Polygon (MATIC) Keeps Going Down Despite Bullish News, Buy The Dip?

27 April 2023 - 12:20PM

NEWSBTC

The Polygon (MATIC) price is currently at a crucial moment. Despite

bullish news, MATIC has been in a downtrend since mid-February.

After retesting the March 10 low yesterday, the price is at a

turning point. According to data from on-chain data provider

IntoTheBlock, Polygon token holders in profit fell to 34% this

week. This is the lowest level since February. Therefore, analyst

@CryptoTheBeast_ raises the question whether MATIC will turn around

here or continue its downward trajectory? According to

@intotheblock data, $MATIC holders in profit reached down to 34%

this week, which is the lowest it has been since February. Will

$MATIC turn around here or will it keep going down?

pic.twitter.com/Pbu5KQjb5d — Crypto ₿east (@CryptoTheBeast_) April

27, 2023 MATIC Price Needs Quick Reversal The 1-day chart of MATIC

reveals that MATIC lost the “bull line”, the 200-day Exponential

Moving Average (EMA) last Thursday. The indicator served as

Polygon’s key support on March 10 and again in late March this

year. Since breaking below the 200-day EMA, currently at $1.0521,

MATIC failed to rise above it. If there is no timely recovery and

another rejection (like yesterday), MATIC could fall towards the

support level at $0.81. Related Reading: MATIC Price Prediction:

Polygon Recovery Faces Many Hurdles However, with an RSI of 35 on

the 1-day chart, MATIC is near oversold territory. So, this price

could be the biggest pain for now. On the other hand, regaining the

200-day EMA could avoid this scenario. As then, the 23.6% Fibonacci

level at $1.09 is expected to come into focus. A dynamic move above

this area would open the possibility for a rise towards the 38.2%

Fibonacci level at $1.185. In this area at the latest, greater

selling pressure from the bears can be expected. Afterwards, the

next target of great importance is the 50% Fibonacci level at

$1.25. In mid-March, MATIC got rejected at this level and thus

failed to achieve a reversal towards the February high. Bullish

News For Polygon Nonetheless, there is no shortage of bullish news

for Polygon at the moment. Traditional finance giant Franklin

Templeton announced yesterday that it will be experimenting with

Polygon. The company has launched the OnChain US Government Money

Fund on the layer-2 blockchain. Related Reading: Polygon Exchange

Supply Spikes, More Downtrend Incoming? Franklin Templeton is one

of the world’s largest asset managers, alongside BlackRock, with

$1.4 trillion in assets under management (AUM). The Nasdaq-listed

mutual fund is the first fund registered in the U.S. to use a

public blockchain. This allows transactions to be processed and

ownership to be recorded transparently, according to a press

release. A share of the fund is represented by the BENJI token,

which investors can manage via a wallet app. In other news, Polygon

Labs and Google Cloud announced a program for Web3 startups on

Tuesday. The blockchain project wrote via Twitter that it has

teamed up with Google Cloud to help Web3 projects and startups. Up

to $3 million will be allocated for this purpose from the Polygon

Ventures Ecosystem Fund. 🫱🏾🫲🏼 We're joining @googlecloud to help

Web3 projects and startups grow with access to:✅ Up to $3M USD in

investments from the Polygon Ventures Ecosystem Fund✅ Priority

Reviews✅ All Polygon Venture benefits ☁️✨https://t.co/wFhIb9af7n

https://t.co/hJGKZivbOQ — Polygon (Labs) (@0xPolygonLabs) April 25,

2023 Featured image from The Economic Times, chart from

TradingView.com

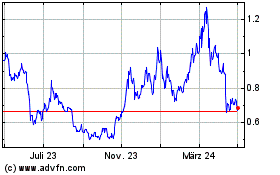

Polygon (COIN:MATICUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

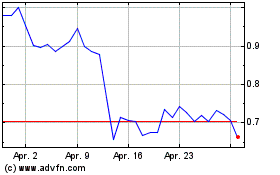

Polygon (COIN:MATICUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024