Bitcoin Sentiment Still Close To Extreme Greed: More Cooldown Needed For Bottom?

25 Dezember 2024 - 4:30AM

NEWSBTC

Data shows the Bitcoin market sentiment is still quite close to the

extreme greed zone, a potential sign that a further price cooldown

may be needed before a bottom. Bitcoin Fear & Greed Index Still

Has A High Greed Value The “Fear & Greed Index” refers to an

indicator created by Alternative that tells us about the average

sentiment among investors in the Bitcoin and wider cryptocurrency

markets. The index uses a numeric scale that runs from zero to

hundred for representing this mentality. Its value being greater

than 53 means the investors as a whole are showing greed, while it

being under 47 implies the presence of fear in the market. Values

lying between these cutoffs correspond to a net neutral sentiment.

Related Reading: Bitcoin Coinbase Premium Giving Potential Buy

Signal, Quant Says Now, here is how the current sentiment in the

sector looks according to the Bitcoin Fear & Greed Index: As is

visible above, the indicator has a value of 73 at the moment, which

suggests the average trader is holding a sentiment of greed. This

greed sentiment is also a particularly strong one, so strong in

fact that it’s sitting very close to a special region called the

extreme greed. The extreme greed occurs when the index reaches a

value of 75 or higher. A similar zone also exists for the fear

side, known as the extreme fear, and is situated at 25 or under.

Historically, the extreme sentiments have proven to be important

for Bitcoin and other cryptocurrencies, as tops and bottoms have

tended to occur while the market has been inside these zones. The

relationship between price and sentiment has generally been an

inverse one, meaning extreme greed leads to tops and extreme fear

to bottoms. The BTC top earlier in the month occurred when the

index was at a value of 87. With the price decline that has

occurred since then, market sentiment has cooled off a bit. The

question is: has it cooled enough? While other phases of the market

usually require dips into fear or extreme fear for bottoms to take

place, bull markets generally don’t see pullbacks that deep.

Related Reading: Dogecoin & Other Memecoins No Longer Grabbing

Social Media Attention: Santiment Often times, a venture into the

normal greed zone or the neutral territory is enough for the price

to regain steam. That said, the recent sentiment has still been

quite close to extreme greed, so it may need a bit more before a

real turnaround is reached. The Fear & Greed Index calculates

its value using multiple factors, one of which is social media

sentiment. While the overall sentiment has still been positive, it

seems social media users have started to show fear, as the

analytics firm Santiment has pointed out in an X post. BTC Price

Bitcoin has shown a sharp 6% rebound during the last 24 hours, a

potential indication that the dip into the greed sentiment may have

been enough for the rally to restart after all. Featured image from

Dall-E, Santiment.net, chart from TradingView.com

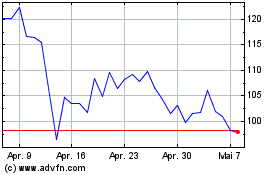

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

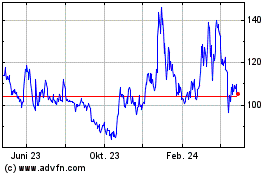

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024