TOP 5 Cryptos To Watch This Week – BNB, BTC, ETH, QNT, LEO

17 Oktober 2022 - 4:18PM

NEWSBTC

In previous weeks, the crypto market looked like it was set to lose

its key support with major altcoins such as Bitcoin (BTC), Ethereum

(ETH), and other altcoins at the brick of losing their support area

holding price sell-offs. Despite the uncertainty, some altcoins

have continued to look green at the face of any litmus test. Let us

discuss on top 5 cryptos you should pay attention to this week.

Disclaimer: The picks listed in this article should not be taken as

investment advice. Always do your research and never invest more

than what you can afford to lose. Related Reading: NEAR Platform

Active Users Soar – ‘Sweat Economy’ Boosting Token’s Price? Top 5

Cryptos- Bitcoin (BTC) Price Analysis On The Daily Chart Last week

BTC saw its price decline from a region of $19,200 to $18,100 with

what looked like a manipulation ahead of the Consumer Price Index

news; BTC bounced from its key demand zone as price rallied to

$19,600 before facing a rejection to break and hold above this

region. The price of BTC failed to close the weekly candle above

$19,500, creating mixed feelings as regards its next movement and

direction. BTC is currently trading at $19,400; the price of BTC

needs to break and close above $19,500 to ignite a possible price

rally to a region of $20,200. Top 5 Cryptos- Price Analysis Of

Ethereum (ETH) On The Daily (1D) Chart The price of Ethereum in

recent weeks had become a shadow of itself after the successful

launch of the “Ethereum Merge” as the price had failed to show the

bullish trend it had when price outperformed BTC in recent months,

rallying from $1,000 to $2,024. ETH price was rejected from $2,030

and has continued to trend lower. The price of ETH got rejected

when the price attempted to flip $1,400; the price of ETH saw its

price decline to a region of $1,270, acting as key support for the

ETH price. The price of ETH is trading below the 50 and 200

Exponential Moving Averages (EMA) on the daily timeframe. If the

ETH price maintains its bearish structure, we could see the price

retesting $1,000 as the demand zone. The price of ETH needs to flip

$1,400 into support for the price to look safe. Price Analysis Of

Binance Coin (BNB) On The Daily (1D) Chart The price of BNB was

rejected from its resistance of $300 and is currently trading at

$270. BNB lost its bullish structure despite showing strength; the

price of BNB got rejected to a low of $268 as the price bounced off

to reclaim its support zone at $270. The price of BNB needs to

rally high to a region of $280-$290 for the price to remain

safe. The price of BNB trades at $272 below the 50 and 200

Exponential Moving Averages (EMA), the values of $280 and $300 act

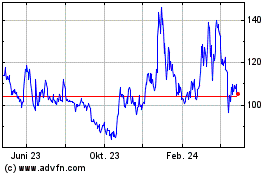

as resistance for BNB price. Price Analysis Of Quant (QNT) On The

Daily (1D) Chart The price of QNT has continued to show bullish

trends holding well above the 50 and 200 EMA. The price saw a rally

from $100, forming good support around that region. Despite the

pullback across crypto assets in the market, QNT has continued to

look strong, respecting the bullish trendline. The price of QNT

broke the resistance at $200, enabling the price of QNT to rally.

QNT’s price faces a resistance at $260; if the price breaks this

resistance, we could see the price rallying to $330, but if it

fails to break the resistance, $200 would be good support for QNT

price. Price Analysis Of LEO On The Daily (1D) Chart The

price of LEO recently looks bullish as price attempts to breakout

above the 50 and 200 EMA, holding off the price from rallying. If

the price of LEO holds above this region, we could see a price

rally to $4.8 Related Reading: Latest Findings Show A Reduction In

Sell Off, Is A Bitcoin Rally Ahead? Featured image from Medium,

Charts from TradingView.com

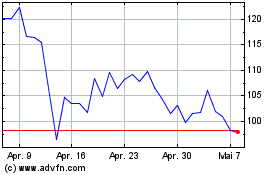

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024