New Reports Shows How Much Capital Was Pulled Out Of Crypto In August

15 September 2023 - 2:45PM

NEWSBTC

The crypto industry is known for its sheer price movement

volatility, driven mainly by events and liquidity crunches. Since

the beginning of the year, there has been a noticeable and

consistent outflow of cash from the cryptocurrency market, which is

unsurprising. According to Bitfinex’s latest report, this

capital drain was evident in August, as the crypto market saw an

exit of about $55 billion in capital from major cryptocurrencies.

$55 Billion Drained In The Past Month Bitfinex’s analysis, which

measured the aggregate realized value metric of Bitcoin (BTC),

Ethereum (ETH), and major stablecoins like Tether’s USDT, USD Coin

(USDC), BUSD, Dai, and TrueUSD (TUSD), indicates that about $55

billion in capital exited the market in August. Related Reading:

The Real Reason Behind That Bitcoin Transaction With A $500,000 Fee

Has Been Revealed Although the market struggled for most of the

first half of the year, things became different in July as Bitcoin

spearheaded inflows. During this period, Bitcoin crossed $30,000

for a while as over $100 billion has entered the market. However,

the momentum changed in early August, as profit-taking and

continued mixed signals from the US economy triggered

outflows. “A deep dive into the data reveals a prevailing

trend: by early August, the industry had begun to experience

capital outflows,” said the report. Interest from institutional

investors during this period, especially, started to wane as

digital asset investment funds registered outflows after four weeks

of heavy inflows. The trend has continued to the time of writing,

as the run of outflows now totals $294 million. What Caused

The Crypto Capital Drain? The report from Bitfinex shows that

August’s capital drain was the biggest this year, especially for

Bitcoin. Most of this drain came from two isolated events,

resulting in immense price movement in a relatively short period.

In particular, the August 17 flash crash saw Bitcoin’s price drop

by 11.4% in a few hours. “August was the largest red monthly

candle for BTC since the bear market bottom was formed in November

2022 at –11.29 percent as per Bitfinex Data.” The crypto derivative

market has also had a similar trajectory. Ether (ETH) futures and

options markets have slowed considerably in 2023. The average daily

trading volume is down almost 50% from the two-year average to

$14.3 billion daily. Related Reading: Why This Crypto

Exchange Founder Believes Bitcoin Can Still Rise 150% From Here

Bitcoin has also seen some liquidity crunches, as data shows almost

69% of all mined Bitcoin have not moved in over a year. On the

other hand, this suggests a high conviction from investors and a

buoyant outlook on the future of the digital currency.

September has been relatively quiet regarding price movement, and

the industry awaits the beginning of the next bull market. However,

this crypto exchange founder believes that a bull run already

started in March but the market is yet to catch on. Total market

cap falls to $1.03 as outflows continue | Source: Crypto Total

Market Cap on Tradingview.com Featured image from Forkast News,

chart from Tradingview.com

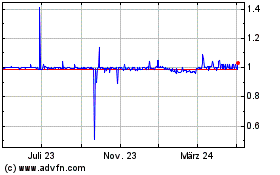

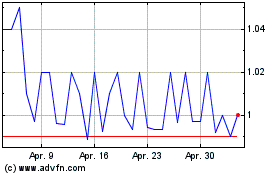

TrueUSD (COIN:TUSDUSD)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

TrueUSD (COIN:TUSDUSD)

Historical Stock Chart

Von Apr 2024 bis Apr 2025