TIDMAOF

Africa Opportunity Fund Limited (AOF.L)

Announcement of Unaudited Interim Results for the 6 month period to

30 June 2009

Africa Opportunity Fund Limited ("AOF" or the "Company"), the

closed-ended investment company which aims to achieve capital growth

and income through investments in value, arbitrage, and special

opportunities derived from the continent of Africa announces its

unaudited results for the 6 month period to 30 June 2009.

Highlights:

* AOF's net asset value per share of US$0.615 increased 21% from

the 31 December 2008 net asset value per share of US$0.511.

* As at 30 June 2009, AOF's investment allocation was 50% listed

equities, 40% Debt and 10% cash.

* Dividends in the amount of $0.0026 per share were paid on 8 April

2009 and 8 July 2009.

* AOF generated basic earnings per share of US$0.109 during the

first six months of 2009.

* AOF initiated a tender offer which closed on 26 February 2009.

* A distribution of US$0.3705 per share, net of fees, was made to

the exiting shareholders on 30 June 2009.

Investment Manager's Statement

NAV Performance and Market Conditions: The first half of 2009 was

eventful for AOF's portfolio, in what was generally an upbeat six

month period for world markets. The NAV was $0.62 per share as of 30

June, a rise of 21% from where it began 2009 and a rise of 21% from

where it began Q2. As a reference, in USD terms during the first

half of 2009 the S&P 500 rose 2%, South Africa rose 25%, Egypt rose

22%, but Kenya declined 4%, and Nigeria declined 21%.

Portfolio Highlights: During the period our holdings in Moto

Goldmines and Addax Petroleum were the subject of agreed takeover

bids. In the case of Moto, the Canadian listed Red Back Mining made

an all-share offer on 1 June which represented a 46% premium over the

then current share price and a transaction valued at $525 million.

Subsequent to 30th June Randgold Resources announced a cash and

shares offer in conjunction with Anglogold Ashanti that was a slight

improvement in value but offered the certainty of a partial cash

payment. Year to date AOF has earned a 172% return on its Moto

investment.

In the case of Addax, the China Petroleum Corporation (Sinopec) made

an all-cash offer on 24 June which represented a 47% premium over the

share price prior to disclosure on 5 June by Addax that it was in

discussions with potential acquirers. The transaction is valued at

$8.8 billion and was described as "transformational" by Sinopec. It

is a remarkable turn of events from the end of last year. In

November, for example, AOF purchased convertible bonds in Addax at

less than 50% of par and we purchased shares in Addax at less than

$20. The bonds have a change of control put and will be redeemed at

par as part of the transaction, and the takeover price for the shares

of $52.80 represents a 133% return from where Addax shares began the

year.

Also during the period, one of our fixed income holdings, Katanga

Mining, appreciated 70% in value to 65% of par from a low of 35% in

March. This was the result of Glencore's announcement that it would

underwrite a $250 million equity rights offering, meaning that this

new money would support the company in a junior position to AOF's

bonds. While the transaction resulted in Glencore acquiring

ownership in the range of 78% of Katanga's outstanding equity, it

represents a substantial commitment to Katanga and to the DRC, and is

very good news for bondholders.

AOF recently acquired subordinated notes issued by Old Mutual PLC, a

FTSE 100 investment grade company that earned more than 70% of its

adjusted operating profits in Africa in 2007 and 2008. The notes rank

senior to the equity in the capital structure and enjoy a $7 billion

equity cushion provided by those shares, but were priced in the 30s

at current yields between 16% and 20%. At those levels, the notes

could triple in price and still trade below par. As with many

insurance companies in the world today, Old Mutual's balance sheet is

stretched, the dividend on the ordinary shares has been cancelled,

and the market is valuing the shares below book value. However, Old

Mutual remained profitable in 2008, it retains an investment grade

rating, and in our judgment is adequately capitalized. While the

market may prize the liquidity of the ordinary shares and view a 30%

discount to book value as a margin of safety, we are delighted to

accept illiquidity for a high yield and a 90% discount to book value.

Elsewhere in the portfolio challenges remain. Diamondcorp has

encountered operational delays and is running short of cash, and the

Ivory Coast has defaulted on its Sphynx notes. However, overall the

portfolio is performing well amidst a difficult economic environment.

Portfolio Appraisal Value: As of 30th June, the Manager's appraisal

of the intrinsic economic value of the portfolio was $0.78 per

share. The market price of $0.48 as of 30 June, represents a 38%

discount. Note the Appraisal Value is intended to provide a measure

of the Manager's long-term view of the attractiveness of AOF's

portfolio. It is a subjective estimate, and does not tell when that

value will be realized, nor does it guarantee that any particular

security will reach its Appraisal Value.

Strategy: We are focused on investing in companies with minimal debt

and little need to access the capital markets, with a particular

emphasis on goods and services in short supply in Africa. Market

leading, cash generative businesses are trading at historically low

valuations, and where we can find companies offering a single digit

PE, significant free cash flow, and a secure market position, we will

look to deploy risk capital. At the same time, in the realm of fixed

income, where we can find a 20%+ yield to maturity and high asset

coverage with a loan-to-value ratio better than 50%, we will also

look to deploy risk capital.

Tender Offer: AOF announced a tender offer in early February which

was closed on the 26th of February. Shareholders were given the

option to submit fully 100% of their holdings for redemption. Given

the severe pressures on the investment community, including some of

AOF's shareholders, the Manager is pleased that 37% of holders chose

to remain invested, and is working diligently to provide rewarding

long term returns for its smaller but newly committed shareholder

base.

Africa Opportunity Partners

CONSOLIDATED INCOME STATEMENT

FOR THE PERIOD 1 JANUARY THROUGH 30 JUNE 2009 AND

2008

Note For the Half For the Half

Year Year

Ended 30 Ended 30 June

June 2009 2008

USD USD

Revenue

Interest income 811,715 3,650,710

Dividend income 983,027 1,232,947

Profit on financial assets at fair

value through profit or loss 980,634 1,883,603

Liquidation fee income 1,505,413 -

Other income 833,957 147,322

5,114,746 6,914,582

Expenses

Management fee 178,437 1,224,839

Custodian, secretarial and

administration fees 100,642 261,091

Brokerage fees and commissions 6,194 311,475

Audit fees 7,566 26,000

Directors' fees 22,144 59,672

Other operating expenses 8,669 62,177

Losses on financial assets at fair

value through profit or loss - 175,163

Realised exchange loss 63,901 -

Unrealised exchange loss on fixed

deposit - 54,773

387,553 2,175,190

Gain for the period 4,727,193 4,739,392

Attributable to:

Equity holders of the Company 4,649,609 4,701,070

Minority interest 77,584 38,322

4,727,193 4,739,392

Basic gain per share for gain

attributable to the 9

equity holders of the Company

during the period 0.1091 0.0376

Note: First half 2009 figures are for the continuing shareholders

only. 42,630,327 or 36.9% of the shares remained post the February

2009 tender offer. Comparative figures should be viewed in this

context.

The notes form an integral part of these financial statements.

CONSOLIDATED BALANCE SHEET

FOR THE PERIOD 1 JANUARY THROUGH 30 JUNE 2009 AND 2008

Notes As at 30 June As at 30 June

2009 2008

USD USD

ASSETS

Held-to-maturity financial assets - 4,730,042

Financial assets at fair value 4 24,257,275 102,654,956

through profit or loss

Trade and other receivables 5 1,098,068 2,125,459

Cash and cash equivalents 6 3,116,285 16,656,293

Liquidation assets 5,290,748 -

Total assets 33,762,376 126,166,750

EQUITY AND LIABILITIES

Equity attributable to equity

holders of the parent

Share capital 7 426,303 1,250,000

Share premium 39,541,433 118,077,481

Retained losses (13,738,621) 4,535,042

Shareholders' interests 26,229,115 123,862,523

Minority interest 495,189 784,800

Total equity 26,724,304 124,647,323

LIABILITIES

Trade and other payables 8 1,747,324 1,519,427

Deferred liability - liquidation 5,290,748 -

Total equity and liabilities 33,762,376 126,166,750

Note: First half 2009 figures are for the continuing shareholders

only. 42,630,327 or 36.9% of the shares remained post the February

2009 tender offer. Comparative figures should be viewed in this

context.

The notes form an integral part of these financial statements.

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD 1 JANUARY THROUGH 30 JUNE 2009

ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT

Issued Share Retained Minority Total

capital premium Losses Total interest Equity

USD USD USD USD USD USD

At 01

January 2008 1,250,000 119,489,981 (166,028) 120,573,953 746,478 121,320,431

Shares buy

back (94,900) (6,262,650) - (6,357,550) - (6,357,550)

Loss for the

year - - (49,658,231) (49,658,231) (328,873) (49,987,104)

Dividend - (5,486,263) - (5,486,263) - (5,486,263)

At 31

December

2008 1,155,100 107,741,068 (49,824,259) 59,071,909 417,605 59,489,514

Attributable

to the

liquidation

pool * (728,797) (67,977,957) 31,436,029 (37,270,725) - (37,270,725)

Profit for

the period

ended 30

June 2009 - - 4,649,609 4,649,609 77,584 4,727,193

Dividend - (221,678) - (221,678) - (221,678)

At 30 June

2009 426,303 39,541,433 (13,738,621) 26,229,115 495,189 26,724,304

* Adjustment to record tender offer share buyback and cancellation

and to allocate pro-rata share of loss to the liquidating

shareholders for losses incurred inception to 27 February 2009.

The notes form an integral part of these financial statements.

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED CASH FLOW STATEMENT

FOR THE PERIOD 1 JANUARY THROUGH 30 JUNE 2009 AND 2008

For the Period For the Period

Ended 30 June Ended 30 June

2008 2008

USD USD

Cash flows from operating

activities

Loss for the year/ period 4,727,193 4,739,392

Adjustment for:

Losses attributable to liquidating

pool 31,436,029 -

Stated capital attributable to

liquidating pool (68,706,754) -

Assets attributable to liquidating

pool 33,785,430 -

Interest income (811,715) (3,650,711)

Loss/(Gain) on financial assets at

fair value through profit or loss (1,678,649) (1,883,603)

Dividend income (983,027) (1,232,947)

Exchange difference on fixed

deposit - (82,842)

Operating loss before working

capital changes (2,231,493) (2,110,711)

Decrease/(increase) in other

receivables and prepayments 196,179 233,442

Increase in other payables and

accrued expenses 130,717 1,291,528

Net cash (used in) / generated from

operating activities (1,904,597) (585,741)

Interest received 811,715 3,650,711

Purchase of financial assets at

fair value through profit or loss (7,935,602) (51,104,465)

Disposal of financial assets at

fair value through profit or loss 8,712,005 2,790,000

Dividend received 983,027 1,232,947

Loss on disposal - 175,163

Net cash used in investing

activities 2,571,145 (43,255,644)

Cash flows from financing

activities

Dividend paid (221,678) (1,412,500)

Shares buy back - -

Net cash flow (used in) / generated

from financing activities (221,678) (1,412,500)

Net (decrease) / increase in cash

and cash equivalents 444,870 (45,253,885)

Cash and cash equivalent at the

start of the year / period 2,671,415 61,827,336

Exchange Difference on fixed

deposits - 82,842

Cash and cash equivalent at the end

of the year / period 3,116,285 16,656,293

The notes form an integral part of these financial statements.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE PERIOD 1 JANUARY THROUGH 30 JUNE 2009

1. GENERAL INFORMATION

Africa Opportunity Fund Limited (the "Company") was launched with an

Alternative Market Listing "AIM" in July 2007. A secondary listing

was obtained on the Channel Islands Stock Exchange ("CISX") in

November 2007.

Africa Opportunity Fund Limited is a closed-ended fund incorporated

with limited liability and registered in Cayman Islands under the

Companies Law on 21 June 2007 and with registered number MC-188243.

The Company is domiciled at PO Box 309 GT, Ugland House, South

Church Street, George Town, Grand Cayman, Cayman Islands.

The Company aims to achieve capital growth and income through

investment in value, arbitrage, and special situations investments in

the continent of Africa. The Company therefore may invest in

securities issued by companies domiciled outside Africa which conduct

significant business activities within Africa. The Company will have

the ability to invest in a wide range of asset classes including real

estate interests, equity, quasi-equity or debt instruments and debt

issued by African sovereign states and government entities.

The Company's investment activities are managed by Africa Opportunity

Partners Limited, a limited liability company incorporated in the

Cayman Islands and acting as the investment manager pursuant to an

Investment Management Agreement dated 18 July 2007.

To ensure that investments to be made by the Company, and the returns

generated on the realisation of investments, are both effected in the

most tax efficient manner, the Company has established Africa

Opportunity Fund L.P. as an exempted limited partnership in the

Cayman Islands. All investments made by the Company will be made

through the limited partnership. The limited partners of the limited

partnership are the Company, AOF CarryCo Limited and Millenium

Special Opportunities Holdings Ltd. The general partner of the

limited partnership is Africa Opportunity Fund (GP) Limited.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of these

unaudited interim financial statements are set out below. These

policies have been consistently applied in dealing with items which

are considered material in relation to the consolidated financial.

Statement of compliance

The financial statements are prepared in accordance with

International Financial Reporting Standards (IFRS) as issued by the

International Accounting Standard Board (IASB).

Basis of preparation

The financial statements have been prepared under the historical cost

convention, as modified by the fair valuation of financial assets at

fair value through profit or loss.

The preparation of financial statements in conformity with IFRS

requires the use of certain critical accounting estimates. It also

requires the Board of Directors to exercise its judgement in the

process of applying the Group's accounting policies. The areas

involving a higher degree of judgement or complexity, or areas where

assumptions and estimates are significant to the financial statements

are disclosed in Note 3.

Basis of consolidation

The consolidated financial statements comprise the financial

statements of the Company and its subsidiaries (referred to as the

"Group") as at 30 June 2009.

Subsidiaries are fully consolidated from the date of acquisition,

being the date on which the Group obtains control and continue to be

consolidated until the date that such control ceases.

The financial statements of the subsidiaries are prepared for the

same reporting period as the parent company, using consistent

accounting policies.

All intra-group balances, income and expenses and unrealised gains

and losses resulting from intra-group transactions are eliminated in

full.

Minority interests represent the portion of profit or loss and net

assets not held by the Group and are presented separately in the

Income Statement and within equity in the Statement of Changes in

Equity from parent shareholders' equity.

Foreign currency translation

(a) Functional and presentation currency

The Group's consolidated financial statements are presented in USD

which is the Group's functional currency. That is the currency of

the primary economic environment in which Africa Opportunity Fund

Limited ("the Company") operates. Each entity in the Group

determines its own functional currency and items included in the

financial statements of each entity are measured using that

functional currency. The functional currency of the entities within

the Group is USD. The Group chose USD as the presentation currency.

(b) Transactions and balances

Transactions in foreign currencies are initially recorded at the

functional currency rate prevailing at the date of transaction.

Monetary assets and liabilities denominated in foreign currencies are

retranslated at the functional currency spot rate of the exchange

ruling at the balance sheet date. All differences are taken to the

income statement. Non-monetary items that are measured in terms of

historical cost in a foreign currency are translated using the

exchange rates as at the dates of the initial transactions.

Non-monetary items measured at fair value in a foreign currency are

translated using the exchange rates at the date when the fair value

is determined.

Financial assets

The Group classifies its financial assets in the following

categories: at fair value through profit or loss, loans and

receivables and held-to-maturity financial assets. The

classification depends on the purpose for which the financial assets

were acquired. Management determines the classification of its

financial assets at initial recognition.

(i) Financial assets at fair value through profit or loss

Financial assets designated at fair value through profit or loss at

inception are those that are managed and their performance evaluated

on a fair value basis in accordance with the Group's documented

investment strategy. The Group's policy is for the Investment Manager

and the partners to evaluate the information about these financial

assets on a fair value basis together with other related financial

information.

The Group determines the classification of its financial assets on

initial recognition and, where allowed and appropriate, re-evaluates

this designation at each financial year end.

Recognition

Regular-way purchases and sales of financial assets are recognised on

the trade date which is the date on which the Group commits to

purchase the asset. Regular way purchases or sales are purchases or

sales of financial assets that require delivery of assets within the

period generally established by regulation or convention in the

market place.

Measurement

When financial assets are recognised initially, they are measured at

fair value, plus, in the case of investments not at fair value

through profit or loss directly attributable transactions costs.

Gains and losses arising from changes in the fair value of the

'financial assets at fair value through profit or loss' category are

presented in the income statement in the period in which they arise.

Interest income from financial assets at fair value through profit or

loss is recognised in the income statement within interest income

using the effective interest method. Dividend income from financial

assets at fair value through profit or loss is recognised in the

income statement within dividend income when the Group's right to

receive payments is established.

(ii) Held-to-maturity financial assets

Non-derivative financial assets with fixed or determinable payments

and fixed maturities are classified as held to-maturity when the

Group has the positive intention and ability to hold to

maturity. After initial measurement held-to maturity investments are

measured at amortised cost using the effective interest method less

allowance for impairment. Gains and losses are recognised in profit

or loss when the investments are derecognised or impaired, as well as

through the amortisation process.

(iii) Loans and receivables

Loans and receivables are non-derivatives financial assets with fixed

or determinable payments that are not quoted in an active market.

Such financial assets are carried at amortised cost using the

effective interest rate method. Gains and losses are recognised in

the consolidated income statement when the loan and receivables are

derecognised or impaired, as well as through the amortisation

process.

(iv) Fair value estimation

Securities listed on a stock exchange or traded on a regulated market

are valued as of the last closing price on such exchange or market.

If no such price is available, the price is determined as the mean of

the bid and ask price for such day. If no such price is available or

if the market price is not representative of the fair market value,

the security is valued based on quotations readily available from

principal-to-principal markets, financial publications, recognised

pricing services or upon the good faith estimate of fair value in

accordance with IFRS, in consultation with the Investment Manager.

(iv) Fair value estimation

Private securities without public markets or the availability of

indicative quotes are valued by the Investment Manager at its best

approximation of fair value. The Investment Manager utilises

financial models to value these investments utilising multiple

investment methodologies or techniques as appropriate, including

discounted cash flows, comparative evaluations, etc.

(v) Impairment of financial assets

The Group assesses at each balance sheet date whether a financial

asset is impaired.

Assets carried at amortised cost

If there is objective evidence that an impairment loss on assets

carried at amortised cost has been incurred, the amount of the loss

is measured as the difference between the asset's carrying amount and

the present value of estimated future cash flows (excluding future

expected credit losses that have not been incurred) discounted at the

financial asset's original effective interest rate (i.e. the

effective interest rate computed at initial recognition). The

carrying amount of the asset is reduced through use of an allowance

account. The amount of the loss is recognised in profit or loss.

If, in a subsequent period, the amount of the impairment loss

decreases can be related objectively to an event occurring after the

impairment was recognised, the previously recognized impairment loss

is reversed, to the extent that the carrying value of the asset does

not exceed its amortised cost at the reversal date. Any subsequent

reversal of an impairment loss is recognised in profit or loss.

Derecognition

A financial asset (or, where a part of a financial asset or part of a

group of similar financial assets) is derecognised when:

* The rights to receive cash flows from the asset have expired;

* The Group retains the right to receive cash flows from the asset,

but has assumed an obligation to pay them in full without

material delay to a third party under a 'pass through'

arrangement; or

* The Group has transferred its rights to receive cash flows from

the asset and either (a) has transferred substantially all the

risks and rewards of the asset, or (b) has neither transferred

nor retained substantially all the risks and rewards of the

asset, but has transferred control of the asset.

When the Group has transferred its rights to receive cash flows from

an asset and has neither transferred nor retained substantially all

the risks and rewards of the asset nor transferred control of the

asset, the asset is recognised to the extent of the Group's

continuing involvement in the asset. Continuing involvement that

takes the form of a guarantee over the transferred asset is measured

at the lower of the original carrying amount of the asset and the

maximum amount of consideration that the Group could be required to

repay.

Financial liabilities

Derecognition

A financial liability is derecognised when the obligation under the

liability is discharged or cancelled or expired.

When an existing liability is replaced by another from the same

lender on substantially different terms, or the terms of an existing

liability are substantially modified, such an exchange or

modification is treated as a derecognition of the original liability

and the recognition of a new liability, and the difference in the

respective carrying amounts is recognised in profit or loss.

Share capital

Ordinary shares are classified as equity.

Revenue recognition

Revenue is recognised to the extent that it is probable that the

economic benefits will flow to the Group and the revenue can be

reliably measured. Revenue is measured at the fair value of the

consideration received, excluding discounts, rebates and sales taxes

or duty.

Interest income:

Revenue is measured as interest accrues using the effective interest

rate.

Interest on bonds and debentures:

Revenue is measured as interest accrues using the effective interest

rate.

Dividend income:

Revenue is recognised when the Group's right to receive the payment

is established.

Other payables

Other payables are recognised initially at fair value and

subsequently measured at amortised cost using the effective interest

method.

Provision

A provision is recognised when and only when there is a present

obligation (legal or constructive) as a result of a past event, and

it is probable that an outflow embodying economic benefits will be

required to settle that obligation and a reliable estimate can be

made of the amount of the obligation. Provisions are reviewed at each

balance sheet date and adjusted to reflect the current best estimate.

Cash and cash equivalents

Cash and cash equivalents comprise cash at bank. Cash equivalents are

short term, highly liquid investments that are readily convertible to

known amounts of cash and which are subject to an insignificant risk

of change in value.

Related parties

For the purposes of these financial statements, parties are

considered to be related to the Group if they have the ability,

directly or indirectly, to control the Group or exercise significant

influence over the Group in making financial and operating decisions,

or vice versa, or where the Company is subject to common control or

common significant influence. Related parties may include key

management personnel and close family members.

Dividend distribution

Dividends are declared and paid to the shareholders when the

directors are satisfied that the Company has sufficient cash

resources to do so.

3. SIGNIFICANT ACCOUNTING JUDGEMENTS, ESTIMATES AND ASSUMPTIONS

The preparation of the financial statements requires management to

make judgements, estimates and assumptions that affect the reported

amounts of revenues, expenses, assets and liabilities at the

reporting date. However, uncertainty about these assumptions and

estimate could result in outcomes that require a material adjustment

to the carrying amount of the asset or liability affected in future

periods.

Critical accounting judgements in applying the Group's accounting

policies

In the process of applying the Group's accounting policies, which are

described in Note 2, the directors have made the following judgements

that have the most effect on the amounts recognised in the financial

statements:-

(i) Determination of functional currency

The determination of the functional currency of the Group is critical

since recording of transactions and exchange differences arising

thereon are dependent on the functional currency selected. As

described in Note 2, the directors have considered those factors

therein and have determined that the functional currency of the Group

is the United States Dollar.

(ii) Fair value of other financial instruments

The fair value of financial instruments that are not traded in an

active market is determined by using valuation techniques including

comparable valuation and Black Scholes model. The Group uses its

judgement to select a variety of methods and make assumptions that

are mainly based on market conditions existing at each balance sheet

date. The judgements include considerations of inputs such as

liquidity risk, credit risk and volatility. Changes in assumptions

about these factors could affect the reported fair value of the

financial instrument.

(iii) Impairment of financial assets

The Group follows the guidance of IAS 39 to determine when

held-to-maturity financial assets and receivables are impaired.

4. FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

1 January through 1 January through

30 June 2009 30 June 2008

USD USD

Designated at fair value

through profit or loss:

At start of year 57,140,459 52,635,051

Additions 8,030,641 51,104,465

Disposals (8,712,006) (2,790,000)

Net gain on financial assets

at fair value through profit

or loss 1,583,606 1,708,440

Allocation of assets to

liquidation pool as of

calculation date (33,785,426) -

At 30 June 24,257,275 102,654,956

Analysis of portfolio:

- Listed equity securities 13,900,094 45,338,089

- Listed debt securities 10,072,240 57,316,867

- Unlisted debt securities 284,941 -

24,257,275 102,654,956

5. TRADE AND OTHER RECEIVABLES

30 June 2009 30 June 2008

USD USD

Interest receivable on bonds 648,759 2,125,459

Dividend receivable 177,634 -

Other receivables 271,675 -

1,098,068 2,125,459

The receivable are neither past due nor impaired. Interest receivable

on bonds are due within six months.

6. CASH AND CASH EQUIVALENTS

30 June 2009 30 June 2008

USD USD

Fixed deposit account - Barclays Bank

PLC - 9,240,516

Fixed deposit account - Newedge 2,856,787 -

Call deposit account - Barclays Bank

PLC 259,498 2,470,550

Fixed deposit account - WestLB AG - 4,945,227

3,116,285 16,656,293

7. SHARE CAPITAL

2009 2009

Number USD

Authorised share capital

Ordinary shares with a par value of USD

0.01 1,000,000,000 10,000,000

2008 2008

Number USD

Share capital

Opening balance 125,000,000 1,250,000

Shares buy back (9,490,000) (94,900)

As at 31 December 2008 115,510,000 1,155,100

2009 2009

Number USD

Opening balance 115,510,000 1,155,100

Exercise of tender offer (72,879,673) (728,797)

As at 30 June 2009 42,630,327 426,303

On February 26 a tender offer was passed pursuant to an approval by

the Board of Directors. 72,879,673 shares were tendered. These

shares were treated as purchased and cancelled on the calculation

date of 27 February 2009 with the applicable tender consideration

outstanding treated as a deferred liability of the Company.

The directors have the general authority to repurchase the ordinary

shares in issue subject to the Company having funds lawfully

available for the purpose. However, if the market price of the

ordinary shares falls to a discount to the Net Asset Value, the

directors will consult with the Investment Manager as to whether it

is appropriate to instigate a repurchase of ordinary shares.

8. TRADE AND OTHER PAYABLES

30 June 2009 30 June 2008

USD USD

Dividend Payable 110,839 -

Accrued expenses 166,590 195,203

Option obligations 698,014 -

Other payables 771,881 1,324,224

1,747,324 1,519,427

Other payables are non-interest bearing and are due on demand.

9. GAIN PER SHARE

Basic gain per share is calculated by dividing the gain attributable

to equity holders by the weighted average number of ordinary shares

in issue during the period excluding ordinary shares purchased by the

Company (including those repurchased in accordance with the Tender

Offer) and held as treasury shares.

The Company's diluted gain per share is the same as basic gain per

share, since the Company has not issued any instrument with dilutive

potential.

2009 2008

Gain attributable to equity holders

of the Company USD 4,649,609 4,701,070

Weighted average number of ordinary

share in issue 42,630,327 125,000,000

Basic gain per share US cents 10.91 3.76

Gains or losses for the period 1 January through 27 February

(Calculation Date) attributable to the liquidation pool have been

allocated to same as an adjustment to the liquidation pool deferred

liability.

10. TAXATION

Under the current laws of Cayman Islands, there is no income, estate,

transfer sales or other Cayman Islands taxes payable by the Fund. As

a result, no provision for income taxes has been made in the

financial statements.

11. EVENTS DURING REPORTING PERIOD

Tender offer

On 4 February 2009, the Board of Directors of the Company resolved to

make a tender offer, conditional upon shareholder approval , to

purchase up to 100% of ordinary shares in issue. A circular setting

out the terms and conditions of the Company was posted to the

shareholders of the Company to that effect, and was subsequently

approved by the shareholders.

The tender offer process closed on 26 February 2009 and the Company

received irrevocable tender forms from its shareholders in respect of

72,879,673 ordinary shares in the Company, which represent 63.09% of

the issued ordinary shares eligible for tender pursuant to the tender

offer. Effective as of the Calculation date of 27 February 2009, the

tendered shares were treated as purchased and cancelled with

applicable Tender Consideration left outstanding as a deferred

liability of the Company.

The resulting ordinary shares outstanding subsequent to the

cancellation of the tendered shares is 42,630,327. Effective 4

March 2009, the Company's ordinary shares were de-listed from the

Official List of the Channel Islands Stock Exchange, LBG and shares

are exclusively traded on the AIM Market of the London Stock

Exchange.

On 30 June 2009 a tender consideration distribution was made to the

tendered shareholders in the amount of USD $0.3705 per share, net of

fees. The Company received a fee of $1,500,018 as part of the

liquidation distribution. Remaining net investment assets of the

tendered shareholders after expenses and fees were approximated at

$0.04 per share as at 30 June 2009. The realisation and distribution

(net of fees) of the remaining assets of the tendered shareholders

assets will be made when and as determined by the Investment Manager.

This report is available on the Company's website

http://www.africaopportunityfund.com and has been posted to the

shareholders.

For further information please contact:

Africa Opportunity Fund Limited

Francis Daniels

Tel: +2711 684 1528

Grant Thornton Corporate Finance (Nominated Adviser)

Philip Secrett

Tel: +44 020 7383 5100

LCF Edmond de Rothschild Securities Limited (Nominated Broker)

Claire Heathfield/Hiroshi Funaki

Tel: +44 020 7845 5960

=--END OF MESSAGE---

This announcement was originally distributed by Hugin. The issuer is

solely responsible for the content of this announcement.

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

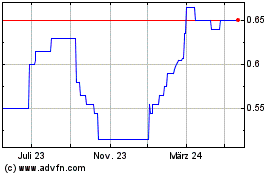

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024