TIDMGUS

RNS Number : 8689V

Gusbourne PLC

19 December 2013

19 December 2013

Gusbourne Plc (the "Company")

Half Yearly Report

Gusbourne Plc today announces its unaudited interim results for

the six months ended 30 September 2013

Gusbourne Plc (London-AIM: GUS) is engaged, via its wholly owned

subsidiary Gusbourne Estate Limited ("Gusbourne Estate"), in the

production and distribution of a range of high quality and award

winning English sparkling and still wines from grapes grown in its

own vineyards in Kent and West Sussex. The majority of Gusbourne

Estate's mature vineyards are located at its 352 acre freehold

estate at Appledore in Kent, where the winery is also based.

Additional vineyards were planted in West Sussex in May 2013 and

the Company now has a total of 105 acres (42 hectares) of vineyards

under cultivation. The Company intends for further plantings to be

undertaken over the next two years on Gusbourne Estate's freehold

site in Kent.

The Company was incorporated in England & Wales on 24

September 2012 and was admitted to AIM on 25 October 2012 following

the merger with Shellproof Limited. Details of this merger are set

out in the Circular to Shareholders dated 10 October 2012.

On 27 September 2013 the Company completed the acquisition of

the Gusbourne Estate business and related freehold property and,

following that acquisition changed its name from Shellproof Plc to

Gusbourne Plc. Details of this transaction are set out in the

Circular to Shareholders dated 3 September 2013.

Results for the six months ended 30 September 2013

The trading results for the 6 months ended 30 September 2013

primarily reflect the activities of the Company prior to the

acquisition of the Gusbourne Estate business on 27 September

2013.

The Company reported a consolidated net loss of LIR639,000 for

the six months ended 30 September 2013 (2012 - profit of

LIR33,000). This loss primarily comprised administration expenses

of GBP630,000, of which GBP398,000 was represented by transaction

expenses written off including stamp duty of GBP211,000. The

vineyard operating costs of GBP122,000 were largely offset by the

gain in the fair value of biological assets (vines), as accounted

for under International Accounting Standard 41. The basic and

diluted loss per ordinary share for the six months ended 30

September 2013 amounted to 7.93 pence (2012 - earnings per share of

0.41 pence).

The main changes to the Company's consolidated balance sheet

since 31 March 2013 reflect the acquisition of the Gusbourne Estate

business and the related freehold property on 27 September 2013.

The total consideration for this acquisition amounted to

GBP7,316,000, further details of which are contained in the

Circular to Shareholders dated 3 September 2013 and also in Note 7

to the unaudited interim results below.

Board and senior management

Upon completion of the Gusbourne Estate acquisition, the board

of the Company was enlarged by the appointments of Andrew Weeber,

the founder and vendor of the Gusbourne Estate business, as

non-Executive Chairman of the Company and by the appointment of

Paul Bentham as a Non-Executive Director.

The Company's broader management team has also been enlarged

with the successful integration of the two complementary management

teams of the Gusbourne Estate business and Gusbourne Plc. This has

provided an experienced and professional executive team which is

well placed to further expand and develop the Gusbourne Estate

business.

Current trading and outlook

The sales of Gusbourne Estate's award winning sparkling and

still wines are performing to expectations and media and consumer

interest in the Company's products continues to be supported by the

quality of its products and its continuing success in winning

awards for them. On 13 November 2013 the Company was delighted to

be presented with two awards from the long established and

prestigious International Wine and Spirit Competition ("IWSC").

These two awards were for "English Wine Producer of the Year" and

for "Best Bottle Fermented Sparkling Wine" for Gusbourne Estate

Brut Reserve 2008.

This year's grape harvest at the Company's vineyards in Kent and

Sussex took place later than usual as a result of the late start to

the growing season. However, the yield volumes were excellent and

more than double the Company's original expectations. The grapes

harvested have continued to meet the unique quality expectations of

Gusbourne Estate. The Company's winery, situated at its freehold

estate in Kent, performed particularly well in dealing with the

larger than expected volumes and these have added significant

stocks of wine to the Company's inventory. Plans are well advanced

for next year's planting of further vineyards on Gusbourne Estate's

freehold estate in Kent.

The Company's growth strategy in this industry requires long

term planning and the Company continues to make steady and pleasing

progress towards its long term goals.

For further information contact:

Gusbourne Plc

Andrew Weeber/Ben Walgate/Ian Robinson +44 (0)1233 758 666

Cenkos Securities plc

Nicholas Wells +44 (0)20 7397 8900

Note: This announcement and other press releases are available

to view at the Company's website: www.gusbourneplc.com

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 September 2013

Unaudited Unaudited Audited

Six months Six months Year ended

to to

30 September 30 September 31 March

Notes 2013 2012 2013

GBP'000 GBP'000 GBP'000

Revenue - - -

Cost of sales (122) - -

Gain in fair value less estimated

costs to sell

of biological assets 102 - 1

------------ ------------ -----------

Gross profit (20) - 1

Transactions expenses - stamp

duty 8 (211) - -

Transactions expenses - other 8 (187) - (259)

Other administrative expenses (232) (69) (352)

--------------------------------------- ----- ------------ ------------ -----------

Total Administrative expenses (630) (69) (611)

------------ ------------ -----------

Loss from operations (650) (69) (610)

Finance income 19 102 156

Finance expense (8) - -

(Loss)/profit before tax (639) 33 (454)

Tax expense - - -

(Loss)/profit for the period

attributable to

owners of the parent (639) 33 (454)

------------ ------------ -----------

(Loss)/earnings per share attributable

to

the ordinary equity holders

of the parent:

Basic (7.93p) 0.41p (5.68p)

Diluted (7.93p) 0.41p (5.68p)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 30 September 2013

Consolidated balance sheet Unaudited Unaudited Audited

30 September 30 September 31 March

Notes 2013 2012 2013

Assets GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 2 5,445 60 347

Goodwill 3 1,004 - -

Biological assets 4 1,254 - 154

7,703 60 501

------------ ------------ --------

Current assets

Inventories 5 1,015 135 137

Trade and other receivables 178 103 295

Cash and cash equivalents 2,770 4,046 3,128

------------ ------------ --------

3,963 4,284 3,560

------------ ------------ --------

Total assets 11,666 4,344 4,061

------------ ------------ --------

Liabilities

Current liabilities

Trade and other payables (766) (39) (194)

Redeemable preference shares - - (50)

(766) (39) (244)

------------ ------------ --------

Non-current liabilities

Loans and borrowings 6 (3,777) - -

(3,777) - -

Total liabilities (4,543) (39) (244)

NET ASSETS 7,123 4,305 3,817

------------ ------------ --------

Issued capital and reserves attributable

to

owners of the parent

Share capital 7,612 4,000 4,000

Share premium 346 - 266

Merger reserve (13) - (266)

Retained earnings (822) 305 (183)

----- ----- -----

TOTAL EQUITY 7,123 4,305 3,817

----- ----- -----

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 30 September 2013

Unaudited Unaudited Audited

Six months to Six months to Six months to Period to

30 September 30 31 March

September

2013 2012 2013

GBP'000 GBP'000 GBP'000

Cashflows from operating

activities

(Loss)/profit for the period before tax (639) 33 (454)

Adjustments for:

Depreciation of property, plant and equipment 12 8 18

(Profit)/loss on disposal of

property, plant

and equipment (8) - -

Finance income (19) (102) (156)

Finance expense 8 - -

Movement in fair value of biological assets (102) - (1)

(748) (61) (593)

Decrease/(Increase) in trade and other

receivables 117 (82) (275)

Increase in inventories (2) (51) (53)

Increase/(Decrease) in trade and other payables 572 15 170

------------------ ----------- ---------

Cash generated from operations 687 (118) (158)

Income taxes paid - - -

------------------ ----------- ---------

Net cash flows from operating activities (61) (179) (751)

Investing activities

Purchases of property, plant and equipment (762) - (297)

Purchase of biological assets - - (153)

Purchase of business and assets (7,000) - -

Sale of property, plant and equipment 35 - -

Net cash from investing activities (7,727) - (450)

------------------ ----------- ---------

Financing activities

Proceeds from issue of share capital 3,901 - -

Share issue expenses (209) - -

Issue of redeemable preference shares - - 50

Redemption of preference shares (50) - -

Proceeds from bank borrowings 2,025 - -

Proceeds from issue of deep discount bond 1,750 - -

Interest paid (6) - -

Interest received 19 102 156

------------------ ----------- ---------

Net cash from financing activities 7,430 102 206

CONSOLIDATED STATEMENT OF CASH FLOWS (continued)

For the six months ended 30 September 2013

Unaudited Unaudited Audited

Six months to Six months to Six months to Period to

30 September 30 September 31 March

2013 2012 2013

GBP'000 GBP'000 GBP'000

Net decrease in cash and cash equivalents (358) (77) (995)

Cash and cash equivalents at beginning of period 3,128 4,123 4,123

------------------------ ------------- ---------

Cash and cash equivalents at end of period 2,770 4,046 3,128

======================== ============= =========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 September 2013

Audited

Total

attributable

to equity

Audited holders

Audited Share Audited Share Audited Merger Retained of

capital premium reserve earnings parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

31 March 2012 4,000 266 (266) 271 4,271

Comprehensive income

for the year

(Loss) - - - (454) (454)

______ ______ ______ ______ ______

Total comprehensive

income for the year - - - (454) (454)

______ ______ ______ ______ ______

31 March 2013 4,000 266 (266) (183) 3,817

______ ______ ______ ______ ______

Unaudited

Total

attributable

to equity

Unaudited Unaudited Unaudited Unaudited holders

Share Share Merger Retained of

capital premium reserve earnings parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

31 March 2013 4,000 266 (266) (183) 3,817

Comprehensive income

for the year

(Loss) - - - (639) (639)

Issue of ordinary

shares 3,612 289 253 - 4,154

Share issue expenses - (209) - - (209)

______ ______ ______ ______ ______

Total comprehensive

income for the year 3,612 80 253 (639) 3,306

______ ______ ______ ______ ______

30 September 2013 7,612 346 (13) (822) 7,123

______ ______ ______ ______ ______

NOTES TO THE ACCOUNTS

For the six months ended 30 September 2013

1 Statement of accounting policies

The interim financial statements have been prepared in

accordance with the recognition and measurement principles as

adopted by the EU, applying the accounting policies and

presentation that were applied in the preparation of the Company's

published consolidated financial statements for the year ended 31

March 2013.

The financial information for the six months ended 30 September

2013 has not been subject to an audit nor a review in accordance

with International Standard on Review Engagements 2410, Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity, issued by the Auditing Practices Board. The

comparative financial information presented herein for the year

ended 31 March 2013 does not constitute full statutory accounts

within the meaning of Section 434 of the Companies Act 2006. The

Group's annual report and accounts for the year ended 31 March 2013

have been delivered to the Registrar of Companies. The Group's

independent auditor's report was unqualified and did not include

references to any matters to which the auditors drew attention by

way of emphasis without qualifying their report and did not contain

a statement under section 498(2) or 498(3) of the Companies Act

2006.

Basis of preparation

The Board of the Company continually assesses and monitors the

key risks of the business. These risks have not significantly

changed from those set out in the Company's Annual Report for the

year ended 31 March 2013. The Board has reviewed forecasts and

remains satisfied with the Company's funding and liquidity

position. On the basis of its forecast and available facilities and

cash balances held on the balance sheet, the Board has concluded

that the going concern basis of preparation continues to be

appropriate.

2 Property, plant and equipment

Unaudited Unaudited Audited

30 September 30 September 31 March

2013 2012 2013

GBP'000 GBP'000 GBP'000

Freehold property 4,585 - 222

Plant, machinery and motor vehicles 420 60 83

Vineyard expenditure 427 - 40

Computer equipment 13 - 2

------------ ------------ --------

5,445 60 347

------------ ------------ --------

The additions in the period include GBP4,363,000 of Freehold

land and buildings, GBP71,000 of plant, machinery and motor

vehicles and GBP5,000 of computer equipment which were acquired as

part of the acquisition of the Gusbourne Estate business and

related freehold property on 27 September 2013.

Vineyard expenditure includes planting expenditure in relation

to vineyards which are carried forward at cost until the vines

reach maturity at which point they are re-measured and transferred

to biological assets.

NOTES TO THE ACCOUNTS (continued)

For the six months ended 30 September 2013

3 Goodwill

Unaudited Unaudited Audited

30 September 30 September 31 March

2013 2012 2013

GBP'000 GBP'000 GBP'000

Goodwill 1,004 - -

1,004 - -

------------ ------------ --------

Goodwill arose on the acquisition of the Gusbourne Estate

business and related Freehold Property and has been calculated as

the difference between the fair value of the consideration paid and

the provisional fair value of the assets and liabilities acquired.

The goodwill has been capitalised and impairment tests are carried

out at reporting dates.

4 Biological assets

Vines

GBP'000

At 1 April 2012 -

Additions 153

Change in fair value 1

At 31 March 2013 154

-------

Acquisitions 998

Change in fair value 102

At 30 September 2013 1,254

-------

Acquisitions in the period comprise biological assets which were

acquired as part of the acquisition of the Gusbourne Estate

business and related freehold property which completed on 27

September 2013.

5 Inventories

Unaudited Unaudited Audited

30 September 30 September 31 March

2013 2012 2013

GBP'000 GBP'000 GBP'000

Raw materials and consumables 36 - -

Wine 979 135 137

------------ ------------ --------

1,015 135 137

------------ ------------ --------

NOTES TO THE ACCOUNTS (continued)

For the six months ended 30 September 2013

6 Loans and borrowings - non-current

Unaudited Unaudited Audited

30 September 30 September 31 March

2013 2012 2013

GBP'000 GBP'000 GBP'000

Bank loan ( secured) 2,025 - -

Deep discount bond (secured) 1,752 - -

3,777 - -

------------ ------------ --------

The secured bank loan is repayable after 5 years, and is subject

to an interest rate of 3% above Barclays' base rate. It is secured

by a cross guarantee and debenture granted by Gusbourne Estate

Limited and the Company, a legal charge granted by Gusbourne Estate

Limited and a charge over a cash deposit granted by the

Company.

Thesecured deep discount bond was issued by the Company at a

subscription priceof GBP1,750,000. The bond has a 4 year term and

is redeemable at its nominal price of GBP2,337,518 on 27 September

2017. The bond may be redeemed early, subject to certain

conditions. Between27 September 2015 and 27 September 2016, the

bond holders have the option to convert some or all of the bonds

into the Company's Shares, at a price of 66 pence per share. The

bond is secured by debentures granted by the Company and Gusbourne

Estate Limited and a legal charge granted by Gusbourne Estate

Limited.

7 Business combinations

On 27 September 2013, Gusbourne Estate Limited, a wholly owned

subsidiary of the Company acquired the Gusbourne Estate business

and related Freehold Property for a total consideration of

GBP7,316,000, which includes contingent consideration of

GBP63,000.

Unaudited

Provisional fair value at

acquisition

GBP'000

Property, plant and equipment 4,439

Biological Assets 998

Inventories 875

Net assets acquired 6,312

Goodwill 1,004

Consideration 7,316

Satisfied by:

Cash to vendors 4,200

Deep discount bond issued to the

vendors 1,750

Market value of shares issued

to the vendors 1,303

Contingent consideration 63

Consideration 7,316

Fair values are provisional and will continue to be reviewed in

the 12 months following the acquisition.

NOTES TO THE ACCOUNTS (continued)

For the six months ended 30 September 2013

8 Transaction expenses

Transaction expenses for the period to 30 September 2013

represent expenses incurred in connection with the acquisition of

the Gusbourne Estate business and related Freehold Property.

Transaction expenses for the period to 31 March 2013 represent

expenses incurred in connection with the merger, on 24 October

2012, with Shellproof Limited.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UWRUROWAUAAA

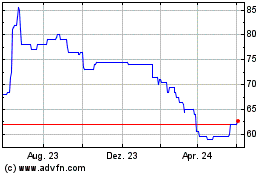

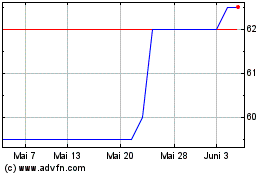

Gusbourne (LSE:GUS)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Gusbourne (LSE:GUS)

Historical Stock Chart

Von Jul 2023 bis Jul 2024