CREDIT AGRICOLE SA: Capital - Notification of the level of Pillar 2 additional requirement

11 Dezember 2024 - 5:45PM

UK Regulatory

CREDIT AGRICOLE SA: Capital - Notification of the level of Pillar 2

additional requirement

Montrouge, 11th December 2024

Capital: notification of the level of Pillar 2

additional requirement

The European Central Bank (ECB) has notified

Crédit Agricole Group and Crédit Agricole S.A. of their capital

requirements in respect of Pillar 2 (P2R) applicable as of

1st January 2025, i.e. 1.80% for Crédit Agricole Group

and 1.65% for Crédit Agricole S.A.

Crédit Agricole Group must comply with a CET1

ratio of at least 9.8% as from 1st January 2025,

including Pillar 1 and Pillar 2 capital requirements as well as the

applicable combined buffer requirement (conservation buffer of

2.5%, buffer for global systemically important institutions (G-SIB)

of 1%, countercyclical buffer estimated at 0.77% and systemic risk

buffer estimated at 0.05%1). Crédit Agricole S.A. must

comply as from 1st January 2025 with a CET1 ratio of at

least 8.7%, including Pillar 1 and Pillar 2 capital requirements as

well as the applicable combined buffer requirement (conservation

buffer of 2.5%, countercyclical buffer estimated at

0.65%1 and systemic risk buffer estimated at

0.09%1).

The CET1 phased-in ratio of Crédit Agricole

Group was 17.4% at end-September 2024. Thus, the Group has the best

level of solvency among European systemic banks.

As the central body of Crédit Agricole Group,

Crédit Agricole S.A. fully benefits from the legal solidarity

mechanism as well as the internal flexibility of capital

circulation within the Crédit Agricole Group. Its phased-in CET1

ratio was 11.7% at end-September 2024.

CRÉDIT AGRICOLE S.A. PRESS CONTACT

Alexandre Barat : 01 57 72 12 19 –

alexandre.barat@credit-agricole-sa.fr

Olivier Tassain : 01 43 23 25 41 –

olivier.tassain@credit-agricole-sa.fr

Find our press release on : www.credit-agricole.com

1 Based on the information available to

date, Crédit Agricole Group and Crédit Agricole S.A.’s

countercyclical buffer would amount respectively to 0.77% and 0.65%

on 1st January 2025. Considering the

activation of the systemic risk buffer on credit and counterparty

risk-weighted exposures to Italian residents as of

31st December 2024, the systemic risk

buffer of Crédit Agricole Group and Crédit Agricole S.A. would

amount respectively to 0.05% and 0.09%.

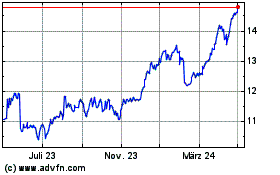

Credit Agricole (BIT:1ACA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

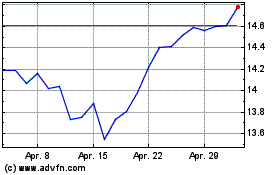

Credit Agricole (BIT:1ACA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025