TIDMGUS

RNS Number : 7874S

Gusbourne PLC

29 September 2014

Gusbourne Plc

(the "Company")

Half Yearly Report

Gusbourne Plc, the English sparkling wine producer, today

announces its unaudited interim results for the six months ended 30

June 2014

Key Highlights

-- An additional 50 acres of vineyards planted in May 2014 on

the Company's freehold estate in Kent, bringing the total acreage

under vine to 155 acres.

-- Bottling of the 2013 vintage in May and June 2014, following

the successful October 2013 harvest which has added significantly

to our stocks for sale in future years.

-- Prospects for another excellent harvest this year with

optimum weather conditions throughout the growing season.

-- International Wine Challenge gold medal for Gusbourne Brut

Reserve 2009 in May 2014. Finalist in the "Best Drinks Producer"

category of the 2014 BBC Food and Farming awards.

-- Sales of GBP194,000 (H1 2013 - GBPnil) for the period in line

with stock availability of prior year vintages.

-- Net loss for the period of GBP501,000 (H1 2013 - GBP202,000)

for the period in line with expectations at this stage of the

Company's development reflecting ongoing investment in the

Company's long term strategic plan.

Andrew Weeber, Chairman, commented:

"I am pleased to report further steady progress towards the

achievement of our long term goals. We have expanded our vineyards

with the additional planting of 50 acres in Kent and we have

continued to develop our trade partnerships and the Gusbourne

brand. A larger than expected harvest last year has added

significantly to our stock levels for sale in future years and

there are good prospects for a similar excellent harvest this

year.

We are proud to produce some of the best English sparkling wines

available and were delighted at the end of last year to win the

trophy for "English Wine Producer of the Year" as well as "Best

Bottle Fermented Sparkling Wine" from the International Wine and

Spirit Competition (IWSC). In May this year we were delighted to

receive an International Wine Challenge gold medal for Gusbourne

Brut Reserve 2009.

The production of premium quality wine from new vineyards is, by

its very nature, a long term, and generational business. It takes

four years to bring a vineyard into full production and a further

four years to transform these grapes into an exquisite sparkling

wine.

The Company benefits from a strong asset backing including

freehold land, vineyards and wine stocks. The Company also benefits

from the well regarded and internationally recognised Gusbourne

brand. Our long term plan includes additional investment in new

vineyards, increased winemaking capacity, wine stocks and most

importantly, brand development. We appreciate the support our

shareholders provide to us and we are proud to be the only English

vineyard to be quoted on AIM".

Financials

Gusbourne PLC ("the Company") is engaged, through its wholly

owned subsidiary Gusbourne Estate Limited (together the "Group"),

in the production and distribution of a range of high quality and

award winning English sparkling and still wines from grapes grown

in its own vineyards in Kent and West Sussex. The majority of the

Group's mature vineyards are located at its freehold estate at

Appledore in Kent where the winery is also based. Additional

vineyards were planted in West Sussex in May 2013 and in Kent in

May 2014. Further plantings are planned in both Kent and West

Sussex.

Results for the six months ended 30 June 2014

Sales for the period amounted to GBP194,000 (H1 2013 - GBPnil).

Whilst these sales reflect the limited stock availability of prior

year vintages, they were however approximately 143 per cent higher

than those made by the Gusbourne Estate business for the same

period in 2013 under its previous ownership and reflect a

continuing like for like growth in the sale of Gusbourne wines.

Cost of sales remain higher than normal due to the impact of fair

valuing of the initial stocks of wine which were acquired as part

of the acquisition of the Gusbourne Estate business in September

2013. Administrative expenses for the period of GBP450,000 (H1 2013

- GBP238,000) reflect the growth in the business following the

acquisition of the Gusbourne Estate business and additional staff.

The operating loss for the period was GBP424,000 (H1 2013 -

GBP238,000). The loss before tax was GBP516,000 (H1 2013 -

GBP202,000) after net finance costs of GBP82,000 (H1 2013 - net

finance income of GBP36,000). These expected losses reflect the

long term development strategy of the business.

Balance Sheet

The changes to the Group's balance sheet during the period to 30

June 2014 reflect the ongoing investment in, and development of,

the Group's business, net of income from wine sales. This includes

the investment in additional vineyards in Kent and including the

ongoing costs associated with the vineyards established in West

Sussex in May 2013 at a cost of GBP345,000 (H1 2013 - GBP374,000),

the purchase of additional plant and equipment for the vineyards

and the winery amounting to GBP62,000 (H1 2013 - GBP108,000) and

the planned ongoing development of the business which is reflected

in the net loss for the period of GBP501,000 (H1 2013 -

GBP202,000).

Total assets at 30 June 2014 of GBP11,057,000 (2013 -

GBP3,962,000) include freehold land and buildings of GBP4,596,000

(2013 - GBP223,000), inventories of wine stocks amounting to

GBP1,260,000 (2013 - GBP150,000), GBP1,413,000 of biological assets

(2013 - GBP154,000) and GBP1,074,000 of cash (2013 - GBP2,685,000).

Intangible assets of GBP1,007,000 (2013 - GBPnil) arise from the

acquisition of the Gusbourne Estate business on 27 September 2013.

Biological assets reflect the fair value of grape vines calculated

in accordance with International Accounting Standard 41.

The Group's net tangible assets at 30 June 2014 amount to

GBP5,623,000 (2013 - GBP3,741,000) and represent 85% of total

equity (2013 - 100%).

Financing

The Group's activities are financed by its own cash resources,

bank loans and convertible bonds. Bank loans and convertible bonds

at 30 June 2014 amount in total to GBP3,792,000 (2013 - GBPnil))

and represent 57% of total equity (2013 - 0%).The achievement of

the Group's long term development strategy will depend on the

raising of further equity and/or debt funds to achieve those goals.

Additional funding will be sought by the Company to invest in

additional vineyards, winery capacity, and stocks of wine as well

as brand development, in line with its development strategy.

For further information contact:

Gusbourne Plc

Andrew Weeber/Ben Walgate +44 (0)12 3375 8666

Cenkos Securities plc

Nicholas Wells +44 (0)20 7397 8900

Broker Profile

Simon Courtenay/Tamsin Shephard +44 (0)20 7448 3244

Note: This announcement and other press releases are available

to view at the Company's website: www.gusbourneplc.com

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 June 2014

Unaudited Unaudited Audited

Six months Six months Nine months

to to to

30 June 30 June 31 December

Notes 2014 2013 2013

GBP'000 GBP'000 GBP'000

Revenue 194 - 129

Cost of sales (168) - (78)

Gross profit 26 - 51

Change in fair value of biological

assets 5 - - 145

Transactions expenses - stamp

duty land tax - - (211)

Transactions expenses - other - - (187)

Other administrative expenses (450) (238) (434)

---------- ---------- ------------

Total administrative expenses (450) (238) (832)

Loss from operations (424) (238) (636)

Finance income 2 15 36 29

Finance expense 2 (107) - (59)

Loss before tax (516) (202) (666)

Tax credit/(expense) 15 - (60)

Loss for the period attributable

to

owners of the parent (501) (202) (726)

---------- ---------- ------------

Loss per share attributable

to

the ordinary equity holders

of the parent:

Basic (3.29p) (2.53p) (6.88p)

Diluted (3.29p) (2.53p) (6.88p)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 30 June 2014

Unaudited Unaudited Audited

30 June 30 June 31 December

Notes 2014 2013 2013

Assets GBP'000 GBP'000 GBP'000

Non-current assets

Intangibles 3 1,007 - 1,007

Property, plant and equipment 4 6,071 761 5,724

Biological assets 5 1,413 154 1,240

8,491 915 7,971

--------- --------- -----------

Current assets

Inventories 6 1,260 150 1,310

Trade and other receivables 232 212 251

Cash and cash equivalents 1,074 2,685 1,703

--------- --------- -----------

2,566 3,047 3,264

--------- --------- -----------

Total assets 11,057 3,962 11,235

--------- --------- -----------

Liabilities

Current liabilities

Trade and other payables (590) (221) (324)

(590) (221) (324)

--------- --------- -----------

Non-current liabilities

Loans and borrowings 8 (2,025) - (2,025)

Convertible deep discount bonds 9 (1,767) - (1,695)

Deferred tax liabilities (45) - (60)

(3,837) - (3,780)

Total liabilities (4,427) (221) (4,104)

NET ASSETS 6,630 3,741 7,131

--------- --------- -----------

Issued capital and reserves attributable

to

owners of the parent

Share capital 7,612 4,000 7,612

Share premium 346 266 346

Merger reserve (13) (266) (13)

Convertible bond reserve 95 - 95

Retained earnings (1,410) (259) (909)

------- ----- -----

TOTAL EQUITY 6,630 3,741 7,131

------- ----- -----

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 30 June 2014

Unaudited Unaudited Audited

Six months to months Six months to Nine months

to to

months to

30 June 30 June 31December

2014 2013 2013

GBP'000 GBP'000 GBP'000

Cashflows from operating

activities

Loss for the period before tax (516) (202) (666)

Adjustments for:

Depreciation of property, plant and equipment 60 12 36

Profit on disposal of property,

plant

and equipment - (8) (8)

Finance expense 107 - 59

Finance income (15) (36) (29)

Movement in biological assets (173) (1) (302)

(537) (235) (910)

Decrease/(increase) in trade and other receivables 19 (119) 44

Decrease/(increase) in inventories 50 (4) (17)

Increase in trade and other payables 266 101 130

---------- ---------- -----------

Cash outflow from operations (202) (257) (753)

Income taxes paid - - -

Net cash out flows from operating activities (202) (257) (753)

Investing activities

Purchases of property, plant

and equipment,

excluding vineyard establishment (62) (108) (653)

Investment in vineyard establishment (345) (374) (418)

Purchase of biological assets - -

Acquisition of Gusbourne Estate business - - (4,263)

Sale of property, plant and equipment - 35 35

Interest received 15 36 29

Net cash from investing activities (392) (411) (5,270)

---------- ---------- -----------

Financing activities

Bank loan - - 2,025

Redemption of redeemable preference shares - - (50)

Interest paid (35) - (19)

Issue of ordinary shares - - 2,851

Share issue expenses - - (209)

Net cash from financing activities (35) - 4,598

CONSOLIDATED STATEMENT OF CASH FLOWS (continued)

For the six months ended 30 June 2014

Unaudited Unaudited Audited

Six months to Six Six months to Nine months to Six months to

months to

30 June 30 June 31 December

2014 2013 2013

GBP'000 GBP'000 GBP'000

Net decrease in cash and cash equivalents (629) (668) (1,425)

Cash and cash equivalents at beginning of

period 1,703 3,353 3,128

---------------- ------------- --------------

Cash and cash equivalents at end of period 1,074 2,685 1,703

================ ============= ==============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2014

Total

attributable

to equity

holders

Share Share Merger Convertible Retained of

Audited: capital premium reserve bond reserve earnings parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

31 March 2013 4,000 266 (266) - (183) 3,817

Shares issued 3,612 80 - - - 3,692

Equity recognised

on issue of

convertible bonds - - - 95 - 95

Excess of fair value

over

nominal value of shares

issued - - 253 - - 253

Comprehensive loss

for the period - - - - (726) (726)

______ ______ ______ ______ ______ ______

Total comprehensive

income for the period 3,612 80 253 95 (726) 3,314

______ ______ ______ ______ ______ ______

31 December 2013 7,612 346 (13) 95 (909) 7,131

______ ______ ______ ______ ______ ______

Total

attributable

to equity

holders

Share Share Merger Convertible Retained of

Unaudited: capital premium reserve bond reserve earnings parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

31 December 2013 7,612 346 (13) 95 (909) 7,131

Comprehensive loss

for the period - - - - (501) (501)

______ ______ ______ ______ ______ ______

Total comprehensive

loss for the period - - - - (501) (501)

______ ______ ______ ______ ______ ______

30 June 2014 7,612 346 (13) 95 (1,410) 6,630

______ ______ ______ ______ ______ ______

NOTES TO THE ACCOUNTS

For the six months ended 30 June 2014

1 Statement of accounting policies

The interim financial statements have been prepared in

accordance with the recognition and measurement principles as

adopted by the EU, applying the accounting policies and

presentation that were applied in the preparation of the Company's

published consolidated financial statements for the nine months

ended 31 December 2013.

The financial information for the six months ended 30 June 2014

has not been subject to an audit nor a review in accordance with

International Standard on Review Engagements 2410, Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity, issued by the Auditing Practices Board. The

comparative financial information presented herein for the nine

months ended 31 December 2013 does not constitute full statutory

accounts within the meaning of Section 434 of the Companies Act

2006. The Group's annual report and accounts for the nine months

ended 31 December 2013 have been delivered to the Registrar of

Companies. The Group's independent auditor's report was unqualified

and did not include references to any matters to which the auditors

drew attention by way of emphasis without qualifying their report

and did not contain a statement under section 498(2) or 498(3) of

the Companies Act 2006.

Basis of preparation

The Board of the Company continually assesses and monitors the

key risks of the business. These risks have not significantly

changed from those set out in the Company's Annual Report for the

nine months ended 31 December 2013. The Board has reviewed

forecasts and remains satisfied with the Company's funding and

liquidity position. On the basis of its forecast and available

facilities and cash balances held on the balance sheet, the Board

has concluded that the going concern basis of preparation continues

to be appropriate.

2 Finance income and expenses

Unaudited Unaudited Audited

30 June 30 June 31 December

2014 2013 2013

GBP'000 GBP'000 GBP'000

Finance income

Interest received on bank deposits 15 36 29

Total finance income 15 36 29

--------- --------- -----------

Finance expense

Interest payable on borrowings 35 - 19

Convertible deep discount bond

charge 72 - 40

--------- --------- -----------

Total finance expense 107 - 59

--------- --------- -----------

NOTES TO THE ACCOUNTS (continued)

For the six months ended 30 June 2014

3 Intangibles

Unaudited Unaudited Audited

30 June 30 June 31 December

2014 2013 2013

GBP'000 GBP'000 GBP'000

Goodwill 777 - 777

Brand 230 - 230

1,007 - 1,007

--------- --------- -----------

4 Property, plant and equipment

Unaudited Unaudited Audited

30 June 30 June 31 December

2014 2013 2013

GBP'000 GBP'000 GBP'000

Freehold land and buildings 4,596 223 4,601

Plant, machinery and motor vehicles 652 160 647

Vineyard establishment 804 374 458

Computer equipment 19 4 17

--------- --------- -----------

6,071 761 5,723

--------- --------- -----------

Vineyard expenditure includes planting expenditure in relation

to vineyards which is carried forward at cost until the vines reach

maturity at which point they are re-measured and transferred to

biological assets.

NOTES TO THE ACCOUNTS (continued)

For the six months ended 30 June 2014

5 Biological assets

Vines

GBP'000

At 1 April 2013 154

Arising on the acquisition of Gusbourne Estate

business 1,074

Fair value of grapes harvested and transferred

to inventory (290)

Crop growing costs 157

Change in fair value due to price,

yield and maturity 145

At 31 December 2013 1,240

Crop growing costs 173

At 30 June 2014 1,413

-------

6 Inventories

Unaudited Unaudited Audited

30 June 30 June 31 December

2014 2013 2013

GBP'000 GBP'000 GBP'000

Raw materials and consumables 41 - 171

Wine 1,219 150 1,139

1,260 150 1,310

--------- --------- -----------

NOTES TO THE ACCOUNTS (continued)

For the six months ended 30 June 2014

7 Loans and borrowings

Unaudited Unaudited Audited

30 June 30 June 31 December

2014 2013 2013

GBP'000 GBP'000 GBP'000

Bank loan 2,025 - 2,025

2,025 - 2,025

--------- --------- -----------

The bank loan of GBP2,025,000 incurs interest at a rate of 3%

over Barclays Bank plc base rate and is due for repayment in full

in September 2018. It is secured by way of a fixed charge over the

group's land and buildings at Appledore, Kent and a floating charge

over all other property and undertakings.

8 Convertible bonds

GBP'000

Present value of debt element

at 1 January 2014 1,695

Discount expense for the period 72

-------

Carrying value of debt element

at 30 June 2014 1,767

Equity element at 1 January and

30 June 2014 95

Total fair value at 30 June 2014 1,862

-------

Convertible bonds represent the debt element of a deep discount

bond issued to Mr A C V Weeber and Mrs C Weeber as part of the

consideration for the acquisition of the Gusbourne Estate business

on 27 September 2013. The Bond is secured by a fixed charge over

the group's land and buildings at Appledore, Kent. The Bond is

redeemable on 27 September 2017 and attracts a coupon rate of 7.5%

per annum which is rolled up annually. From 27 September 2015 until

the 26 September 2016 the holders of the Bond can convert some or

all of the bonds into Gusbourne PLC ordinary shares at a price of

66 pence per share.

In accordance with the requirements of IAS 32 the Bond is

classified as a compound financial instrument containing an element

of debt and equity. The debt element is calculated as the present

value of future cash flows assuming the Bond is redeemed on the

redemption date, discounted at the market rate for an equivalent

debt instrument with no option to convert to equity. A rate of 9%

has been used. The difference between the cash payable on maturity

and the present value of the debt element is recognised in equity.

The discount is charged over the life of the Bond to the statement

of comprehensive income and included within finance expenses.

NOTES TO THE ACCOUNTS (continued)

For the six months ended 30 June 2014

9 Business combinations

On 27 September 2013 Gusbourne Estate Limited, a wholly owned

subsidiary of the Group, acquired the Gusbourne Estate business and

related freehold property for a total consideration of

GBP7,316,000. The principal reason for this acquisition was to

invest in, and further develop, the Gusbourne Estate business

including, in particular, its award winning Gusbourne brand to take

advantage of further anticipated market growth in this sector of

the wine industry.

Details of the fair value of identifiable assets and liabilities

acquired, purchase consideration and goodwill are as follows:

Fair value

Book value Adjustment Fair value

Net assets at the acquisition GBP'000 GBP'000 GBP'000

date

Property, plant and equipment 4,369 - 4,369

Biological assets 1,074 - 1,074

Inventories 641 225 866

Brand - 230 230

Total net assets 6,084 455 6,539

---------- ---------- ----------

Fair value of consideration paid: GBP'000

Cash 4,263

Shares 1,303

Convertible bond - present value of debt element 1,655

Convertible bond - equity element 95

Total consideration 7,316

-------

Goodwill 777

-------

Transaction costs of GBP187,000 and Stamp Duty Land Tax of

GBP211,000 in connection with the acquisition were recognised in

the statement of comprehensive income in the period ended 31

December 2013.

The fair value of the Group's shares issued in consideration for

the acquisition was based on the acquisition date share price of

GBP0.67 per share. The convertible bond was also fair valued at the

date of acquisition.

The main factors leading to the recognition of goodwill are the

presence of intangible assets, such as the workforce of the

acquired entity, which do not qualify for separate recognition, and

synergies resulting from material cost savings and sharing of

expertise and systems which will enable future growth.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UNRNRSUAKUAR

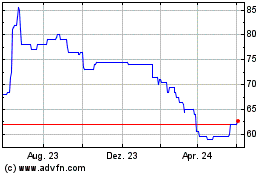

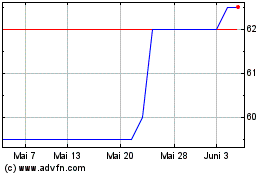

Gusbourne (LSE:GUS)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Gusbourne (LSE:GUS)

Historical Stock Chart

Von Jul 2023 bis Jul 2024