3 Reasons Bitcoin Price Rally Is At Risk – Details

29 September 2024 - 12:30PM

NEWSBTC

Bitcoin emerged as an investors’ favorite this past week, recording

a price rise of 4.07% according to data from CoinMarketCap. During

this price surge, the premier cryptocurrency traded as high as

$66,000, a level last reached in late July. However, despite this

price gain which extends Bitcoin’s “unusual” positive performance

in September, certain market conditions indicate concern over the

sustainability of this rally. Related Reading: Bitcoin Set For

Biggest September Gains In A Decade: Here’s Why Why Bitcoin’s Rally

Is In Danger In a Quicktake post on CryptoQuant, an analyst with

username Wenry outlined several reasons Bitcoin may not sustain its

current upward trend. Firstly, Wenry notes that there is a lack of

interest from retail investors in Korea and the US as indicated by

a stagnant Taker volume. This status is different from previous

Bitcoin price rallies where retail activity in these countries was

prominent. Therefore, the analyst postulates that the current price

surge is devoid of new investments and is likely driven by a select

group of market participants. Furthermore, Wenry highlights there

is currently a high level of Open Interest in the BTC market, but

the asset continues to move in a range-bound market i.e.

consolidation due to a low spot volume. The combination of both

factors reflects the absence of a significant buying interest in

Bitcoin despite the present rally. Another point of concern

raised by Wenry states the current Bitcoin price gain is caused by

a rise in derivatives trading due to macroeconomic factors such as

the reduction of interest rates. The crypto analyst pinpoints a

lack of equal support from the spot market therefore, the rally is

likely a “temporal uptick rather than a structural market shift”.

In conclusion, Wenry states that the absence of significant spot

market volume, a stagnant Taker volume, and low retail

participation all threaten the longevity of Bitcoin’s current

rally. Notably, if retail investors remain away from the market,

Bitcoin would likely remain in consolidation or even experience a

price correction. Related Reading: Analyst Backs Bitcoin Hitting

$290,000 In Bull Run – Here’s Why Bitcoin To Break All-Time High In

Q4? On another front, popular analyst Michaël van de Poppe

has backed Bitcoin to surpass its all-time high price of $73,750 in

the last quarter of 2024, following a similar trajectory with gold.

Van de Poppe’s prediction seems quite plausible as Q4 is

traditionally the most bullish moment for Bitcoin. In addition, the

renowned analyst is also backing altcoins to experience a 3-5x

price surge in the same period. At the time of writing, Bitcoin

continues to trade at $65,810 following a 0.40% gain in the last

day. In tandem, the asset’s daily trading volume is down 53.16% and

valued at $65,649. Featured image from Freepik, chart from

Tradingview

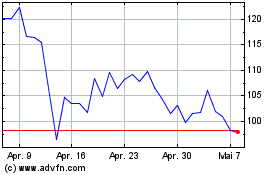

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

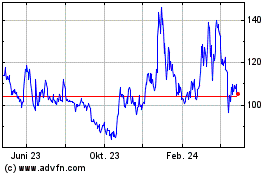

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024