Uniswap Bloodbath: UNI Price Crashes 16% On SEC Lawsuit Fears

11 April 2024 - 10:30AM

NEWSBTC

The US Securities and Exchange Commission (SEC) has served a Wells

Notice to Uniswap, a leading decentralized exchange (DEX). This

pre-enforcement notice, a precursor to potential legal action,

triggered a plunge in Uniswap’s native token, UNI. At the time of

writing, UNI was trading at $9.37, down 16.2% in the last 24 hours,

data from Coingecko shows. The crypto has also sustained a 15% loss

in the last seven days. Uniswap Whales Seek Safer Shores The news

of the SEC’s looming action acted as a fire alarm for Uniswap’s

biggest investors. On-chain data analysts at Lookonchain reported

significant market movements, with three large whales shedding a

staggering 2.03 million UNI tokens – a cool $20 million vanishing

from the Uniswap ecosystem within hours. Related Reading: Bitcoin

Below $70,000: Is $80K Still Possible, Or Is The Rally Over? The

wallets offloaded a combined 1.25 million UNI, potentially

profiting by $3.5 million if they sold at current market prices.

These tokens, interestingly, originated from a Binance transfer in

March 2023, hinting at a potential strategy of holding on the

exchange until the regulatory clouds cleared. UNI takes a dip in

the last 24 hours. Source: Coingecko Another whale liquidated over

472,000 UNI for a quick $4.6 million USDC payout, netting a cool

$1.67 million in profit. The fire sale wasn’t limited to these

three giants – six other whale-sized wallets collectively moved

316,400 UNI tokens to Binance, valued at roughly $3.15 million.

This mass exodus of heavyweight investors exacerbated the downward

spiral of UNI’s price, leaving retail investors scrambling to

assess the situation. whitzardflow.eth was liquidated 107,010

$UNI($1M) 1 hour ago. He bought 262,045 $UNI($3M) from Mar 1 to Mar

13 at $11.42 and deposited it into #Aave, then borrowed $1.8M of

stablecoins. Due to the decrease in $UNI price, he was liquidated

107,010 $UNI($1M) to repay the debt and… pic.twitter.com/6mRg8sL3YE

— Lookonchain (@lookonchain) April 11, 2024 Uniswap Founder Vows To

Fight, DeFi Future Uncertain Uniswap founder Hayden Adams reacted

swiftly and fiercely to the SEC’s move. In a fiery statement posted

on the X platform, Adams condemned the SEC’s approach, accusing

them of prioritizing opaque, legacy financial systems over the

interests of consumers. Today @Uniswap Labs received a Wells notice

from the SEC. I’m not surprised. Just annoyed, disappointed, and

ready to fight. I am confident that the products we offer are legal

and that our work is on the right side of history. But it’s been

clear for a while that rather than… — hayden.eth 🦄 (@haydenzadams)

April 10, 2024 He emphasized the need to defend Uniswap and the

broader DeFi industry, underscoring the potential of decentralized

finance to revolutionize financial inclusion. The Wells Notice

marks the beginning of what could be a long and arduous legal

battle. Adams acknowledged the possibility of a years-long fight,

highlighting the immense stakes involved. The outcome of this

clash, he argued, could significantly impact the future trajectory

of DeFi and the entire cryptocurrency landscape. UNI market cap

currently at $5.6 billion. Chart: TradingView.com Related Reading:

From Hat To Heights: Dogwifhat’s $17 Crypto Leap Electrifies

Investors Crypto Market Braces For Regulatory Storm Investors are

now grappling with the specter of increased regulatory scrutiny for

DEXs, a sector that has thrived on its permissionless nature. The

uncertainty surrounding Uniswap’s legal status has cast a shadow

over investor confidence, raising concerns about the potential

devaluation of their holdings. Featured image from Knowledge at

Wharton – University of Pennsylvania, chart from TradingView

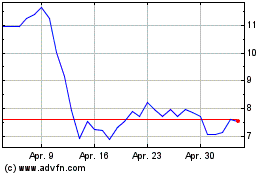

Uniswap (COIN:UNIUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Uniswap (COIN:UNIUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024