- Half-year sales doubled to €3.3 million compared to H1 2023,

with expanded market diversification

- Structuring milestones achieved in international expansion

in Saudi Arabia and the United States

- Solid financial structure: shareholders' equity of €62

million and cash position of €24.8 million

- Short- and medium-term financial guidance confirmed

Regulatory News:

Hoffmann Green Cement Technologies (ISIN: FR0013451044, Ticker:

ALHGR) (“Hoffmann Green Cement” or the “Company”), an industrial

player committed to the decarbonation of the construction sector

that designs and markets innovative clinker-free cements, announces

its 2024 half-year results. The Company's Supervisory Board met on

September 13, 2024 to review the financial statements for the year

ended June 30, 2024, as approved by the Executive Board.

€ thousand – IFRS

At June 30, 2024

At June 30, 2023

Revenue

3,280

1,676

EBITDA

-3,094

-3,648

Recurring operating profit/loss (EBIT)

-5,033

-5,133

Financial profit/loss

-37

270

Tax

-96

1,259

Net profit/loss

-5,190

-3,606

€ thousand – IFRS

At June 30, 2024

At June 30, 2023

Cash and cash equivalents (including

placements)

25,034

42,001

Shareholders’ equity

67,035

74,693

Julien Blanchard and David Hoffmann, co-founders of Hoffmann

Green Cement Technologies, said: “The first half of 2024 was

marked by Hoffmann Green's ongoing business development,

highlighted by the signing of significant new partnerships with

industry leaders. In response to the ongoing slowdown in France's

new housing construction sector, the company has diversified its

focus toward high-value markets, including renewable energy, waste

treatment, and B2C retail. These growth drivers in expanding

sectors position Hoffmann Green to face the future with confidence.

We are highly satisfied with our international progress, having

initiated the construction of the H-KSA 1 unit in Saudi Arabia and

secured a significant 30-year exclusive licensing agreement in the

United States. The doubling of our revenue, coupled with tight cost

control, has led to a significant improvement in EBITDA, which is

on track to reach breakeven in 2024. In light of these strong

commercial and financial achievements, we reaffirm all of our

short- and medium-term financial guidance.”

H1 2024 highlights: increased volumes, a strengthened order

book driven by new partnerships, international expansion, and

recognition through CSR awards

Higher sales volumes and stronger order book:

- Cement sales volume up +6.7% year-on-year to 7,833 tons. Sales

were mainly generated by H-UKR technology, and are mainly

attributable to the execution of contracts in the order book.

- Order book increased to over 270,000 tons, up by 10,000 tons of

cement over the first half of 2024. This increase is the result of

strategic partnerships and order commitments on H-UKR and H-IONA

technologies with key players in the sector:

- Signature of a partnership running until the end of 2027 with

Groupe Trecobat, France's 4th largest builder of single-family

homes;

- Strategic partnership with ViaVilla, a leading real estate

company specializing in the construction of villas on the Atlantic

coast;

- Signature of a key partnership to distribute Hoffmann

decarbonized cements in 600 outlets of the LES MOUSQUETAIRES Group

(Bricomarché, Bricorama, Brico Cash, Tridôme), marking the first

B2C retail agreement in France;

- Extension of the partnership with Bouygues Immobilier, a key

player in property development, for two years;

- Signing of a commercial partnership with Groupe Tartarin, a

Vienne-based producer of a wide range of ready-to-use

concretes;

- Extension of a 5-year distribution partnership with Groupe

Ravate, a major player on Reunion Island and in the Indian

Ocean;

- Partnership with the Polylogis Group and its subsidiary

LogiOuest, social housing providers, for the recommendation and

promotion of Hoffmann cement-based concretes for future housing

programs in Loire Atlantique and Maine et Loire.

In a new housing construction market that remains in a slowdown,

the Company has been able to diversify its business by penetrating

new growth markets such as renewable energies. In June 2024,

Hoffmann Green took part in a world first with the VALOREM Group:

the pouring of the first wind turbine foundation made of 0% clinker

decarbonized concrete.

In addition, building on the commercial dynamic of the first

half of 2024, interest in Hoffmann Green's technologies continues

unabated, as evidenced by the signing of additional strategic

contracts.

The company has signed a partnership agreement with Béton

Contrôle de l'Estuaire (BCE), an entity of the Duclos Group based

in Charente-Maritime (17), which produces a wide range of ready-mix

concrete, to provide Hoffmann Green Cement's 0% clinker cements to

its network of concrete plants.

Structuring milestones achieved in international

expansion

- Launch of H-KSA 1 construction

- Construction of Hoffmann's first cement production unit in

Saudi Arabia has begun with the laying of the foundation stone at

the Rabigh site. This event represents a key milestone, following

the signing in 2023 of the licensing agreement with the Shurfah

Group, a Saudi conglomerate.

- Signing of a key licensing contract in the United States

- This exclusive 30-year licensing agreement includes the

construction of several H2-type vertical production units in the

United States to support the decarbonization of the construction

sector. The contract also offers the partner the possibility of

sub-licensing Hoffmann units in the targeted states.

- In return, and in accordance with the strategy deployed as part

of its international development, the Company will receive an entry

fee of up to 20 million euros (including 2 million euros

guaranteed), as well as fixed and variable annual royalties based

on sales generated by the commercialization of Hoffmann cements in

the United States.

- This contract was signed with Hoffmann Green USA, whose

shareholders, Olivier Ducimetière-Monod and Francis Beauvallet, are

well established in the United States and have recognized expertise

in the sector.

Recognition of Hoffmann Green's CSR policy

- At the beginning of the year, the company published a scope 3

carbon footprint® based on the Net Zero Initiative® reference

framework developed by Carbone 4. The company is one of the first

cement companies to publish its carbon footprint according to all

three scopes.

- Hoffmann Green has also received assessments from French and

international extra-financial rating agencies, ranking the company

among the best-performing companies in its category.

- The Company was awarded the Solar Impulse Efficient Solution

label and joined the Bpifrance Excellence Club, two important

recognition marks guaranteeing the quality and economic

profitability of its H-UKR cement and certifying Hoffmann Green's

decarbonized manufacturing process and business model.

2024 half-year results

In the first half of 2024, revenue amounted to €3.3 million, up

+95.7% on the first half of 2023. The increase in sales in the

first half of 2024 is mainly due to the acceleration of

international expansion and the invoicing of an entry fee of €2

million to the American partner, and to higher cement sales volumes

(7,338 tons at the end of June 2023 vs. 7,833 tons at the end of

June 2024).

The improvement in EBITDA (+0.6 M€) results from the growth in

sales, tempered by an increase in commercial development costs and

a decrease in capitalized R&D development costs. The Company's

workforce is stable year-on-year (56 employees at end June 2023 vs.

55 employees at end June 2024).

Operating income before non-recurring items came to €5.0

million. The year-on-year change (+0.1 M€) is explained by the

evolution of EBITDA and the increase in depreciation and

amortization charges linked in particular to the launch of the H2

unit.

Financial result decreased by -0.3 M€ year-on-year due to the

fall in market value of the Company's mutual funds.

After taking into account a tax charge of -0.1 M€, Net Income at

the end of June 2024 amounted to -5.2 M€.

A strong financial structure

At June 30, 2024, the Company had a solid balance sheet, with

shareholders' equity of €62.0 million.

Available cash amounted to 13.1 M€ and 24.8 M€ including

investments, in accordance with the Company's development plan.

The change in cash and cash equivalents over the first half of

2024 (-0.2 M€) is explained by operating cash flows (-5.2 M€),

investment cash flows (-2.0 M€) and financing cash flows (+7.0 M€),

including the two OCEANE issues carried out over the period (+10.0

M€).

The Company's financial statements to June 30, 2024 will be

disclosed in the Company's half-yearly financial report, which will

be made available to shareholders on the Company's website by

October 30, 2024 at the latest, in accordance with legal and

regulatory requirements.

Strategy and outlook

- Commercial

- Continue to sign and extend contracts with strategic

partners;

- International deployment, through licensing agreements with

partners in charge of financing, building and operating Hoffmann

Green vertical production units in their geographical territory,

and commercializing the Company's technologies.

- Industrial

- Expansion of Hoffmann Green's production base with the launch

of construction of the H3 plant at the Grand Port Maritime de

Dunkerque (GPMD), scheduled for delivery in 2025.

- Financial

- Break-even EBITDA by 2024;

- Positive current operating income from 2025;

- Sales of €130 million and EBITDA margin of around 40% by

2026.

- R&D

- Acceleration of R&D funding to strengthen the environmental

performance and quality of Hoffmann Green products, rewarded in

2024 by the Solar Impulse Efficient Solution label.

- CSR

- Continue to commercialize carbon credits;

- Continuous improvement of CSR approach: increase in

extra-financial rating.

ABOUT HOFFMANN GREEN CEMENT TECHNOLOGIES

Founded in 2014 and based in Bournezeau (Vendée, Western

France), Hoffmann Green Cement Technologies designs, produces and

distributes innovative extremely low-carbon cements – with a carbon

footprint 5 times lower than traditional cement – that present, at

equivalent dosage and with no alteration to the concrete

manufacturing process, superior performances than traditional

cement.

Hoffmann Green operates two production units powered by a solar

tracker park on the Bournezeau site: a 4.0 factory and H2, the

world's first vertical cement plant inaugurated in May 2023. A

third factory will be established at the Grand Port of Dunkirk in

2025, bringing the total production capacity to 550,000 tons per

year, representing 3% of the French market. The group has

industrialized a genuine technological breakthrough based on

modifying cement composition and creating a cold manufacturing

process, with 0% clinker and low energy consumption, making it a

leading and unique player in the cement market that has not evolved

for 200 years.

In a context of climate urgency and energy price inflation,

Hoffmann Green Cement actively participates in energy transition by

producing clean cement that consumes 10 to 15 times less energy

than Portland cement. It also promotes eco-responsible construction

and encourages circular economy and natural resource preservation.

With its unparalleled and constantly evolving technological

expertise, driven by high-performing teams, Hoffmann Green Cement

Technologies serves all markets in the construction sector, both in

France and internationally.

Hoffmann Green was selected among the 2022 promotion of the top

20 French green startups as part of the French Tech Green20

program, led by the French Tech Mission in partnership with the

Ministry of Ecological Transition. In June 2023, the company was

selected for French Tech 2030, a new ambitious support program

operated by the French Tech Mission alongside the General

Secretariat for Investment (SGPI) and Bpifrance.

The company continues its international development with

contract signings in the United Kingdom, Belgium, Switzerland,

Saudi Arabia and recently in the United States.

For further information, please go to :

www.ciments-hoffmann.fr/

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240915881495/en/

Hoffmann Green

- Jérôme Caron

- Chief Financial Officer

- finances@ciments-hoffmann.fr

- 02 51 460 600

NewCap Investors Relations

- Thomas Grojean

- Alban Dufumier

- ciments-hoffmann@newcap.eu

- 01 44 71 94 94

NewCap Financial Media Relations

- Nicolas Merigeau

- Antoine Pacquier

- ciments-hoffmann@newcap.eu

- 01 44 71 94 98

Hoffmann Green Cement Technologies | Telephone : +33 2 51 460

600 | Email : fınances@ciments-hoffmann.fr

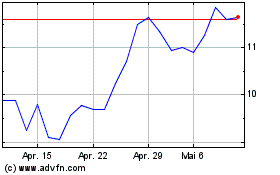

Hoffmann Green Cement Te... (EU:ALHGR)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Hoffmann Green Cement Te... (EU:ALHGR)

Historical Stock Chart

Von Dez 2023 bis Dez 2024