Touax: Growth in business activity at end-September 2022

14 November 2022 - 5:45PM

Touax: Growth in business activity at end-September 2022

PRESS

RELEASE Paris, 14

November 2022 – 5.45 p.m.

YOUR OPERATIONAL LEASING SOLUTION FOR

SUSTAINABLE TRANSPORTATION

Growth in business activity at

end-September 2022

|

Revenue of €120.2 million in the first nine months of the

year, up €37.5 million (+45.3%) |

The Group's performance remains strong in a more

uncertain global economic environment.

Total restated revenue from activities at the

end of the third quarter amounted to €120.2 million (€112.8 million

at constant scope and currency1), compared with €82.7 million in

the same period in 2021, for an increase of €37.5 million (+45.3%).

The positive exchange rate effect linked to the dollar and focused

on the Containers business was €7.2 million.

|

Restated Revenue from activities (*) |

Q1 2022 |

Q2 2022 |

Q3 2022 |

TOTAL 2022 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

TOTAL 2021 |

|

(in € thousand) |

| Leasing

revenue on owned equipment |

15,509 |

16,909 |

17,178 |

49,596 |

13,229 |

13,633 |

14,480 |

41,342 |

|

Ancillary services |

5,732 |

4,884 |

7,390 |

18,006 |

2,745 |

3,747 |

5,530 |

12,022 |

|

Total leasing activity |

21,241 |

21,793 |

24,568 |

67,602 |

15,974 |

17,380 |

20,010 |

53,364 |

|

Sales of owned equipment |

14,862 |

14,249 |

15,392 |

44,503 |

7,085 |

8,328 |

9,132 |

24,545 |

|

Total sales of equipment |

14,862 |

14,249 |

15,392 |

44,503 |

7,085 |

8,328 |

9,132 |

24,545 |

|

Total of owned activity |

36,103 |

36,042 |

39,960 |

112,105 |

23,059 |

25,708 |

29,142 |

77,909 |

| Syndication

fees |

0 |

2,522 |

65 |

2,587 |

17 |

946 |

48 |

1,011 |

|

Management fees |

978 |

986 |

1,083 |

3,047 |

897 |

891 |

895 |

2,683 |

|

Sales fees |

336 |

1,349 |

801 |

2,486 |

591 |

358 |

181 |

1,130 |

|

Total of management activity |

1,314 |

4,857 |

1,949 |

8,120 |

1,505 |

2,195 |

1,124 |

4,824 |

|

Other capital gains on disposals |

0 |

0 |

6 |

6 |

0 |

6 |

0 |

6 |

|

Total Others |

0 |

0 |

6 |

6 |

0 |

6 |

0 |

6 |

|

Total Restated Revenue from activities |

37,417 |

40,899 |

41,915 |

120,231 |

24,564 |

27,909 |

30,266 |

82,739 |

(*) The key indicators in the

Group’s activity report are presented differently from the IFRS

income statement, to enable an understanding of the activities’

performance. As such, no distinction is made in third-party

management, which is presented solely in agent form.

This presentation therefore allows a direct

reading of syndication fees, sales commissions, and management

fees.

This new presentation has no impact on EBITDA,

operating income, or net income. The accounting presentation of

revenue from activities is presented in the appendix to the press

release.

DYNAMIC GROWTH IN OWNED AND MANAGEMENT

ACTIVITIES AT END-SEPTEMBER 2022

Owned activities grew by €34.2 million over nine

months, with respective increases of €14.2 million for leasing

activity and €20.0 million for equipment sales activity thanks to

sales of own-account containers, which outperformed.

Management activity grew by €3.3 million, with

an increase of €1.6 million in syndication fees (Freight Railcars

and Containers activities) and sales fees on used equipment

belonging to investors (+€1.4 million in the Containers

activity).

ANALYSIS OF CONTRIBUTIONS BY

DIVISION

The Freight Railcars activity

rose (+11.3%) to €40.4 million in the first nine months:

- Owned activity

expanded by €3.6 million, resulting from an increase in leasing

revenue from owned equipment (+15.7%), driven by growth in the

utilisation rate (87.1% versus 84.6% over the same period in 2021)

and by the leasing of newly acquired railcars.

- Management activity

was also up, with syndication fees increasing by €0.4 million with

transactions carried out in June 2022.

The River Barges activity saw a

boost in revenue of €5.1 million thanks to the vigorous level of

barge chartering in the Rhine basin. The utilisation rate in the

third quarter of 2022 was nearly 100% in the division.

The Containers activity posted

a sharp increase of €33.9 million. The performance of leasing

activity remained strong (+€5.4 million) with an average

utilisation rate of 98.1% over the period. However, most of the

increase came from sales of owned equipment (new built containers

trading activity), which rose by €25.8 million. Management activity

increased by €2.8 million, spurred by syndication fees in the

second quarter and commissions on the sale of investor

equipment.

The Modular Buildings activity

in Africa, presented on the "Miscellaneous" line, was down €5.6

million with fewer projects delivered than in 2021.

|

Restated Revenue from activities |

Q1 2022 |

Q2 2022 |

Q3 2022 |

TOTAL 2022 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

TOTAL 2021 |

|

(in € thousand) |

| Leasing

revenue on owned equipment |

10,544 |

11,142 |

11,292 |

32,978 |

9,152 |

9,223 |

10,123 |

28,498 |

| Ancillary

services |

1,858 |

1,177 |

1,820 |

4,855 |

1,873 |

1,724 |

1,951 |

5,548 |

| Total

leasing activity |

12,402 |

12,319 |

13,112 |

37,833 |

11,025 |

10,947 |

12,074 |

34,046 |

| Sales of owned

equipment |

110 |

238 |

369 |

717 |

320 |

403 |

162 |

885 |

| Total

sales of equipment |

110 |

238 |

369 |

717 |

320 |

403 |

162 |

885 |

|

Total of owned activity |

12,512 |

12,557 |

13,481 |

38,550 |

11,345 |

11,350 |

12,236 |

34,931 |

| Syndication

fees |

0 |

446 |

1 |

447 |

0 |

0 |

0 |

0 |

| Management

fees |

466 |

451 |

507 |

1,424 |

463 |

470 |

451 |

1,384 |

|

Total of management activity |

466 |

897 |

508 |

1,871 |

463 |

470 |

451 |

1,384 |

|

Total Freight railcars |

12,978 |

13,454 |

13,989 |

40,421 |

11,808 |

11,820 |

12,687 |

36,315 |

| Leasing

revenue on owned equipment |

1,619 |

1,789 |

1,869 |

5,277 |

1,688 |

1,745 |

1,770 |

5,203 |

| Ancillary

services |

1,807 |

2,385 |

3,788 |

7,980 |

683 |

972 |

1,286 |

2,941 |

| Total

leasing activity |

3,426 |

4,174 |

5,657 |

13,257 |

2,371 |

2,717 |

3,056 |

8,144 |

| Sales of owned

equipment |

0 |

0 |

0 |

0 |

41 |

0 |

0 |

41 |

| Total

sales of equipment |

0 |

0 |

0 |

0 |

41 |

0 |

0 |

41 |

|

Total of owned activity |

3,426 |

4,174 |

5,657 |

13,257 |

2,412 |

2,717 |

3,056 |

8,185 |

| Management

fees |

14 |

5 |

11 |

30 |

6 |

6 |

5 |

17 |

|

Total of management activity |

14 |

5 |

11 |

30 |

6 |

6 |

5 |

17 |

|

Total River Barges |

3,440 |

4,179 |

5,668 |

13,287 |

2,418 |

2,723 |

3,061 |

8,202 |

| Leasing

revenue on owned equipment |

3,342 |

3,973 |

4,013 |

11,328 |

2,384 |

2,654 |

2,572 |

7,610 |

| Ancillary

services |

2,070 |

1,325 |

1,779 |

5,174 |

191 |

1,054 |

2,297 |

3,542 |

| Total

leasing activity |

5,412 |

5,298 |

5,792 |

16,502 |

2,575 |

3,708 |

4,869 |

11,152 |

| Sales of owned

equipment |

13,205 |

12,575 |

12,967 |

38,747 |

3 480 |

3,524 |

5,991 |

12,995 |

| Total

sales of equipment |

13,205 |

12,575 |

12,967 |

38,747 |

3,480 |

3,524 |

5,991 |

12,995 |

|

Total of owned activity |

18,617 |

17,873 |

18,759 |

55,249 |

6,055 |

7,232 |

10,860 |

24,147 |

| Syndication

fees |

0 |

2,076 |

64 |

2,140 |

17 |

946 |

48 |

1,011 |

| Management

fees |

498 |

530 |

565 |

1,593 |

428 |

415 |

439 |

1,282 |

| Sales

fees |

336 |

1,349 |

801 |

2,486 |

591 |

358 |

181 |

1,130 |

|

Total of management activity |

834 |

3,955 |

1,430 |

6,219 |

1,036 |

1,719 |

668 |

3,423 |

|

Total Containers |

19,451 |

21,828 |

20,189 |

61,468 |

7,091 |

8,951 |

11,528 |

27,570 |

| Leasing

revenue on owned equipment |

4 |

5 |

4 |

13 |

5 |

11 |

15 |

31 |

| Ancillary

services |

-3 |

-3 |

3 |

-3 |

-2 |

-3 |

-4 |

-9 |

| Total

leasing activity |

1 |

2 |

7 |

10 |

3 |

8 |

11 |

22 |

| Sales of owned

equipment |

1,547 |

1,436 |

2,056 |

5,039 |

3,244 |

4,401 |

2,979 |

10,624 |

| Total

sales of equipment |

1,547 |

1,436 |

2,056 |

5,039 |

3,244 |

4,401 |

2,979 |

10,624 |

|

Total of owned activity |

1,548 |

1,438 |

2,063 |

5,049 |

3,247 |

4,409 |

2,990 |

10,646 |

|

Other capital gains on disposals |

0 |

0 |

6 |

6 |

0 |

6 |

0 |

6 |

|

Total Others |

0 |

0 |

6 |

6 |

0 |

6 |

0 |

6 |

|

Total Miscellaneous and eliminations |

1,548 |

1,438 |

2,069 |

5,055 |

3,247 |

4,415 |

2,990 |

10,652 |

| |

|

|

|

|

|

|

|

|

|

Total Restated Revenue from activities |

37,417 |

40,899 |

41,915 |

120,231 |

24,564 |

27,909 |

30,266 |

82,739 |

OUTLOOK

In the current context of inflationary pressures

and rising interest rates, Touax continues to roll out its

activities, thanks to a resilient business model and recurring

revenues based on long-term contracts. The Group plans to seize new

asset acquisition opportunity over the coming months, while also

adopting a prudent investment policy. The current inflationary

environment has a positive effect on the valuation of the portfolio

of assets. However, prices have normalised in the container

business, with the purchase price of new containers returning to

the average levels of 2020.

From a structural and medium- to long-term

perspective, the business outlook in the long-term leasing of

equipment for sustainable transportation is positive. Our various

asset classes are benefiting from developments in relation to

infrastructures, e-commerce and intermodal logistics as they keep

pace with the expectations of consumers, industrial groups, public

authorities, lenders and investors around green transport.

UPCOMING EVENTS

- 22 March 2023:

Press release on annual results (English/French)

- 22 March 2023:

Presentation of annual results to financial analysts in Paris (in

French)

- 23 March 2023:

Investor call (in English)

TOUAX Group leases out

tangible assets (freight railcars, river barges and containers) on

a daily basis worldwide, both on its own account and for investors.

With €1.3 billion in assets under management, TOUAX is a European

leader in the leasing of this type of equipment.

TOUAX is listed on the

EURONEXT stock market in Paris – Euronext Paris Compartment C

(ISIN: FR0000033003) – and is listed on the CAC® Small, CAC® Mid

& Small and EnterNext©PEA-PME 150 indices.

For further

information please visit: www.touax.com

Contacts:TOUAX ACTIFINFabrice

& Raphaël

Walewski Ghislaine

Gasparettotouax@touax.com ggasparetto@actifin.frwww.touax.com Tel:

+33 1 56 88 11 11Tel:

+33 1 46 96 18 00

APPENDIX: Accounting presentation of

revenue from activities

|

|

|

|

|

|

|

|

|

|

|

Revenue from activities |

Q1 2022 |

Q2 2022 |

Q3 2022 |

TOTAL 2022 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

TOTAL 2021 |

|

(in € thousand) |

| Leasing

revenue on owned equipment |

15,509 |

16,909 |

17,178 |

49,596 |

13,229 |

13,633 |

14,480 |

41,342 |

| Ancillary

services |

6,578 |

8,632 |

8,886 |

24,096 |

3,084 |

3,946 |

5,887 |

12,917 |

| Total

leasing activity |

22,087 |

25,541 |

26,064 |

73,692 |

16,313 |

17,579 |

20,367 |

54,259 |

| Sales of owned

equipment |

14,862 |

14,249 |

15,392 |

44,503 |

7,085 |

8,328 |

9,132 |

24,545 |

| Total

sales of equipment |

14,862 |

14,249 |

15,392 |

44,503 |

7,085 |

8,328 |

9,132 |

24,545 |

|

Total of owned activity |

36,949 |

39,790 |

41,456 |

118,195 |

23,398 |

25,907 |

29,499 |

78,804 |

| Leasing

revenue on managed equipment |

10,819 |

10,917 |

11,382 |

33,118 |

11,072 |

10,912 |

11,420 |

33,404 |

| Syndication

fees |

0 |

2,522 |

65 |

2,587 |

17 |

946 |

48 |

1,011 |

| Management

fees |

270 |

286 |

364 |

920 |

157 |

166 |

165 |

488 |

| Sales

fees |

336 |

1,349 |

801 |

2,486 |

591 |

358 |

181 |

1,130 |

|

Total of management activity |

11,425 |

15,074 |

12,612 |

39,111 |

11,837 |

12,382 |

11,814 |

36,033 |

| Other capital

gains on disposals |

0 |

0 |

6 |

6 |

0 |

6 |

0 |

6 |

|

Total Others |

0 |

0 |

6 |

6 |

0 |

6 |

0 |

6 |

|

Total Revenue from activities |

48,374 |

54,864 |

54,074 |

157,312 |

35,235 |

38,295 |

41,313 |

114,843 |

Table showing the transition from summary

accounting presentation to restated presentation

|

|

|

|

|

|

|

|

|

Revenue from activities |

Q3 2022 |

Restatement |

Restated Q3 2022 |

Q3 2021 |

Restatement |

Restated Q3 2021 |

|

(in € thousand) |

|

|

|

|

| Leasing

revenue on owned equipment |

49,596 |

|

49,596 |

41,342 |

|

41,342 |

| Ancillary

services |

24,096 |

-6,090 |

18,006 |

12,917 |

-895 |

12,022 |

| Total

leasing activity |

73,692 |

-6,090 |

67,602 |

54,259 |

-895 |

53,364 |

| Sales of owned

equipment |

44,503 |

|

44,503 |

24,545 |

|

24,545 |

| Total

sales of equipment |

44,503 |

|

44,503 |

24,545 |

|

24,545 |

|

Total of owned activity |

118,195 |

-6,090 |

112,105 |

78,804 |

-895 |

77,909 |

| Leasing

revenue on managed equipment |

33,118 |

-33,118 |

0 |

33,404 |

-33,404 |

0 |

| Syndication

fees |

2,587 |

|

2,587 |

1,011 |

|

1,011 |

| Management

fees |

920 |

2,127 |

3,047 |

488 |

2,195 |

2,683 |

| Sales

fees |

2,486 |

|

2,486 |

1,130 |

|

1,130 |

|

Total of management activity |

39,111 |

-30,991 |

8,120 |

36,033 |

-31,209 |

4,824 |

| Other capital

gains on disposals |

6 |

|

6 |

6 |

|

6 |

|

Total Others |

6 |

0 |

6 |

6 |

0 |

6 |

|

Total Revenue from activities |

157,312 |

-37,081 |

120,231 |

114,843 |

-32,104 |

82,739 |

1 Based on a comparable structure and average

exchange rates at 30 September 2021.

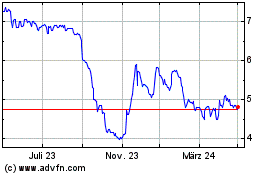

Touax (EU:TOUP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Touax (EU:TOUP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024