PARROT: 2021 full-year earnings

| |

PRESS RELEASEParis, March 17, 2022, 6pm CET |

2021 full-year earnings

-

+19% growth like-for-like and at constant

exchange

rates(1)

- Positive

impact of divestments on earnings and the cash

position

-

Growth

trajectory to continue in

2022

2021 business

Now focused exclusively on the design,

development and marketing of professional drone solutions, in 2021

the Parrot Group completed the repositioning and reorganization

launched at the end of 2018. Factoring in its capacity for

innovation and the maturity of its technologies and markets, Parrot

has assessed the potential of its assets and chosen to focus its

resources on quadricopter microdrones and image metrics and

analytics software.

Within this framework, two divestment operations

were carried out in 2021, aimed specifically at further

strengthening the Group’s financing capacity and reducing its

operating expenditure. They generated a €32.0m capital gain on

disposals in the 2021 consolidated accounts. The subsidiary

Micasense (sensors) was sold in January and did not contribute to

2021 revenues, while the subsidiaries SenseFly SA and SenseFly Inc

(fixed-wing drones) were divested in October and contributed to

revenues until October 19, 2021.

The changes in scope resulting from these

divestments account for the contraction in consolidated revenues to

€54.3m in 2021, compared with €57.3m at end-2020. The subsidiaries

divested generated €7.7m of revenues (excluding intragroup billing)

in 2021, compared with €16.1m in 2020.

Based on the new reference scope from 2022, i.e.

excluding sales from the companies divested and end-of-life

consumer products, the Group’s revenues for 2021 came to around

€40.4m, with year-on-year growth of +17% (+19% at constant exchange

rates).

In 2021, the Group benefited from growth in its

offering, realigned around professional drone technologies. On the

one hand, the expansion of the range of solutions, launched in 2020

in the inspection, civil security and precision farming fields,

initially focused on mapping and geomatics, paved the way for Pix4D

to record revenues of €26.2m, up 12% (+15% at constant exchange

rates). On the other hand, the ramping up of sales of professional

microdrones, and particularly the ANAFI USA, enabled Parrot Drones*

to achieve revenues of €20.9m, up 12% (+13% at constant exchange

rates). This performance was offset by the finalization of the

sales of legacy consumer products (-€0.4m) in the third quarter of

2021, and the non-recurrence of funded R&D projects

(-€2.4m).

In the fourth quarter, still based on the new

reference scope, Group revenues came to approximately €15.7m, up

+48% (+44% at constant exchange rates), thanks in particular to the

start of ANAFI USA deliveries for the French armed forces and the

robust commercial trend for Pix4D software solutions at the end of

the year. The consolidated and restated information is presented

below, while an identical table for the fourth quarter is

appended.

|

|

Revenues (€m) |

2020 |

2021 |

Change |

|

A |

Parrot Drones |

18.7 |

33% |

20.9 |

38% |

+12% |

|

B |

Of which, consumer products(2) |

6.6 |

12% |

6.2 |

11% |

-6% |

|

C |

Pix4D |

23.3 |

41% |

26.2 |

48% |

+12% |

|

D |

Parrot SA |

0.3 |

0% |

0.3 |

1% |

0% |

|

E |

Intragroup eliminations |

-1.1 |

-2% |

-0.8 |

-2% |

-25% |

|

F |

SenseFly (activity divested in October 2021) |

10.8 |

19% |

7.7 |

14% |

-28% |

|

G |

MicaSense (activity divested in January 2021) |

5.3 |

9% |

0.0 |

0% |

-100% |

|

|

CONSOLIDATED PARROT GROUP TOTAL |

57.3 |

100% |

54.3 |

100% |

-5% |

|

|

NEW SCOPE

TOTAL(1)

(=A-B+C+D+E) |

34.6 |

60% |

40.4 |

74% |

+17% |

(1) “New scope total” is a performance indicator

reflecting the impacts of the strategy rolled out since the end of

2018. It corresponds to the Parrot Group’s consolidated revenues

less revenues from consumer products (cf. 2) and revenues from the

subsidiaries divested. Note that intragroup eliminations are not

reallocated and therefore include a relatively insignificant amount

of sales from the subsidiaries divested.(2) Consumer products:

consumer drones (all ranges), legacy automotive products (car kit,

plug & play) and connected devices.

2021

earnings(1)

|

Condensed consolidated accounts - IFRS (€m) |

2020 |

2021 |

Change |

|

Consolidated revenues |

57.3 |

54.3 |

-5% |

|

Gross margin |

40.2 |

39.1 |

-3% |

|

% of revenues |

70.2% |

72.0% |

|

|

Research and development costs |

-40.2 |

-40.2 |

-0% |

|

Sales and marketing costs |

-16.3 |

-14.0 |

-14% |

|

Administrative costs and overheads |

-13.6 |

-13.6 |

- |

|

Production and industrialization costs |

-6.1 |

-5.4 |

-12% |

|

Income from ordinary operations |

-36.0 |

-34.2 |

+5% |

|

% of revenues |

-62.9% |

-62.9% |

|

|

Other operating income and expenses |

0.5 |

30.4 |

- |

|

EBIT |

-35.6 |

-3.7 |

- |

|

% of revenues |

-62.1% |

-6.9% |

|

|

Net income (Group share) |

-38.4 |

-1.9 |

- |

|

% of revenues |

-67.0% |

-3.6% |

|

(1) Micasense is no longer consolidated since

January 1, 2021, while SenseFly is consolidated until October 19,

2021.

In 2021, the Parrot Group continued to

strengthen its product mix, focusing on professional drones and

solutions, with a gross margin of 72.0%, up 1.8pts

from 2020, despite the completion of the stock clearance process

for consumer drones in the third quarter of 2021.

In 2021, the Parrot Group’s consolidated

operating expenditure totaled €73.2m, compared with €76.2m

in 2020. The subsidiaries divested represent around €9.1m of

operating costs in 2021 and €13.6m in 2020. The additional capacity

freed up in this way will make it possible to increase the

resources allocated to professional drones and solutions,

supporting their capacity for developing new uses and attracting

new clients. The expenditure figures for 2021 also take into

account the non-recurrence of the support measures linked to the

health crisis (€0.4m in 2021, versus €2.4m in 2020).

More specifically, the resources allocated to

R&D (€40.2m) paved the way for the successful launch of the new

professional drone ANAFI Ai, while helping drive the development of

software solutions for new activities. Sales and marketing spending

came to €14.0m (-14%), benefiting from the optimization measures

made possible by the realignment around professional drones. The

range’s realignment is also reflected in the reduction in

production spending to €5.4m (-12%). Overheads are stable at

€13.6m. At end-2021, the Group’s workforce

(permanent and fixed-term contracts) represented 448 people (521 at

December 31, 2020), in addition to 49 external contractors (42 at

December 31, 2020), with a reduction linked to the transfer of 111

people.

Thanks primarily to the sale of Micasense during

the first quarter and SenseFly in the fourth quarter, the Group

recorded €30.4m of non-current operating income,

taking EBIT for 2021 to -€3.7m. After €1.5m of financial income and

expenses and a €0.4m share of income from associates,

consolidated net income (Group share) totaled

-€1.9m, compared with -€38.4m for 2020.

Changes in the cash position and balance

sheet in 2021

The Group had €82.0m of net cash at end-December

2021 excluding the impact of IFRS 16, and €72.6m including IFRS 16.

Cash and cash equivalents came to €82.8m, with €5.1m consumption

versus 2020.

Cash flow from operations totaled -€31.2m,

corresponding to the loss for income from ordinary operations,

primarily adjusted for the IFRS 16 restatement of lease charges

(+€2.7m). Factoring in the change in working capital requirements,

cash from operating activities totaled -€25.3m.

The change in working capital requirements

reflects the following developments: (i) a -€3.2m impact for the

change in trade and other receivables; (ii) a +€5.1m change in

trade and other payables; (iii) a +€4.4m change in inventories,

notably linked to the clearance of stock of older generations of

consumer drones.

Cash flow from investment activities came to

+€23.0m, linked primarily to the €24.0m payment from the disposal

of SenseFly and Micasense, less investments of €1.6m in equipment,

particularly for ANAFI Ai production.

Cash flow from financing activities came to

-€4.1m, including €3.4m for the repayment of lease liabilities with

the application of IFRS 16.

Since the 2021 year-end

In February 2022, the Group carried out a CHF

10m capital increase for its subsidiary Pix4D, with CHF 8m invested

by Parrot and CHF 2m invested by Pix4D’s founder-manager and

minority shareholder. This investment aims to increase the

resources available for technological developments, looking in

particular to expand the analytical capabilities of the software

developed by Pix4D to benefit other equipment, dovetailing

effectively with the drones.

The Group has launched sales of the ANAFI Ai, a

4G-connected microdrone designed to overcome the limitations of

wifi, with autopilot features developed on a fully open source

platform, making it easier to customize its missions, presented at

the end of June 2021. ANAFI Ai is currently available at a price

starting from €4,000 (ex VAT) and includes a range of advanced

photogrammetry features based on the integration of Pix4D

solutions.

Outlook for 2022

Realigned, streamlined and driven by its

professional solutions at the forefront of innovation, Parrot is

looking ahead to 2022 with confidence in its strategy and vigilance

concerning the changes in the international environment.

The Group is continuing to allocate its

resources to an ambitious R&D roadmap. Supported by its

progress in the field of artificial intelligence and the growing

integration between hardware and software, Parrot aims to continue

facilitating the adoption of drone technologies and offer new use

cases that are aligned with the needs of professionals, businesses

and institutions, focused on (i) 3D Mapping, Geomatics and

Inspection, (ii) Defense and Security, and (iii) Precision

Farming.

To secure its production capacity over the

medium and long term, and respond to the growing interest in its

microdrones at the start of this year, Parrot is further

strengthening the synergies between R&D, procurement and

production management. The increase in the resources allocated to

these operations will be combined with an agile sourcing

management. These strategic initiatives could limit the reduction

in costs in 2022, and their effectiveness are still strongly

correlated to the health context in China, where the situation is

deteriorating at the start of this year.

Looking beyond the disruption linked to the

economic and geopolitical environment, which is difficult to

predict, the Group plans to move forward with its revenue growth

trajectory on its “new scope” and capitalize on the opportunities

opened up by the growing adoption of drone technologies in

businesses and the public sector. The Group will continue to

closely monitor the allocation of its cash, and will be ready to

respond and adapt to potential changes in the conditions.

Next financial dates

-

2022 first-quarter business: Thursday May 12, 2022

-

Parrot’s general shareholders’ meeting: Wednesday June 15,

2022

-

2022 first-half earnings: Thursday July 28, 2022

ABOUT

PARROT

Founded in 1994 by Henri Seydoux, Parrot is

today the leading European drone manufacturer in this rapidly

expanding market. Visionary, at the forefront of innovation Parrot

has a complementary range of equipment and software adapted to the

needs of companies, large groups and government organizations. Its

offer is mainly centred on three vertical markets: (i) Inspection,

3D mapping and Geomatics, (ii) Defence and security, and Precision

agriculture.

Its ANAFI range of micro UAVs, recognized for

their performance, robustness and ease of use, features an open

source architecture and meets the highest safety standards. Its

software suite for mobile and drone mapping is based on advanced

expertise in photogrammetry and offers solutions tailored to the

specificities of the verticals it addresses.

The Parrot Group designs and develops its

products in Europe, mainly in Paris where its headquarters are

located and in Switzerland. Today, it has approximately 450

employees worldwide and carries out the vast majority of its sales

internationally. Parrot has been listed on Euronext Paris since

2006 (FR0004038263 - PARRO). For more information:www.parrot.com,

www.pix4d.com

CONTACTS

|

Investors,

analysts,

financial

medias Marie

Calleux - T. : +33(0) 1 48 03 60 60parrot@calyptus.net |

Tech

& consumer

mediasJean Miflin - T. : +33(0) 1 48 03 60

60jean.miflin@parrot.com |

The consolidated full-year accounts for 2021

were approved by the Board of Directors on March 16, 2021. The

audit procedures have been carried out by the statutory auditors

and the reports will be issued once the necessary procedures have

been completed. The Universal Registration Document will then be

published on: https://www.parrot.com/uk/corporate/reports

BREAKDOWN OF REVENUES BY

BUSINESS

|

|

Revenues (€m) |

Q4 2020 |

Q4 2021 |

Change |

|

A |

Parrot Drones |

6.3 |

38% |

6.6 |

44% |

5% |

|

B |

Of which, consumer products(2) |

2.2 |

13% |

(0.2) |

-1% |

-110% |

|

C |

Pix4D |

6.7 |

40% |

8.4 |

56% |

26% |

|

D |

Parrot SA |

0.1 |

0% |

0.1 |

0% |

-0% |

|

E |

Intragroup eliminations |

-0.3 |

-2% |

-0.1 |

-1% |

-68% |

|

F |

SenseFly (activity divested in October 2021) |

2.4 |

15% |

0.1 |

1% |

-97% |

|

G |

MicaSense (activity divested in January 2021) |

1.3 |

8% |

0.0 |

0% |

-100% |

|

|

CONSOLIDATED PARROT GROUP TOTAL |

16.5 |

100% |

15.1 |

100% |

-6% |

|

|

NEW SCOPE TOTAL (=A-B+C+D+E) |

10,6 |

64% |

15,7 |

101% |

+48% |

(1) “New scope total” is a performance indicator

reflecting the impacts of the strategy rolled out since the end of

2018. It corresponds to the Parrot Group’s consolidated revenues

less revenues from consumer products (cf. 2) and revenues from the

subsidiaries divested. Note that intragroup eliminations are not

reallocated and therefore include a relatively insignificant amount

of sales from the subsidiaries divested.(2) Consumer products:

consumer drones (all ranges), legacy automotive products (car kit,

plug & play) and connected devices.

CONSOLIDATED INCOME

STATEMENT, IFRS, €m

|

|

Dec 31, 2020 |

Dec 31, 2021 |

|

Revenues |

57.3 |

54.3 |

|

Cost of sales |

-17.0 |

-15.2 |

|

Gross margin |

40.2 |

39.1 |

|

% of revenues |

70.2% |

72.0% |

|

Research and development costs |

-40.2 |

-40.2 |

|

% of revenues |

-70.2% |

-74.1% |

|

Sales and marketing costs |

-16.3 |

-14.0 |

|

% of revenues |

-28.4% |

-25.8% |

|

Overheads |

-13.6 |

-13.6 |

|

% of revenues |

-23.8% |

-25.1% |

|

Production and quality |

-6.1 |

-5.4 |

|

% of revenues |

-10.7% |

-10.0% |

|

Income from ordinary operations |

-36.0 |

-34.2 |

|

% of revenues |

-62.9% |

-62.9% |

|

Other operating income and expenses |

0.5 |

30.4 |

|

EBIT |

-35.6 |

-3.7 |

|

% of revenues |

-62.1% |

-6.9% |

|

Income from cash and cash equivalents |

0.0 |

0.0 |

|

Gross finance costs |

-0.3 |

-0.2 |

|

Net finance costs |

-0.2 |

-0.2 |

|

Other financial income and expenses |

-2.0 |

1.8 |

|

Financial income and expenses |

-2.2 |

1.5 |

|

Share in income from associates |

-0.4 |

0.4 |

|

Tax |

-0.3 |

-0.1 |

|

Net income |

-38.4 |

-1.9 |

|

Group share |

-38.4 |

-1.9 |

|

% of revenues |

-67.0% |

-3.6% |

|

Non-controlling interests |

-0.1 |

0.0 |

CONSOLIDATED BALANCE

SHEET, IFRS, €m

|

ASSETS |

Dec 31, 2020 |

Dec 31, 2021 |

|

Non-current assets |

21.0 |

27.3 |

|

Other intangible assets |

0.4 |

0.3 |

|

Property, plant and equipment |

2.3 |

1.8 |

|

Right of use |

5.9 |

8.7 |

|

Investments in associates |

5.0 |

5.6 |

|

Financial assets |

6.5 |

6.5 |

|

Non-current lease receivables |

0.7 |

0.1 |

|

Deferred tax assets |

0.2 |

0.4 |

|

Other non-current assets |

0.0 |

4.0 |

|

Current assets |

121.7 |

117.3 |

|

Inventories |

10.2 |

4.9 |

|

Trade receivables |

6.0 |

5.2 |

|

Tax receivables |

7.6 |

6.9 |

|

Other receivables |

9.1 |

16.9 |

|

Current lease receivables |

0.7 |

0.5 |

|

Cash and cash equivalents |

88.0 |

82.8 |

|

Assets held for sale |

2.7 |

0.0 |

|

Total assets |

145.4 |

144.6 |

|

Shareholders’ equity and liabilities |

Dec 31, 2020 |

Dec 31, 2021 |

|

Shareholders’ equity |

99.7 |

100.1 |

|

Share capital |

4.6 |

4.6 |

|

Additional paid-in capital |

331.7 |

331.7 |

|

Reserves excluding earnings for the period |

-204.0 |

-242.2 |

|

Earnings for the period - Group share |

-38.4 |

-1.9 |

|

Exchange gains or losses |

5.2 |

7.5 |

| Equity

attributable to Parrot SA shareholders |

99.2 |

99.6 |

|

Non-controlling interests |

0.5 |

0.5 |

|

Non-current liabilities |

10.6 |

10.5 |

|

Non-current financial liabilities |

1.8 |

0.0 |

|

Non-current lease liabilities |

4.1 |

6.7 |

|

Provisions for pensions and other employee benefits |

1.3 |

1.1 |

|

Deferred tax liabilities |

0.0 |

0.2 |

|

Other non-current provisions |

0.1 |

0.4 |

|

Other non-current liabilities |

3.4 |

1.9 |

|

Current liabilities |

33.6 |

34.0 |

|

Current financial liabilities |

0.7 |

0.8 |

|

Current lease liabilities |

3.5 |

2.7 |

|

Current provisions |

3.9 |

1.2 |

|

Trade payables |

11.9 |

9.9 |

|

Current tax liabilities |

0.1 |

0.1 |

|

Other current liabilities |

13.5 |

19.4 |

|

Liabilities held for sale |

1.6 |

0.0 |

|

Total shareholders’ equity and liabilities |

145.4 |

144.6 |

CONSOLIDATED CASH FLOW

STATEMENT, IFRS, €m

|

|

Dec 31, 2020 |

Dec 31, 2021 |

|

Operating cash flow |

|

|

|

Earnings for the period from continuing operations |

(38.4) |

(1.9) |

|

Net income

attributable to owners of the parent |

(38.4) |

(1.9) |

|

Non-controlling

interests |

(0.1) |

0.0 |

|

Share in income from associates |

0.4 |

(0.4) |

|

Depreciation and amortization |

3.7 |

2.3 |

|

Capital gains and losses on disposals |

0.3 |

(32.9) |

|

Tax expense |

0.3 |

0.1 |

|

Cost of share-based payments |

1.1 |

1.3 |

|

Net finance costs |

0.2 |

0.2 |

|

Cash flow from operations before net finance costs and tax |

(32.4) |

(31.2) |

|

Change in working capital requirements |

2.5 |

6.2 |

|

Tax paid |

(0.2) |

(0.2) |

|

Cash flow from operating activities (A) |

(30.1) |

(25.3) |

|

Investing cash flow |

|

|

|

Acquisition of property. plant and equipment and intangible

assets |

(2.1) |

(1.6) |

|

Acquisition of subsidiaries. net of cash acquired |

- |

- |

|

Acquisition of financial assets |

(2.3) |

(2.7) |

|

Disposal of property. plant and equipment and intangible

assets |

0.1 |

- |

|

Disposal of subsidiaries. net of cash divested |

(0.4) |

24.0 |

|

Disposal of investments in associates |

- |

- |

|

Disposal of financial assets |

0.8 |

3.2 |

|

Cash flow from investment activities (B) |

(3.8) |

23.0 |

|

Financing cash flow |

|

|

|

Equity contributions |

0.0 |

- |

|

Receipts linked to new loans |

1.7 |

- |

|

Cash invested for over 3 months |

- |

- |

|

Net finance costs |

(0.2) |

(0.2) |

|

Repayment of short-term financial debt (net) |

(4.2) |

(3.9) |

|

Sales / (Purchases) of treasury stock(4) |

- |

- |

|

Cash flow from financing activities (C) |

(2.8) |

(4.1) |

|

Net change in cash position (D = A+B+C) |

(36.7) |

(6.4) |

|

Impact of change in exchange rates |

(1.1) |

1.3 |

|

Impact of changes in accounting principles (IFRS 5 reclass.) |

(0.8) |

- |

|

Cash and cash equivalents at start of period |

126.6 |

88.0 |

|

Cash and cash equivalents at end of period |

88.0 |

82.8 |

***

- Parrot_CP_FY-2021_20220317_EN

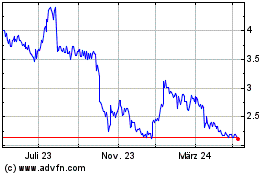

Parrot (EU:PARRO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

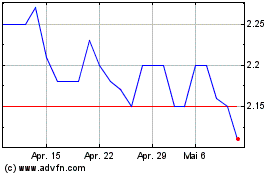

Parrot (EU:PARRO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025