Bitcoin Exchange Inflows Mostly Coming From Loss Holders, Weak Hands Exiting?

26 Mai 2023 - 3:59PM

NEWSBTC

On-chain data suggests a majority of the Bitcoin exchange inflows

are currently coming from investors holding their coins at a loss.

Bitcoin Exchange Inflow Volume Is Tending Towards Losses Right Now

According to data from the on-chain analytics firm Glassnode, the

short-term holders are mostly contributing to these loss inflows.

The “exchange inflow” is an indicator that measures the total

amount of Bitcoin that’s currently flowing into the wallets of

centralized exchanges. Generally, investors deposit to these

platforms whenever want to sell, so a large amount of inflows can

be a sign that a selloff is going on in the BTC market right now.

Low values of the metric, on the other hand, imply holders may not

be participating in much selling at the moment, which can be

bullish for the price. In the context of the current discussion,

the exchange inflow itself isn’t of relevance; a related metric

called the “exchange inflow volume profit/loss bias” is. As this

indicator’s name already suggests, it tells us whether the inflows

going to exchanges are coming from profit or loss holders

currently. When this metric has a value greater than 1, it means

the majority of the inflow volume contains coins that their holders

had been carrying at a profit. Similarly, values under the

threshold imply a dominance of the loss volume. Related Reading:

Bitcoin Hangs At $26,200: Why This Is A Crucial Support Level Now,

here is a chart that shows the trend in the Bitcoin exchange inflow

profit/loss bias over the last few years: The value of the metric

seems to have observed some decline in recent days | Source:

Glassnode on Twitter As shown in the above graph, the Bitcoin

exchange inflow volume profit/loss bias has had a value above 1 for

most of the ongoing rallies that started back in January of this

year. This suggests that most of the exchange inflows in this

period have come from the profit holders. This naturally makes

sense, as any rally generally entices a large number of holders to

sell and harvest their gains. Related Reading: Bitcoin Bearish

Signal: NUPL Finds Rejection At Long-Term Resistance There have

been a couple of exceptional instances, however. The first was back

in March when the asset’s price plunged below the $20,000 level.

The bias in the market shifted towards loss selling then, implying

that some investors who bought around the local top had started

capitulating. A similar pattern has also occurred recently, as the

cryptocurrency’s price has stumbled below the $27,000 level.

Following this plunge, the indicator’s value has come down to just

0.70. Further data from Glassnode reveals that the bias of the

long-term holders (LTHs), the investors holding their coins since

at least 155 days ago, have actually leaned towards profits

recently. Looks like the indicator has a positive value right now |

Source: Glassnode on Twitter From the chart, it’s visible that the

indicator has a value of 1.73 for the LTHs, implying a strong bias

toward profits. Naturally, if the LTHs haven’t been selling at a

loss, the opposite cohort must be the short-term holders (STHs).

This group seems to have a heavy loss bias currently | Source:

Glassnode on Twitter Interestingly, the indicator’s value for the

STHs is 0.69, which is almost exactly the same as the average for

the entire market. This would mean that the LTHs have contributed

relatively little to selling pressure recently. The STHs selling

right now would be the ones that bought at and near the top of the

rally so far and their capitulation may be a sign that these weak

hands are currently being cleansed from the market. Although the

indicator hasn’t dipped as low as in March yet, this capitulation

could be a sign that a local bottom may be near for Bitcoin. BTC

Price At the time of writing, Bitcoin is trading around $26,400,

down 1% in the last week. BTC has struggled recently | Source:

BTCUSD on TradingView Featured image from 愚木混株 cdd20 on

Unsplash.com, charts from TradingView.com, Glassnode.com

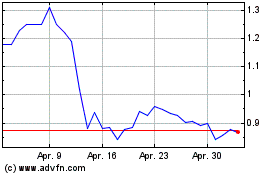

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024