Is Bitcoin Headed For $34,000? Large Buyer’s Purchase May Signal Yes

30 Mai 2023 - 12:00AM

NEWSBTC

Bitcoin is finally seeing some green after trading at a loss over

the past two weeks. The cryptocurrency continues to trade within a

tight range, but activity in the options market could hint at a

potential run toward new highs. Related Reading: No All-Time High

For Bitcoin In 2023, Former BitMEX Head Arthur Hayes Predicts As of

this writing, Bitcoin (BTC) trades at $27,900 with a 2.5% profit in

the last 24 hours. Over the last week, the cryptocurrency has seen

twice the profits recording a 4.4% performance. Other

cryptocurrencies in the top 10 by market cap are experiencing

similar momentum. Bitcoin Options Hint At Fresh Rally? Data from

crypto options trading platform Deribit indicates a drop in Implied

Volatility (IV). This metric measures the expectation of future

price movements by market participants. IV has been trading

sideways over the past month, with a tendency to the downside.

Deribit claims that growing uncertainty in the crypto market and

the macroeconomic landscape is fueling the current dynamic on this

metric, which translates into slow price action for BTC and crypto.

As the price of Bitcoin retraces, option buyers have been selling

their contracts. When the opposite happens, and BTC sees an uptick,

options sellers dump their contracts. This dynamic has put

“constant selling pressure” on the IV and contributed to

suppressing the BTC spot sector. However, the upcoming U.S. debt

ceiling, the date this country could default on its national

financial commitments, could change the status quo. The narrative

around this event hints at a further appreciation for BTC and

risk-on assets. Today, equities and crypto rallied as key political

factions in the North American country reached a tentative

agreement that could avert a crisis across the financial world.

Over the weekend and into today’s development, Deribit noted that

maturity for BTC options turned profitable. The exchange also saw

aggressive calls buying as the landscape signals profits for the

cryptocurrency and prices return north of $27,000. This large

player bought calls (buy orders), betting that BTC could hit

$34,000 somewhere in July/August 2023, as seen on the chart below.

Related Reading: Polkadot Experiences Correction After Reaching

$5.54: What’s Next In Store? Deribit stated in a market update: Sub

7day ATM-28k Calls + July 31k Calls bought bravely ahead of the

long weekend Theta turned profitable as Debt-ceiling talks

progressed and a large DSOB buyer of July+Aug 34k Calls

aggressively accumulated at higher prices just prior to Spot

slicing through 27.3k and now 28k Cover image from Unsplash, chart

from Tradingview

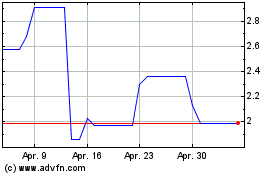

Theta (COIN:THETAUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Theta (COIN:THETAUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024