1.1m to #0.6m

* Cash outflow before financing reduced from #1.4m to #0.5m

* First patent granted and issued in February 2004

* First sales of the MyID(TM) product offerings ie MyID

Corporate, MyID Campus, MyID Citizen and MyID Service

Provider

* Thales, Gemplus and Giesecke & Devrient have signed

agreements to resell the Group's technology as part of

their respective product ranges

* Good progress continues to be made in the development of

strategic relationships with a number of other product

companies and channel partners

* The Group's technology is now being bid by major industry

players on smart card related projects in all parts of the

world

Richard Parris, Chairman & Chief Executive of Intercede, said today:

"Following continued financial and commercial progress, the Group is now

exploiting its technology lead to generate revenues from customers throughout

the world."

25 May 2004

ENQUIRIES:

Intercede Group plc Tel. 01455 558111

Richard Parris, Chairman & Chief

Executive

Andrew Walker, Finance Director

INTERCEDE GROUP plc

Preliminary Results for the Year Ended 31 March 2004

CHAIRMAN'S STATEMENT

Following continued financial and commercial progress, the Group is now

exploiting its technology lead to generate revenues from customers throughout

the world.

Introduction

Intercede is a leading developer of software for the issuance and management of

smart cards and digital identities.

Governments, financial institutions, service providers, airlines, educational

institutions, mass transit authorities and employers are starting to issue

digital identities to employees, customers, citizens and students to enhance

security, improve service levels and reduce costs. When combined with a smart

card, or similar device, digital identities can complement or replace other

forms of identification because they are resistant to fraud, require the card

holder to be present at point of use, may be used over the Internet and can be

interfaced directly to computer applications or on-line services. Furthermore,

smart cards may incorporate additional credentials such as digital certificates,

fingerprints or portable personal information in a cryptographically sealed

format that can only be read by authorised individuals.

Within the next five years most individuals in the developed world, and many in

the developing world, are likely to carry at least one digital identity on a

smart card device. This may be a national identity card, a driver's licence, a

health care card, a bank card, a travel pass, a company identity badge or a

student campus card. Each of these cards will need to be issued securely and

managed throughout its life cycle. This is a huge market opportunity for smart

card and identity management software companies, and Intercede has one of the

most advanced issuance and management product suites currently available.

Intercede's software serves as the foundation for identity solutions that are

changing the way organizations improve their security and operating efficiency.

Many global organizations - including the Amsterdam Medical Center, Barclays

Bank, COLT Telecom, the European Patent Office, Fujitsu, Lloyds TSB, the NHS,

Royal Bank of Scotland, and various US federal government agencies - utilize

Intercede's software and support services to cut costs, improve security and to

create new sources of revenue.

Results

In the year ended 31 March 2004, turnover of #1.6m was achieved at a gross

margin of 83% (compared to #1.8m at a gross margin of 71% in the previous

period).

For the second consecutive year, Intercede has virtually halved operating losses

from #1.1m to #0.6m and the cash outflow before financing has been reduced from

#1.4m to #0.5m. As at 31 March 2004, the Group had a cash balance in excess of

#1m.

I am delighted that the strategy of concentrating on the promotion of our own

products while controlling costs has brought the Group so much closer to

break-even. This has been the Board's primary objective during the year. Whilst

a further reduction in resale revenues from third party products has resulted in

a 12% fall in total sales, the favourable impact on gross margins is clear to

see.

Strategy and Outlook

In my statement last year, I highlighted that in the 2003/04 year the Group

would be focused on executing its strategy to ensure the exploitation of:

*The Company's technical product lead.

*Established distribution channels.

*Major vertical markets using Intercede's MyIDTM solutions brand.

I also remarked in the 2003 Interim Report that "We anticipate a continuing

trend towards break-even, pending an anticipated step change in sales during

2004."

After 12 months of continued progress, I am pleased to report success in

executing this strategy as demonstrated by the following new orders, new

partners and associated activities:

*The adoption of edeficeTM technology to drive the identity management

strategy by a major global bank.

*The deployment of edefice to enable the use of smart cards by a major

health care provider.

*The first MyID Corporate sales to prestigious European clients.

*The first MyID Campus sale to an enterprising overseas university.

*The integration of the edefice platform within the Thales e-Security

Safesign product range.

*The integration of MyID within the Gemplus SafeSite product range.

*The signing of Giesecke & Devrient, a major global smart card

manufacturer, as an Intercede partner and MyID reseller.

*The registration of a patent for our key edefice technology.

*Gross margins have continued to grow from 71% to 83% year on year.

*For the second consecutive year, Intercede has halved losses and is close

to achieving break-even operation.

Our strategy in the forthcoming year is to:

* Increase our software licence revenues from Europe and the US and to

establish distribution channels in the Asia Pacific region.

* Progress OEM partners from initial OEM licence fees through to recurring

licence revenues.

* Continue product development focused on the packaging of the MyID range

of solutions to meet a wider range of vertical markets.

* Expand the Group's turnover much faster than the associated cost base by

exploiting our technology's scalability, ease of use and global distribution

channels.

The effectiveness of this strategy is dependent on the ongoing high calibre of

our products, the dedication and professionalism of our staff, the quality of

our partners and the ongoing support of our shareholders. In all of these

respects, Intercede has an impressive track record. Furthermore, a programme of

continuous product improvement and new innovation continues to ensure that

Intercede remains a leader amongst a small number of global competitors.

The outlook for the next 12 months is one of accelerating growth in the number

of software licences sold to an increasing number of customers around the world.

After an extended period of depressed expenditure in the IT sector, there are

positive indications that customers are now starting to allocate budgets to

identity management and smart card projects. As a result, sales opportunities

are growing in both quantity and value. However, the lead time for individual

new orders continues to be long and subject to uncertainty.

Intercede is well positioned, through its established products and distribution

network, to take advantage of this emerging growth. The management team is

committed to maintaining the Group on its focused course and I look forward to

reporting further commercial progress over the coming months.

Richard Parris

Chairman & Chief Executive

25 May 2004

INTERCEDE GROUP plc

Preliminary Results for the Year Ended 31 March 2004

OPERATING AND FINANCIAL REVIEW

With current levels of pre-sales activity at an all time high, the management

focus continues to be on ensuring that the necessary support is provided to take

advantage of sales opportunities and to further develop partner relationships,

whilst maintaining tight control over costs.

Introduction

The main message of the last financial year is the recurring theme of

significant progress being made with limited funds. The Group has continued to

develop its technology and international sales channels whilst moving closer to

a break-even trading and cash generative position.

After a prolonged period of time when IT security projects have struggled to get

off the ground in all parts of the world, the start of 2004 appears to have

brought an encouraging increase in activity with a number of identity management

projects being put out to tender.

Business Development

Following the Placing, which raised #1.3m net of expenses in July 2003, the

Group has now raised #6.4m of external funding to date. The Board appreciates

the continued backing of its existing shareholders, the vast majority of whom

have provided support throughout the period since the Group's admission to AIM.

This backing has enabled the Group to develop its technology to the point where

it is now being bid by major industry players on smart card related projects in

all parts of the world.

This development has already enabled the Group to realise its vision of creating

the first web-based open platform for security management purposes. A number of

the areas of development were considered to be sufficiently innovative for

patent applications to be made, the first of which ("Secure Multipart

Authorization") was granted and issued by the UK Patent Office on 18 February

2004. Development efforts continue to be focused on further increases in the

level of interoperability of the edefice technology and additional areas of

functionality as driven by the various market sector requirements.

Partner agreements have been put in place during the past year with Thales,

Gemplus and Giesecke & Devrient. This provides a legal and commercial framework

for the increasing number of bid opportunities which we are being requested to

support throughout the world. Each of these partners is investing sales,

pre-sales and technical resource to take Intercede's technology on board. Good

progress continues to be made in the development of strategic relationships with

a number of other product companies and channel partners.

Financial Results

Further progress has been made towards profitability over the past financial

year. Whilst sales have fallen year on year, this reflects a #427,000 reduction

in the sales of third party products. The level of edefice related sales has

increased in both absolute and percentage terms (from 49% to 62%).

Historically, edefice related sales have represented a combination of advance

licence commitments from channel partners and projects completed for early

adopters, primarily in the UK Finance and Government sectors. The past year has

seen the first sales of the MyID product offerings which are targeted at

different vertical markets ie MyID Corporate, MyID Campus, MyID Citizen and MyID

Service Provider. A number of evaluation systems and proof of concept

installations have also been implemented in the US and Europe.

The level of operating losses has fallen substantially, despite the reduction in

sales, due to the combined effect of increased margins and lower operating

costs.

Year ended Year ended Change

31 March 2004 31 March 2003 %

#000 #000

--- ---

Sales 1,605 1,819 (11.8)

Gross margin (%) 1,339 (83%) 1,291 (71%) 3.7

Operating costs (1,960) (2,365) (17.1)

Operating loss (621) (1,074) (42.2)

Loss per share (2.9)p (5.6)p (48.2)

Funding

As at 31 March 2004, the Group had cash balances totalling #1,068,000 (2003:

#317,000). Whilst this clearly reflects the funds raised from the Placing, it is

encouraging to note that the net cash outflow prior to financing has been

reduced from #1,421,000 to #503,000.

Summary

The momentum is continuing to build for the Group to realise the potential of

its technology. Good progress has been made throughout the past year in

developing relationships with a number of significant global partners. This has

resulted in an increasing number of ongoing requests to support bids throughout

the world.

The short term focus is to win as many of these bids as possible, both to

strengthen our references in each market (ie MyID Corporate, MyID Campus, MyID

Citizen and MyID Service Provider) and to develop our position with the various

partners until they reach the point where they are fully trained to successfully

sell and deliver the Group's technology.

Andrew Walker

Finance Director

25 May 2004

INTERCEDE GROUP plc

Consolidated Profit and Loss Account for the year ended 31 March 2004

Notes 2004 2003

#'000 #'000

Turnover 1,605 1,819

Cost of sales (266) (528)

--------- --------

Gross profit 1,339 1,291

Other operating expenses (1,960) (2,365)

--------- --------

Operating loss (621) (1,074)

Interest receivable and similar income 34 29

Interest payable and similar charges (74) (78)

--------- --------

Loss on ordinary activities before taxation (661) (1,123)

Taxation 2 (202) 212

--------- --------

Retained loss on ordinary activities after taxation

and (863) (911)

for the year --------- --------

Basic and diluted loss per ordinary share 3 (2.9)p (5.6)p

========= ========

All operations of the Group continued throughout both years and no operations

were acquired or discontinued.

There are no recognised gains or losses in either year other than the loss for

the year.

INTERCEDE GROUP plc

Consolidated Balance Sheet at 31 March 2004

2004 2003

#'000 #'000

Fixed assets

Tangible assets 42 70

-------- --------

Current assets

Stocks - 2

Debtors 119 544

Cash at bank and in hand 1,068 317

-------- --------

1,187 863

Creditors: Amounts falling due within one (778) (887)

year -------- --------

Net current assets/(liabilities) 409 (24)

-------- --------

Total assets less current liabilities 451 46

Creditors: Amounts falling due after more

than one year

Convertible debt (1,432) (1,432)

Other creditors - (2)

-------- --------

(1,432) (1,434)

-------- --------

Net liabilities (981) (1,388)

======== ========

Capital and reserves

Called-up share capital 4,271 4,095

Share premium account 2,107 1,013

Other reserves 1,508 1,508

Profit and loss account (8,867) (8,004)

-------- --------

Shareholders' deficit - all equity (981) (1,388)

======== ========

INTERCEDE GROUP plc

Consolidated Cash Flow Statement for the year ended 31 March 2004

Notes 2004 2003

#'000 #'000

Net cash outflow from operating activities 5 (525) (1,608)

======== =======

Returns on investments and servicing of finance

Interest received 31 30

Interest paid (1) (17)

Interest element of finance lease rentals (2) (5)

-------- -------

Net cash inflow from returns on investments and

servicing 28 8

of finance ======== =======

Taxation received - 190

======== =======

Capital expenditure

Purchase of tangible fixed assets (6) (11)

======== =======

Cash outflow before financing (503) (1,421)

======== =======

Financing

Issue of ordinary share capital 1,270 7

Repayment of secured loan (10) (10)

Capital element of finance lease rentals (6) (31)

-------- -------

Net cash inflow/(outflow) from financing 1,254 (34)

======== =======

Increase/(decrease) in cash in the year 6 751 (1,455)

======== =======

INTERCEDE GROUP plc

Preliminary Results for the Year Ended 31 March 2004

NOTES

1. The financial information set out in this announcement does not constitute

the Group's Statutory Accounts for the years ended 31 March 2003 or 2004, but is

derived from those accounts. Statutory Accounts for 2003 have been delivered to

the Registrar of Companies and those for 2004, which have been approved by the

Board of Directors, will be delivered following the Group's Annual General

Meeting. Accounting policies have been consistently applied throughout both

accounting periods. The Company's auditors have reported on those accounts;

their reports were unqualified and did not contain statements under Section 237

(2) or (3) of the Companies Act 1985.

2. TAX ON LOSS ON ORDINARY ACTIVITIES

The tax (charge)/credit comprises:

Year ended 31 March

2004 2003

#'000 #'000

Current year - UK corporation tax - 201

Adjustment in respect of prior periods (202) 11

---------- ----------

(202) 212

========== ==========

No benefit has been taken in the current year in respect of the Group's claim

for a research and development tax credit. An adjustment has also been made in

respect of the prior period. The tax credit will be recognized as and when the

research and development claims have been agreed by the Inland Revenue.

3. BASIC AND DILUTED LOSS PER ORDINARY SHARE

The calculations of loss per ordinary share are based on the loss for the

financial year and the weighted average number of ordinary shares in issue

during each year.

Year ended 31 March

2004 2003

#'000 #'000

Loss for the year (863) (911)

------------ -----------

Number Number

Weighted average number of shares 29,672,863 16,372,931

------------ -----------

Pence Pence

Basic and diluted loss per ordinary share (2.9) (5.6)

============ ===========

4. DIVIDEND

The Directors do not recommend the payment of a dividend.

5. RECONCILIATION OF OPERATING LOSS TO OPERATING CASH FLOW

2004 2003

#'000 #'000

Operating loss (621) (1,074)

Depreciation charge 34 51

Decrease in stock 2 6

Decrease/(increase) in debtors 226 (119)

Decrease in creditors (166) (472)

--------- -------

Net cash outflow from operating activities (525) (1,608)

========= =======

6. ANALYSIS AND RECONCILIATION OF NET DEBT

2003 Cash Flow 2004

#'000 #'000 #'000

Cash at bank and in hand 317 751 1,068

--------- -------- --------

Debt due within one year (10) 8 (2)

Debt due after one year (1,434) 2 (1,432)

Finance leases (6) 6 -

--------- -------- --------

(1,450) 16 (1,434)

--------- -------- --------

Net debt (1,133) 767 (366)

========= ======== ========

The reconciliation of net cash flow to the movement in net debt is as follows:

2004 2003

#'000 #'000

Increase/(decrease) in cash in the 751 (1,455)

year

Cash inflow from decrease in debt and lease financing 16 41

-------- --------

Movement in net cash in the year 767 (1,414)

Net (debt)/cash at beginning of (1,133) 281

year -------- --------

Net debt at end of year (366) (1,133)

======== ========

7. ANNUAL GENERAL MEETING

The Annual General Meeting of the Company will be held at 9.00am on Wednesday 7

July 2004 at Lutterworth Hall.

8. ANNUAL REPORT AND ACCOUNTS

Copies of the full Statutory Accounts will be despatched to shareholders in due

course. Copies will also be available on the website (www.intercede.com) and

from the registered office of the Company: Lutterworth Hall, St. Mary's Road,

Lutterworth, Leicestershire, LE17 4PS.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR QKQKDOBKDAPB

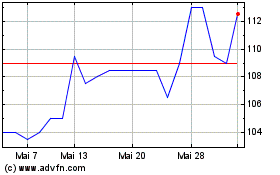

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024