SES-led consortium to design, deliver, and

operate innovative MEO-LEO network.

IRIS2 will expand SES’s network with 18 new MEO

satellites providing pole-to-pole global coverage, plus extended

access to LEO capacity, to keep pace with rapidly expanding

customer demand.

SES’s participation in IRIS2 is consistent with

our disciplined financial policy, benefiting from significant

public funding, which is frontloaded, and built-in protection

mechanisms.

Post Intelsat integration, SES Adjusted Free

Cash Flow expected to ramp to over €1 billion by 2027/2028

supporting existing deleveraging commitment, IRIS2 CapEx, and

expanding shareholder returns.

SES S.A. announces that the SpaceRISE consortium, led by SES,

has signed the Concession Contract with the European Commission to

design, deliver, and operate the innovative, multi-orbit IRIS2

sovereign connectivity system for a period of 12 years, with the

network expected to provide services from the beginning of

2030.

Infrastructure for Resilience, Interconnectivity and Security by

Satellite (IRIS2) will be European Union's (EU) preferred and

trusted network to provide reliable, secure, and cost-effective

communication solutions for governmental institutions, commercial

organisations, and European citizens.

SES’s contribution to IRIS2 will be to develop, procure, and

operate 18 new MEO satellites providing 100% pole-to-pole coverage

with carrier-grade connectivity solutions. SES will have rights to

commercialise the MEO capacity and part of the LEO capacity of the

IRIS2 system. The compelling combination of high throughput data

rates, low latency, service flexibility, and managed solutions will

cater to EU’s sophisticated requirements, as well as allied nations

and SES’s customers around the world.

With deployment of SES’s O3b mPOWER completed in 2027 and

subsequent commercial ramp up, the delivery of IRIS2 is well timed

to provide next-generation MEO capabilities to serve expanding

customer demand for SES’s high performance connectivity solutions,

underpinning profitable growth into the next decade. The IRIS2

satellites will form the foundation for SES's next-generation MEO

capabilities.

Adel Al-Saleh, Chief Executive Officer of SES, commented, “We

are delighted to secure this important contract as the European

Commission’s trusted partner for this flagship project to realise

the ambition of secure, sovereign multi-orbit-based network for

EU’s strategic communications autonomy. IRIS2 will bring a new

level of connectivity for the EU and its citizens in a public

private partnership structure which aligns all interests and

derisks the development phase with upfront public investment. IRIS2

will be Europe’s network of choice with the EU and Member States

being the constellation’s anchor customers.

IRIS2 enables the profitable expansion of our differentiated MEO

architecture into the next decade, while giving us access to LEO

with owners' economics, to keep pace with the rapidly growing

customer demand in our target segments where we have a strong right

to win, record of delivering value for our customers, and history

of growth execution. The contract terms we have agreed demonstrate

our commitment to disciplined investment, delivering required rate

of return, maintaining investment grade balance sheet metrics, and

returning cash to our shareholders.”

The Internal Rate Return (IRR) of the contract is expected to

exceed 10% and is underpinned by a strong commercial value

proposition and built-in protection mechanisms. The MEO offering,

complemented by access to LEO capacity, will serve a range of

government and commercial requirements including fixed government

connectivity; intelligence, surveillance, and reconnaissance; navy

and air force needs; mobile backhaul and trunking; enterprise and

cloud applications; global inflight connectivity; and connecting

cruise ships around the world.

The initial phases of IRIS2 will benefit from upfront public

funding with limited need for private financing in the early years

of design and procurement. In total, SES will contribute

approximately 50% of the MEO cost while having the benefit of

commercialising over 90% of the MEO capacity and part of the LEO

capacity.

The EU and Member States will be the anchor customers to the

IRIS2 constellation, while also attracting allied nations across

the world, underpinning revenue generation which is expected to

cumulatively be around €6 billion over the 12 years. Starting in

2025, SES expects to generate incremental revenue and EBITDA for

works related to the design and procurement phases. The Contract

also provides for the possibility to add hosted payloads for

commercial services, adding to the value proposition towards

customers.

The contract grants protections to support SES’s IRR including,

but not limited to, i) a rendezvous point in 12 months’ time to

validate the project cost, technical requirements, and delivery

timetable, whereby any party can exit in the event of excess

expected cost, not meeting technical requirements, and/or delays to

the in-service date; ii) mechanism to seek renegotiation to protect

the IRR for qualifying reasons, such as delay in start of service;

iii) certain protections from annual cost overruns; and iv) the

Commission will cover any extra cost resulting from launch failures

up to in-orbit validation.

Participation in IRIS2 is fully consistent with the principles

of SES’s financial policy. SES maintains its prior expectation to

have an Adjusted Net Debt to Adjusted EBITDA ratio of below 3 times

within 12-18 months after closing the Intelsat acquisition, which

is on track to complete during H2 2025. SES’s commitment to a

stable to progressive dividend is also reaffirmed with an annual

base dividend of at least €0.50 per A-share. SES intends to

increase the annual dividend as soon as the Adjusted Net Debt to

Adjusted EBITDA ratio is reduced to below 3 times which is expected

by 2027 as noted above.

The IRIS2 contract will be incremental to SES’s current

investment outlook (average of around €350 million per year on a

standalone basis and €600-650 million per year pro forma for the

Intelsat acquisition over 2025-2030), revenue, and profit plans.

The capital expenditure (CapEx) for IRIS2 of up to €1.8 billion

will start ramping from 2027 and have an average annual spend of

around €400 million over 2027-2030.

With the Intelsat acquisition, normalised Adjusted Free Cash

Flow (pre-IRIS2) is expected to ramp to over €1 billion by

2027/2028(1) driven by revenue and Adjusted EBITDA growth and

execution of synergies (approximately 70% of the expected total

annual rate of €370 million will be delivered by the end of Year

3). This level of cash generation will more than support the

incremental CapEx for IRIS2 while retaining financial flexibility

to increase shareholder returns and consider further balance sheet

strengthening.

Click below links for other releases issued by the European

Institutions:

European Commission European Space Agency

Follow us on:

LinkedIn | Facebook | YouTube | Twitter | Instagram

Read our Blogs > Visit the Media Gallery >

About SES

SES has a bold vision to deliver amazing experiences everywhere

on Earth by distributing the highest quality video content and

providing seamless data connectivity services around the world. As

a provider of global content and connectivity solutions, SES owns

and operates a geosynchronous orbit fleet and medium earth orbit

(GEO-MEO) constellation of satellites, offering a combination of

global coverage and high performance services. By using its

intelligent, cloud-enabled network, SES delivers high-quality

connectivity solutions anywhere on land, at sea or in the air, and

is a trusted partner to telecommunications companies, mobile

network operators, governments, connectivity and cloud service

providers, broadcasters, video platform operators and content

owners around the world. The company is headquartered in Luxembourg

and listed on Paris and Luxembourg stock exchanges (Ticker: SESG).

Further information is available at: www.ses.com.

1) Financial outlook assumes nominal satellite health and

launch schedule

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241216108829/en/

Richard Whiteing Investor Relations Tel. +352 710 725 261

richard.whiteing@ses.com

Suzanne Ong Communications Tel. +352 710 725 500

suzanne.ong@ses.com

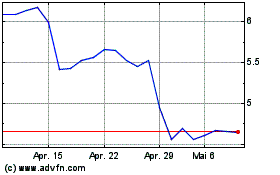

SES (EU:SESG)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

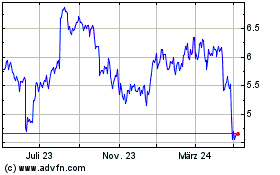

SES (EU:SESG)

Historical Stock Chart

Von Jan 2024 bis Jan 2025