Directors' fees 56,922 40,000

Audit fees 21,120 20,251

Performance fees - 1,319,179

------------ ----------

7,605,134 2,343,113

------------ ----------

Profit/(loss) for the period (5,485,000) 7,049,778

Tax incurred on dividend received (104,758) (663)

------------ ----------

(5,589,758) 7,049,778

Other comprehensive income - -

------------ ----------

Total comprehensive income/(loss) for

the period (5,589,758) 7,049,778

============ ==========

Attributable to:

Equity holders (5,559,277) 6,985,000

Non-controlling interest (30,481) 64,778

(5,589,758) 7,049,778

------------ ----------

Basic gains/(loss) per share for gain

attributable to the equity holders see note

of the Company during the period 10 10 0.1639

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2014

Notes As at As at

30 June 2014 30 June

2013

-------------- ---------

USD USD

ASSETS

Financial assets at fair value

through profit or loss 5(a) 65,669,485 51,038,216

Trade and other receivables 6 1,691,088 1,160,571

Cash and cash equivalents 22,818,766 3,031,033

----------- -----------

Total assets 90,179,339 55,229,820

=========== ===========

EQUITY AND LIABILITIES

Liabilities

Financial liabilities at fair value

through profit or loss 5(b) 11,684,689 5,479,421

Trade and other payables 8 2,506,619 1,520,732

Total liabilities 14,191,308 7,000,153

----------- -----------

Equity

Ordinary share capital 7(a) 426,303 426,303

Ordinary share premium 37,844,593 38,092,003

C share capital 7(b) 2,920,000 -

C share premium 26,280,000 -

Retained earnings 8,141,919 9,352,924

----------- -----------

Equity attributable to equity holders

of the parent 75,612,815 47,871,230

Non-controlling interest 375,216 358,437

Total equity 75,988,031 48,229,667

----------- -----------

Total equity and liabilities 90,179,339 55,229,820

=========== ===========

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD FROM 1 JANUARY 2014 TO 30 JUNE 2014

Ordinary Share C Share C Share Retained Total Non Total equity

Share premium Issued premium earnings controlling

Issued capital interest

capital

--------- ----------- ---------- ----------- -------------- -------------- ------------ --------------

USD USD USD USD USD USD USD USD

At 1 January

2014 426,303 37,921,452 - - 13,701,196 52,048,951 405,697 52,454,648

C Share

Placing - - 2,920,000 26,280,000 - 29,200,000 - 29,200,000

Total

comprehensive

income for

the period - - - - (5,559,277) (5,559,277) (30,481) (5,589,758)

Dividend - (76,859) - - - (76,859) - (76,859)

At 30 June

2014 426,303 37,844,593 2,920,000 26,280,000 8,141,919 75,612,815 375,216 75,988,031

========= =========== ========== =========== ============== ============== ============ ==============

At 1 January 2013 426,303 38,262,525 - - 2,367,924 41,056,752 293,659 41,350,411

Total comprehensive

income for the period - - - - 6,985,000 6,985,000 64,778 7,049,778

Dividend - (170,522) - - - (170,522) - (170,522)

At 30 June 2013 426,303 38,092,003 - - 9,352,924 47,871,230 358,437 48,229,667

======== =========== ==== ==== ============ ============ ========= ============

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE PERIOD FROM 1 JANUARY 2014 TO 30 JUNE 2014

Notes For the Period For the Period

Ended 30 Ended 30

June 2014 June 2013

--------------- ----------------

USD USD

Cash flows from operating activities

Comprehensive income/ (loss) for the

period (5,589,758) 7,049,777

Adjustment for:

Interest income (722,152) (337,420)

Dividend income (995,397) (932,097)

(Gain)/ loss on financial assets at fair

value through profit or loss 5,068,917 (7,391,461)

(Gain)/ loss on financial liabilities

at fair value through profit or loss (71,392) (246,236)

Operating losses before working capital

changes (2,309,782) (1,857,437)

Increase in other receivables and prepayments (83,777) (54,077)

Increase in other payables and accrued

expenses 9,385 1,023,984

------------- -------------

Net cash used in operating activities (2,384,174) (887,530)

------------- -------------

Investing activities

Purchase of financial assets at fair

value through profit or loss 5(a) (16,679,578) (16,106,663)

Disposal of financial assets at fair

value through profit or loss 5(a) 1,415,107 14,619,208

Purchase of financial liabilities at

fair value through profit or loss 5(b) 6,792,217 (2,304,319)

Disposal of financial liabilities at

fair value through profit or loss 5(b) - 3,484,092

Interest received 453,743 239,099

Dividend received 770,496 524,081

-------------

Net cash generated from investing activities (7,248,015) 455,498

------------- -------------

Financing activities

Dividend paid (162,149) (170,522)

C Share Placing 29,200,000 -

------------- -------------

Net cash flow used in financing activities 29,037,851 (170,522)

------------- -------------

Net increase/ (decrease) in cash and

cash equivalents 19,405,662 (602,554)

Cash and cash equivalents at 1 January 3,413,104 3,633,587

-------------

Cash and cash equivalents at 30 June 22,818,766 3,031,033

============= =============

1. GENERAL INFORMATION

Africa Opportunity Fund Limited (the "Company") was launched and

admitted to trading on the London Stock Exchange AIM market ("AIM")

in July 2007. On 17 April 2014, AOF closed a placing of 29.2

million C shares. The Ordinary shares and the C shares of the

Company were admitted to trading on the London Stock Exchange's

Specialist Fund Market ("SFM"). Concurrent with the listing on the

SFM, the ordinary shares were cancelled from admission to trading

on AIM.

Africa Opportunity Fund Limited is a closed-ended fund

incorporated with limited liability and registered in Cayman

Islands under the Companies Law on 21 June 2007 and with registered

number MC-188243.

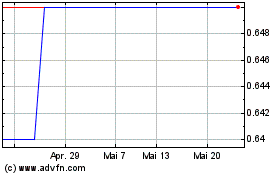

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

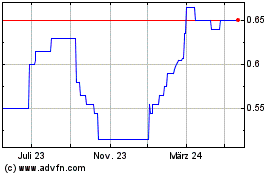

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024