Bitcoin Breaks $66,000, But Analyst Warns Against Fresh Longs—Here’s Why

28 September 2024 - 1:00PM

NEWSBTC

Bitcoin has shown bullish momentum during the past day, but an

analyst has pointed out how the asset may be in a high-risk zone

now due to the Open Interest trend. Bitcoin Open Interest Has Seen

A Rapid Increase Recently As explained by CryptoQuant community

manager Maartunn in a new post on X, the Bitcoin Open Interest has

just surged to high levels. The “Open Interest” is an indicator

that keeps track of the total amount of BTC-related positions

currently open on all derivatives exchanges. Related Reading: Shiba

Inu Rallies 34%, But Will FOMO End The Rally? When the value of

this metric rises, it means the investors are opening up fresh

positions on the derivatives market right now. As the overall

leverage in the sector increases when this trend occurs, it can

lead to higher asset price volatility. On the other hand, the

indicator heading down suggests the derivatives contract holders

are either closing up positions of their own volition or getting

forcibly liquidated by their platform. This kind of trend can lead

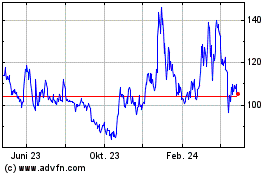

to more stability for BTC. Now, here is a chart that shows the

trend in the Bitcoin Open Interest over the past year: As displayed

in the above graph, the Bitcoin Open Interest had cooled off to

relatively low levels earlier in the month as the asset’s price

crashed. With the recovery in the coin, however, the indicator has

been noting growth again. The indicator is now high, potentially

implying the market has become overleveraged. As mentioned earlier,

a high metric value can lead to more volatility for BTC. The reason

behind this is that mass liquidation events can become more

probable to occur at these levels, making the price act more

volatile. On paper, the volatility emerging from an Open Interest

increase can take the coin in either direction, but BTC has shown a

consistent pattern in the past year. As the analyst has highlighted

in the chart, the indicator entering into the same zone as now has

generally turned out to be bearish for Bitcoin in this window.

Related Reading: Render (RENDER) Shows 23% Surge As Sharks &

Whales Continue To Buy In these instances, the Open Interest surge

had occurred alongside price surges, indicating that long positions

had been piling up. The latest growth in the indicator has also

naturally come similarly. “We’re in a high-risk zone, and in my

opinion, it’s not the best time for fresh long positions,” notes

Maartunn. It remains to be seen how Bitcoin develops in the coming

days and if it will hit the top, just like it did during those

other instances. BTC Price Following the rally in the past day,

Bitcoin has managed to find a break above the $66,000 level for the

first time in almost two months Featured image from Dall-E,

CryptoQuant.com, chart from TradingView.com

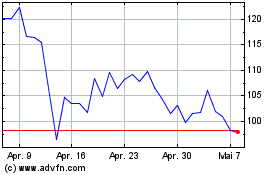

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024