VSA Capital Group PLC Silverwood Brands PLC investment in Lush (3489J)

12 Dezember 2022 - 8:05AM

UK Regulatory

TIDMVSA TIDMSLWD

RNS Number : 3489J

VSA Capital Group PLC

12 December 2022

12 December 2022

VSA Capital Group plc

("VSA Capital Group", or the "Company")

Silverwood Brands PLC investment in Lush

VSA Capital Group notes the announcement today by Silverwood

Brands plc ("Silverwood") on its acquisition of a 19.8% stake in

Lush Cosmetics Limited ("LCL"), and Cosmetic Warriors Limited

("CWL"), together ("Lush"). Lush is a manufacturer and seller of

fresh handmade skincare goods and cosmetic products. Lush operates

retail outlets in 48 countries and has manufacturing facilities in

6 nations. It produces a wide range of beauty and personal care

products using only vegetarian or vegan recipes. Lush has

championed its ESG credentials and has continued to push a strong

sustainability agenda across all areas of its business. The

Company's regulated subsidiary, VSA Capital Limited ("VSA") is the

Aquis Corporate Advisor to Silverwood.

VSA had been engaged to advise Andrew Gerrie and Alison Hawksley

(the "Lush Vendors") on this transaction for the past two years. To

avoid a conflict of interest and ensure an arms-length independent

transaction was undertaken in compliance with the Articles of

Association of LCL and CWL, VSA recused itself from advising the

independent directors of Silverwood Brands on their decision to

acquire the shareholding in Lush. VSA did, however, fulfil its role

as a Corporate Advisor to Silverwood by advising on Aquis

regulatory issues and discussions with the Takeover Panel.

The Lush transaction value amounted to GBP216.8 million and the

fee payable to VSA will have a materially positive impact on VSA

Capital Group's results for the year ending 31 March 2023.

Andrew Monk, CEO of VSA Capital Group, said "This is a great

deal for VSA to have advised on and it demonstrates the strength

and depth of our investment banking capabilities. This deal will

also create long-term value for all parties. We recognise that

there is strong loyalty to Lush and we want to help all

stakeholders, especially customers and employees, reap the benefits

of investing directly in this fast-growing brand by owning shares

in Silverwood".

For more information, please contact:

+44(0)20 3005

VSA Capital Group plc 5000

Andrew Monk, CEO

Andrew Raca, Head of Corporate Finance

Marcia Manarin, Finance Director

+44 (0)20 3772

Alfred Henry - AQSE Corporate Adviser 0021

Nick Michaels & Maya Wassink www.alfredhenry.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXGPGMAPUPPUQP

(END) Dow Jones Newswires

December 12, 2022 02:05 ET (07:05 GMT)

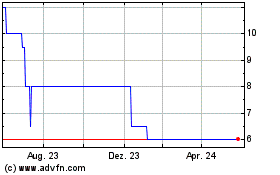

VSA Capital (AQSE:VSA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

VSA Capital (AQSE:VSA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025