Inauguration Effect? Bitcoin Whales Start Accumulating As Trump Era Begins

25 Januar 2025 - 4:30AM

NEWSBTC

Following Donald Trump’s inauguration on January 20th, Bitcoin

(BTC) has remained range-bound, trading between $101,000 to

$110,000. However, a new report by CryptoQuant states that behind

this routine price action, Bitcoin ‘whales’ are quietly back to

accumulating the premier cryptocurrency. Bitcoin Whales Back In

Accumulation Mode According to the report, large BTC holders –

commonly referred to as Bitcoin ‘whales’ – have re-entered the

accumulation phase. Recent data shows a significant uptick in the

monthly percentage growth of BTC holdings among these large

investors. Related Reading: Bitcoin Price Forecast Of $150,000 ‘Too

Low’ Amid Rising Adoption, Crypto Trader Says Notably, Bitcoin

whale holdings increased from a decline of -0.25% on January 14 to

a growth of 2% by January 17, marking the highest monthly growth

rate since mid-December. In absolute terms, these investors’ BTC

holdings rose from 16.2 million on November 4 to 16.4 million as of

January 24. The surge in whale accumulation appears to be driven by

several bullish developments early in Trump’s administration. For

example, the US president has already signed an executive order

establishing a Working Group on Digital Asset Markets. This Working

Group has been tasked with proposing a federal regulatory framework

for cryptocurrencies – including stablecoins – within six months.

Additionally, the group will evaluate the potential creation of a

national digital asset stockpile, fueling speculation about a

potential US strategic Bitcoin reserve. Besides growth in whale

holdings, selling pressure for BTC has declined sharply since major

profit-taking in December. This aligns with a recent report which

found that BTC profit-taking has dropped by 93% from its December

peak. The report reads: Bitcoin holders realized daily profits as

high as $10 billion as Bitcoin approached $100K in December.

However, daily realized profits have fallen to levels around $2-$3

billion in January, which indicates market participants may have

finished selling Bitcoin for the most part. Moreover, the traders’

unrealized profit margins have declined near zero, a level which

typically marks a price floor during bull markets. However, the

report also highlights that overall Bitcoin spot demand has

weakened over the past month, raising concerns about the likelihood

of another bullish rally. Specifically, the rate of demand growth

for Bitcoin has fallen from 279,000 BTC in early December to just

75,000 BTC at the time of writing. Analysts Confident Of Another

BTC Rally Despite the cooling of on-chain demand, crypto analysts

remain optimistic about another major price rally for Bitcoin. For

instance, a recent report suggested that BTC could target a price

as high as $249,000 during Trump’s presidency. Related Reading:

Could Bitcoin Hit Its Peak In Summer 2025? Analysts Weigh In

Another report by Bitfinex predicted that BTC is likely headed to

$200,000 by mid-year amid mild price pullbacks. However, a lot

depends on how the US Federal Reserve handles interest rate

adjustments this year. From a technical standpoint, BTC’s

cup-and-handle pattern projects a price target of as high as

$275,000. At press time, BTC trades at $106,074, up 0.1% in the

past 24 hours. Featured image from Unsplash, Chart from

TradingView.com

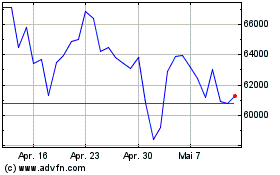

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025