Hedera Analyst Thinks HBAR Will Easily 30X After Sinking 70% In 6 Months

09 Oktober 2024 - 7:00PM

NEWSBTC

Hedera, a proof-of-stake platform, wasn’t spared from aggressive

bears in early October. After HBAR, its native token, floated

higher in September, the rejection of bulls in early October

resulted in a double top. Overall, there is optimism that bulls

will resume and push prices to new Q4 2024 highs. The pace of this

growth will depend on how the market performs and whether

fundamental factors around the project will prop up buyers. Will

HBAR Rise By At Least 30X? While there are cracks in the HBAR price

action, considering the dump from April highs of around $0.18, one

analyst on X thinks the token is set for major gains. From his

assessment, Hedera can easily score 30X in the coming sessions,

mirroring the gains posted by Cardano in the last cycle. Then, ADA

soared by over 170X. If HBAR is to follow the same path, the token

can easily soar to $6, over 60X from its 2024 highs. Related

Reading: Bitcoin’s Non-Realized Profits Hit Negative Levels—What

Does This Mean for Investors? Presently, technical candlestick

arrangements favor sellers. After the rally to $0.18 in April 2024,

HBAR has been falling. To put the numbers into perspective, the

token is down 70% but is stable after finding support in August and

September. The local resistance is the double top at around

September highs. If prices break above this liquidation zone, HBAR

bulls could embark on the journey to drive the coin to $0.18. In

effect, this will resume the uptrend set in motion in Q1 2024 and

early Q2 2024. Hedera Fundamentals Key To Driving Growth There are

fundamental factors to consider that may propel HBAR, helping the

token shake off weaknesses. Early this month, Canary Capital

released the first United States HBAR Trust. Like

Grayscale products, including the ETHE and GBTC, the HBAR Trust

allows institutional investors to gain exposure to HBAR.

Accordingly, this could drive demand, lifting prices. Related

Reading: ETH’s Fate Hinges On $2,300: Will Ethereum Soar To $6,000

Or Dive To $1,600? In September, Hedera launched the Asset

Tokenization studio. Through this solution, the network would be at

the forefront of driving the tokenization of real-world assets

(RWAs) while adhering to existing laws. Already, BlackRock, one of

the world’s largest asset managers, believes tokenization will

rapidly grow in the coming years, managing trillions. According to

rwa.xyz, over $12.7 billion worth of RWAs has been tokenized.

Additionally, there is interest. In the last month alone, the

number of RWA holders rose to 68,929, a 4% increase. Most of these

assets are tokenized on Ethereum and Stellar. Feature image from

DALLE, chart from TradingView

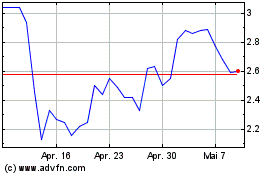

Optimism (COIN:OPUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Optimism (COIN:OPUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024