Crypto Expert Predicts Major Altcoin Season As Market Cap Eyes Record Levels

19 Dezember 2024 - 9:30AM

NEWSBTC

Market expert Lark Davis has recently taken to social media to

assert that the much-anticipated altcoin season is far from over

despite short-term corrections and challenges the broader crypto

market faces. Davis believes that significant opportunities

lie ahead for altcoins, particularly as their total market

capitalization (excluding Bitcoin and Ethereum) hovers around $1.05

trillion. Key Factors For Impending Altcoin Season The expert

points out that the current altcoin market cap is nearing its

previous high of $1.13 trillion from November 2021. He recalls a

similar scenario from February 2021, when the altcoin market cap

tested the highs from January 2018 before breaking through.

This breakout resulted in an impressive surge from $360 billion in

February 2021 to $1.13 trillion by November 2021—an increase of

over 200%. Davis firmly believes that once the altcoin market

cap surpasses the $1.13 trillion threshold again, we could witness

one of the largest altcoin seasons in the history of

cryptocurrency. Related Reading: Whales Snap Up 30 Million XRP As

Ripple Launches Its RLUSD Stablecoin Several key factors contribute

to Davis’s optimism regarding the impending altcoin surge:

Bitcoin’s Performance: Currently at all-time highs, the Bitcoin

price strength often catalyzes interest in altcoins. Political

Transition: With Donald Trump set to take office in just 34 days,

market sentiment may shift favorably towards cryptocurrencies.

Global Rate Cuts: Central banks worldwide are reducing interest

rates, which typically increases liquidity in the market. Increased

Capital Investment: An influx of cheap capital is making its way

into the cryptocurrency space, setting the stage for potential

growth. Risk-On Environment: The current market conditions are

among the strongest for risk-on assets, creating an ideal backdrop

for altcoin investment. Rally Anticipated As Bitcoin Dominance

Rises Echoing Davis’s sentiments, crypto analyst Miles Deutscher

emphasizes that the real altcoin season has yet to commence. He

points to compelling historical evidence suggesting that

alt-seasons are not mere coincidences but rather distinct seasonal

phenomena backed by statistical patterns. Historically, Ethereum

(ETH) has shown impressive returns from January to May, often

outperforming Bitcoin during this period. During these months,

Ethereum averages about 28% monthly returns, compared to a mere 3%

for the rest of the year. Related Reading: MicroStrategy’s

Bankruptcy Risk: CEO Warns Bitcoin Must Drop To $16,500 To Trigger

Collapse In addition, the analyst asserts that the current

environment is particularly favorable for this rotation, as

Ethereum has historically outperformed Bitcoin by approximately 20%

per month during alt-seasons. As Bitcoin’s performance

strengthens, so too does the likelihood of capital flowing into

Ethereum and other altcoins. This rotation is already observable in

the recent surge in Bitcoin dominance, which has mirrored patterns

seen in previous alt-seasons around 2017 and 2021. At the time of

writing, ETH, the largest altcoin on the market, is trading at

$3,686, down 4.4% over the 24-hour period and nearly 6% over the

week. Featured image from DALL-E, chart from TradingView.com

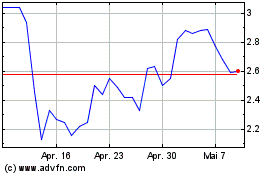

Optimism (COIN:OPUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Optimism (COIN:OPUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024