Bitcoin Eyes Further Gains as Ethereum Struggles With Declining Demand

22 Januar 2025 - 6:00AM

NEWSBTC

Bitcoin recently achieved a new all-time high, climbing above

$109,000 and continuing its strong upward momentum. This

performance has further highlighted the disparity between Bitcoin

and Ethereum’s price trajectories, with Ethereum underperforming in

recent months. While Bitcoin has captured attention for its

resilience and gains, Ethereum faces challenges that have weighed

on its progress. According to Percival, a CryptoQuant analyst, the

new regulatory clarity provided by the pro-crypto administration in

the US is contributing to Bitcoin’s strength. In contrast,

Ethereum’s internal difficulties, coupled with declining demand in

the spot market, have created a challenging environment for the

asset. This divergence highlights how the two leading

cryptocurrencies are currently moving along very different paths,

with Bitcoin thriving and Ethereum struggling to maintain its

footing. Related Reading: 1 Million Bitcoin Pulled From Exchanges

In The Past 3 Years: What It Means For The BTC Market Ethereum’s

Decline and Market Sentiment Percival pointed out that Ethereum’s

struggles can be seen in several key metrics. Spot market

transactions have dropped dramatically since the previous cycle,

with current volumes at $8 billion compared to $52 billion during

the bull market’s peak in early 2021. This represents a sharp

reduction in demand, signaling that Ethereum’s current bull market

participation is significantly diminished. Additionally, data shows

that Ethereum has returned to levels seen in 2016, with a majority

of trading days now classified as “unprofitable” when compared to

Bitcoin. These challenges, according to Percival, have prompted

concerns that Ethereum may need to establish a “bottom” before it

can regain stability. Without this stabilization, investor

sentiment could become increasingly volatile, potentially leading

to further price declines. The analyst also suggests that until

Ethereum can address its internal issues and rebuild confidence,

its underperformance relative to Bitcoin is likely to persist.

Bitcoin Momentum And Market Structure While Ethereum struggles,

Bitcoin continues to benefit from favorable market conditions and

positive sentiment. Percival notes that macroeconomic factors,

along with increasing regulatory clarity, have positioned Bitcoin

for continued growth. The Choppiness Index, an indicator of market

consolidation and trend readiness, currently signals that Bitcoin

has built the necessary strength to sustain its upward trajectory.

The analyst believes that Bitcoin’s current market structure

supports further gains in the coming days. Particularly, after a

period of consolidation, Bitcoin appears poised to extend its

rally, attracting more investor interest and reinforcing its

position as the leading cryptocurrency. Related Reading: Ethereum

Struggles As Bitcoin Dominance Pushes ETH/BTC Pair To 4-Year Low As

Ethereum grapples with its challenges, Bitcoin’s steady momentum

highlights the stark contrast between the two assets’ market

dynamics. However, it is worth noting that it’s not all gloom for

Ethereum. According to a recent post from renowned crypto analyst

Ali, Q1 might just be Ethereum’s year of sudden rebound. Q1,

particularly in odd-numbered years, has historically been when

#Ethereum $ETH delivers its strongest performance!

pic.twitter.com/Gq2iEtRGfi — Ali (@ali_charts) January 18, 2025

Featured image created with DALL-E, Chart from TradingView

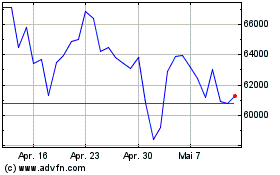

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025