US Regional Bank Failures Trigger Bitcoin Surge, $30,000 Level In Sight

04 Mai 2023 - 9:00PM

NEWSBTC

Bitcoin (BTC) is on the verge of reaching the $30,000 milestone,

but regional banks in the United States face significant anxiety

and fear. Investors are concerned about the potential for contagion

following the recent struggles of PacWest, a California-based

lender. The bank’s shares have plummeted by as much as 60%

overnight, causing it to reassure investors and confirm that it is

in talks with potential partners and investors about a deal, as

reported by The Telegraph. Despite insisting that it has not

experienced any unusual deposit flows, regional bank stocks are

down by more than 5% today, with not one of the 349 banks in the

sector seeing gains. Related Reading: Polkadot (DOT) Under Sell

Pressure As Bears Retaliate Regional Banks Take A Hit, 130 Stocks

Down Over 5% The fears surrounding regional banks are undoubtedly

fueled by the recent failure and sale of First Republic Bank to

JPMorgan Chase. This high-profile event has highlighted the

potential risks and challenges facing smaller banks, particularly

in the current economic climate. Despite the broader concerns in

the financial sector, Bitcoin has climbed above the $29,000 level,

up by 1.7% in the last 24 hours, potentially fueled by the ongoing

concerns surrounding the US banks. This suggests that there

may be some investors who are turning to alternative assets as a

potential hedge against the risks and uncertainties in traditional

financial markets, which have shown no signs of relief for the

short term. Furthermore, according to CryptoCon, a Bitcoin

market analyst, the accurate BTC bull market is here. This is based

on the mid-line crossover of the 3 Week Keltner Channels, a

technical indicator measuring volatility and trend in Bitcoin. When

BTC crosses over the mid-line, currently priced at $26,500, it is a

strong signal that a bull market has begun. Additionally, CryptoCon

notes that historically, Bitcoin has not returned under the

mid-line after crossing, supporting the argument that a bull market

is underway. According to the analyst, this has been true, as the

crossover has consistently brought months of bull market activity.

Bitcoin On The Rise As US Bank Failures Mount Daan Crypto Trades, a

cryptocurrency market analyst, has analyzed Bitcoin’s

dominance and potential impact in the broader cryptocurrency

market. According to the analyst, Bitcoin dominance, which measures

the percentage of the total cryptocurrency market capitalization

made up of Bitcoin, is currently trading at its range highs at the

48-49% area. Daan suggests that if Bitcoin can push through this

range and make new local highs, it could move toward 52% or higher.

This likely leads to continuing the ongoing trend of Bitcoin

dominance, which has increased in recent months. However, the

analyst notes that if Bitcoin remains range-bound between $27-30K,

it could lead to a recovery in ALT/BTC pairs, seeing Bitcoin

dominance come down. This would suggest that altcoins, or

alternative cryptocurrencies to Bitcoin, could outperform Bitcoin

in the short term. Related Reading: Coinbase And Ripple CLOs Meet,

Will XRP Listing Follow? When writing, the top cryptocurrency in

the market is trading at $29,000. In the past 24 hours, there has

been a total liquidation of $100 million in short positions. The

question is whether Bitcoin will continue its upward trend or

experience a healthy pullback to fill in the liquidity below its

crucial resistance levels. Featured image from iStock, chart from

TradingView.com

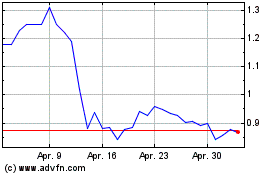

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024