Yen Falls Amid Risk Appetite

05 Juni 2023 - 4:35AM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Monday, as investor sentiment reacted positively

to the resolution of the U.S. debt ceiling crisis after it was

signed into law by U.S. President Joe Biden. They also reacted to

solid U.S. employment data and easing fears of recession.

In economic news, the services sector in Japan continued to

expand in May and at a faster pace, the latest survey from Jibun

Bank showed on Monday with a services PMI of 55.9. That's up from

55.4 in April, and it moves further above the boom-or-bust line of

50 that separates expansion from contraction. The survey also

showed that the composite index grew from 52.9 in April to 54.3 in

May.

Crude oil prices rallied after Saudi Arabia pledged about

production cuts of another 1 million barrels per day from July.

West Texas Intermediate Crude oil futures for July ended higher by

$1.64 or 2.3 percent at $71.74 a barrel. Brent crude futures was at

$78.42 a barrel, up $2.29, or 3 percent, after hitting a

session-high of $78.73 a barrel earlier.

In the Asian trading today, the safe-haven yen fell to a 6-day

low of 150.05 against the euro from Friday's closing at 149.82. The

yen may test support near the 154.00 region.

Against the U.S. dollar and the Swiss franc, the yen dropped to

5-day lows of 140.26 and 154.15 from last week's closing quotes of

139.91 and 153.94, respectively. If the yen extends its downtrend,

it may find support around 142.00 against the greenback and 156.00

against the franc.

The yen edged down to 174.37 against the pound, from Friday's

closing of 174.12. On the downside, 176.00 is seen as the next

support level for the yen.

Against the Australia and the Canadian dollars, the yen slipped

to more than a 4-month low of 92.61 and more than a 6-month low of

104.45 from Friday's closing quotes of 92.39 and 104.16,

respectively. The yen may test support near 94 against the aussie

and 106 against the loonie.

Moving away from Friday's closing value of 84.74 against the NZ

dollar, the yen slipped to a 6-day low of 84.96. The next possible

downside target level for the yen is seen around the 88.00

region.

Looking ahead, Switzerland inflation data for May is due to be

released at 2:30 am ET, in the pre-European session.

In the European session, PMI data for May from different

European economies and U.K and Eurozone PPI for April are slated

for release.

In the New York session, U.S. PMI data for May and factory

orders for April are set to be released.

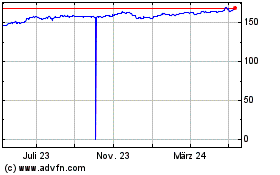

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Nov 2024 bis Dez 2024

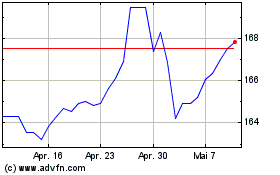

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Dez 2023 bis Dez 2024