U.S. Dollar Advances After Jobless Claims Data

18 April 2024 - 2:27PM

RTTF2

The U.S. dollar appreciated against its major counterparts in

the New York session on Thursday, as weekly jobless claims remained

flat last week, indicating continued strength in the labor

market.

Data from the Labor Department showed that initial jobless

claims came in at 212,000, unchanged from the previous week's

revised level. Economists had expected jobless claims to rise to

215,000 from the 211,000 originally reported for the previous

week.

Data from the Philadelphia Federal Reserve showed a growth in

regional manufacturing activity in the month of April.

The Philly Fed said its diffusion index for current general

activity jumped to 15.5 in April from 3.2 in March, with a positive

reading indicating growth. Economists had expected the index to

edge down to 1.5.

New York Federal Reserve President John Williams said that there

is no urgency to lower rates soon.

The greenback climbed to 1.0646 against the euro and 1.2436

against the pound, from an early 6-day low of 1.0690 and a 3-day

low of 1.2484, respectively. The greenback is seen finding

resistance around 1.03 against the euro and 1.21 against the

pound.

The greenback advanced to 154.64 against the yen and 0.9121

against the franc, from an early 2-day low of 153.95 and a 1-week

low of 0.9080, respectively. The greenback is likely to face

resistance around 158.00 against the yen and 0.93 against the

franc.

The greenback recovered to 0.6425 against the aussie, 0.5909

against the kiwi and 1.3771 against the loonie, from its early

3-day lows of 0.6456, 0.5933 and 1.3741, respectively. The

greenback is poised to challenge resistance around 0.63 against the

aussie, 0.58 against the kiwi and 1.40 against the loonie.

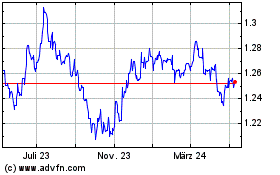

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

Von Apr 2024 bis Mai 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

Von Mai 2023 bis Mai 2024