Press release Biocartis Group NV: Mandatory Conversion Bondholder

Notification

PRESS RELEASE: REGULATED INFORMATION5 December 2022, 17:40

CET

Mandatory Conversion Bondholder

Notification

Capitalised terms not otherwise defined in this

notice shall have the meaning given to them in the Terms and

Conditions of the Bonds.

Mechelen, Belgium, 5

December 2022 – This

announcement constitutes a notice (the “Mandatory Conversion

Bondholder Notification”) in accordance with, respectively,

Condition 5(m)(v) of the terms and conditions of the 4.00%

convertible bonds due 2024/2027 (the "Existing Convertible Bonds")

(ISIN BE0002651322) and Condition 6(b)(v) of the terms and

conditions of the 4.50% new second lien secured convertible bonds

due 2024/2026 (the "New Convertible Bonds") (together, the "Terms

and Conditions of the Bonds") (ISIN BE6338582206) issued by

Biocartis Group NV (the "Company" or "Biocartis"), an innovative

molecular diagnostics company (Euronext Brussels: BCART).

The Company today announces, that the

Recapitalisation Transactions (as such term is defined in the Terms

and Conditions of the Bonds) have completed on Friday, 2 December

2022 (the “Recapitalisation Transactions Completion Date”).

In accordance with the Terms and Conditions of

the Bonds, the occurrence of the Recapitalisation Transactions

Completion Date results in a number of consequences for the holders

of the Existing Convertible Bonds and/or the New Convertible Bonds,

including (but not limited to):

- the automatic extension of the

Final Maturity Dates of such Bonds to 9 November 2026 (in the case

of the New Convertible Bonds) and 9 November 2027 (in the case of

the Existing Convertible Bonds);

- the start of the Bondholder

Conversion Option Period for the New Convertible Bonds from the

Mandatory Conversion Date (as defined in the terms and conditions

of the New Convertible Bonds) of Friday, 16 December 2022. In

accordance with Condition 6(b)(v) of the terms and conditions of

the New Convertible Bonds, the Company informs the Bondholders that

the lowest price per Share at which Shares were sold to investors

in the Required Topco Equity Offering was EUR 0.75 per Share.

Accordingly, the initial "Bondholder Conversion Option Conversion

Price" (as defined in the terms and conditions of the New

Convertible Bonds) is EUR 1.125 per Share; and

- the Mandatory Conversion of 10% of

the principal amount outstanding under each of the Existing

Convertible Bonds and the New Convertible Bonds. For the Mandatory

Conversion of the Existing Convertible Bonds the Conversion Price

in effect on the Conversion Date is EUR 12.8913 per Share; the

Mandatory Conversion Price for the New Convertible Bonds is EUR

12.8913 per Share as well.

The aforementioned Mandatory Conversion will

occur 10 Brussels business days after the Recapitalisation

Transactions Completion Date. Accordingly, the Mandatory Conversion

Date (in the case of the New Convertible Bonds) and the Conversion

Date (in the case of the Existing Convertible Bonds) (both as

defined in the Terms and Conditions of the Bonds) is Friday, 16

December 2022.

In accordance with the Terms and Conditions of

the Bonds, the Bondholders are required to complete the following

formalities in order to obtain delivery of the shares issued

pursuant to the aforementioned Mandatory Conversion:

- a duly completed and signed

Mandatory Conversion Investor Notice needs to be provided by the

Bondholder to the Agent (copying such other persons as indicated in

the form of the Mandatory Conversion Investor Notice) by 17:00 CET

on the Cut-Off Date on Friday, 9 December 2022. In

order to complete the Mandatory Conversion Investor Notice, a

Bondholder may need to contact the financial institution at which

the Bonds are held to its order, for assistance in providing the

required securities and bank account details; and

- the Bondholder must request the

financial institution at which the Bonds are held to its order to

provide the Agent with proof that the Bonds, as specified in the

submitted Mandatory Conversion Investor Notice, are held to its

order or under its control and blocked by it. This proof must

either be a certificate of blocking from the financial institution

at which the Bonds are held, or a proof by the recognized account

holder of the NBB-SSS Clearing System at which the Bonds are held,

delivered by swift messaging directly to the Agent. Such proof must

reach the Agent at the latest by 17:00 CET on Monday, 12

December 2022.

A copy of the current form of the "Mandatory

Conversion Investor Notice" can be obtained from the Agent (via its

specified office or via regulations@belfius.be) or directly from

the Company (via rdegrave@biocartis.com).

Failure to comply with the formalities by the

applicable deadlines will result in the relevant shares being sold

by the Share Settlement Agent and the proceeds (if any, after

deducting a.o. the costs of such procedure) being distributed

rateably to the relevant Bondholders. In

view thereof, the Company

encourages the Bondholders that

have not yet been in contact with the Company in the context of the

Recapitalisation Transactions to contact

the Company urgently.

The Terms and Conditions of the Bonds can be consulted, subject

to applicable legal restrictions, on

https://investors.biocartis.com/en/convertible-bonds .

--- END ---

More information: Renate

DegraveHead of Corporate Communications & Investor Relations

Biocartise-mail rdegrave@biocartis.com tel

+32 15 631 729

mobile +32 471 53 60 64

About Biocartis

With its revolutionary and proprietary Idylla™

platform, Biocartis (Euronext Brussels: BCART) aspires to enable

personalized medicine for patients around the world through

universal access to molecular testing, by making molecular testing

actionable, convenient, fast and suitable for any lab. The Idylla™

platform is a fully automated sample-to-result, real-time PCR

(Polymerase Chain Reaction) based system designed to offer in-house

access to accurate molecular information in a minimum amount of

time for faster, informed treatment decisions. Idylla™'s

continuously expanding menu of molecular diagnostic tests address

key unmet clinical needs, with a focus in oncology. This is the

fastest growing segment of the molecular diagnostics market

worldwide. Today, Biocartis offers tests supporting melanoma,

colorectal, lung and liver cancer, as well as for COVID-19, Flu,

RSV and sepsis. For more information, visit www.biocartis.com

or follow Biocartis on Twitter @Biocartis_ , Facebook or

LinkedIn.

Biocartis and Idylla™ are registered trademarks

in Europe, the United States and other countries. The Biocartis and

Idylla™ trademark and logo are used trademarks owned by Biocartis.

Please refer to the product labeling for applicable intended uses

for each individual Biocartis product. This press release is not

for distribution, directly or indirectly, in any jurisdiction where

to do so would be unlawful. Any persons reading this press release

should inform themselves of and observe any such restrictions.

Biocartis takes no responsibility for any violation of any such

restrictions by any person. This press release does not constitute

an offer or invitation for the sale or purchase of securities in

any jurisdiction. No securities of Biocartis may be offered or sold

in the United States of America absent registration with the United

States Securities and Exchange Commission or an exemption from

registration under the U.S. Securities Act of 1933, as amended.

Important information

This announcement is not a prospectus for the

purposes of Regulation 2017/1129, as amended (together with any

applicable implementing measures in any Member State of the

European Economic Area, the “Prospectus Regulation”) or the

Prospectus Regulation as it forms part of UK domestic law by virtue

of the UK European Union (Withdrawal) Act 2018 and as amended by

The Prospectus (Amendment etc.) (EU Exit) Regulations 2019 (each as

amended) (the "UK Prospectus Regulation").

THIS ANNOUNCEMENT IS NOT FOR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN THE UNITED STATES OF AMERICA, AUSTRALIA,

CANADA, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE TO DO

SO WOULD BE PROHIBITED BY APPLICABLE LAW.

THIS ANNOUNCEMENT IS FOR GENERAL INFORMATION

ONLY AND DOES NOT FORM PART OF ANY OFFER TO SELL OR PURCHASE, OR

THE SOLICITATION OF ANY OFFER TO SELL OR PURCHASE, ANY NEW BONDS,

OUTSTANDING BONDS OR OTHER SECURITIES. THE DISTRIBUTION OF THIS

ANNOUNCEMENT AND THE OFFER, SALE AND PURCHASE OF THE NEW BONDS, NEW

TERM LOANS OR THE OUTSTANDING BONDS DESCRIBED IN THIS ANNOUNCEMENT

IN CERTAIN JURISDICTIONS MAY BE RESTRICTED BY LAW. ANY PERSONS

READING THIS ANNOUNCEMENT SHOULD INFORM THEMSELVES OF AND OBSERVE

ANY SUCH RESTRICTIONS.

There shall be no offer, solicitation, sale or

purchase or exchange of the Existing Convertible Bonds or the New

Convertible Bonds in any jurisdiction in which such offer,

solicitation, sale, or purchase would be unlawful prior to

registration, exemption from registration or qualification under

the securities laws of any such jurisdiction. The securities

referred to herein have not been and will not be registered under

the U.S. Securities Act of 1933, as amended from time to time (the

"U.S. Securities Act") or the securities laws of any state of the

United States, and may not be offered or sold in the United States

unless these securities are registered under the U.S. Securities

Act, or an exemption from the registration requirements of the U.S.

Securities Act is available.

Biocartis has not registered, and does not

intend to register, any portion of the offering of the securities

concerned in the United States, and does not intend to conduct a

public offering of securities in the United States. This

communication is only addressed to and directed at persons in

member states of the European Economic Area (each a "Member

States") and in the United Kingdom who are "qualified investors"

within the meaning of Article 2(e) of the Prospectus Regulation and

of the UK Prospectus Regulation, respectively ("Qualified

Investors"). This communication is only being distributed to and is

only directed at (i) persons who are outside the United Kingdom or

(ii) investment professionals falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (the "Order") or (iii) high net worth companies, and other

persons to whom it may lawfully be communicated, falling within

Article 49(2)(a) to (d) of the Order (all such persons together

being referred to as "relevant persons"). The securities referred

to herein are only available to, and any invitation, offer or

agreement to subscribe, purchase or otherwise acquire such

securities will be engaged in only with, relevant persons. Any

person who is not a relevant person should not act or rely on this

document or any of its contents. This announcement cannot be used

as a basis for any investment agreement or decision. Biocartis is

not liable if the aforementioned restrictions are not complied with

by any person.

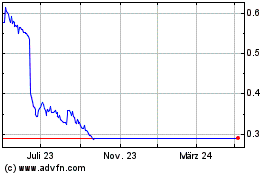

Biocartis Group NV (EU:BCART)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

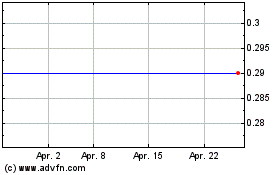

Biocartis Group NV (EU:BCART)

Historical Stock Chart

Von Apr 2023 bis Apr 2024