-- The revised financial liability provisions maintain the

existing amortised cost measurement basis for most liabilities. New

requirements apply where an entity chooses to measure a liability

at fair value through profit or loss - in these cases, the portion

of the change in fair value related to changes in the entity's own

credit risk is presented in other comprehensive income rather than

within profit or loss.

Amendments in 2013

-- Introduces a new chapter to IFRS 9 on hedge accounting,

putting in place a new hedge accounting model that is designed to

be more closely aligned with how entities undertake risk management

activities when hedging financial and non-financial risk

exposures

-- Permits an entity to apply only the requirements introduced

in IFRS 9 (2010) for the presentation of gains and losses on

financial liabilities designated as at fair value through profit or

loss without applying the other requirements of IFRS 9, meaning the

portion of the change in fair value related to changes in the

entity's own credit risk can be presented in other comprehensive

income rather than within profit or loss

-- Removes the mandatory effective date of IFRS 9 (2013), IFRS 9

(2010) and IFRS 9 (2009), leaving the effective date open pending

the finalisation of the impairment and classification and

measurementrequirements. Notwithstanding the removal of an

effective date, each standard remains available for

application.

These amendments are not expected to impact the Group's

financial statement position or performance.

IAS 32 Financial Instruments: Presentation - Offsetting

Financial Assets and Financial Liabilities - effective

1 January 2014

This amendment to IAS 32 Financial Instruments: Presentation was

made to clarify certain aspects because of diversity in application

of the requirements on offsetting thereby focusing on four main

areas:

-- the meaning of 'currently has a legally enforceable right of set-off'

-- the application of simultaneous realisation and settlement

-- the offsetting of collateral amounts

-- the unit of account for applying the offsetting requirements.

These amendments are not expected to impact the Group's

financial position or performance.

Investment Entities (Amendments to IFRS 10, IFRS 12 and IAS 27)

- effective 1 January 2014

These amendments to IFRS 10 Consolidated Financial Statements,

IFRS 12 Disclosure of Interests in Other Entities and IAS 27

Separate Financial Statements were made to:

-- provide 'investment entities' (as defined) an exemption from

the consolidation of particular subsidiaries and instead require

that an investment entity measure the investment in each eligible

subsidiary at fair value through profit or loss in accordance with

IFRS 9 Financial Instruments or IAS 39 Financial Instruments:

Recognition and Measurement

-- require additional disclosure about why the entity is

considered an investment entity, details of the entity's

unconsolidated subsidiaries, and the nature of relationship and

certain transactions between the investment entity and its

subsidiaries

-- require an investment entity to account for its investment in

a relevant subsidiary in the same way in its consolidated and

separate financial statements (or to only provide separate

financial statements if all subsidiaries are unconsolidated).

These amendments are not expected to impact the Group's

financial position or performance.

Recoverable Amount Disclosures for Non-Financial Assets

(Amendments to IAS 36) - effective 1 January 2014

IAS 36 Impairment of Assets was amended to reduce the

circumstances in which the recoverable amount of assets or

cash-generating units is required to be disclosed, clarify the

disclosures required, and to introduce an explicit requirement to

disclose the discount rate used in determining impairment (or

reversals) where recoverable amount (based on fair value less costs

of disposal) is determined using a present value technique. These

amendments are not expected to impact the Group's financial

position or performance.

Novation of Derivatives and Continuation of Hedge Accounting

(Amendments to IAS 39) - effective 1 January 2014

The amendments to IAS 39 Financial Instruments: Recognition and

Measurement were made to clarify that there is no need to

discontinue hedge accounting if a hedging derivative is novated,

provided certain criteria are met.

A novation indicates an event where the original parties to a

derivative agree that one or more clearing counterparties replace

their original counterparty to become the new counterparty to each

of the parties. In order to apply the amendments and continue hedge

accounting, novation to a central counterparty (CCP) must happen as

a consequence of laws or regulations or the introduction of laws or

regulations. These amendments are not expected to impact the

Group's financial position or performance.

Defined Benefit Plans: Employee Contributions (Amendments to IAS

19) - effective 1 July 2014

This amendment to IAS 19 Employee Benefits clarifies the

requirements that relate to how contributions from employees or

third parties that are linked to service should be attributed to

periods of service. In addition, it permits a practical expedient

if the amount of the contributions is independent of the number of

years of service, in that contributions, can, but are not required,

to be recognised as a reduction in the service cost in the period

in which the related service is rendered. These amendments are not

expected to impact the Group's financial position or

performance.

Annual Improvements 2010-2012 Cycle - effective 1 July 2014

The annual improvements 2010-2012 Cycle make amendments to the

following standards:

-- IFRS 2 - Amends the definitions of 'vesting condition' and

'market condition' and adds definitions for 'performance condition'

and 'service condition';

-- IFRS 3 - Require contingent consideration that is classified

as an asset or a liability to be measured at fair value at each

reporting date;

-- IFRS 8 - Requires disclosure of the judgements made by

management in applying the aggregation criteria to operating

segments, clarify reconciliations of segment assets only required

if segment assets are reported regularly;

-- IFRS 13 - Clarify that issuing IFRS 13 and amending IFRS 9

and IAS 39 did not remove the ability to measure certain short-term

receivables and payables on an undiscounted basis (amends basis for

conclusions only);

-- IAS 16 and IAS 38 - Clarify that the gross amount of

property, plant and equipment is adjusted in a manner consistent

with a revaluation of the carrying amount; and

-- IAS 24 -Clarify how payments to entities providing management

services are to be disclosed.

These amendments are not expected to impact the Group's

financial position or performance.

Annual Improvements 2011-2013 Cycle - effective 1 July 2014

The annual improvements 2011-2013 Cycle make amendments to the

following standards:

-- IFRS 1 - Clarify which versions of IFRSs can be used on

initial adoption (amends basis for conclusions only);

-- IFRS 3 - Clarify that IFRS 3 excludes from its scope the

accounting for the formation of a joint arrangement in the

financial statements of the joint arrangement itself;

-- IFRS 13 - Clarify the scope of the portfolio exception in paragraph 52; and

-- IAS 40 - Clarifying the interrelationship of IFRS 3 and IAS

40 when classifying property as investment property or

owner-occupied property.

These amendments are not expected to impact the Group's

financial position or performance.

IFRIC 21 Levies - effective 1 January 2014

Provides guidance on when to recognise a liability for a levy

imposed by a government, both for levies that are accounted for in

accordance with IAS 37 Provisions, Contingent Liabilities and

Contingent Assets and those where the timing and amount of the levy

is certain.

The Interpretation identifies the obligating event for the

recognition of a liability as the activity that triggers the

payment of the levy in accordance with the relevant legislation. It

provides the following guidance on recognition of a liability to

pay levies:

-- The liability is recognised progressively if the obligating

event occurs over a period of time; and

-- If an obligation is triggered on reaching a minimum

threshold, the liability is recognised when that minimum threshold

is reached.

These amendments are not expected to impact the Group's

financial position or performance.

IFRS 14 Regulatory Deferral Accounts - effective 1 January

2016

The Interpretation was issued to provide first-time adopters of

IFRS with relief from derecognizing rate-regulated assets and

liabilities until a comprehensive project on accounting for such

assets and liabilities as completed by the IASB. This interim

standard is intended to encourage rate-regulated entities to adopt

IFRS while bridging the gap with entities that already apply IFRS,

but do not recognize regulatory deferral accounts. The standard

will have no impact on the financial position or performance of the

Group.

4. SIGNIFICANT ACCOUNTING JUDGEMENTS, ESTIMATES AND ASSUMPTIONS

The preparation of the Group's financial statements requires

management to make judgements, estimates and assumptions that

affect the reported amounts recognised in the financial statements

and disclosure of contingent liabilities. However, uncertainty

about these assumptions and estimates could result in outcomes that

could require a material adjustment to the carrying amount of the

asset or liability affected in future periods.

Judgements

In the process of applying the Group's accounting policies,

management has made the following judgements, which have the most

significant effect on the amounts recognised in the financial

statements:

Going Concern

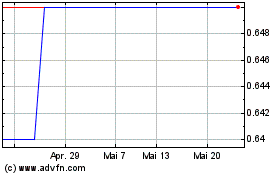

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

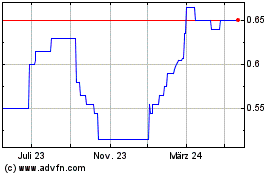

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024