ATARI: FY2023 ANNUAL RESULTS

FY2023 ANNUAL

RESULTSCONTINUED TRANSFORMATION AND IMPLEMENTATION

OF STRATEGIC PLAN

PARIS, FRANCE (August 1st, 2023 - 8.00

am CET) - Atari® — one of the world's most iconic consumer

brands and interactive entertainment producers — today

announced the Group’s consolidated results for the fiscal year

ended March 31, 2023, approved by the Board of Directors during its

meeting held on July 31, 2023. Consolidated accounts have been

audited by the statutory auditors.

FY2023

Operational highlights

- Completion of a €12.5M capital increase

- Termination of the license related to the ATRI Token

- Launch of Atari X, consolidating Atari Web3 interests into a

unified operation

- Transfer of the listing of Atari shares to the Euronext Growth

Paris market

- Transformation of the organization and operations across all

four lines of business

- Launch of eight new premium games over the period

- Tender offer by Irata LLC

- RollerCoaster Tycoon license extended for a 10-year period

●

Acquisition of Berzerk and Frenzy IPs

- Announced agreement to acquire Night Dive Studios, Inc.

Post-closing

events

- Acquisition of more than 100 PC and console titles from the 80s

and 90s

- Update to listing on OTC markets in the United States

- Acquisition of M Network Atari 2600 titles and related

trademarks

- Closing of Night Dive Studios, Inc. acquisition

- €30M convertible bond offering

- Strategic collaboration with Playmaji Inc.

FY2023

financial performance summary

- Revenues for the period at €10.1M (vs €14.9M in previous year),

with Games Revenue for the period at €7.3M (vs €5.7M in previous

year)

- Current operating income -€6.1M (vs -€2.3M in previous

year)

- Operating income at -€8.5M (vs -€23.0M in previous year)

- Net income at -€9.5M (vs -€23.8M in previous year)

Wade Rosen, Chairman

and Chief Executive Officer commented: “The financial performance

of the Group is reflective of Atari’s continuing transformational

efforts to refocus all four lines of Atari’s business on projects

critical to the brand’s DNA. With this strategic refocus,

complemented by acquisitions completed during the year, we continue

to put in place the necessary foundation for long term

success.”

HIGHLIGHTS OF

THE PERIOD

During the year, the Company focused its

resources on the transformation of its operations and organization

while laying the foundation for a new strategic orientation across

each of its four lines of business:

- Games – Atari continued the execution of its

strategy to develop premium games based on the intellectual

property owned or acquired by Atari. Since the beginning of the

period Atari launched eight new premium games, including Atari 50:

The Anniversary Celebration, Atari Mania, and Akka Arrh, as well as

new additions to its Recharged series with Gravitar: Recharged,

Yars: Recharged, Caverns of Mars: Recharged and Missile Command:

Recharged and a new IP, Kombinera.

- Hardware – The year was primarily dedicated to

the reorganization of the Hardware line of business which included

the suspension of direct hardware manufacturing relationships,

notably with regards to the Atari VCS, for which a new commercial

strategy has been implemented as of the end of calendar year 2022

and that will continue in calendar year 2023. In July 2023, Atari

announced a strategic collaboration with Playmaji Inc., the company

behind the Polymega game console, to collaborate on innovative

retro hardware and software initiatives.

- Licensing – Atari has focused its efforts on

building new licensing verticals, with the support of a brand

licensing agency, to drive significant initiatives across new

categories and geographies with world-class partners.

- Web3 – The fiscal year was primarily focused

on laying the foundation of Atari X which included collaborations

and partnerships with Web3 partners, as well as the implementation

of successful NFT sales, despite unfavorable market conditions for

blockchain related activities.

- Acquisitions - Atari has also expanded its

catalog of retro intellectual property through the acquisitions of

12 arcade titles including Berzerk and Frenzy in March 2023, in

April 2023, the acquisition of more than 100 PC and console,

including notable games from the Bubsy, Hardball, and Demolition

Racer series, and in May 2023, the acquisition of M Network, a

collection of Atari 2600 titles and related trademarks originally

developed by Intellivision. Finally, in May 2023, Atari finalized

the acquisition of Night Dive Studios, Inc., a full service game

development and publishing company, critically acclaimed for the

release of titles including System Shock and remasters of Turok,

Turok 2, Doom 64, and Quake.

BREAKDOWN OF

REVENUES BY LINES OF BUSINESS

| (M€) |

FY 23 |

FY 22 |

| Games |

7.3 |

5.7 |

| Hardware |

0.7 |

3.1 |

| Licensing |

1.3 |

1.3 |

| Web3 |

0.8 |

4.9 |

| Total Revenue |

10.1 |

15.0 |

Revenues - As of March 31,

2023, Atari recorded consolidated revenues of €10.1M, compared with

€14.9M in the previous year. The decrease, -32% at current exchange

rates and -39% at constant exchange rates, is reflective of Atari’s

strategic orientations implemented by the Group over the period,

across all its lines of business and one-off revenue in FY22 that

was not replicated in FY23.

- Games: During the fiscal year Atari continued

with the execution of its strategy focusing on premium games based

on Atari’s own IP and launched eight new games. For the period,

Games revenues increased to around €7.3M compared to €5.7M in

previous year.

- Hardware: The year was primarily dedicated to

the reorganization of the Hardware line of business, and the

implementation of a new commercial strategy for the VCS. Hardware

revenues stand at €0.7M for the year, compared to €3.1M in previous

year, and also include revenues generated by the sale of VCS and XP

Cartridges on the Atari.com storefront, which was launched in

November 2022.

- Licensing: Licensing revenues for the period

reached €1.3M, stable versus prior year, which is consistent with

Atari’s efforts to build new licensing verticals and drive

initiatives across new categories and geographies.

- Web3: Web3 revenues for the year primarily

consisted of NFT sales completed in the first half of the year,

despite a challenging market environment for cryptocurrencies in

general. Web3 revenues for the year of €0.9M decreased compared to

the previous period, which accounted for one-off sales of certain

digital assets.

CONSOLIDATED

INCOME STATEMENT SUMMARY

| (M€) |

FY23 |

FY 22 |

| REVENUE |

10.1 |

14.9 |

| GROSS MARGIN |

7.9 |

11.5 |

| CURRENT OPERATING INCOME

(LOSS) |

(6.1) |

(2.3) |

| OPERATING INCOME

(LOSS) |

(8.5) |

(23.0) |

| NET INCOME (LOSS) FOR THE

YEAR |

(9.5) |

(23.8) |

| |

|

|

Gross Margin – Gross margin

improved from 77% to 79% of revenues. This is mainly due to the

decrease in Hardware COGS resulting from the suspension of existing

VCS manufacturing contracts in light of the revision of Atari’s

hardware strategy.

Research and Development

Expenses – Research and development expenses totalled

€4.4M (compared to €7.5M in previous year), demonstrating the

Group’s focus on new premium games development and lower expenses

related to hardware projects compared to previous period.

Marketing and Selling Expenses

– Marketing and selling expenses totalled €0.7M, compared with

€1.2M in the previous year. This significant reduction is in line

with Atari's efforts to improve profitability of its Games activity

and the reduction of VCS marketing.

General and Administrative

Expenses – General and administrative expenses represent

€8.5M, compared with €5.1 M the previous year mainly due to

the increase in legal and personnel costs incurred in context of

the transformation strategy and new team organization.

Other Income and Expenses –

Other income and expenses came at -€2.5M, compared to -€20.7M which

included mainly one-offs, non cash items recorded in context of the

Group’s strategic review of its operations. For FY23, other income

include, notably, positive effect from reversal of provisions for

litigations for €1.3M. Other Expenses include notably €1.9M

impairment on VCS inventories and spare parts, €1.3M impairment on

games, €0.6M impairment and losses on financial and certain digital

assets.

Operating Income – Operating

income for the year ended March 31, 2023 came to -€8.5M, compared

with -€23.0M for the year ended March 31, 2022.

Net Income – Consolidated net

income for the year came to -€9.5M, compared with -€23.8M in

previous year.

BALANCE SHEET

SUMMARY

| ASSETS (M€) |

FY23 |

FY 22 |

| Non-current

assets |

18.1 |

18.9 |

| Current assets |

7.1 |

7.0 |

| Total assets |

25.2 |

26.0 |

| |

|

|

| EQUITY & LIABILITIES

(M€) |

FY23 |

FY 22 |

| Total equity |

7.8 |

4.4 |

| Non-current

liabilities |

9.5 |

8.0 |

| Current

liabilities |

7.9 |

13.6 |

| Total equity and

liabilities |

25.2 |

26.0 |

Non-current AssetsIntangible assets increased

from €6.1M to €7.7M. The increase is due to:

- +€1.9M increase in capitalized R&D with the continued

investment in the development of new games;

- +€0.1M increase in Licenses essentially due to the acquisition

of one IP;

- -€0.4M decrease in digital assets - taking into account the

disposal of certain assets and the €0.1M impairment related to

cryptocurrencies that were previously recorded on historical

value.

Current Assets remain stable at

€7.1M over the period. The evolution is mainly due to the €1.7M

decrease in inventories resulting mainly from hardware inventory

depreciation, increase in trade receivables and €1.0M increase in

cash and cash equivalents, in connection with the capital increase

of April 2022 and shareholder loans granted throughout the

year.

Non-current Liabilities

increased to €9.5M over the period, notably due to the evolution of

shareholders loans over the period (redemption by debt set-off in

the capital increase, for a total amount of €2.9M, and €2.5M new

shareholder loans granted throughout the year) and the reversal of

a provision for litigation for €0.9M.

Current Liabilities decreased

to €7.9M, notably thanks to the €5.4M decrease in trade payables

resulting from the clean-up of certain working capital items with

the proceeds of the capital increase. Other current liabilities

represent €4.6M, and include, notably, €2.4M in deferred revenues

from ATRI Tokens previously sold or awarded, and staff-related

liabilities for €2.1M.

Shareholders’ equity increased

from €4.4M to €7.8M and was mainly impacted by the proceeds of the

capital increase concluded in April 2022 for a total amount of

€12.5M and the allocation of a portion of costs of the capital

increase on issuance premium for an amount of €0.6M.

Net debt - At March 31, 2023,

the Group had a net debt position of €6.2M, compared to a net debt

of €4.6M in the previous year. Net debt position does not take into

account the proceeds from the €30M convertible bond issuance

completed on June 5, 2023 (€12.9M in cash), nor shareholder loans

that have been concluded between Irata and Atari after year end

close. At the date of this Document, all shareholder loans

previously granted by IRATA to Atari (€16.3M in total) have been

redeemed in full by way of debt set-off.

| (M€) |

FY23 |

FY 22 |

| Cash and cash

equivalents |

1.7 |

0.6 |

| Non-current financial

liabilities |

(7.7) |

(5.0) |

| Current financial

liabilities |

(0.2) |

(0.1) |

| Net debt |

(6.2) |

(4.6) |

Cash flow statement

| (M€) |

FY 23 |

FY 22 |

| NET CASH USED IN OPERATING

ACTIVITIES |

(8.3) |

(5.8) |

| NET CASH USED IN INVESTING

ACTIVITIES |

(5.6) |

(4.4) |

| NET CASH PROVIDED BY FINANCING

ACTIVITIES |

14.7 |

7.5 |

| NET CHANGE IN CASH AND CASH

EQUIVALENTS |

1.0 |

(1.9) |

| (M€) |

FY 23 |

FY 22 |

| Net opening cash

balance |

0.6 |

2.5 |

| Net closing cash

balance |

1.7 |

0.6 |

| NET CHANGE IN CASH AND CASH

EQUIVALENTS |

1.0 |

(1.9) |

Net change in cash for the period was positive

at €1.0M, comprising -€8.3M cash generated by operating activities

due to lower activity and €4.8M investments related to R&D

costs for new game development. Financing activities generated

€14.7M, including €11.9M from capital increase and €2.7M from

shareholders loans granted throughout the year. End of year cash

position of €1.7M, excludes proceeds from i) shareholder loan

granted by Irata of €5.0M in April 2023, ii) $4.5M loan from Irata

for the purpose of Nightdive acquisition financing and iii) cash

proceeds from the convertible bonds.

STRATEGY &

OUTLOOK

After a transition year which saw the Group

successfully put in place the drivers for growth, profitability and

cash generation, Atari is focusing on the execution of its

strategic roadmap to monetize its IP portfolio across all four

lines of business:

- Gaming - Increase the monetization of the

large back catalog of games and acquired IP, continue to invest in

the development of a dynamic pipeline of new premium game releases

of 12 new games scheduled over the next 18 months, and the

successful integration of Nightdive Studios;

- Hardware - Continue to work on new and

innovative hardware products, via partnerships and under license

agreements, and continue to support the VCS with value-added

partnerships, notably with Polymega;

- Licensing - Continue development of Licensing

opportunities in new verticals and geographical areas and benefit

from the contribution of multi-year licenses signed during the

previous periods;

- Web3 - Continue development of Atari’s Web3

ecosystem under Atari X with the forthcoming launch of Atari Club.

Atari also intends to continue building partnerships and

collaborations with leading blockchain and Web3

partners.

Atari will continue to selectively consider

potential acquisitions and/or minority investments in companies

offering value-added solutions for the Group, and acquisitions of

retro games that further compliment its portfolio of intellectual

property.

Going Concern

As at March 31, 2023, the Company reported a net

loss of €9.5M (compared with €23.8M in previous year).

Shareholders’ equity was €7.8M, compared to €4.4M in previous year.

Net debt stood at €(6.2)M compared to net debt position of €4.6M in

previous year, and includes €1.7M of cash and €7.9M of financial

debt.

The Company conducted a review of its liquidity

risk based on projections on all of its four activities: Gaming,

Hardware, Licensing and Web3, excluding any external financing.

Under this assumption, the Group considers that it can meet its

future obligations and that it holds sufficient liquidity to

continue its activities over the next 12 months. This consideration

excludes potential future inorganic growth opportunities.

The Group benefits from the flexibility provided

by the proceeds raised with the convertible bonds issuance

completed in June 2023 for an amount of (€30 M which comprised

€16.3 M subscription by debt set-off and €12.9M in cash).

Token Update

As previously disclosed, Atari terminated the

license with the former joint venture that created and distributed

the ATRI Token. Atari also disclosed plans to provide a claim

for a new token for certain ATRI holders. As stated in subsequent

disclosures on Atari.com, given the changing regulatory and

commercial landscapes, as well as Atari’s strategic priorities,

Atari is unable to create a new token. Instead, Atari has confirmed

that ATRI holders are free to continue to trade their ATRI tokens

and Atari will provide a claim to each eligible ATRI wallet holder

identified in the snapshot on April 18, 2022 for a share of a pool

of a third-party token currently held by Atari. Atari will focus

its resources on growing its activities across Games, Licensing and

Hardware lines of business, and in Web3, with the development of

the Atari Club and continued collaborations and partnerships.

ANNUAL GENERAL

MEETING

The Shareholders’

Annual Meeting is scheduled to be held on September 29, 2023 and

will be convened shortly.

AVAILABILITY OF AUDITED ANNUAL

AND CONSOLIDATED FINANCIAL STATEMENTS FOR THE 2022-2023 FINANCIAL

YEAR

Annual and

consolidated financial statements for the 2022-23 financial year,

ending March 31, 2023 are available on the Company's website.

About

ATARI

Atari is an

interactive entertainment company and an iconic gaming industry

brand that transcends generations and audiences. The company is

globally recognized for its multi-platform, interactive

entertainment and licensed products. Atari owns and/or manages a

portfolio of more than 200 unique games and franchises, including

world-renowned brands like Asteroids®, Centipede®, Missile

Command®, Pong®, and RollerCoaster Tycoon®. Atari has offices in

New York and Paris. Visit us online at www.Atari.com.

Atari shares are

listed in France on Euronext Growth Paris (ISIN Code FR0010478248,

Ticker ALATA) and OTC Pink Current (Ticker PONGF).

©2022 Atari

Interactive, Inc. Atari wordmark and logo are trademarks owned by

Atari Interactive, Inc.

Contacts

Atari - Investor RelationsTel + 33 1 83 64 61 57

- investisseur@atari-sa.com | www.atari.com/news/

Calyptus – Marie Calleux Tel + 33 1 53 65 68 68

– atari@calyptus.net

Listing Sponsor- EurolandTel +33 1 44 70 20

84Julia Bridger - jbridger@elcorp.com

APPENDIX

Consolidated P&L

| (M€) |

FY23 |

FY 22 |

| Revenue |

10.1 |

14.9 |

| Cost of goods sold |

(2.2) |

(3.4) |

| GROSS MARGIN |

7.9 |

11.5 |

| Research and development expenses |

(4.4) |

(7.5) |

| Marketing and selling expenses |

(0.7) |

(1.2) |

| General and administrative

expenses |

(8.5) |

(5.1) |

| Other operating income (expense) |

(0.4) |

- |

| CURRENT OPERATING INCOME

(LOSS) |

(6.1) |

(2.3) |

| Other income (expense) |

(2.5) |

(20.7) |

| OPERATING INCOME

(LOSS) |

(8.5) |

(23.0) |

| Cost of debt |

(0.2) |

(0.2) |

| Other financial income (expense) |

0.1 |

(1.7) |

| Share of net operational profit of

equity affiliates |

- |

- |

| Income tax |

(0.9) |

(0.1) |

| NET INCOME (LOSS) FROM

CONTINUING OPERATIONS |

(9.5) |

(25.0) |

| Net income (loss) from discontinued

operations |

0.1 |

1.1 |

| NET INCOME (LOSS) FOR THE

YEAR |

(9.5) |

(23.8) |

| Group share |

(9.5) |

(23.8) |

Balance Sheet

| ASSETS (M€) |

FY23 |

FY 22 |

| Intangible assets |

7.7 |

6.1 |

| Property, plant and equipment |

0.0 |

0.0 |

| Rights of use relating to leases |

1.3 |

1.6 |

| Non-current financial assets |

7.9 |

9.2 |

| Deferred tax assets |

1.2 |

2.0 |

| Non-current

assets |

18.1 |

18.9 |

| Inventories |

0.5 |

2.1 |

| Trade receivables |

3.1 |

2.4 |

| Other current assets |

1.8 |

1.7 |

| Cash and cash equivalents |

1.7 |

0.6 |

| Assets held for sale |

0.0 |

0.1 |

| Current assets |

7.1 |

7.0 |

| Total assets |

25.2 |

26.0 |

| |

|

|

| EQUITY & LIABILITIES

(M€) |

FY23 |

FY 22 |

| Capital stock |

3.8 |

3.1 |

| Share premium |

32.7 |

21.4 |

| Consolidated reserves |

(19.2) |

3.7 |

| Net income (loss) Group share |

(9.5) |

(23.8) |

| Total equity |

7.8 |

4.4 |

| Provisions for non-current

contingencies and losses |

- |

0.9 |

| Non-current financial liabilities |

7.7 |

5.0 |

| Long term lease liabilities |

1.0 |

1.3 |

| Other non-current liabilities |

0.7 |

0.7 |

| Non-current

liabilities |

9.5 |

8.0 |

| Provisions for current contingencies

and losses |

- |

0.4 |

| Current financial liabilities |

0.2 |

0.1 |

| Short term lease liabilities |

0.4 |

0.4 |

| Trade payables |

2.7 |

8.2 |

| Other current liabilities |

4.6 |

4.5 |

| Liabilities held for sale |

0.0 |

0.1 |

| Current

liabilities |

7.9 |

13.6 |

| Total equity and

liabilities |

25.2 |

26.0 |

Cash-flow statement

| (M€) |

FY 23 |

FY 22 |

| Net income (loss) for the

year |

(9.5) |

(23.8) |

| Non cash expenses and

revenue |

|

|

| Charges (reversals) for depreciation,

amortization and provisions for non current assets |

5.4 |

14.7 |

| Cost of (revenue from) stock options

and related benefits |

0.8 |

0.8 |

| Losses (gains) on disposals |

- |

- |

| Other non cash items |

0.3 |

(0.2) |

| CASH FLOW BEFORE NET COST OF

DEBT AND TAXES |

(3.0) |

(8.5) |

| Income taxes paid |

- |

- |

| Changes in working

capital |

|

|

| Inventories |

1.7 |

(4.4) |

| Trade receivables |

(0.1) |

2.4 |

| Trade payables |

(4.5) |

0.6 |

| Other current & non current assets

and liabilities |

(2.5) |

4.2 |

| NET CASH USED IN OPERATING

ACTIVITIES |

(8.3) |

(5.7) |

| Purchases of/additions

to |

|

|

| Intangible assets |

(5.8) |

(4.3) |

| Property, Plant & equipment |

(0.0) |

- |

| Non current financials assets |

- |

(0.1) |

| Disposals/repayments

of |

|

|

| Intangible assets |

0.2 |

- |

| Property, Plant & equipment |

- |

- |

| Non current financials assets |

- |

- |

| NET CASH USED IN INVESTING

ACTIVITIES |

(5.6) |

(4.4) |

| Net funds raised

from |

|

|

| Share issues |

12.0 |

2.4 |

| Loans |

2.7 |

5.0 |

| Net funds disbursed

for |

|

|

| Interest and other financial

charges |

0.0 |

- |

| Debt repayment |

- |

0.1 |

| NET CASH PROVIDED BY (USED IN)

FINANCING ACTIVITIES |

14.7 |

7.5 |

| Impact of changes in exchange

rates |

0.2 |

0.7 |

| NET CHANGE IN CASH AND CASH

EQUIVALENTS |

1.0 |

(1.9) |

Cash-flow statement

(cont’d)

| (M€) |

FY 23 |

FY 22 |

| Net opening cash

balance |

0.6 |

2.5 |

| Net closing cash

balance |

1.7 |

0.6 |

| NET CHANGE IN CASH AND CASH

EQUIVALENTS |

1.0 |

(1.9) |

| Net closing cash

balance |

|

|

| Cash and cash equivalents |

1.7 |

0.6 |

| Bank overdrafts (including current

financial debts) |

- |

- |

Summary of Digital Assets holdings (as

of March 31, 2023)

Cryptocurrencies

|

Nature |

Units |

Value (€K) |

| ETHerum |

29 |

48 |

| WETH |

7 |

12 |

| SAND |

503,052 |

267 |

| USDC |

11,000 |

10 |

| CHAIN Token |

430,000 |

10 |

| LYM Token |

670,819 |

2 |

Other digital assets

|

|

Units |

Value (€K) |

| Sandbox Lands |

972 parcels |

- |

| ATRI Tokens |

259 million |

716 |

Atari does not intend to sell ATRI Token or parcels of land in

The Sandbox within the next twelve months period starting from

December 16, 2022.

DISCLAIMER

This press release contains certain non-factual

elements, including but not restricted to certain statements

concerning its future results and other future events. These

statements are based on the current vision and assumptions of

Atari’s leadership team. They include various known and unknown

uncertainties and risks that could result in material differences

in relation to the expected results, profitability and events. In

addition, Atari, its shareholders and its respective affiliates,

directors, executives, advisors and employees have not checked the

accuracy of and make no representations or warranties concerning

the statistical or forward-looking information contained in this

press release that is taken from or derived from third-party

sources or industry publications. If applicable, these statistical

data and forward-looking information are used in this press release

exclusively for information.

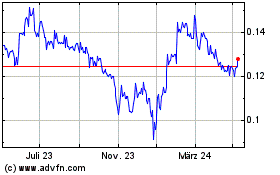

Atari (EU:ALATA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

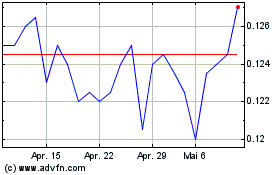

Atari (EU:ALATA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025