Bearish Signal For Ethereum: Funding Rates Hit New 2024 Lows—Is A Rally Still Possible?

17 September 2024 - 11:30AM

NEWSBTC

Ethereum, the second-largest cryptocurrency by market

capitalization, is experiencing increasing bearish sentiment in its

futures market, according to a recent analysis by CryptoQuant

analyst ShayanBTC. The analyst reported on the CryptoQuant

QuickTake platform that Ethereum’s futures market has shown its

lowest funding rates of 2024. This trend indicates that traders in

the perpetual futures market are currently less optimistic about

Ethereum’s short-term price movements. Related Reading: Ethereum

Sees Massive Outflows from Derivatives: What Does This Mean For

ETH? Ethereum Declining Funding Rates And Market Implications

According to ShayanBTC, the 50-day moving average of Ethereum’s

funding rates has been on a consistent downward trend, indicating a

persistent bearish outlook among futures traders. For context,

funding rates in perpetual futures contracts are payments made

between long and short traders based on the difference between

perpetual futures and spot prices. When funding rates are positive,

it implies that long traders pay short traders, suggesting bullish

sentiment. Conversely, negative funding rates mean short traders

pay long traders, signaling a more bearish market stance. In the

case of Ethereum, the current negative trend in funding rates

highlights a lack of buying interest in the perpetual futures

market. Shayan noted: For Ethereum to recover and reach higher

price levels, demand in the perpetual futures market must increase.

If the current trend of negative funding rates continues, it is

likely that Ethereum will experience further price declines in the

mid-term. Is A Rally Still Possible? The impact of these bearish

funding rates has been quite evident in Ethereum’s recent

performance. So far, the cryptocurrency has experienced a

consistent decline, dropping by 4.9% in the past 24 hours alone.

This decline has dragged Ethereum’s price below the $2,300 mark,

compounding its losses over the past month to more than 10%. The

persistent bearishness is partly attributed to the “lack of buying

interest” in the futures market, as noted by the CryptoQuant

analyst. Despite the negative sentiment in the futures market, some

analysts remain optimistic about Ethereum’s potential for a

rebound. One such analyst, Koroush AK, expressed a more positive

outlook, suggesting that Ethereum is due for a significant bounce.

Related Reading: Analyst Predicts $4,000 Mid-Term Target for

Ethereum, Declares End to ETH Correction Koroush pointed to higher

time frames, highlighting the 100-week moving average and the key

psychological support level at $2,000 as potential catalysts for a

recovery. He anticipates a 10-20% bounce for Ethereum in the coming

weeks despite the current market conditions. $ETH Ethereum due a

large bounce. Zooming out and looking at the higher time frames;

-100 week moving average -Key psychological support ($2000)

Expecting a 10-20% bounce over next few weeks.

pic.twitter.com/THPPc99oMf — Koroush AK (@KoroushAK) September 16,

2024 Notably, while negative funding rates often reflect a bearish

market sentiment, they can also be early indicators of potential

market recovery. Negative rates can result in short liquidation

cascades, where short positions are forced to close, leading to a

sharp price reversal. Featured image created with DALL-E, Chart

from TradingView

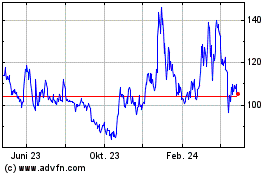

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

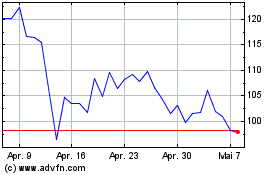

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024