Ethereum Pinned Below $2,000 Despite Network Burning Over 3 Million ETH

28 März 2023 - 1:30PM

NEWSBTC

Ethereum prices remain below $2,000 months after the network

initiated EIP-1559, trackers on March 28 reveal. Ethereum

Prices Trending Below $2,000 ETH, the native currency of Ethereum,

is currently trading at $1,717, stable on the last day and week but

retracing from recent highs of around $1,850. The network has burnt

over 3 million ETH from gas fees since the activation of Ethereum

Improvement Proposal (EIP) 1559 in August 2021, a move that

gradually makes the coin deflationary. However, despite this, the

coin has been unable to break above $2,000 since May 2022.

EIP-1559 was an intervention by the developer community to reduce

the supply of ETH and it was a new way for Ethereum to calculate

process transaction fees, effectively adjusting the fee market and

making gas more predictable. Earlier, Ethereum used an auction

system where miners prioritized transactions tagged with high fees.

Related Reading: Ethereum Price is Struggling, But It’s Too Early

to Say Bulls Have Given Up In EIP-1559, the team agreed to

introduce a base fee and a “tip” for every gas fee paid in a

transaction. The base fee is what everyone transacting on Ethereum

must pay. Notably, this fee will be adjustable depending on network

demand and would be burned. At the same time, the transactor would

give a “tip” to the block validator as an incentive to include

their transaction in a block. This fee is optional, and only those

who want their transactions to be included in blocks faster can

pay. Ethereum Price On March 28 | Source: ETHUSDT On Binance,

TradingView Over 3 Million ETH Burned Since August 2021 From August

2021, when Ethereum introduced EIP-1559, the network

has burned over 3 million ETH. At the same time, over

69,450 ETH has been destroyed since the Merge, when Ethereum

officially transited to a proof of stake system, switching off

miners. Considering the current pace of ETH burning, the coin has

been deflationary by 0.1% annually. Proponents are bullish that ETH

will never be inflationary again, a move that could push prices

even higher in the months and years ahead. The pace of ETH burning

depends on network activity. Over the months, especially during the

2022 bear run, ETH and token prices crashed, as DeFi and NFT

activities also fell. The total value locked (TVL) in DeFi remains

less than half the peaks of 2021, while NFT trading is subdued even

with the recovery of asset prices in Q1 2023. Related Reading:

Number Of Ethereum Addresses In Profit Hits 10-Month High As ETH

Continues Rally Trackers on March 28 indicate that ETH transfers

contribute to the bulk of coins destroyed since EIP-1559. From

August 2021, users transferring ETH between addresses have

contributed to 266,217.50 ETH being destroyed. Meanwhile, because

of NFTs, primarily through OpenSea, 230,050 ETH have been burned,

with 152,369 ETH destroyed from Uniswap’s trading activities.

Feature Image From Canva, Chart From TradingView

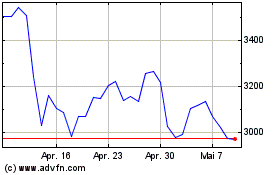

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024